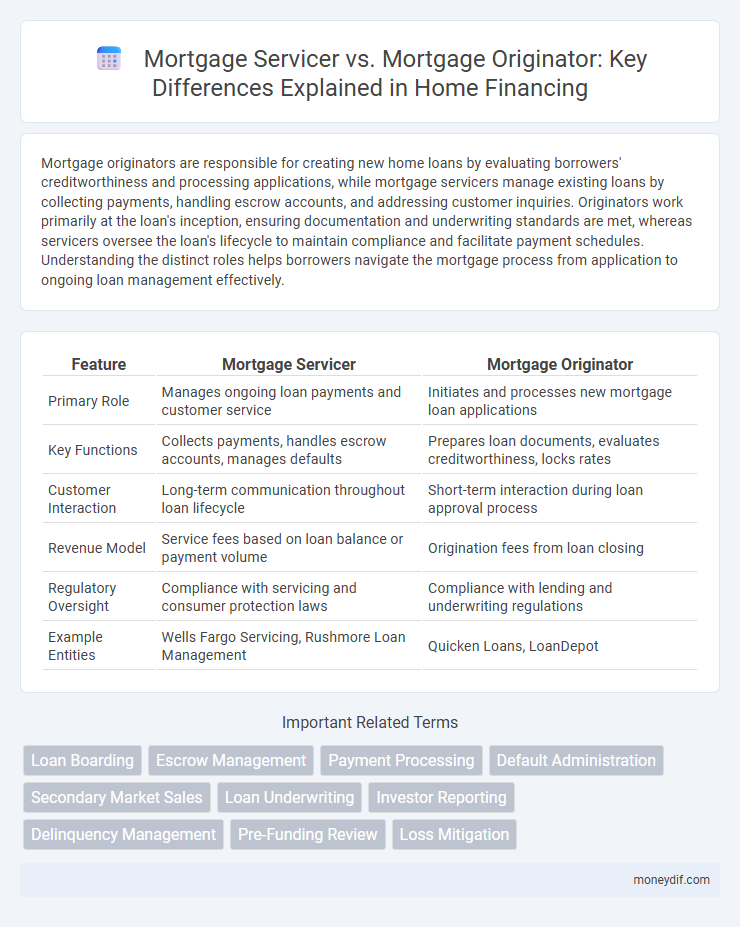

Mortgage originators are responsible for creating new home loans by evaluating borrowers' creditworthiness and processing applications, while mortgage servicers manage existing loans by collecting payments, handling escrow accounts, and addressing customer inquiries. Originators work primarily at the loan's inception, ensuring documentation and underwriting standards are met, whereas servicers oversee the loan's lifecycle to maintain compliance and facilitate payment schedules. Understanding the distinct roles helps borrowers navigate the mortgage process from application to ongoing loan management effectively.

Table of Comparison

| Feature | Mortgage Servicer | Mortgage Originator |

|---|---|---|

| Primary Role | Manages ongoing loan payments and customer service | Initiates and processes new mortgage loan applications |

| Key Functions | Collects payments, handles escrow accounts, manages defaults | Prepares loan documents, evaluates creditworthiness, locks rates |

| Customer Interaction | Long-term communication throughout loan lifecycle | Short-term interaction during loan approval process |

| Revenue Model | Service fees based on loan balance or payment volume | Origination fees from loan closing |

| Regulatory Oversight | Compliance with servicing and consumer protection laws | Compliance with lending and underwriting regulations |

| Example Entities | Wells Fargo Servicing, Rushmore Loan Management | Quicken Loans, LoanDepot |

Understanding Mortgage Servicers vs Mortgage Originators

Mortgage servicers manage ongoing loan payments, escrow accounts, and customer service, ensuring borrowers stay current while handling late payments and defaults. Mortgage originators initiate the loan process by evaluating creditworthiness, processing applications, and underwriting to approve new mortgages. Understanding the distinct roles of servicers and originators is crucial for navigating loan lifecycle and borrower support effectively.

Key Roles of a Mortgage Originator

A mortgage originator plays a crucial role in the home loan process by guiding borrowers through loan applications, assessing creditworthiness, and offering suitable mortgage products. Unlike mortgage servicers who handle loan repayment management and customer service post-closing, originators focus on initiating loans and securing financing approval. Their expertise in underwriting, loan structuring, and compliance ensures a smooth and compliant approval process for first-time buyers and refinancing clients alike.

Responsibilities of a Mortgage Servicer

A mortgage servicer manages the ongoing administrative tasks of a loan after origination, including collecting monthly payments, managing escrow accounts, and handling customer inquiries. They ensure timely payment processing, maintain accurate records, and coordinate with investors on behalf of the loan owner. Mortgage servicers also manage delinquency and foreclosure processes, making them essential for loan maintenance and borrower support throughout the life of the mortgage.

Process: From Loan Origination to Servicing

Mortgage originators initiate the loan process by evaluating borrower creditworthiness, collecting documentation, and submitting applications for approval. Once the loan closes, mortgage servicers manage ongoing responsibilities such as payment processing, escrow management, and customer inquiries. The transition from origination to servicing ensures continuous loan administration from approval through payoff or refinancing.

Differences in Customer Interaction

Mortgage servicers manage existing loan accounts by handling payments, escrow, and customer service inquiries, ensuring ongoing communication throughout the loan term. Mortgage originators engage with clients primarily at the loan application stage, guiding borrowers through qualification, loan options, and documentation before closing. The key difference lies in servicers maintaining long-term customer relationships, while originators focus on initial loan acquisition and underwriting.

