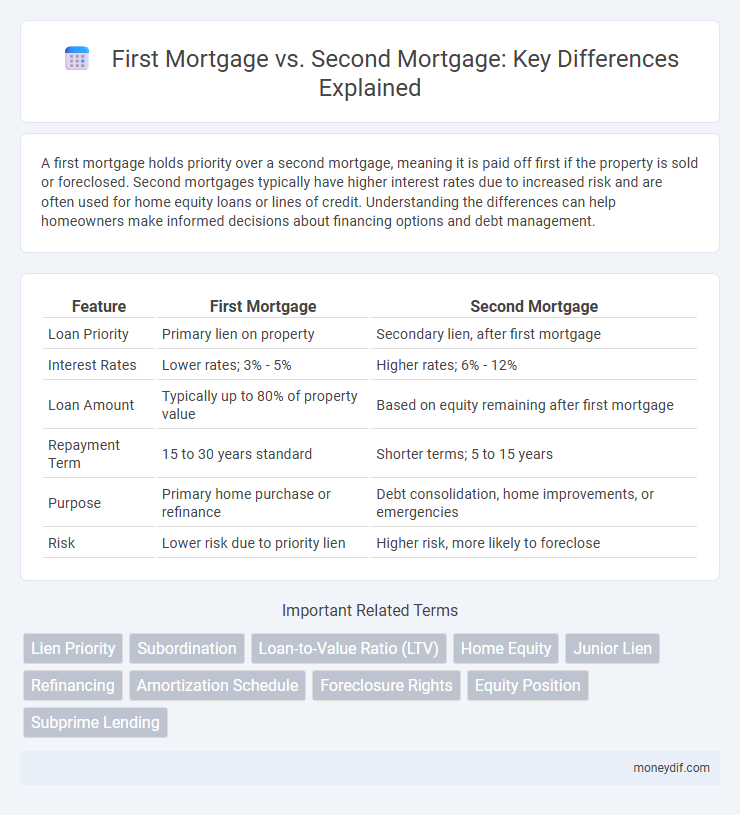

A first mortgage holds priority over a second mortgage, meaning it is paid off first if the property is sold or foreclosed. Second mortgages typically have higher interest rates due to increased risk and are often used for home equity loans or lines of credit. Understanding the differences can help homeowners make informed decisions about financing options and debt management.

Table of Comparison

| Feature | First Mortgage | Second Mortgage |

|---|---|---|

| Loan Priority | Primary lien on property | Secondary lien, after first mortgage |

| Interest Rates | Lower rates; 3% - 5% | Higher rates; 6% - 12% |

| Loan Amount | Typically up to 80% of property value | Based on equity remaining after first mortgage |

| Repayment Term | 15 to 30 years standard | Shorter terms; 5 to 15 years |

| Purpose | Primary home purchase or refinance | Debt consolidation, home improvements, or emergencies |

| Risk | Lower risk due to priority lien | Higher risk, more likely to foreclose |

Understanding First Mortgages: Basics and Benefits

A first mortgage represents the primary loan secured by a property, holding priority over any secondary liens in case of default. It typically offers lower interest rates and longer repayment terms compared to second mortgages, making it a cost-effective option for homebuyers. Understanding the benefits of a first mortgage, such as better approval chances and higher borrowing limits, is crucial for maximizing home financing options.

What is a Second Mortgage? Key Features Explained

A second mortgage is a type of loan secured against a property that already has an existing first mortgage, allowing homeowners to borrow additional funds based on their home equity. Key features include a typically higher interest rate than the first mortgage, a riskier position since it is subordinate to the first mortgage in repayment priority, and uses the property's remaining equity as collateral. Borrowers often use second mortgages for home improvements, debt consolidation, or large expenses, with repayment terms that can be fixed or variable depending on the lender.

First vs Second Mortgage: Primary Differences

A first mortgage holds priority over a second mortgage in case of borrower default, meaning it gets repaid first during foreclosure. The loan amount for a first mortgage typically covers the majority of the property's value, while a second mortgage, often a home equity loan or line of credit, taps into the remaining equity. Interest rates on first mortgages are usually lower due to their higher priority status and lower risk compared to second mortgages.

Eligibility Requirements for First Mortgages

Eligibility requirements for first mortgages typically include a strong credit score, stable income, and a low debt-to-income ratio to ensure repayment ability. Lenders often require a minimum down payment ranging from 3% to 20%, with documentation such as tax returns, pay stubs, and bank statements to verify financial stability. First mortgages prioritize primary residence financing, which impacts qualification criteria compared to second mortgages that usually hinge on existing equity and creditworthiness.

Qualifying for a Second Mortgage: What You Need to Know

Qualifying for a second mortgage requires assessing your existing first mortgage balance, credit score, and debt-to-income ratio to ensure eligibility. Lenders typically require at least 20% equity in your home and a credit score above 620, though specific criteria may vary by institution. Understanding these financial benchmarks helps streamline the approval process and secure favorable loan terms.

