Porting a mortgage allows borrowers to transfer their existing loan terms, including the interest rate, to a new property without requalifying, which can save money if rates have increased. Assumption of a mortgage involves the buyer taking over the seller's existing loan, often requiring lender approval and potentially involving fees or eligibility criteria. Both strategies can offer cost savings but differ in flexibility and lender requirements, making it essential to compare them based on individual financial situations and market conditions.

Table of Comparison

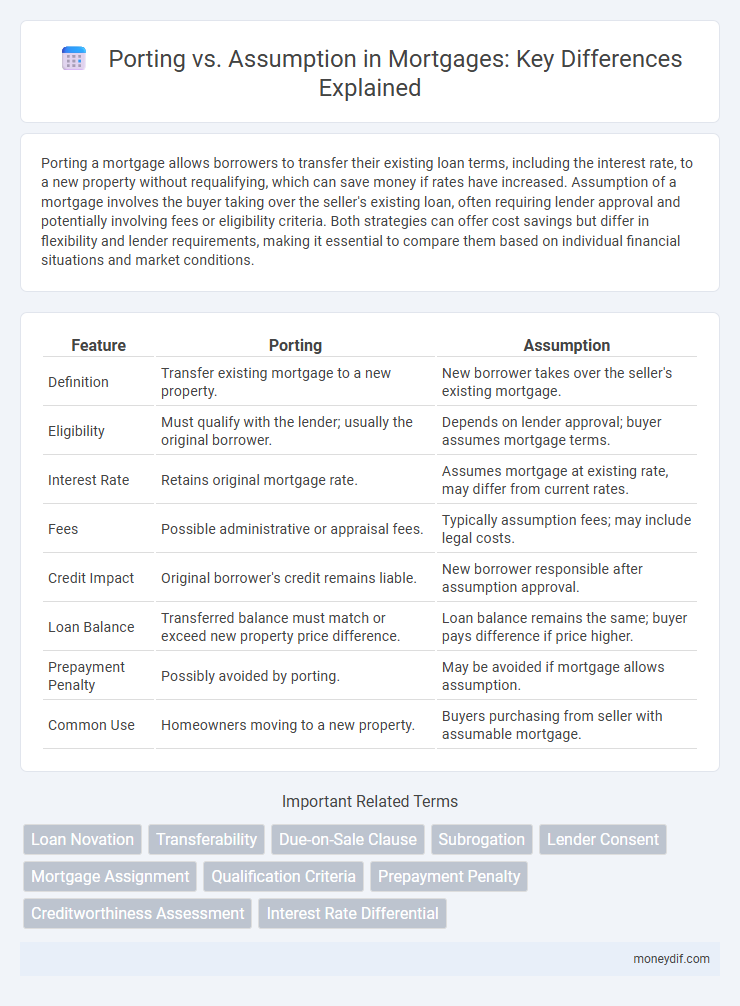

| Feature | Porting | Assumption |

|---|---|---|

| Definition | Transfer existing mortgage to a new property. | New borrower takes over the seller's existing mortgage. |

| Eligibility | Must qualify with the lender; usually the original borrower. | Depends on lender approval; buyer assumes mortgage terms. |

| Interest Rate | Retains original mortgage rate. | Assumes mortgage at existing rate, may differ from current rates. |

| Fees | Possible administrative or appraisal fees. | Typically assumption fees; may include legal costs. |

| Credit Impact | Original borrower's credit remains liable. | New borrower responsible after assumption approval. |

| Loan Balance | Transferred balance must match or exceed new property price difference. | Loan balance remains the same; buyer pays difference if price higher. |

| Prepayment Penalty | Possibly avoided by porting. | May be avoided if mortgage allows assumption. |

| Common Use | Homeowners moving to a new property. | Buyers purchasing from seller with assumable mortgage. |

What Is Mortgage Porting?

