Conforming mortgages meet the underwriting guidelines and loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac, offering lower interest rates and easier qualification processes. Nonconforming loans, including jumbo loans, do not adhere to these standards, often resulting in higher interest rates and stricter credit requirements. Borrowers typically choose conforming loans for affordability and predictability, while nonconforming loans cater to those with unique financial situations or higher loan amounts.

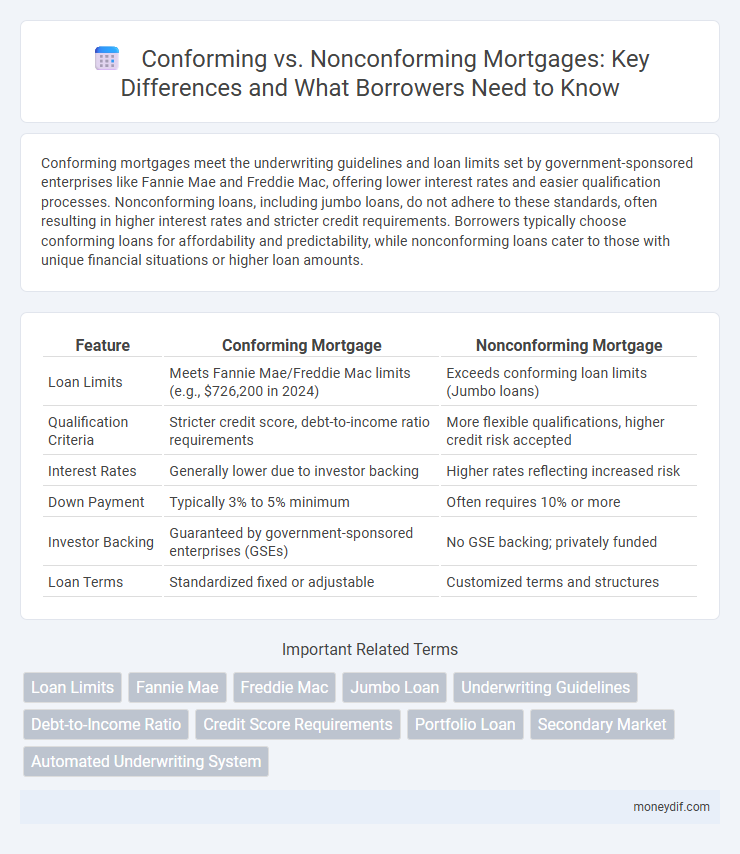

Table of Comparison

| Feature | Conforming Mortgage | Nonconforming Mortgage |

|---|---|---|

| Loan Limits | Meets Fannie Mae/Freddie Mac limits (e.g., $726,200 in 2024) | Exceeds conforming loan limits (Jumbo loans) |

| Qualification Criteria | Stricter credit score, debt-to-income ratio requirements | More flexible qualifications, higher credit risk accepted |

| Interest Rates | Generally lower due to investor backing | Higher rates reflecting increased risk |

| Down Payment | Typically 3% to 5% minimum | Often requires 10% or more |

| Investor Backing | Guaranteed by government-sponsored enterprises (GSEs) | No GSE backing; privately funded |

| Loan Terms | Standardized fixed or adjustable | Customized terms and structures |

Understanding Conforming and Nonconforming Loans

Conforming loans meet the underwriting guidelines and loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac, making them easier to qualify for and typically offering lower interest rates. Nonconforming loans, including jumbo loans, exceed these limits or do not meet standard criteria, often resulting in higher interest rates and stricter approval requirements. Understanding the differences helps borrowers choose the right mortgage product based on factors like loan size, credit score, and financial stability.

Key Differences Between Conforming and Nonconforming Mortgages

Conforming mortgages adhere to limits set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, ensuring lower interest rates and easier qualification due to standardized underwriting criteria. Nonconforming mortgages, including jumbo loans, exceed these limits or do not meet GSE standards, often resulting in higher interest rates and stricter qualification requirements. Key differences include loan size, credit score thresholds, and down payment requirements, with nonconforming loans typically demanding higher credit scores and larger down payments.

