The debt-to-income ratio measures a borrower's monthly debt payments against their gross monthly income, indicating their ability to manage monthly obligations, while the loan-to-value ratio compares the loan amount to the appraised value of the property, assessing the risk level for lenders based on the equity in the home. Understanding both ratios is crucial for mortgage approval, as lenders evaluate a borrower's financial stability through their DTI and the property's collateral value via the LTV. A lower debt-to-income ratio and loan-to-value ratio typically improve the chances of securing favorable loan terms and interest rates.

Table of Comparison

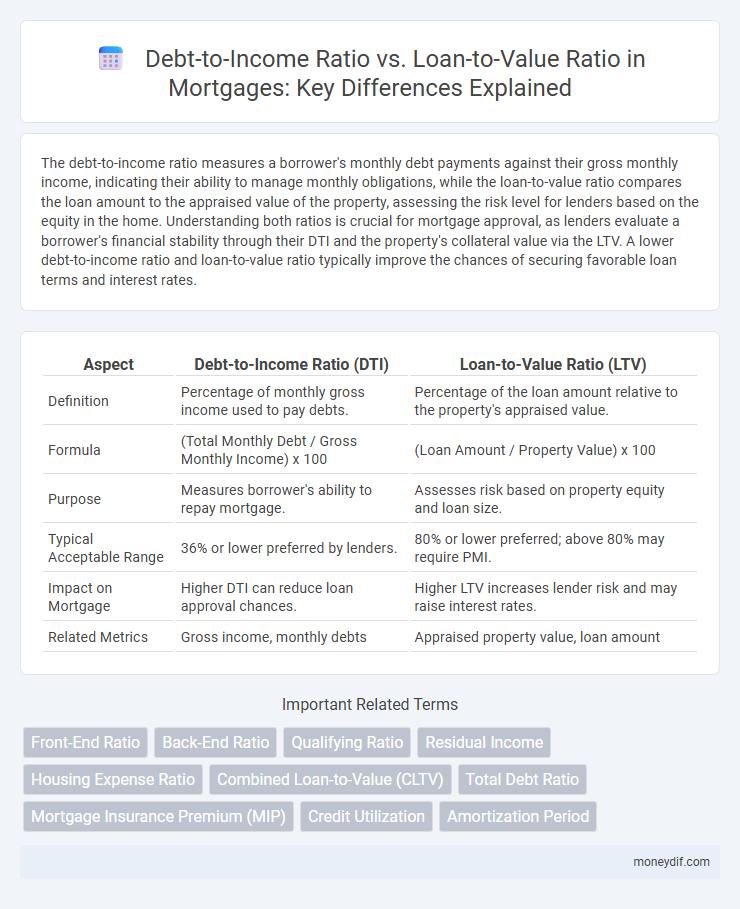

| Aspect | Debt-to-Income Ratio (DTI) | Loan-to-Value Ratio (LTV) |

|---|---|---|

| Definition | Percentage of monthly gross income used to pay debts. | Percentage of the loan amount relative to the property's appraised value. |

| Formula | (Total Monthly Debt / Gross Monthly Income) x 100 | (Loan Amount / Property Value) x 100 |

| Purpose | Measures borrower's ability to repay mortgage. | Assesses risk based on property equity and loan size. |

| Typical Acceptable Range | 36% or lower preferred by lenders. | 80% or lower preferred; above 80% may require PMI. |

| Impact on Mortgage | Higher DTI can reduce loan approval chances. | Higher LTV increases lender risk and may raise interest rates. |

| Related Metrics | Gross income, monthly debts | Appraised property value, loan amount |

Understanding Debt-to-Income Ratio in Mortgages

Debt-to-Income Ratio (DTI) measures the percentage of a borrower's monthly gross income that goes toward paying debts, including mortgage payments, credit cards, and loans. Lenders use DTI to assess a borrower's ability to manage monthly payments and repay the mortgage, with a generally preferred DTI below 43% for conventional loans. Understanding DTI helps borrowers evaluate their financial health and improve loan eligibility by reducing debts or increasing income before applying for a mortgage.

What Is Loan-to-Value Ratio?

Loan-to-Value Ratio (LTV) measures the loan amount compared to the appraised value or purchase price of a property, expressed as a percentage. A lower LTV indicates less risk to lenders, often resulting in better mortgage rates and terms. Lenders use LTV to assess the risk of loan default and determine the need for private mortgage insurance (PMI).

Key Differences Between DTI and LTV

The Debt-to-Income (DTI) ratio measures a borrower's monthly debt payments relative to their gross monthly income, indicating their ability to manage monthly payments, while the Loan-to-Value (LTV) ratio compares the mortgage loan amount to the appraised property value, assessing the risk level of the loan itself. Lenders use DTI to evaluate financial stability and repayment capacity, whereas LTV helps determine the amount of equity and impacts mortgage insurance requirements. Both ratios are critical in mortgage underwriting but serve distinct purposes in assessing borrower risk and loan security.

How Lenders Use DTI in Mortgage Approval

Lenders use the Debt-to-Income (DTI) ratio to assess a borrower's ability to manage monthly mortgage payments alongside existing debt, ensuring financial stability and lowering default risk. A lower DTI ratio typically improves mortgage approval chances by indicating a balanced income-to-debt relationship. While Loan-to-Value (LTV) ratio measures the loan amount relative to the property's value, DTI directly reflects the borrower's income capacity to repay the loan.

