Lien priority determines the order in which creditors are paid from the proceeds of a foreclosure or sale, with senior liens having precedence over junior ones. Subordination agreements alter this priority by allowing a lower-priority lien to move ahead of a higher-priority lien, typically to facilitate refinancing or new financing. Understanding the impact of lien priority and subordination is essential for protecting interests in mortgage transactions and ensuring clear title transfer.

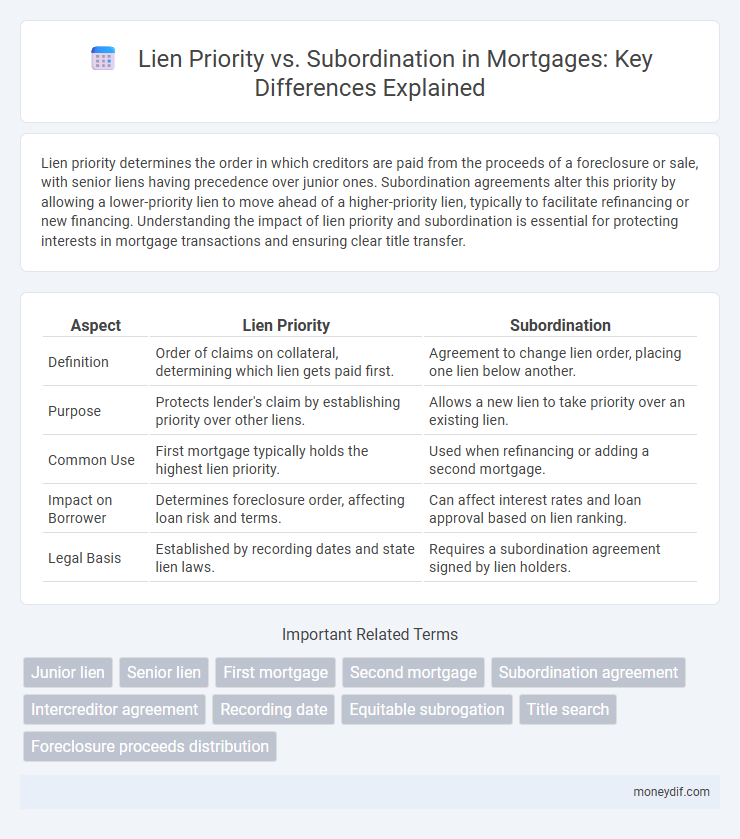

Table of Comparison

| Aspect | Lien Priority | Subordination |

|---|---|---|

| Definition | Order of claims on collateral, determining which lien gets paid first. | Agreement to change lien order, placing one lien below another. |

| Purpose | Protects lender's claim by establishing priority over other liens. | Allows a new lien to take priority over an existing lien. |

| Common Use | First mortgage typically holds the highest lien priority. | Used when refinancing or adding a second mortgage. |

| Impact on Borrower | Determines foreclosure order, affecting loan risk and terms. | Can affect interest rates and loan approval based on lien ranking. |

| Legal Basis | Established by recording dates and state lien laws. | Requires a subordination agreement signed by lien holders. |

Understanding Lien Priority in Mortgages

Lien priority determines the order in which creditors are paid from a property sale, with the first mortgage typically holding the highest priority. Understanding lien priority is crucial for lenders and borrowers to evaluate the risks associated with secondary liens or second mortgages. Subordination agreements can alter this order, but without them, the initial recording date usually governs lien precedence.

What is Subordination in Real Estate?

Subordination in real estate refers to the legal process where a lender agrees to place their mortgage or lien below another lien, altering the original priority order. This means the subordinated lienholder consents to have their claim paid after a higher-priority lien, such as a first mortgage, in the event of foreclosure. Subordination agreements are crucial for refinancing or taking out additional loans without disrupting existing lien hierarchies.

How Lien Priority Affects Mortgage Lenders

Lien priority determines the order in which mortgage lenders are paid in the event of a property foreclosure, with the first lien holder receiving payment before subordinate lien holders. This priority directly impacts a lender's risk exposure since a higher-priority mortgage is more likely to be repaid in full, reducing potential losses. Subordination agreements can alter lien priority, allowing junior liens to take precedence, which may increase risk for senior lenders by delaying their repayment.

The Process of Subordination Agreements

The process of subordination agreements involves restructuring lien priorities to prioritize a new or refinanced mortgage over existing liens. This legal agreement is essential when a borrower seeks additional financing, ensuring the new lender holds a superior lien position. Lenders evaluate credit risk and property value before consenting to subordinate an existing lien.

Primary vs. Secondary Lien Positions

In mortgage lending, lien priority determines the order in which claims on a property are paid in foreclosure, with the primary lien holding the superior position to secure repayment first. Secondary lien positions, often referred to as junior liens, are subordinate to the primary lien and typically carry higher risk and interest rates due to their lower repayment priority. Understanding the distinction between primary and secondary liens is crucial for lenders and borrowers to assess risk, refinancing options, and the impact on credit availability.

