Conforming loans meet the guidelines set by Fannie Mae and Freddie Mac, including maximum loan limits and credit requirements, making them easier to qualify for and often offering lower interest rates. Non-conforming loans fall outside these standards due to higher loan amounts or borrower risk factors, resulting in potentially higher interest rates and stricter approval criteria. Choosing between conforming and non-conforming mortgages depends on your financial profile and the loan amount needed.

Table of Comparison

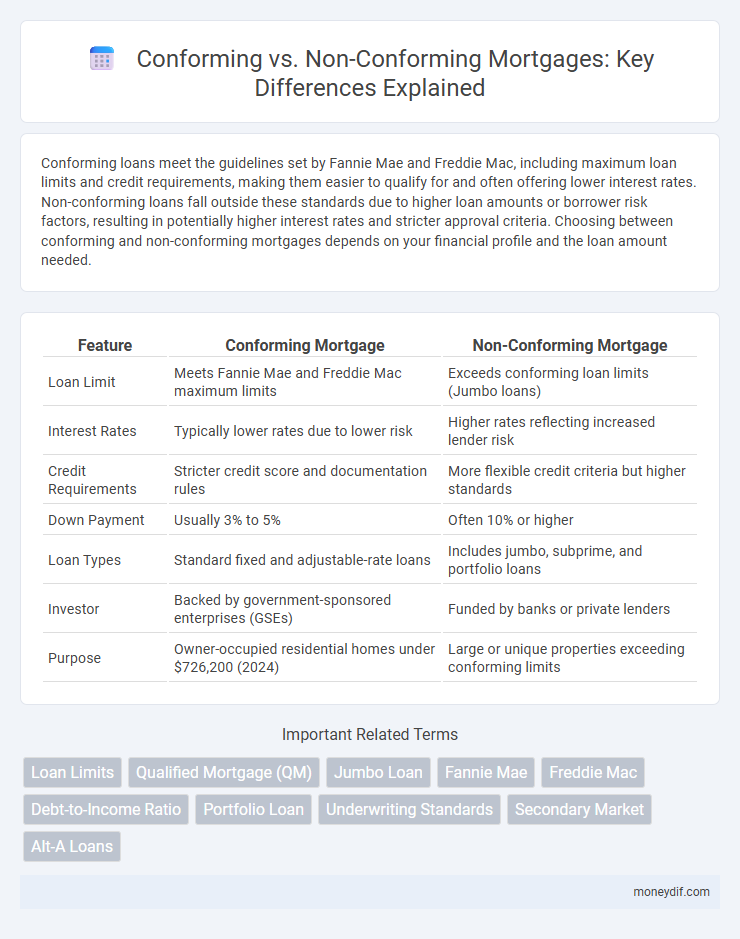

| Feature | Conforming Mortgage | Non-Conforming Mortgage |

|---|---|---|

| Loan Limit | Meets Fannie Mae and Freddie Mac maximum limits | Exceeds conforming loan limits (Jumbo loans) |

| Interest Rates | Typically lower rates due to lower risk | Higher rates reflecting increased lender risk |

| Credit Requirements | Stricter credit score and documentation rules | More flexible credit criteria but higher standards |

| Down Payment | Usually 3% to 5% | Often 10% or higher |

| Loan Types | Standard fixed and adjustable-rate loans | Includes jumbo, subprime, and portfolio loans |

| Investor | Backed by government-sponsored enterprises (GSEs) | Funded by banks or private lenders |

| Purpose | Owner-occupied residential homes under $726,200 (2024) | Large or unique properties exceeding conforming limits |

Understanding Conforming vs Non-Conforming Mortgages

Conforming mortgages meet the guidelines set by government-sponsored enterprises like Fannie Mae and Freddie Mac, including limits on loan size, credit score, and debt-to-income ratio, which typically result in lower interest rates and easier qualification. Non-conforming mortgages, also known as jumbo loans, exceed these limits or fall outside standard criteria, often carrying higher interest rates and requiring more stringent borrower qualifications. Understanding these differences helps borrowers select the right mortgage product based on their financial profile and loan needs.