Loan Limits: How They Define Conforming vs. Nonconforming

Conforming loans adhere to specific loan limits set by the Federal Housing Finance Agency (FHFA), which in 2024 generally cap at $726,200 for single-family homes in most U.S. counties, while high-cost areas may have higher limits up to $1,089,300. Loans exceeding these thresholds are classified as nonconforming, often referred to as jumbo loans, which typically carry stricter underwriting standards and higher interest rates. These loan limits are crucial in defining eligibility for sale to Fannie Mae or Freddie Mac, impacting loan availability and pricing in the mortgage market.

Credit Requirements for Conforming and Nonconforming Loans

Conforming loans typically require a credit score of at least 620, with higher scores improving approval chances and interest rates, while nonconforming loans often accept lower credit scores or more flexible criteria due to their designation outside Federal Housing Finance Agency limits. Debt-to-income ratios for conforming loans generally should not exceed 43%, whereas nonconforming loan lenders may allow higher ratios based on compensating factors. Documentation standards for conforming loans are stricter, necessitating verifiable income and assets, whereas nonconforming loans might permit alternative documentation or reduced verification.

Interest Rates: Conforming vs. Nonconforming Mortgages

Interest rates on conforming mortgages are typically lower due to their adherence to Fannie Mae and Freddie Mac guidelines, which reduce lender risk and increase loan liquidity. Nonconforming mortgages, including jumbo loans, usually carry higher interest rates because they exceed conforming loan limits or do not meet standard criteria, posing greater risk to lenders. Borrowers with nonconforming loans often face higher costs over the life of the loan compared to conforming mortgage borrowers.

Pros and Cons of Conforming Loans

Conforming loans offer lower interest rates and easier approval due to adherence to Fannie Mae and Freddie Mac guidelines, making them ideal for borrowers with strong credit and stable income. These loans have limits on loan size and borrower eligibility, which can restrict financing options for high-value properties or those with unique financial situations. While conforming loans provide predictability and reduced risk for lenders, borrowers seeking larger loan amounts or more flexible terms may need to consider nonconforming alternatives.

Pros and Cons of Nonconforming Loans

Nonconforming loans offer flexibility for borrowers with unique financial situations or higher loan amounts that exceed conforming limits, allowing access to funding beyond standard Fannie Mae and Freddie Mac guidelines. However, these loans typically come with higher interest rates and stricter underwriting criteria, potentially increasing the overall cost of borrowing. Borrowers should weigh the benefit of easier qualification against the drawback of less favorable loan terms when considering nonconforming mortgage options.

Which Borrowers Benefit from Each Loan Type?

Borrowers with strong credit scores, stable income, and smaller loan amounts typically benefit from conforming loans due to lower interest rates and streamlined approval processes. Those needing loans exceeding conforming limits or with unique financial situations, such as self-employment or lower credit scores, often qualify for nonconforming loans like jumbo or subprime loans. Understanding credit profiles, loan size requirements, and financial stability helps borrowers select the optimal loan type for affordability and approval chances.

How to Qualify for Conforming or Nonconforming Loans

Qualifying for conforming loans requires meeting Fannie Mae or Freddie Mac guidelines, including maximum loan limits, credit score thresholds typically above 620, and debt-to-income ratios below 43%. Nonconforming loans, such as jumbo loans, allow higher loan amounts and more flexible credit requirements but often require higher credit scores, larger down payments, and stronger asset documentation. Lenders assess income stability, employment history, and financial reserves to determine eligibility for both loan types.

Choosing the Right Mortgage: Factors to Consider

Choosing the right mortgage depends on factors such as loan amount, credit score, and down payment size, which determine if a conforming or nonconforming loan is suitable. Conforming loans meet Fannie Mae and Freddie Mac limits and generally offer lower interest rates and streamlined approval processes. Nonconforming loans, including jumbo loans, cater to high-value properties or borrowers with unique financial situations but often come with higher rates and stricter qualification criteria.

