Lien theory allows borrowers to retain legal title to the property while the lender holds a lien as security for the loan, ensuring the borrower's ownership during repayment. Title theory, in contrast, grants the lender legal title until the mortgage is fully paid, giving the lender possession rights if the borrower defaults. Understanding these differences is crucial for homeowners and lenders to navigate property rights and foreclosure processes effectively.

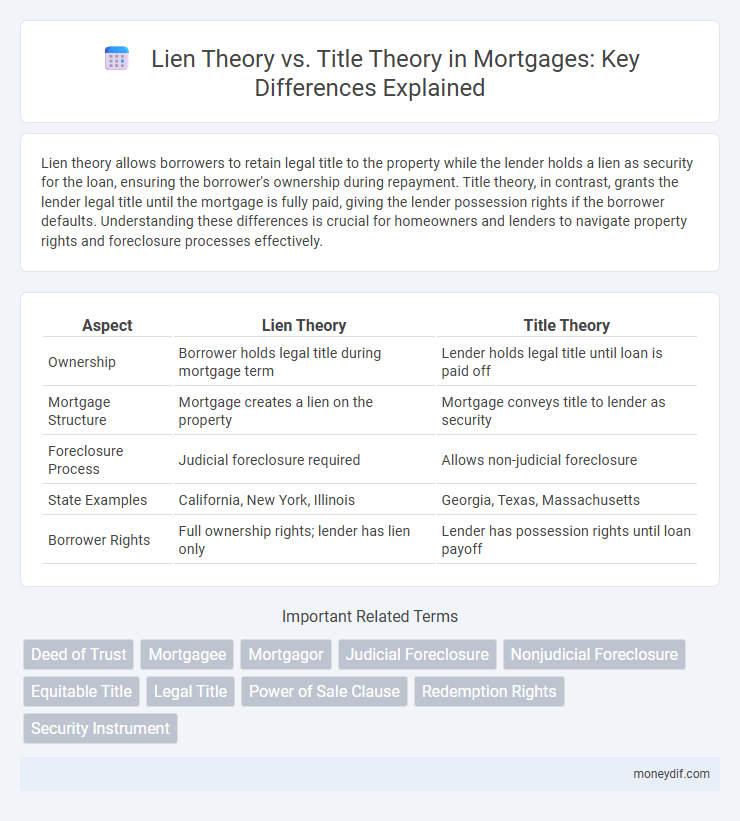

Table of Comparison

| Aspect | Lien Theory | Title Theory |

|---|---|---|

| Ownership | Borrower holds legal title during mortgage term | Lender holds legal title until loan is paid off |

| Mortgage Structure | Mortgage creates a lien on the property | Mortgage conveys title to lender as security |

| Foreclosure Process | Judicial foreclosure required | Allows non-judicial foreclosure |

| State Examples | California, New York, Illinois | Georgia, Texas, Massachusetts |

| Borrower Rights | Full ownership rights; lender has lien only | Lender has possession rights until loan payoff |

Understanding Lien Theory and Title Theory

Lien Theory treats the mortgage as a security interest, where the borrower retains title to the property while the lender holds a lien as collateral until the loan is repaid. Title Theory grants the lender legal title to the property during the loan term, with the borrower holding equitable title, allowing the lender to take possession in case of default. Understanding these distinctions is crucial for borrowers and lenders, as they impact foreclosure procedures and property rights during the mortgage term.

Key Differences Between Lien Theory and Title Theory

Lien Theory allows the borrower to retain both legal and equitable title to the property while the lender holds a lien as security for the loan, meaning the borrower retains ownership unless foreclosure occurs. Title Theory grants the lender legal title to the property during the mortgage term, with the borrower holding equitable title, enabling the lender to possess full ownership if the borrower defaults. The primary difference lies in property ownership and possession rights during the loan period: lien theory maintains borrower ownership with a security interest for the lender, whereas title theory transfers legal title to the lender until the loan is repaid.

How Lien Theory Works in Mortgages

Lien Theory in mortgages means the borrower retains both legal and equitable title to the property while the lender holds a lien as security for the loan. The lien allows the lender to initiate foreclosure if the borrower defaults, but the borrower maintains ownership rights and can sell or refinance the property before foreclosure. This approach differs from Title Theory, where the lender holds legal title until the mortgage is fully repaid.

How Title Theory Impacts Homeownership

In Title Theory states, the lender holds legal title to the property until the mortgage is fully paid, affecting homeowners' rights during the loan term. This arrangement can limit the borrower's ability to make decisions about the property without lender approval, influencing homeownership control and flexibility. Conversely, Title Theory may allow for faster foreclosure processes, impacting homeowners' security and risk compared to Lien Theory states.

States That Follow Lien Theory vs. Title Theory

States that follow lien theory, such as California, New York, and Texas, recognize the borrower retains legal title to the property while the lender holds a lien as security for the mortgage debt. Title theory states, including Florida and Georgia, grant the lender legal title to the property until the mortgage is fully repaid, providing the lender with immediate control in case of default. Understanding whether a state follows lien or title theory is crucial for borrowers and lenders to navigate property rights, foreclosure processes, and mortgage enforcement effectively.

Foreclosure Processes: Lien vs. Title Theory

In lien theory states, the borrower retains title to the property while the lender holds a lien, requiring judicial foreclosure to resolve defaults, which can be time-consuming and involves court approval. Title theory states grant the lender legal title during the mortgage term, allowing non-judicial foreclosure that accelerates the repossession process without court intervention. Understanding the distinction between judicial foreclosure in lien theory and non-judicial foreclosure in title theory is critical for borrowers and lenders navigating mortgage default scenarios.

