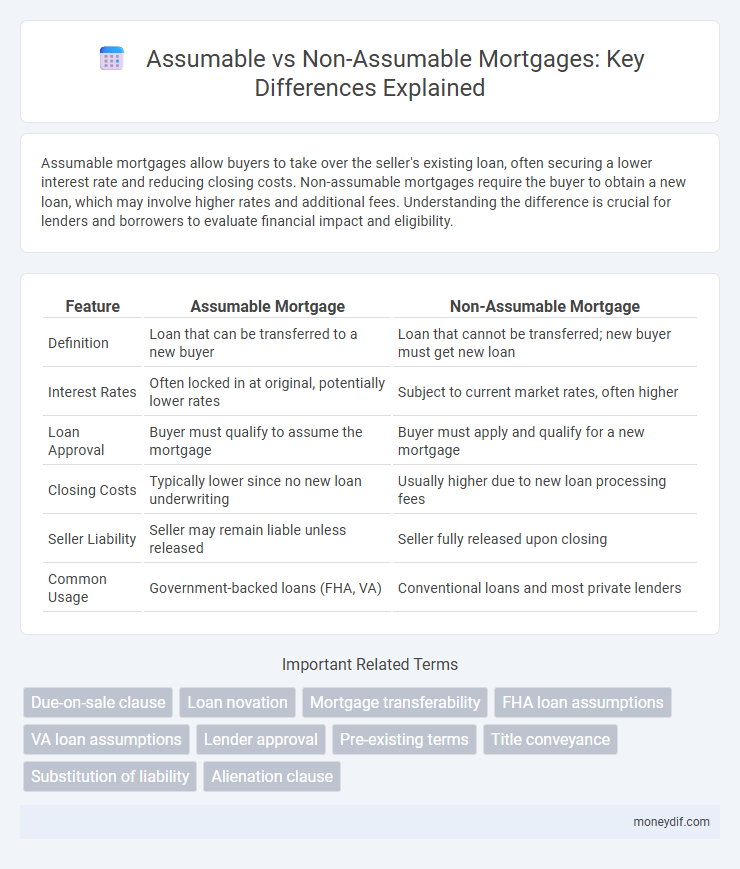

Assumable mortgages allow buyers to take over the seller's existing loan, often securing a lower interest rate and reducing closing costs. Non-assumable mortgages require the buyer to obtain a new loan, which may involve higher rates and additional fees. Understanding the difference is crucial for lenders and borrowers to evaluate financial impact and eligibility.

Table of Comparison

| Feature | Assumable Mortgage | Non-Assumable Mortgage |

|---|---|---|

| Definition | Loan that can be transferred to a new buyer | Loan that cannot be transferred; new buyer must get new loan |

| Interest Rates | Often locked in at original, potentially lower rates | Subject to current market rates, often higher |

| Loan Approval | Buyer must qualify to assume the mortgage | Buyer must apply and qualify for a new mortgage |

| Closing Costs | Typically lower since no new loan underwriting | Usually higher due to new loan processing fees |

| Seller Liability | Seller may remain liable unless released | Seller fully released upon closing |

| Common Usage | Government-backed loans (FHA, VA) | Conventional loans and most private lenders |

Understanding Assumable and Non-assumable Mortgages

Assumable mortgages allow a buyer to take over the seller's existing loan, potentially benefiting from lower interest rates and reduced closing costs, whereas non-assumable mortgages require the buyer to secure new financing. Lenders typically restrict assumable loans to government-backed loans such as FHA, VA, and USDA mortgages, limiting their availability in the market. Understanding the terms and conditions of assumable versus non-assumable mortgages is crucial for buyers evaluating financing options and negotiating purchase agreements.

Key Features of Assumable Mortgages

Assumable mortgages allow a buyer to take over the seller's existing loan terms, including the interest rate and remaining balance, often providing lower closing costs and smoother transactions. These loans typically have fixed interest rates, making them attractive in rising rate environments, and require lender approval to ensure the buyer meets financial qualifications. Key features include the potential for faster loan approval, the preservation of favorable loan terms, and possible savings on interest payments.

Key Features of Non-assumable Mortgages

Non-assumable mortgages require borrowers to obtain their own financing, preventing the transfer of loan terms to a new buyer. These loans often include strict qualification criteria, ensuring the original borrower remains solely responsible for repayment. Lenders maintain control over interest rates and terms, reducing risk associated with market fluctuations or buyer creditworthiness.

Pros and Cons of Assumable Mortgages

Assumable mortgages allow buyers to take over an existing home loan's terms, often at a lower interest rate than current market rates, providing financial savings and easier qualification for the buyer. Pros include reduced closing costs and the ability to bypass new loan approval processes, while cons involve potential seller liability and requirement for lender approval, which can complicate or limit transfer options. This type of mortgage works best in environments with rising interest rates but may come with restrictions that affect flexibility and transferability.

Advantages and Disadvantages of Non-assumable Mortgages

Non-assumable mortgages require new buyers to secure their own financing, which can simplify the lender approval process and ensure borrowers meet current credit standards. They protect lenders from liability associated with previous borrowers, reducing financial risk. However, non-assumable loans may limit buyer flexibility and increase transaction costs since buyers cannot take advantage of existing favorable interest rates, potentially making properties less attractive in competitive markets.