Interest Rates Comparison: First vs Second Mortgage

First mortgages typically feature lower interest rates compared to second mortgages due to their primary lien position, which reduces risk for lenders. Second mortgage interest rates are generally higher because they are subordinated loans, increasing borrower risk and lender exposure. Borrowers should consider these rate differences when deciding between first and second mortgage financing options.

Pros and Cons of a First Mortgage

A first mortgage offers lower interest rates and better repayment terms compared to second mortgages, making it a more cost-effective option for homebuyers. It provides higher loan amounts and priority in foreclosure situations, ensuring greater security for lenders but also limiting the homeowner's ability to take on additional loans. However, first mortgages typically have stricter qualification criteria and longer approval processes than second mortgages.

Advantages and Risks of a Second Mortgage

A second mortgage allows homeowners to access additional funds by borrowing against their home equity without refinancing the first mortgage, offering advantages such as lower interest rates compared to personal loans and the potential for tax-deductible interest. However, the risks include higher interest rates than the primary mortgage, increased financial liability, and the possibility of foreclosure if payments on either loan are missed. Borrowers must carefully assess their repayment capability and the impact on overall debt to avoid jeopardizing their homeownership.

When Should You Consider a Second Mortgage?

A second mortgage can be a strategic financial tool when you have significant equity in your home and need access to additional funds for major expenses like home improvements, education, or debt consolidation. This option becomes ideal if your first mortgage has favorable terms and you can manage payments on both loans without financial strain. Evaluating interest rates, loan terms, and your overall financial stability is crucial before taking on a second mortgage to avoid excessive debt risk.

First Mortgage vs Second Mortgage: Which is Right for You?

A first mortgage is the primary loan secured by your home, typically offering lower interest rates and higher borrowing limits due to its priority in repayment if you default. A second mortgage, such as a home equity loan or line of credit, uses your home as collateral but carries higher interest rates and is subordinate to the first mortgage in repayment priority. Choosing between a first and second mortgage depends on your financial goals, loan amount needed, and your ability to manage additional debt securely.

Important Terms

Lien Priority

A first mortgage holds superior lien priority over a second mortgage, meaning the first lender has the primary legal claim to the property in case of default or foreclosure. This priority status impacts the order of repayment, with the first mortgage being paid off before any remaining funds are allocated to the second mortgage holder.

Subordination

A first mortgage holds priority over a second mortgage in lien position, meaning the first lender gets paid before the second in foreclosure. Subordination agreements can alter this hierarchy by allowing a second mortgage to take precedence over an existing lien, commonly used in refinancing or home equity lines of credit.

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) measures the loan amount against the property's appraised value, playing a critical role in both first and second mortgages by determining borrowing limits and risk exposure. First mortgages typically have lower LTV ratios and higher priority claims, while second mortgages carry higher LTVs and increased interest rates due to subordinate lien positions.

Home Equity

Home equity represents the portion of a property's value owned outright by the homeowner, calculated as the current market value minus any outstanding mortgage balances. A first mortgage holds priority lien status over a second mortgage, meaning it must be fully paid off before the second mortgage lender can collect in foreclosure, affecting interest rates, loan terms, and risk levels for borrowers.

Junior Lien

A Junior Lien represents a secondary claim on a property, ranking below the First Mortgage in repayment priority during foreclosure or sale. Second Mortgages are common forms of Junior Liens, carrying higher interest rates due to increased risk for lenders compared to the First Mortgage.

Refinancing

Refinancing a first mortgage typically offers lower interest rates and longer repayment terms compared to a second mortgage, which often carries higher rates due to increased lender risk. Homeowners may choose to refinance a second mortgage to consolidate debt or reduce monthly payments, but this process usually involves stricter credit requirements and higher closing costs.

Amortization Schedule

An amortization schedule for a first mortgage typically outlines consistent monthly payments prioritizing principal and interest over a 15 to 30-year term, whereas a second mortgage amortization often involves shorter terms with varied payment structures due to higher interest rates and increased risk. The first mortgage holds priority in lien position, affecting payoff sequences during refinancing or property sales, making accurate amortization schedules essential for managing combined debt obligations effectively.

Foreclosure Rights

First mortgage holders have primary foreclosure rights, enabling them to initiate foreclosure and claim property proceeds before second mortgage holders. Second mortgage lenders face higher risk since their repayment depends on leftover equity after the first mortgage is satisfied in foreclosure sales.

Equity Position

An equity position in real estate refers to the ownership interest held by a borrower after accounting for mortgage debts, where the first mortgage holds primary claim and priority over the property if default occurs, while the second mortgage represents a subordinate lien with higher risk and typically higher interest rates. Understanding the difference between first and second mortgage positions is crucial for lenders and borrowers to assess risk, loan terms, and potential recovery in foreclosure scenarios.

Subprime Lending

Subprime lending involves high-risk borrowers receiving loans with higher interest rates, often seen in both first mortgage and second mortgage scenarios where first mortgages have priority claims on property and second mortgages carry increased default risk due to subordinate lien position. First mortgages typically offer lower interest rates due to lower risk, while subprime second mortgages compensate lenders for heightened credit risk and potential for foreclosure loss.

First Mortgage vs Second Mortgage Infographic

moneydif.com

moneydif.com