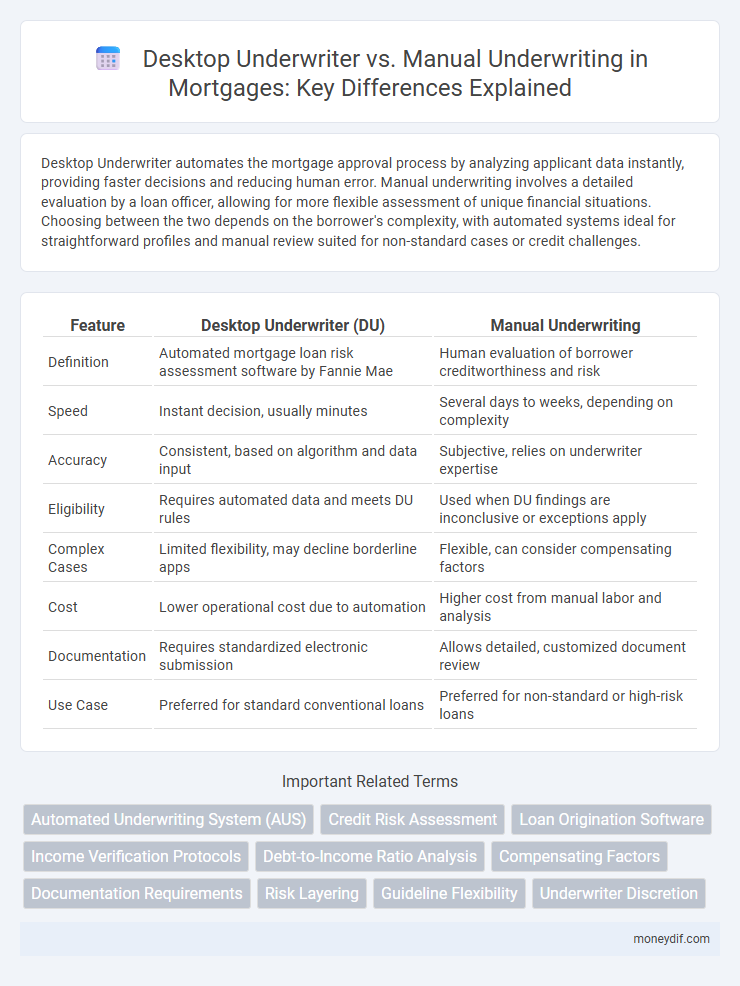

Desktop Underwriter automates the mortgage approval process by analyzing applicant data instantly, providing faster decisions and reducing human error. Manual underwriting involves a detailed evaluation by a loan officer, allowing for more flexible assessment of unique financial situations. Choosing between the two depends on the borrower's complexity, with automated systems ideal for straightforward profiles and manual review suited for non-standard cases or credit challenges.

Table of Comparison

| Feature | Desktop Underwriter (DU) | Manual Underwriting |

|---|---|---|

| Definition | Automated mortgage loan risk assessment software by Fannie Mae | Human evaluation of borrower creditworthiness and risk |

| Speed | Instant decision, usually minutes | Several days to weeks, depending on complexity |

| Accuracy | Consistent, based on algorithm and data input | Subjective, relies on underwriter expertise |

| Eligibility | Requires automated data and meets DU rules | Used when DU findings are inconclusive or exceptions apply |

| Complex Cases | Limited flexibility, may decline borderline apps | Flexible, can consider compensating factors |

| Cost | Lower operational cost due to automation | Higher cost from manual labor and analysis |

| Documentation | Requires standardized electronic submission | Allows detailed, customized document review |

| Use Case | Preferred for standard conventional loans | Preferred for non-standard or high-risk loans |

Overview: Desktop Underwriter vs Manual Underwriting

Desktop Underwriter uses automated algorithms to evaluate mortgage applications against lender guidelines, providing faster decision-making and consistent risk assessment. Manual underwriting involves a lender or underwriter reviewing financial documents and credit history individually, allowing for flexibility in complex cases or atypical borrower profiles. Both processes assess borrower eligibility, but Desktop Underwriter emphasizes efficiency while manual underwriting prioritizes personalized evaluation.