Eligibility Requirements for Assumable Loans

Assumable loans require the buyer to meet specific eligibility criteria, including creditworthiness, income verification, and debt-to-income ratio assessments similar to standard mortgage approvals. Typically, only government-backed loans like FHA, VA, or USDA are assumable, limiting eligibility to qualified applicants approved by the lender or loan guarantor. Meeting these requirements ensures a smooth transfer of loan obligations and maintains the loan's favorable terms for the new borrower.

Common Types of Assumable Mortgages

Common types of assumable mortgages include FHA, VA, and USDA loans, which allow buyers to take over the seller's existing mortgage under its current terms. These government-backed loans typically offer lower interest rates and require less stringent credit qualifications compared to conventional loans. Non-assumable mortgages, often conventional loans, do not permit transfer of the loan balance, requiring buyers to secure new financing.

Financial Implications: Costs and Savings

Assumable mortgages allow buyers to take over the seller's existing loan, often resulting in lower closing costs and potential savings on interest rates compared to starting a new mortgage. Non-assumable loans require the buyer to secure a new mortgage, incurring higher fees such as origination charges, appraisal costs, and possibly higher interest rates depending on market conditions. Evaluating the financial implications of both options is crucial, as assumable loans can reduce upfront expenses and long-term interest payments while non-assumable loans may offer more flexible terms at a higher initial cost.

Steps to Transfer an Assumable Mortgage

To transfer an assumable mortgage, the buyer must first qualify with the lender, meeting all credit and income requirements. The lender then performs an approval process to ensure the buyer can assume the loan, followed by drafting an assumption agreement. Finally, the transaction is recorded with the appropriate public records office to formalize the mortgage transfer.

Choosing Between Assumable and Non-assumable Mortgages

Choosing between assumable and non-assumable mortgages depends on factors like interest rates, buyer qualifications, and transaction complexity. Assumable mortgages can offer lower interest rates and reduced closing costs if the buyer meets lender criteria, making them attractive in rising rate environments. Non-assumable loans require new financing, which may involve higher rates but provide more flexibility and fewer lender restrictions.

Important Terms

Due-on-sale clause

The due-on-sale clause allows lenders to demand full repayment of a loan if the property is sold or transferred, making most conventional loans non-assumable by new buyers. In contrast, assumable loans permit the buyer to take over the existing mortgage under its original terms without triggering the due-on-sale clause, often benefiting buyers in a rising interest rate environment.

Loan novation

Loan novation involves replacing an original loan obligation with a new one, transferring full responsibility to a new borrower, which typically applies to assumable loans and facilitates smoother ownership transfer. Non-assumable loans prohibit such transfer, requiring the original borrower to remain liable, making novation impossible and often complicating loan or property transfers.

Mortgage transferability

Mortgage transferability depends on whether the loan is assumable or non-assumable, with assumable mortgages allowing the buyer to take over the seller's loan terms, often benefiting from lower interest rates. Non-assumable mortgages require the buyer to secure a new loan, typically facing current market rates and more stringent credit qualifications.

FHA loan assumptions

FHA loan assumptions allow a qualified buyer to take over the existing mortgage under its original terms, potentially saving on interest rates and closing costs, while non-assumable loans require the buyer to secure new financing. Assumable FHA loans are beneficial in a rising interest rate environment, providing advantage over non-assumable loans that demand full recalculations and approvals for new creditworthiness.

VA loan assumptions

VA loan assumptions allow eligible buyers to take over an existing VA mortgage with potentially lower interest rates, making them financially advantageous compared to non-assumable loans that require new financing under current market rates. Understanding the conditions under which VA loans are assumable, including lender approval and veteran status, can significantly impact purchase affordability and loan transferability.

Lender approval

Lender approval is a critical factor distinguishing assumable loans, which require lender consent to transfer the mortgage to the buyer, from non-assumable loans that prohibit transfer without full payoff. Obtaining lender approval for assumable loans often involves verifying the buyer's creditworthiness and financial stability to ensure compliance with original loan terms.

Pre-existing terms

Pre-existing terms in loans distinguish assumable from non-assumable agreements, where assumable loans allow buyers to take over existing mortgage terms, facilitating smoother property transfers and often lower closing costs. Non-assumable loans restrict this transfer, requiring new financing that may entail higher interest rates or stricter approval processes.

Title conveyance

Title conveyance involves transferring legal ownership of a property, where assumable loans allow the buyer to take over the seller's mortgage under its existing terms, often simplifying the process and potentially reducing costs. In contrast, non-assumable loans require new financing by the buyer, which can involve higher interest rates and additional closing procedures, impacting the ease and expense of property transfer.

Substitution of liability

Substitution of liability occurs when a new party replaces the original borrower's liability on a loan, often seen in assumable mortgages where the buyer assumes responsibility for the debt under existing terms. Non-assumable loans prohibit this transfer, requiring the original borrower to remain liable or pay off the balance before the property sale can proceed.

Alienation clause

An alienation clause in a mortgage contract prohibits the borrower from transferring the loan to a new owner without the lender's consent, making the loan non-assumable by default. Assumable loans allow buyers to take over the existing mortgage, but the presence of an alienation clause typically requires full loan repayment upon property sale, preventing assumption.

Assumable vs Non-assumable Infographic

moneydif.com

moneydif.com