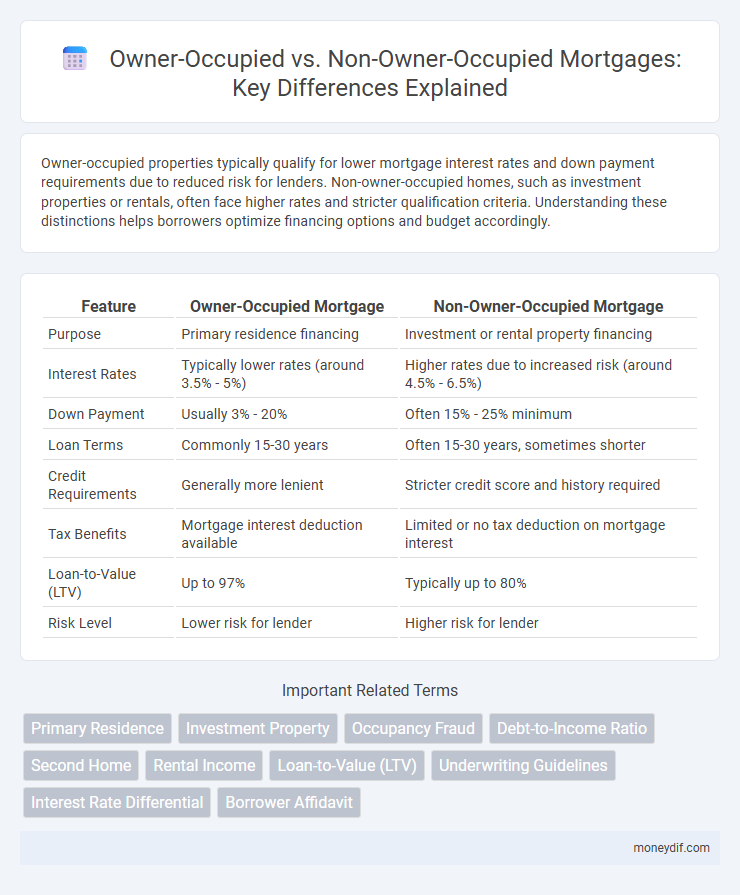

Owner-occupied properties typically qualify for lower mortgage interest rates and down payment requirements due to reduced risk for lenders. Non-owner-occupied homes, such as investment properties or rentals, often face higher rates and stricter qualification criteria. Understanding these distinctions helps borrowers optimize financing options and budget accordingly.

Table of Comparison

| Feature | Owner-Occupied Mortgage | Non-Owner-Occupied Mortgage |

|---|---|---|

| Purpose | Primary residence financing | Investment or rental property financing |

| Interest Rates | Typically lower rates (around 3.5% - 5%) | Higher rates due to increased risk (around 4.5% - 6.5%) |

| Down Payment | Usually 3% - 20% | Often 15% - 25% minimum |

| Loan Terms | Commonly 15-30 years | Often 15-30 years, sometimes shorter |

| Credit Requirements | Generally more lenient | Stricter credit score and history required |

| Tax Benefits | Mortgage interest deduction available | Limited or no tax deduction on mortgage interest |

| Loan-to-Value (LTV) | Up to 97% | Typically up to 80% |

| Risk Level | Lower risk for lender | Higher risk for lender |

Understanding Owner-Occupied and Non-Owner-Occupied Properties

Owner-occupied properties are residential units where the owner lives as their primary residence, which often qualifies them for lower mortgage rates and favorable loan terms. Non-owner-occupied properties include rental or investment properties where the owner does not reside, typically facing higher interest rates and stricter lending criteria. Understanding the distinction impacts mortgage eligibility, interest rates, down payment requirements, and potential tax benefits.

Key Differences Between Owner-Occupied and Non-Owner-Occupied Mortgages

Owner-occupied mortgages typically offer lower interest rates and require smaller down payments because lenders view homeowner occupancy as a lower risk compared to non-owner-occupied properties. Non-owner-occupied mortgages often have stricter credit requirements and higher insurance costs due to increased default risk and potential vacancy. Mortgage underwriting criteria for owner-occupied loans prioritize borrower income and creditworthiness, while non-owner-occupied loans focus on rental income verification and property cash flow analysis.

Eligibility Requirements for Owner-Occupied Loans

Owner-occupied loans require borrowers to occupy the property as their primary residence within a specified timeframe, typically 30 to 60 days of closing. Eligibility criteria often include proof of residency through utility bills, driver's license address, or a signed affidavit confirming intent to occupy. Lenders also consider income verification, credit score, and debt-to-income ratio to ensure the borrower can meet payment obligations for owner-occupied properties.

Non-Owner-Occupied Mortgage Qualification Criteria

Non-owner-occupied mortgage qualification criteria typically require higher credit scores, lower debt-to-income ratios, and larger down payments compared to owner-occupied loans. Lenders often mandate a minimum credit score of 680 and a down payment of at least 20-25% for investment properties. Proof of rental income, comprehensive cash reserve documentation, and stricter debt service coverage ratios also play a crucial role in non-owner-occupied mortgage approvals.

Interest Rates: Owner-Occupied vs Non-Owner-Occupied

Interest rates for owner-occupied mortgages are typically lower compared to non-owner-occupied loans due to reduced lender risk associated with primary residences. Non-owner-occupied properties, often investment or rental units, carry higher interest rates to offset increased default risk and potential vacancy issues. Borrowers should expect a premium of approximately 0.5% to 1.0% on interest rates for non-owner-occupied mortgages relative to owner-occupied loans.