How Desktop Underwriter Works

Desktop Underwriter (DU) evaluates mortgage applications by analyzing borrower credit data, income, assets, and property information through automated algorithms developed by Fannie Mae. The system generates risk assessments and eligibility recommendations based on established guidelines, streamlining loan approval processes. DU's integration with credit bureaus and property databases ensures faster, more consistent underwriting decisions compared to manual underwriting.

Manual Underwriting: Definition and Process

Manual underwriting is a detailed evaluation process where a lender's underwriter reviews a borrower's financial documents independently rather than relying on automated software like Desktop Underwriter. This process involves analyzing credit history, income stability, debt-to-income ratio, and asset verification in depth to assess the borrower's ability to repay the loan. Manual underwriting is often used when automated systems flag uncertainties or when applicants have non-standard financial profiles, ensuring a more personalized risk assessment.

Key Differences Between Automated and Manual Underwriting

Automated underwriting systems like Desktop Underwriter use algorithms to analyze borrower data quickly, providing instant loan eligibility decisions based on credit scores, income, and asset verification. Manual underwriting requires a loan officer to review financial documents individually, allowing more flexibility to consider unique situations such as non-traditional income sources or credit challenges. While automated underwriting improves efficiency and consistency, manual underwriting offers personalized assessment, often benefiting borrowers with complex financial profiles.

Advantages of Desktop Underwriter

Desktop Underwriter streamlines the mortgage approval process by using automated risk assessment algorithms, resulting in faster decisions and reduced human error compared to Manual Underwriting. It integrates borrower data, credit reports, and employment verification to enhance accuracy and consistency throughout loan evaluation. Lenders benefit from improved efficiency and lower operational costs while delivering a smoother borrower experience.

Benefits of Manual Underwriting

Manual underwriting allows for a more personalized evaluation of a borrower's financial situation, accommodating unique circumstances that automated Desktop Underwriter systems may overlook. It benefits applicants with non-traditional income sources, credit issues, or incomplete credit histories by providing flexibility and nuanced judgment. This approach can increase loan approval chances for individuals who do not meet strict automated criteria while maintaining compliance with lending guidelines.

Eligibility Requirements for Each Underwriting Method

Desktop Underwriter (DU) eligibility requires borrowers to meet automated criteria such as credit score minimums, stable income verification, and automated asset analysis, streamlining conventional loan approvals. Manual Underwriting is applied when DU cannot approve due to non-standard financial situations, requiring detailed documentation of income, credit explanations, and compensating factors to assess eligibility flexibly. Both methods aim to evaluate borrower risk, but DU emphasizes efficiency with automated eligibility while manual underwriting prioritizes comprehensive financial review.

Common Scenarios for Manual Underwriting

Manual underwriting is commonly used when borrowers have non-traditional income sources such as self-employment, irregular income, or recent credit events like bankruptcy. Lenders often require manual review for loan applications with gaps in credit history, high debt-to-income ratios, or insufficient documentation that automated systems like Desktop Underwriter cannot verify. This process allows underwriters to consider the overall financial profile and compensating factors, providing approval flexibility beyond automated guidelines.

Impact on Mortgage Approval Speed

Desktop Underwriter utilizes automated algorithms to analyze borrower data, significantly accelerating the mortgage approval speed compared to Manual Underwriting. Manual Underwriting involves thorough human review of application documents, often extending approval times by several days or weeks. Lenders using Desktop Underwriter can provide quicker pre-approvals, improving borrower experience and competitive advantage.

Which Underwriting Method Is Right for You?

Choosing between Desktop Underwriter (DU) and manual underwriting depends on your financial profile and documentation clarity. DU offers faster decisions by automating risk assessment using credit scores, income, and asset data, ideal for straightforward cases. Manual underwriting suits borrowers with non-traditional income sources or credit issues, as it allows more personalized evaluation of financial stability.