Mortgage porting allows homeowners to transfer their existing mortgage terms and interest rate to a new property when moving, preventing penalties associated with breaking the original mortgage contract. This option is beneficial when favorable interest rates are locked in, enabling borrowers to maintain financial stability without restarting the mortgage process. Porting typically requires lender approval and a qualifying credit assessment to ensure the borrower can support the mortgage on the new property.

What Does Mortgage Assumption Mean?

Mortgage assumption means a homebuyer takes over the seller's existing mortgage along with its current terms, interest rate, and balance. This process can save money and simplify financing by avoiding new loan approval and closing costs. Not all mortgages are assumable; typically, FHA, VA, and USDA loans allow for assumption, while conventional loans often do not.

Key Differences Between Porting and Assumption

Porting a mortgage involves transferring an existing loan from one property to a new property while maintaining the current terms and interest rate, primarily beneficial when moving to a new home. Assumption allows a buyer to take over the seller's existing mortgage, often qualifying for the seller's interest rate and terms, but requires lender approval and sometimes a new credit evaluation. Key differences include that porting is typically initiated by the borrower during relocation, whereas assumption is a transfer of mortgage responsibility to a new borrower, potentially affecting eligibility and liability.

Eligibility Criteria for Mortgage Porting

Eligibility criteria for mortgage porting typically require the borrower to meet the lender's current creditworthiness standards, including a sufficient credit score and stable income verification. The existing mortgage must be portable under the original loan agreement, and the property being purchased must generally meet the lender's approved property type and value guidelines. Lenders may also require that the mortgage holder remains the primary borrower throughout the process to ensure compliance with underwriting policies.

Who Qualifies for Mortgage Assumption?

Mortgage assumption allows buyers who meet specific lender criteria, such as creditworthiness and income verification, to take over an existing mortgage, often benefiting from lower interest rates. Typically, qualified buyers must demonstrate financial stability and meet the original loan terms, including debt-to-income ratios and credit score minimums set by the lender. FHA, VA, and USDA loans frequently permit assumption, provided the new borrower obtains lender approval, making them attractive for those who might not qualify for a new mortgage at current market rates.

Pros and Cons of Mortgage Porting

Mortgage porting allows homeowners to transfer their existing mortgage terms and interest rates to a new property, preserving benefits like a lower interest rate and avoiding prepayment penalties. It offers financial predictability and potential savings but may be limited by lender approval and the new property's value relative to the original mortgage. However, porting can involve strict timelines and may require a larger down payment if the new home is more expensive, reducing flexibility compared to a mortgage assumption.

Advantages and Disadvantages of Mortgage Assumption

Mortgage assumption allows a buyer to take over the seller's existing mortgage, often at a lower interest rate than current market offerings, providing significant cost savings and streamlined approval processes. However, the lender's approval is required, and the buyer assumes all responsibilities for the loan, which may include due-on-sale clauses or unexpected financial liabilities. This option can benefit buyers in stable or declining interest rate environments but limits flexibility if refinancing is needed later.

Porting vs Assumption: Which Is Right for You?

Porting a mortgage allows homeowners to transfer their existing loan terms and interest rate to a new property, preserving favorable conditions and potentially saving on early repayment penalties. Mortgage assumption enables a buyer to take over the seller's mortgage under the original terms, often requiring lender approval and credit qualification. Choosing between porting and assuming depends on factors like current interest rates, lender policies, and your credit profile, making it crucial to evaluate cost savings and eligibility before deciding.

Costs and Fees Involved in Porting and Assumption

Porting a mortgage typically involves lower fees, including administrative costs charged by the lender to transfer the existing loan to a new property, whereas assumption may require a substantial assumption fee and possible qualification expenses. In porting, the borrower often avoids prepayment penalties, but must cover legal and appraisal fees, while assumptions might incur lender processing fees and potentially higher interest rates if the original loan terms differ. Both options can include title insurance and registration fees, but assumption often has more stringent credit and qualification costs impacting the overall expense.

