Choosing between a rate lock and rate float is crucial when securing a mortgage as it affects the interest cost over the loan term. A rate lock guarantees the current interest rate for a specified period, protecting borrowers from market fluctuations, while rate float allows the rate to change with the market until closing, potentially benefiting from a drop. Understanding these options helps borrowers manage risk and optimize their mortgage costs.

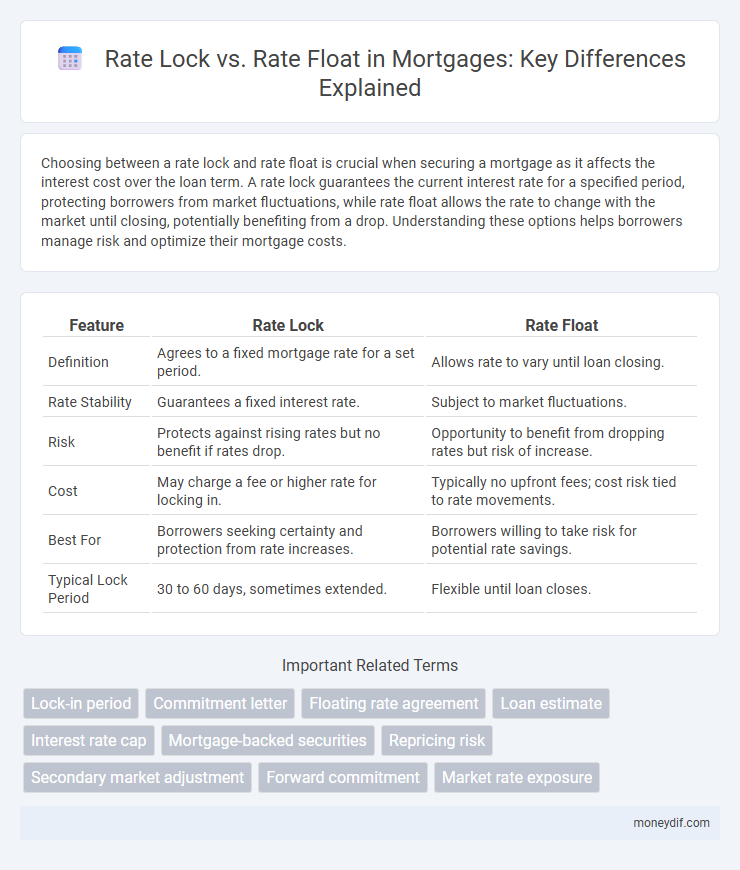

Table of Comparison

| Feature | Rate Lock | Rate Float |

|---|---|---|

| Definition | Agrees to a fixed mortgage rate for a set period. | Allows rate to vary until loan closing. |

| Rate Stability | Guarantees a fixed interest rate. | Subject to market fluctuations. |

| Risk | Protects against rising rates but no benefit if rates drop. | Opportunity to benefit from dropping rates but risk of increase. |

| Cost | May charge a fee or higher rate for locking in. | Typically no upfront fees; cost risk tied to rate movements. |

| Best For | Borrowers seeking certainty and protection from rate increases. | Borrowers willing to take risk for potential rate savings. |

| Typical Lock Period | 30 to 60 days, sometimes extended. | Flexible until loan closes. |

Understanding Mortgage Rate Locks

Mortgage rate locks guarantee an interest rate for a set period, typically 30 to 60 days, protecting borrowers from market fluctuations during the loan approval process. Rate float allows interest rates to fluctuate until closing, potentially benefiting from lower rates but also risking increases. Understanding mortgage rate locks helps borrowers manage interest rate risk and plan timely loan closings.

What Is a Rate Float?

A rate float refers to the choice borrowers have to postpone locking in an interest rate during the mortgage application process, allowing them to monitor market fluctuations to potentially secure a lower rate. This strategy carries the risk of rates increasing before locking, which can lead to higher monthly payments. Understanding the dynamics of rate float is essential for managing mortgage costs and aligning with financial goals.

Key Differences Between Rate Lock and Rate Float

Rate lock guarantees a fixed mortgage interest rate for a specified period, protecting borrowers from market fluctuations and providing payment certainty. Rate float allows borrowers to wait for potential rate decreases before locking in, offering flexibility but exposing them to the risk of rising rates. Understanding these differences helps in choosing between stability with rate lock and market timing potential with rate float during mortgage rate decisions.

Pros and Cons of Locking Your Mortgage Rate

Locking your mortgage rate guarantees a fixed interest rate, protecting you from market fluctuations and providing financial predictability during the loan approval process. Rate locks typically last 30 to 60 days, but if closing is delayed, you may face extension fees or lose the locked rate advantage. Conversely, floating the rate allows potential benefit from declining rates but risks an increase, making budgeting uncertain and possibly raising overall borrowing costs.

Benefits and Risks of Floating Your Mortgage Rate

Floating your mortgage rate allows borrowers to benefit from potential interest rate drops before loan closing, increasing savings if market rates decline. However, this strategy carries the risk of rising rates, which can lead to higher monthly payments and overall loan costs. Careful market analysis and timely decision-making are critical when opting to float, as unexpected rate increases may outweigh any initial benefits.

When Should You Lock Your Rate?