Down Payment Differences: What to Expect

Owner-occupied properties typically require a lower down payment, often ranging from 3% to 5%, compared to non-owner-occupied or investment properties where down payments usually start around 15% to 25%. Lenders impose higher down payment thresholds on non-owner-occupied mortgages due to increased risk, impacting eligible loan amounts and interest rates. Understanding these down payment differences is crucial for borrowers planning their mortgage financing strategy.

Loan Terms and Flexibility Comparison

Owner-occupied mortgages typically offer lower interest rates and higher loan-to-value ratios compared to non-owner-occupied loans, reflecting reduced lender risk. Loan terms for owner-occupied properties often include more flexible qualifying criteria and longer repayment periods, enhancing borrower affordability. In contrast, non-owner-occupied loans usually require larger down payments, have stricter credit requirements, and feature shorter terms, limiting flexibility for investors.

Tax Implications for Owner vs Non-Owner Mortgages

Owner-occupied mortgages often qualify for significant tax deductions, including mortgage interest and property tax deductions, which reduce taxable income for homeowners. Non-owner-occupied properties, such as rental investments, allow for deductions related to rental expenses, depreciation, and maintenance costs, but these are categorized differently and affect tax calculations under investment income. Understanding the distinction in tax treatment between owner-occupied and non-owner-occupied mortgages is essential for optimizing tax benefits and compliance with IRS regulations.

Investment Strategies Using Non-Owner-Occupied Properties

Non-owner-occupied properties serve as powerful investment vehicles, offering higher interest rates and stricter loan requirements but greater long-term returns through rental income and property appreciation. Real estate investors leverage non-owner-occupied mortgages to diversify portfolios, maximize cash flow, and capitalize on market-driven property value increases. Strategic use of these properties involves balancing mortgage costs against projected rental yields and tax advantages for optimized investment growth.

Choosing the Right Mortgage for Your Property Type

Owner-occupied mortgages typically offer lower interest rates and require smaller down payments, reflecting the lower risk to lenders since borrowers live in the property. Non-owner-occupied mortgages, including investment properties or rental homes, often come with higher rates and stricter qualification criteria due to increased default risk. Evaluating your property usage and financial goals is crucial to selecting the appropriate mortgage product that aligns with your occupancy status and maximizes loan benefits.

Important Terms

Primary Residence

Primary residence refers to the main dwelling where an individual or family resides most of the time, often qualifying for owner-occupied status with associated tax benefits and lower mortgage rates. Owner-occupied properties typically have lower risk profiles compared to non-owner-occupied homes, which are often investment or rental properties subject to different loan terms and higher interest rates.

Investment Property

Investment properties categorized as owner-occupied typically involve the property owner living in the residence while renting out parts of it, offering potential tax benefits and easier financing options due to lower risk perception by lenders. Non-owner-occupied investment properties, conversely, are fully rented out and often require higher down payments and interest rates, but can generate greater rental income and long-term appreciation potential.

Occupancy Fraud

Occupancy fraud occurs when a borrower misrepresents the property as owner-occupied to secure favorable loan terms despite intending to rent or leave it vacant, leading to higher default risks for lenders. Lenders distinguish owner-occupied properties, typically verified through occupancy affidavits and utility bills, from non-owner-occupied units to mitigate fraud and ensure accurate risk assessment.

Debt-to-Income Ratio

Debt-to-Income Ratio (DTI) typically influences loan approval criteria differently for owner-occupied and non-owner-occupied properties, with stricter limits often applied to investment properties due to higher risk. Lenders usually allow lower DTI thresholds for owner-occupied homes, reflecting the borrower's primary housing need and reduced default risk compared to rental or investment properties.

Second Home

Second homes classified as owner-occupied are primarily used by the owner for personal vacations or seasonal stays, providing opportunities for lifestyle benefits and potential tax advantages. Non-owner-occupied second homes, often rented out or left vacant, are treated differently for mortgage qualification and tax purposes, typically reflecting investment properties with distinct financial implications.

Rental Income

Rental income from non-owner-occupied properties typically generates higher returns due to full market rent exposure, while owner-occupied properties may limit income potential as portions are used for personal residence. Tax implications and mortgage qualification criteria also vary significantly between owner-occupied and non-owner-occupied properties, influencing overall profitability.

Loan-to-Value (LTV)

Owner-Occupied properties typically have lower Loan-to-Value (LTV) ratios, often capped around 80%, reflecting lower risk for lenders, whereas Non-Owner-Occupied properties, such as investment homes, usually face stricter LTV limits, sometimes as low as 65-75%. Higher LTV limits on Owner-Occupied loans result from borrower occupancy reducing default risk, while Non-Owner-Occupied loans demand larger down payments due to increased market and vacancy risks.

Underwriting Guidelines

Underwriting guidelines differentiate Owner-Occupied properties, where the borrower resides, from Non-Owner-Occupied properties, primarily investment or rental units, impacting risk assessment and loan terms; lenders typically require higher credit scores, larger down payments, and stricter debt-to-income ratios for Non-Owner-Occupied loans due to increased default risk. These distinctions influence interest rates, loan-to-value ratios, and occupancy verification processes to ensure accurate property use classification.

Interest Rate Differential

Interest Rate Differential between owner-occupied and non-owner-occupied properties typically reflects risk assessment, with owner-occupied loans often featuring lower rates due to perceived lower default risk and higher regulatory support. Non-owner-occupied loans usually incur higher interest rates to compensate lenders for increased market exposure and potential vacancy risk.

Borrower Affidavit

A Borrower Affidavit verifies occupancy status, distinguishing owner-occupied properties where borrowers certify primary residence use, from non-owner-occupied properties often associated with investment or rental purposes. Accurate affidavit completion impacts loan eligibility, interest rates, and compliance with lending regulations for each occupancy type.

Owner-Occupied vs Non-Owner-Occupied Infographic

moneydif.com

moneydif.com