Frequently Asked Questions on Porting and Assumption

Porting a mortgage allows borrowers to transfer their existing loan terms and interest rate to a new property without refinancing, typically requiring lender approval and meeting current qualification criteria. Assumption enables a buyer to take over the seller's existing mortgage, often with less stringent qualification but may involve lender fees and potential interest rate differences if the loan is not assumable. Common FAQs include eligibility requirements, potential costs, impact on credit, and how each option affects loan terms and closing timelines.

Important Terms

Loan Novation

Loan novation involves replacing the original loan agreement with a new one, effectively transferring all rights and obligations to a new borrower, which differs from porting where the existing loan terms are retained but shifted to a new property under the same borrower. Unlike assumption, where the new borrower takes over the original loan with lender approval but the original contract remains unchanged, novation creates a completely new contractual relationship, often requiring fresh credit assessment and lender consent.

Transferability

Transferability in the context of porting versus assumption refers to the ease with which software or data can be moved and adapted from one system or environment to another. Porting involves modifying code to function in a new environment, ensuring compatibility, while assumption relies on the expectation that existing components will operate correctly without significant changes, often risking reduced performance or functionality.

Due-on-Sale Clause

The Due-on-Sale Clause in mortgage agreements triggers full loan repayment upon property transfer, making porting a preferred option for borrowers wanting to retain favorable loan terms while moving to a new property without triggering this clause. In contrast, loan assumption involves a new buyer taking over the existing mortgage, typically requiring lender approval to avoid activating the Due-on-Sale Clause.

Subrogation

Subrogation involves one party stepping into the legal shoes of another to claim rights or recover debt, often seen in insurance contexts, while porting allows the transfer of benefits or policies from one provider to another without loss of continuity. In contrast, assumption refers to one party taking over an existing contract or liability entirely, which may involve formal consent and changes in responsibility distinct from the seamless nature of porting.

Lender Consent

Lender consent is crucial when comparing porting a mortgage to assuming it, as porting often requires explicit approval from the lender to transfer the existing loan terms to a new property. In contrast, assumption involves the buyer taking over the seller's mortgage obligations, which typically mandates lender consent to verify the new borrower's creditworthiness and agreement to the original loan conditions.

Mortgage Assignment

Mortgage assignment legally transfers a loan's ownership from one lender to another, while porting involves borrowers moving their existing mortgage terms to a new property without requalification. Assumption allows a new buyer to take over the current mortgage under the original terms, often requiring lender approval and possibly higher interest rates.

Qualification Criteria

Qualification criteria for porting typically require thorough compatibility assessments between existing systems and new platforms, ensuring seamless migration without data loss or functionality disruption. In contrast, assumption-related criteria focus on verifying that all legal, financial, and operational obligations are transferable and that the acquiring entity has the capacity to uphold these commitments.

Prepayment Penalty

Prepayment penalties often influence the decision between loan porting and assumption, as porting typically avoids triggering penalties by transferring the existing mortgage terms to a new property. In contrast, assuming a mortgage may involve a prepayment penalty if the original loan is paid off early or terms are modified during the transfer.

Creditworthiness Assessment

Creditworthiness assessment plays a crucial role in both loan porting and assumption, determining a borrower's ability to meet financial obligations under new terms or ownership. Lenders evaluate credit scores, income stability, and debt-to-income ratios to minimize risk when approving porting, which allows transfer of an existing loan to a new property, or assumption, where a new borrower takes over the original loan.

Interest Rate Differential

Interest Rate Differential (IRD) plays a crucial role in mortgage porting versus assumption decisions, as IRD is the fee charged by lenders when a borrower transfers an existing mortgage to a new property or a new borrower takes over the loan. Porting allows borrowers to retain their original mortgage terms, including the IRD, whereas assumption involves a new borrower taking on the existing mortgage, potentially triggering a different calculation or waiver of the IRD depending on lender policies.

Porting vs Assumption Infographic

moneydif.com

moneydif.com