Lock your mortgage rate when interest rates are rising or expected to increase to secure a lower monthly payment and protect against market volatility. Consider floating your rate if rates are stable or predicted to drop, allowing potential savings through a lower interest rate at closing. Timing rate locks based on economic forecasts and personal financial readiness can maximize cost efficiency in your mortgage loan.

Factors Influencing Rate Movement

Rate lock provides borrowers with a fixed interest rate by securing the rate at the time of application, protecting against market volatility caused by economic data releases, Federal Reserve decisions, and bond market fluctuations. Rate float allows borrowers to benefit from potential rate decreases but exposes them to risks from inflation reports, employment figures, and geopolitical events that drive rate increases. Key factors influencing rate movements include Treasury yields, monetary policy changes, and macroeconomic indicators such as GDP growth and consumer confidence.

Rate Lock Periods and Their Impact on Your Loan

Rate lock periods typically range from 15 to 60 days, securing the interest rate and protecting borrowers from market fluctuations during this time. Longer rate lock periods may come with higher fees but provide more certainty, especially in volatile markets. Choosing the appropriate rate lock period impacts monthly payments and overall loan affordability by stabilizing rates before closing.

Costs Associated with Rate Locks and Rate Floats

Rate locks typically involve upfront fees or higher interest rates to secure a specific mortgage rate, protecting borrowers from market fluctuations but potentially increasing initial costs. Rate floats allow buyers to wait for potentially lower rates without paying upfront fees, although this strategy risks rising interest rates and unpredictable loan expenses. Understanding these cost dynamics helps borrowers optimize mortgage affordability and manage financial risk effectively.

Tips for Choosing Between Rate Lock and Rate Float

Evaluate current market trends and economic forecasts to decide between rate lock and rate float, as locking secures your mortgage interest rate amidst rising rates, whereas floating might capitalize on potential rate decreases. Consider your loan closing timeline and financial risk tolerance; a rate lock offers certainty for a fixed period, while floating requires monitoring rate fluctuations closely. Consult with mortgage professionals to assess lender policies on rate lock fees and float-down options to optimize your mortgage cost-effectiveness.

Important Terms

Lock-in period

The lock-in period defines the timeframe during which the agreed interest rate remains fixed, protecting borrowers from rate fluctuations in a rate lock scenario. In contrast, rate float allows lenders to adjust the rate up or down during the lock-in period, offering potential savings if rates decrease but posing risks if rates rise.

Commitment letter

A commitment letter outlines the agreed loan terms, including whether a borrower chooses a rate lock or a rate float option during mortgage processing; rate lock guarantees a fixed interest rate for a specified period, protecting against market fluctuations. Rate float allows the borrower to benefit from potential rate decreases before closing but carries the risk of rates rising, impacting final loan costs.

Floating rate agreement

A Floating Rate Agreement (FRA) allows parties to hedge interest rate exposure by locking in a rate for a future period, contrasting with a rate float approach where the interest rate is tied to a reference index like LIBOR or SOFR and fluctuates over time. This mechanism helps manage interest rate risk by either fixing the cost upfront through a rate lock or allowing flexibility with potential savings via rate float.

Loan estimate

A Loan Estimate details the costs and terms of a mortgage, specifying whether the interest rate is locked or floating, impacting the borrower's financial planning. Rate lock guarantees a fixed interest rate for a set period, protecting against market fluctuations, while rate float allows potential changes in rates, offering flexibility but increased risk.

Interest rate cap

An interest rate cap limits the maximum rate a borrower pays on a variable-rate loan, offering protection against rising rates during a rate float period. In contrast, a rate lock guarantees a fixed interest rate for a specified time, eliminating uncertainty but potentially foregoing the benefits of rate decreases if rates fall.

Mortgage-backed securities

Mortgage-backed securities (MBS) performance is significantly influenced by the choice between rate lock and rate float during the mortgage origination process, as rate locks secure a fixed interest rate, reducing prepayment risk and enhancing cash flow predictability for investors. Conversely, rate float exposes borrowers to market fluctuations, potentially increasing yield variability and impacting the valuation and risk profile of MBS portfolios.

Repricing risk

Repricing risk arises when loan interest rates reset before the underlying asset or liability matures, affecting cash flows and profitability. In rate lock agreements, the interest rate is fixed upfront, minimizing repricing risk, whereas rate float agreements expose parties to fluctuating market rates and higher repricing risk during the lock period.

Secondary market adjustment

Secondary market adjustment impacts the lender's pricing risk when choosing between rate lock and rate float options in mortgage lending. Opting for a rate lock secures the interest rate but exposes the lender to potential losses or gains due to market fluctuations, whereas rate float allows adjustment to market conditions but risks rate increases during the lock period.

Forward commitment

Forward commitment secures a fixed interest rate on a loan or mortgage before closing, protecting borrowers from rate increases during the lock period. Rate lock guarantees the agreed rate, while rate float allows the borrower to benefit from potential rate drops but assumes the risk of rate increases before loan finalization.

Market rate exposure

Market rate exposure reflects the risk borrowers and lenders face due to fluctuations in interest rates between loan approval and closing. Choosing a rate lock minimizes this exposure by securing a fixed rate, while rate float leaves borrowers vulnerable to market volatility but allows potential benefit if rates decline.

Rate lock vs Rate float Infographic

moneydif.com

moneydif.com