How Mortgage Originators Make Money

Mortgage originators primarily make money through origination fees, which are typically a percentage of the loan amount paid by borrowers at closing. They may also earn commission-based compensation from lenders for each loan they successfully process and fund. Some originators receive yield spread premiums, allowing them to profit by offering borrowers interest rates above the par rate set by lenders.

How Mortgage Servicers Make Money

Mortgage servicers make money primarily by collecting monthly payments from borrowers and managing escrow accounts for taxes and insurance, earning a servicing fee that is typically a small percentage of the loan balance. They may also generate income through late fees, penalties, and ancillary services such as loan modifications and default management. Servicers do not loan money themselves; instead, they manage the loan on behalf of the investor who owns the mortgage.

Impact on Homeowners: Originator vs Servicer

Mortgage originators directly influence homeowners by initiating loan agreements and setting initial terms, affecting affordability and loan structure. Mortgage servicers impact homeowners throughout the loan lifecycle by managing payments, handling escrow accounts, and assisting with modifications or delinquencies, which can affect financial stability and credit health. The distinction in roles determines how homeowners interact with their mortgage, shaping their overall experience and loan outcomes.

Choosing a Lender: What Borrowers Should Know

Borrowers should understand that mortgage originators are responsible for creating and processing loan applications, while mortgage servicers handle the ongoing management of the loan after closing, including payments and escrow accounts. Choosing a lender involves evaluating the originator's loan terms, customer service, and responsiveness, as these factors impact loan approval and initial experience. It is also important to research the servicer's reputation for efficient payment processing and support to ensure smooth long-term loan management.

Common FAQs About Mortgage Servicers and Originators

Mortgage servicers handle the ongoing management of a loan after closing, including payment processing, escrow accounts, and customer service, while mortgage originators assist borrowers during the loan application and approval process. Common FAQs address how servicers manage escrow funds, the process for loan modifications, and differences in borrower interaction compared to originators who focus on credit evaluation and loan options. Understanding the roles helps clarify who to contact for payment issues versus loan application questions.

Important Terms

Loan Boarding

Loan boarding involves transferring a mortgage loan's data from the originator to the servicer, ensuring accurate setup for payment processing and escrow management. Mortgage originators focus on loan approval and initial documentation, while mortgage servicers handle ongoing loan administration, customer service, and compliance post-boarding.

Escrow Management

Escrow management in mortgage servicing involves the accurate collection and disbursement of funds for property taxes and insurance, ensuring borrower compliance and protection. Mortgage servicers handle escrow accounts with ongoing payment administration, whereas mortgage originators primarily focus on loan origination without managing escrow responsibilities post-closing.

Payment Processing

Mortgage originators handle initial payment collection and loan disbursement, while mortgage servicers manage ongoing payment processing, escrow accounts, and borrower communication. Effective payment processing by servicers ensures accurate application of principal, interest, taxes, and insurance, reducing default risk and optimizing loan performance.

Default Administration

Default administration involves managing delinquent mortgage loans, focusing on loss mitigation, foreclosure processing, and investor reporting. Mortgage servicers handle these tasks directly, while mortgage originators primarily focus on loan production and transfer servicing rights post-origination.

Secondary Market Sales

Secondary market sales involve mortgage servicers selling existing loans to investors, enabling liquidity and risk transfer, whereas mortgage originators primarily focus on creating new loans for borrowers. This distinction highlights the servicer's role in managing loan repayments and investor relations, contrasting with the originator's responsibility for initial borrower underwriting and loan funding.

Loan Underwriting

Loan underwriting evaluates borrower risk by analyzing credit, income, and property value to approve mortgage applications, primarily conducted by mortgage originators who initiate the loan process. Mortgage servicers, on the other hand, manage ongoing loan payments, escrow accounts, and customer service after loan closing, ensuring compliance and default management rather than underwriting.

Investor Reporting

Investor reporting for mortgage servicers involves detailed documentation of loan performance, payment histories, and compliance with investor guidelines, ensuring transparency and accuracy for loan investors. Mortgage originators primarily focus on initial loan documentation and credit risk assessment, while servicers manage ongoing reporting and investor communication throughout the loan lifecycle.

Delinquency Management

Delinquency management in mortgage servicing focuses on monitoring overdue payments and implementing loss mitigation strategies to minimize defaults, while mortgage originators primarily concentrate on loan origination and underwriting without direct involvement in post-loan payment issues. Effective delinquency management enhances mortgage servicers' ability to maintain portfolio performance and borrower retention compared to mortgage originators who are less involved after loan closing.

Pre-Funding Review

Pre-Funding Review ensures mortgage originators submit accurate and compliant loan documentation before funding, minimizing risks for mortgage servicers during loan purchase or servicing transfer. Mortgage servicers rely on this review to verify loan eligibility, ownership rights, and adherence to underwriting standards, safeguarding portfolio quality and regulatory compliance.

Loss Mitigation

Loss mitigation strategies typically involve mortgage servicers who manage loan modifications, forbearance, or short sales to prevent foreclosure, whereas mortgage originators primarily focus on loan creation and underwriting processes. The servicer's role in loss mitigation directly impacts borrower retention and default management, distinguishing it from the originator's initial lending activities.

Mortgage Servicer vs Mortgage Originator Infographic

moneydif.com

moneydif.com