Impact of Lien Priority on Foreclosure

Lien priority determines the order in which liens are paid off during foreclosure, with senior liens receiving payment before junior liens. Subordination agreements can alter this order by voluntarily lower-priority lien holders consenting to move behind higher-priority liens. The impact of lien priority on foreclosure affects the likelihood of recovery for lien holders and can influence lender willingness to finance or refinance a property.

When Is Subordination Necessary?

Subordination is necessary when a borrower takes out a new mortgage or loan that needs to have priority over an existing lien, ensuring the new loan is recorded in a higher position on the lien hierarchy. This often occurs during refinancing or home improvement financing, where the new lender requires a superior claim to the property in case of default. Without subordination, the original lien retains priority, potentially complicating or increasing costs for the borrower.

Risks Associated with Subordinated Loans

Subordinated loans carry higher risks due to their lower lien priority, meaning in foreclosure scenarios, they are paid only after primary mortgage holders are satisfied. This increased risk often results in higher interest rates for borrowers seeking subordinate financing. Lenders must carefully evaluate these risks to balance potential returns against the likelihood of non-recovery in default situations.

Lien Priority and Home Equity Loans

Lien priority determines the order in which creditors are paid from the proceeds of a property sale, with first liens having the highest claim over home equity loans. Home equity loans typically hold a subordinate lien position behind the primary mortgage, meaning they are paid only after the first mortgage lien is satisfied. Understanding lien priority is crucial for homeowners considering additional financing, as it impacts the risk and recovery prospects of home equity lenders.

Best Practices for Managing Lien Priority and Subordination

Effective management of lien priority and subordination requires clear documentation and timely recording of mortgage liens to establish the hierarchy of claims on the property. Mortgage lenders should negotiate and execute subordination agreements carefully to protect their security interests while accommodating subsequent liens or refinancing. Regularly reviewing title reports and maintaining communication with all lienholders minimizes disputes and ensures accurate lien positions throughout the loan lifecycle.

Important Terms

Junior lien

A junior lien holds a lower priority compared to a senior lien, meaning it is subordinate in repayment if the borrower defaults. Subordination agreements explicitly establish this order by ranking liens, ensuring the senior lien's claim takes precedence over the junior lien in lien priority.

Senior lien

Senior lien holds priority over other claims, ensuring payment ahead of junior liens during asset liquidation or foreclosure. Subordination agreements alter lien priority by contractually ranking a junior lien above a senior lien, impacting the order of repayment in debt structures.

First mortgage

First mortgage holds primary lien priority over any subsequent liens, ensuring the lender's superior claim on the property in case of default. Subordination agreements allow a later lien to take priority over an earlier one, but without such agreements, the first mortgage maintains its dominant legal position.

Second mortgage

A second mortgage holds a subordinate lien position behind the first mortgage, which means it is repaid only after the primary lender in the event of default; lien priority can be altered through a subordination agreement, allowing the second mortgage to take precedence over other liens. Understanding lien priority and subordination is crucial for borrowers and lenders to manage risk and clarify repayment hierarchy in property financing.

Subordination agreement

A subordination agreement legally establishes that a lienholder's claim takes lower priority compared to another lien, ensuring the primary lienholder's interests are protected during property foreclosure or sale. This contractual arrangement is crucial in real estate financing to clearly define lien priority and avoid disputes between creditors.

Intercreditor agreement

Intercreditor agreements establish the hierarchy between multiple creditors by defining lien priority and subordination rights, ensuring clarity on which lender holds superior claims on collateral in default scenarios. These agreements are crucial for mitigating risks and protecting the interests of secured creditors by specifying enforcement procedures and repayment order.

Recording date

Recording date is critical in determining lien priority, as most jurisdictions follow the "first to record" rule, which grants priority to liens recorded earlier. Subordination agreements alter this priority by contractually ranking one lien below another, regardless of their recording dates, impacting the enforceability and payment order during foreclosure or settlement.

Equitable subrogation

Equitable subrogation allows a lender or insurer who has paid off a superior lien to assume that lien's priority, protecting their security interest against lower-priority claims. This principle ensures that lien priority is maintained without subordination, preventing the loss of rights caused by payments made to satisfy senior encumbrances.

Title search

Title searches reveal existing liens and clarify lien priority, ensuring the first recorded lien holds precedence over subsequent claims. Subordination agreements adjust this hierarchy by legally placing a lien behind higher-priority interests, impacting mortgage and loan refinancing structures.

Foreclosure proceeds distribution

Foreclosure proceeds distribution prioritizes lienholders based on the established lien priority, where senior liens are paid in full before junior liens receive any funds. Subordination agreements alter this order by legally shifting lien priority, allowing normally junior liens to be paid ahead of senior liens during foreclosure distributions.

Lien priority vs Subordination Infographic

moneydif.com

moneydif.com