Key Differences Between Conforming and Non-Conforming Loans

Conforming loans adhere to the loan limits set by the Federal Housing Finance Agency (FHFA) and meet the underwriting standards required by Fannie Mae and Freddie Mac, ensuring lower interest rates and easier approval. Non-conforming loans exceed these limits or fail to meet the criteria, often resulting in higher interest rates and stricter qualification requirements due to increased lender risk. Key differences include loan size, credit score requirements, down payment amount, and eligibility for government programs.

Loan Limits: What Sets Conforming Mortgages Apart

Conforming mortgages adhere to loan limits established annually by the Federal Housing Finance Agency (FHFA), typically capped at $726,200 for single-family homes in most U.S. areas as of 2024. Loans exceeding these limits are classified as non-conforming or jumbo loans, which carry higher interest rates and stricter underwriting criteria due to increased risk. These loan limits determine a borrower's eligibility for conforming loan programs secured by Fannie Mae and Freddie Mac, impacting affordability and mortgage options.

Credit Requirements for Conforming and Non-Conforming Loans

Conforming loans require borrowers to meet strict credit score thresholds, typically a minimum FICO score of 620, along with low debt-to-income ratios and a clean credit history. Non-conforming loans, including jumbo loans, allow for more flexible credit requirements, often accepting lower credit scores and higher debt-to-income ratios to accommodate borrowers with unique financial situations. Lenders offering non-conforming loans assess creditworthiness on a case-by-case basis, leading to varied qualification standards compared to the uniform criteria mandated by government-sponsored enterprises like Fannie Mae and Freddie Mac.

Interest Rates: Comparing Conforming and Non-Conforming Mortgages

Conforming mortgages typically offer lower interest rates due to their adherence to Fannie Mae and Freddie Mac guidelines, which reduce lender risk. Non-conforming loans, including jumbo mortgages, often carry higher rates reflecting increased risk and less liquidity in secondary markets. Borrowers with strong credit profiles might secure competitive rates on some non-conforming loans, but generally, conforming loans remain the more cost-effective option for interest payments.

Qualification Criteria for Both Loan Types

Conforming loans require borrowers to meet strict qualification criteria set by government-sponsored enterprises, including maximum loan limits, credit score minimums typically above 620, and debt-to-income (DTI) ratios usually below 43%. Non-conforming loans, such as jumbo loans, allow higher loan amounts but have more flexible credit score requirements and DTI ratios, catering to borrowers with unique financial situations or higher incomes. Lenders evaluating non-conforming loans often consider alternative documentation and nuanced risk factors beyond traditional underwriting standards.

Pros and Cons of Conforming vs Non-Conforming Loans

Conforming loans typically offer lower interest rates and easier qualification due to adherence to Fannie Mae and Freddie Mac guidelines, making them ideal for borrowers with strong credit and stable income. Non-conforming loans provide flexibility for borrowers with unique financial situations or high loan amounts but often come with higher interest rates and stricter terms. Evaluating credit score, loan size, and documentation requirements is crucial when choosing between conforming and non-conforming mortgage options.

Impact on Down Payments and Mortgage Insurance

Conforming loans typically require lower down payments, often as low as 3%, and allow borrowers to avoid private mortgage insurance (PMI) with a 20% down payment. Non-conforming loans, including jumbo loans, usually demand higher down payments, ranging from 10% to 25%, and often mandate mortgage insurance regardless of down payment size. Understanding these differences helps borrowers optimize upfront costs and ongoing insurance expenses when selecting a mortgage product.

Choosing the Right Loan Type for Your Home Purchase

Choosing the right loan type depends on your financial profile and the loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac. Conforming loans typically offer lower interest rates and easier qualification for borrowers with good credit and standard income levels, while non-conforming loans--such as jumbo loans--cater to higher-priced properties or borrowers with unique credit situations but may come with higher rates and stricter requirements. Evaluating property value, credit score, and down payment size helps determine whether a conforming or non-conforming mortgage aligns best with your home purchase goals.

Frequently Asked Questions About Conforming and Non-Conforming Mortgages

Conforming mortgages adhere to loan limits set by the Federal Housing Finance Agency (FHFA) and meet Fannie Mae and Freddie Mac underwriting guidelines, typically offering lower interest rates and easier approval processes. Non-conforming mortgages include jumbo loans, which exceed conforming limits, and loans that do not meet standard criteria due to credit issues or unique property types, often carrying higher interest rates and stricter terms. Borrowers frequently ask about differences in down payment requirements, eligibility criteria, and loan limits when comparing conforming versus non-conforming mortgage options.