Borrower and Lender Rights Under Each Theory

In lien theory states, borrowers retain legal title to the property while lenders hold a lien as security, allowing borrowers to maintain ownership rights and possession during the loan period. Title theory states grant lenders legal title to the property until the mortgage is fully paid, giving lenders stronger control but limiting borrower rights to possession and transfer. Understanding these distinctions is crucial for borrowers and lenders to assess risk, rights, and foreclosure procedures in their specific jurisdiction.

Lien Theory vs. Title Theory: Pros and Cons

Lien Theory offers borrowers ownership of the property during the mortgage term, providing greater control and flexibility, but leaves lenders with a lien rather than possession, potentially complicating foreclosure. Title Theory grants the lender legal title until the mortgage is fully paid, enhancing lender security and simplifying foreclosure processes but limiting borrower rights and property control during repayment. Choosing between Lien Theory and Title Theory depends on balancing lender protection with borrower autonomy and the efficiency of foreclosure procedures in specific jurisdictions.

Legal Implications for Homeowners

Lien theory treats the mortgage as a security interest, allowing homeowners to retain legal title while the lender holds a lien until the loan is paid off. Title theory grants the lender legal title to the property during the loan term, giving them ownership rights that can expedite foreclosure in case of default. Understanding these distinctions impacts foreclosure procedures, homeowner rights, and the ability to redeem the property after default.

Choosing the Right Mortgage Based on State Theory

Choosing the right mortgage hinges on whether your state follows lien theory or title theory, as lien theory states grant borrowers ownership during repayment while title theory states vest legal title with lenders until full payment. States like California and New York operate under lien theory, offering borrowers more control and easier refinancing options. Understanding your state's approach influences mortgage structuring, foreclosure processes, and borrower protections crucial for selecting the most advantageous loan terms.

Important Terms

Deed of Trust

A Deed of Trust involves three parties: the borrower, the lender, and a neutral trustee who holds legal title until the loan is repaid, contrasting with the Title Theory where the lender holds title directly as security. Under Lien Theory states, borrowers retain both legal and equitable title, and the lien represents the lender's security interest, while Title Theory states treat the mortgage as a transfer of title, giving the lender possession rights during default.

Mortgagee

Mortgagee's rights differ under Lien Theory and Title Theory; in Lien Theory states, the mortgagee holds a lien as security but the borrower retains title, whereas in Title Theory states, the mortgagee holds legal title until the debt is fully repaid, impacting foreclosure procedures and property possession. Understanding the distinction affects foreclosure timing, legal possession rights, and enforcement of mortgage obligations for the mortgagee.

Mortgagor

In lien theory states, the mortgagor retains legal title to the property while the lender holds a lien as security for the loan, allowing the borrower to possess full ownership rights until default. In contrast, title theory states grant the mortgagee legal title during the loan term, giving the lender possession rights and the ability to foreclose without judicial proceedings if the mortgagor defaults.

Judicial Foreclosure

Judicial foreclosure, a court-supervised process used primarily in lien theory states, involves the lender seeking a court order to sell the property to satisfy an unpaid debt, as the borrower retains title until foreclosure completion. In contrast, title theory states allow lenders to hold legal title during the loan term, enabling non-judicial foreclosure procedures that bypass court involvement.

Nonjudicial Foreclosure

Nonjudicial foreclosure occurs in states following lien theory, where the mortgage creates a lien but the borrower retains title, enabling lenders to initiate foreclosure without court involvement upon default. In contrast, title theory states vest legal title in the lender during the loan term, often requiring judicial foreclosure to transfer ownership after borrower default.

Equitable Title

Equitable title refers to the beneficial interest held by a buyer in real property, allowing rights to use and enjoy the property before legal title transfers; under lien theory states, the borrower retains legal title while the lender holds a lien, whereas in title theory states, the lender holds legal title until the mortgage is fully paid. Understanding the distinction between lien theory and title theory is critical for interpreting the rights and remedies associated with equitable title during mortgage transactions.

Legal Title

Legal title in lien theory states that the borrower retains ownership of the property while the lender holds a lien as security for the loan, whereas in title theory, the lender holds legal title until the loan is fully repaid. The distinction affects foreclosure processes, with lien theory requiring court action and title theory allowing non-judicial foreclosure.

Power of Sale Clause

The Power of Sale Clause allows a mortgagee to sell the property without court intervention upon default, primarily used in lien theory states where the borrower retains title until foreclosure. In contrast, title theory states treat the lender as holding legal title during the loan term, often requiring judicial foreclosure without relying on a Power of Sale Clause.

Redemption Rights

Redemption rights allow borrowers to reclaim their property by paying off the debt after foreclosure, a principle more aligned with Lien Theory states where the lender holds a lien rather than title. In Title Theory states, the lender holds legal title during the loan term, limiting redemption rights and often resulting in quicker foreclosure proceedings.

Security Instrument

A security instrument, such as a mortgage or deed of trust, establishes the lender's interest in real property as collateral for a loan, directly impacting the lien theory and title theory frameworks. In lien theory states, the borrower retains the title while the lender holds a lien until the debt is paid, whereas in title theory states, the lender holds legal title to the property until the loan is satisfied, influencing foreclosure procedures and borrower rights.

Lien Theory vs Title Theory Infographic

moneydif.com

moneydif.com