Important Terms

Loan Limits

Conforming loan limits are set by the Federal Housing Finance Agency (FHFA) and determine the maximum loan amount eligible for purchase by Fannie Mae and Freddie Mac, typically ranging from $726,200 in most U.S. counties to $1,089,300 in high-cost areas for 2024. Nonconforming loans exceed these limits and include jumbo loans, which often have stricter credit requirements and higher interest rates due to their increased risk and lack of government backing.

Fannie Mae

Fannie Mae primarily purchases and guarantees conforming loans that meet specific criteria such as loan size limits, borrower creditworthiness, and documentation standards, which facilitates liquidity in the mortgage market. Nonconforming loans, including jumbo, subprime, and Alt-A mortgages, fall outside Fannie Mae's purchasing guidelines due to factors like loan amount exceeding conforming limits or borrower risk profiles.

Freddie Mac

Freddie Mac primarily purchases conforming loans that meet specific size, credit, and underwriting standards set by the Federal Housing Finance Agency (FHFA), which ensures liquidity in the conventional mortgage market. Nonconforming loans, such as jumbo loans that exceed Freddie Mac's limits, fall outside their purchase criteria and typically carry higher interest rates due to increased risk.

Jumbo Loan

Jumbo loans exceed conforming loan limits set by the Federal Housing Finance Agency, making them nonconforming and not eligible for purchase by Fannie Mae or Freddie Mac. These loans typically require higher credit scores, larger down payments, and stricter underwriting due to increased risk associated with loan amounts above conforming thresholds.

Underwriting Guidelines

Underwriting guidelines distinguish conforming loans, which meet Fannie Mae and Freddie Mac's criteria including size limits and borrower credit standards, from nonconforming loans that exceed these parameters or involve higher risk profiles. Nonconforming loans often require stricter underwriting standards, higher interest rates, and larger down payments due to their increased credit risk and lack of guarantee by government-sponsored entities.

Debt-to-Income Ratio

The Debt-to-Income (DTI) ratio is a key metric lenders use to evaluate a borrower's ability to manage monthly payments and repay debts, with conforming loans typically requiring a DTI below 43% to meet Fannie Mae and Freddie Mac guidelines. Nonconforming loans often allow higher DTIs, sometimes exceeding 50%, accommodating borrowers with unique financial situations but generally at higher interest rates and stricter terms.

Credit Score Requirements

Conforming loans typically require a minimum credit score of 620 to qualify, aligning with government-sponsored enterprises' standards like Fannie Mae and Freddie Mac. Nonconforming loans, including jumbo loans, often demand higher credit scores above 700 due to increased borrower risk and stricter underwriting criteria.

Portfolio Loan

Portfolio loans are types of mortgage loans that lenders keep on their own books rather than selling to investors, allowing more flexible underwriting guidelines compared to conforming loans that must meet Fannie Mae or Freddie Mac standards. Nonconforming loans, including portfolio loans, often accommodate higher loan amounts, unique borrower qualifications, and property types that fall outside standard conforming loan limits and criteria.

Secondary Market

The secondary market facilitates the buying and selling of mortgage loans, with conforming loans meeting Fannie Mae or Freddie Mac guidelines, ensuring higher liquidity and lower interest rates due to guaranteed purchase. In contrast, nonconforming loans, including jumbo or subprime loans, do not adhere to these standards, often resulting in higher interest rates and limited resale options in the secondary market.

Automated Underwriting System

Automated Underwriting Systems (AUS) rapidly evaluate loan applications by analyzing credit, income, and property data to determine eligibility for conforming loans that meet Fannie Mae or Freddie Mac guidelines, enabling faster approval processes. For nonconforming loans, which fall outside standard criteria due to higher risk factors or loan amounts, AUS provide risk assessments but often require manual review to address exceptions in underwriting.

Conforming vs Nonconforming Infographic

moneydif.com

moneydif.com