Important Terms

Loan Limits

Loan limits for conforming loans are set by the Federal Housing Finance Agency (FHFA) and typically cap at $726,200 for a single-family home in most U.S. counties in 2024, ensuring eligibility for purchase by Fannie Mae and Freddie Mac. Non-conforming loans exceed these limits or fail to meet underwriting guidelines, often referred to as jumbo loans, requiring higher credit scores and larger down payments due to increased risk.

Qualified Mortgage (QM)

Qualified Mortgage (QM) standards apply primarily to conforming loans that meet specific underwriting criteria, including debt-to-income limits and documentation requirements, ensuring borrower ability to repay. Non-conforming loans, such as jumbo or subprime mortgages, typically fall outside QM guidelines due to their higher risk profiles and looser lending standards.

Jumbo Loan

Jumbo loans exceed the conforming loan limits set by the Federal Housing Finance Agency, making them non-conforming loans that cannot be purchased or securitized by Fannie Mae or Freddie Mac. These loans typically have stricter qualification requirements, higher interest rates, and larger down payments compared to conforming loans due to the increased risk for lenders.

Fannie Mae

Fannie Mae primarily guarantees conforming loans that meet specific size, credit, and underwriting standards, enabling lower interest rates and easier market access for borrowers. Non-conforming loans fall outside these criteria, often due to loan size or borrower credit profile, and are not eligible for Fannie Mae's guarantee, leading to higher interest rates and stricter lending requirements.

Freddie Mac

Freddie Mac primarily deals with conforming loans that meet specific underwriting criteria and loan limits set by the Federal Housing Finance Agency (FHFA), enabling these loans to be securitized and purchased in the secondary market. Non-conforming loans, which exceed these limits or fail to meet standard guidelines, are not eligible for Freddie Mac purchase, often resulting in higher interest rates and limited liquidity options for borrowers.

Debt-to-Income Ratio

The Debt-to-Income (DTI) ratio plays a critical role in distinguishing conforming from non-conforming loans, with conforming loans typically requiring a DTI below 43% to meet Freddie Mac and Fannie Mae guidelines, while non-conforming loans may allow higher DTIs based on lender criteria. Lenders assess DTI to evaluate a borrower's ability to manage monthly payments and qualify for loans that conform to standard underwriting rules or fall outside those parameters due to credit risk factors.

Portfolio Loan

Portfolio loans are mortgages that lenders keep on their balance sheets, allowing more flexible underwriting standards compared to conforming loans, which must meet Fannie Mae or Freddie Mac guidelines. Non-conforming portfolio loans often accommodate borrowers with unique financial situations, higher risk profiles, or property types that fall outside conventional loan limits.

Underwriting Standards

Underwriting standards for conforming loans adhere to guidelines set by Fannie Mae and Freddie Mac, including strict credit score, debt-to-income ratio, and loan amount limits to ensure loan quality and eligibility for purchase. Non-conforming loans, such as jumbo or subprime loans, have more flexible underwriting criteria but often require higher credit scores, larger down payments, and carry increased risk due to lack of standardization in loan approval and securitization.

Secondary Market

The secondary market facilitates the trading of mortgage-backed securities, distinguishing conforming loans that meet Fannie Mae and Freddie Mac guidelines from non-conforming loans, which exceed these standards and often carry higher interest rates. Liquidity in the secondary market is generally stronger for conforming loans due to their standardized criteria, while non-conforming loans--such as jumbo and subprime mortgages--face more limited investor demand.

Alt-A Loans

Alt-A loans occupy a gray area between prime and subprime mortgages, often classified as non-conforming due to relaxed underwriting standards like reduced income verification or higher debt-to-income ratios. Unlike conforming loans that meet Fannie Mae and Freddie Mac's guidelines, Alt-A loans typically exceed conforming loan limits or fail to fulfill specific credit criteria, making them riskier and subject to higher interest rates.

Conforming vs Non-conforming Infographic

moneydif.com

moneydif.com