The Role of LTV in Securing a Home Loan

The Loan-to-Value (LTV) ratio plays a crucial role in securing a home loan by measuring the loan amount against the appraised value of the property, directly impacting lender risk assessment and interest rates. A lower LTV ratio typically signals less risk to lenders, often leading to better loan terms and potential waiver of private mortgage insurance (PMI). Unlike the Debt-to-Income (DTI) ratio, which evaluates borrower income relative to debt obligations, LTV focuses specifically on the collateral value, making it a key determinant in loan approval and refinancing decisions.

Impact of DTI on Your Mortgage Qualifying Power

Debt-to-Income (DTI) ratio is a critical factor lenders assess to determine your mortgage qualifying power, as it measures your monthly debt payments against your gross monthly income. A lower DTI ratio enhances your chances of loan approval and may secure better interest rates, while a high DTI ratio can limit borrowing capacity or result in loan denial. Unlike Loan-to-Value (LTV) ratio, which compares the loan amount to the property's appraised value, DTI directly reflects your ability to manage monthly debt obligations, making it pivotal in mortgage underwriting.

How LTV Affects Mortgage Rates and Terms

Loan-to-Value (LTV) ratio directly impacts mortgage rates and terms by influencing lender risk assessment, where lower LTV ratios often result in more favorable interest rates and reduced fees. High LTV ratios, typically above 80%, can trigger the need for private mortgage insurance (PMI) and may lead to higher mortgage rates and stricter loan terms. Lenders use LTV to determine the maximum loan amount relative to the property value, shaping borrower eligibility and the overall cost of mortgage financing.

Improving Your Debt-to-Income Ratio

Improving your Debt-to-Income (DTI) ratio involves reducing monthly debt payments and increasing gross income to boost mortgage eligibility and secure lower interest rates. Paying down credit card balances, consolidating debts, and avoiding new loans can significantly lower your DTI, enhancing your financial profile for lenders. Monitoring your DTI alongside your Loan-to-Value (LTV) ratio provides a comprehensive view of your borrowing capacity and helps optimize mortgage approval chances.

Strategies to Lower Your Loan-to-Value Ratio

Lowering your Loan-to-Value (LTV) ratio enhances mortgage approval chances and secures better interest rates. Strategies include making a larger down payment, opting for property renovations that increase home value, and reducing the mortgage amount through refinancing or paying down existing debt. Combining these efforts effectively decreases LTV, improving loan terms and financial stability.

DTI vs. LTV: Which Matters More for Borrowers?

Debt-to-Income (DTI) ratio measures a borrower's monthly debt payments relative to their gross income, while Loan-to-Value (LTV) ratio compares the loan amount to the appraised property value. Lenders prioritize DTI because it reflects the borrower's ability to repay the mortgage, often setting maximum DTI limits around 43-50%. LTV influences the required down payment and mortgage insurance but DTI typically holds greater weight in loan approval decisions.

Important Terms

Front-End Ratio

The Front-End Ratio measures housing-related debt against gross income, highlighting borrower affordability compared to the Debt-to-Income Ratio, which includes all debts, and the Loan-to-Value Ratio, which assesses loan amount relative to property value.

Back-End Ratio

The Back-End Ratio measures the percentage of a borrower's gross monthly income allocated to total debt payments, offering a more comprehensive assessment of credit risk compared to the Debt-to-Income Ratio, while the Loan-to-Value Ratio evaluates loan amount against property value to gauge collateral risk.

Qualifying Ratio

Qualifying Ratio measures loan eligibility by comparing Debt-to-Income Ratio, which assesses borrower's income versus debt payments, against Loan-to-Value Ratio, which evaluates the loan amount against the property's appraised value.

Residual Income

Residual income gauges borrower cash flow after debt obligations, directly impacting Debt-to-Income Ratio assessments, while Loan-to-Value Ratio measures loan amount against property value, jointly influencing mortgage approval risk.

Housing Expense Ratio

The Housing Expense Ratio measures mortgage-related costs relative to income, comparing key financial metrics like the Debt-to-Income Ratio, which assesses overall borrower indebtedness, and the Loan-to-Value Ratio, which evaluates loan amount against property value.

Combined Loan-to-Value (CLTV)

Combined Loan-to-Value (CLTV) measures total mortgage debt compared to property value and impacts borrower qualification when analyzed alongside Debt-to-Income (DTI) ratio and Loan-to-Value (LTV) ratio.

Total Debt Ratio

The Total Debt Ratio measures a borrower's total monthly debt payments divided by gross monthly income, contrasting with the Debt-to-Income Ratio which focuses solely on income-related debt burdens, while the Loan-to-Value Ratio compares the loan amount to the appraised property value, highlighting collateral risk.

Mortgage Insurance Premium (MIP)

Mortgage Insurance Premium (MIP) rates are influenced more significantly by the Loan-to-Value (LTV) ratio than the Debt-to-Income (DTI) ratio when determining FHA loan eligibility and costs.

Credit Utilization

Credit utilization directly impacts the debt-to-income ratio by reflecting the amount of revolving credit used relative to income, while the loan-to-value ratio measures loan amount against asset value, both crucial for assessing borrowing risk.

Amortization Period

Amortization periods influence debt-to-income ratios by affecting monthly payments, while loan-to-value ratios determine maximum borrowing limits based on property value.

Debt-to-Income Ratio vs Loan-to-Value Ratio Infographic

moneydif.com

moneydif.com