Important Terms

Automated Underwriting System (AUS)

Automated Underwriting Systems (AUS) like Desktop Underwriter analyze loan applications using algorithms to assess credit risk quickly, increasing efficiency and consistency compared to manual underwriting which involves subjective evaluation by human underwriters. Desktop Underwriter specifically streamlines mortgage approval by integrating borrower data, credit reports, and property information to produce risk assessments faster than traditional manual processes.

Credit Risk Assessment

Credit Risk Assessment in mortgage lending often involves comparing Desktop Underwriter (DU), an automated underwriting system analyzing borrower creditworthiness through algorithms and standardized data, with Manual Underwriting, where loan officers perform a detailed, case-by-case evaluation of credit reports, income documentation, and borrower stability. DU speeds decision-making using predictive models to assess risk efficiently, while Manual Underwriting allows for nuanced judgments in complex cases, impacting loan approval rates and credit risk management strategies.

Loan Origination Software

Loan origination software streamlines the credit evaluation process by integrating Desktop Underwriter, an automated system that assesses borrower risk using algorithmic analysis, significantly speeding up approvals and reducing human error. In contrast, manual underwriting relies on human judgment to interpret credit data and assess risk, offering flexibility for complex cases but increasing processing time and potential inconsistencies within lending decisions.

Income Verification Protocols

Income verification protocols differ significantly between Desktop Underwriter (DU) and manual underwriting processes; DU utilizes automated data validation and third-party verification services to quickly assess borrower income accuracy, whereas manual underwriting requires detailed document review including pay stubs, tax returns, and employer verification for thorough income assessment. Lenders often rely on DU for streamlined processing and reduced risk of income misrepresentation, while manual underwriting is preferred for complex income scenarios or self-employed borrowers requiring personalized evaluation.

Debt-to-Income Ratio Analysis

Debt-to-Income (DTI) ratio analysis in Desktop Underwriter systems automates risk assessment by quickly evaluating borrower income against debt obligations using preset algorithms, enhancing underwriting efficiency. Manual underwriting relies on detailed human judgment to interpret DTI ratios contextually, often allowing for more nuanced decisions in complex financial scenarios.

Compensating Factors

Compensating factors in Desktop Underwriter (DU) often include strong credit scores, significant cash reserves, or a stable employment history that offset higher debt-to-income ratios during automated mortgage loan approvals. Manual underwriting evaluates compensating factors more flexibly by analyzing detailed borrower explanations, non-traditional credit sources, and unique financial circumstances to approve loans that DU flags as higher risk.

Documentation Requirements

Documentation requirements for Desktop Underwriter (DU) typically involve automated verification of income, assets, and credit data through electronic systems, reducing the need for extensive paper documentation. Manual underwriting requires comprehensive submission of detailed financial records, including pay stubs, tax returns, and bank statements, to assess borrower eligibility when DU findings are inconclusive or borrowers present non-standard credit profiles.

Risk Layering

Risk layering occurs when multiple risk factors combine in a mortgage application, potentially increasing the borrower's overall credit risk. Desktop Underwriter (DU) assesses risk layering algorithmically, allowing for faster, standardized loan approvals, while Manual Underwriting requires detailed human analysis of layered risks to determine borrower eligibility.

Guideline Flexibility

Guideline flexibility in Desktop Underwriter (DU) offers automated underwriting decisions based on predefined criteria, enabling faster loan processing but with limited accommodation for unique borrower circumstances. Manual underwriting provides greater flexibility by allowing underwriters to evaluate exceptions and non-standard scenarios case-by-case, improving approval rates for complex profiles without strict adherence to automated parameters.

Underwriter Discretion

Underwriter discretion plays a critical role in manual underwriting, allowing lenders to evaluate unique borrower circumstances beyond automated criteria used by Desktop Underwriter (DU) systems. Unlike DU, which relies on algorithmic risk assessments and predefined credit parameters, manual underwriting enables personalized judgment to address exceptions and verify compensating factors for loan approval.

Desktop Underwriter vs Manual Underwriting Infographic

moneydif.com

moneydif.com