Fixed-rate mortgages provide consistent monthly payments with a stable interest rate throughout the loan term, ideal for budgeting and long-term planning. Adjustable-rate mortgages typically offer lower initial rates that fluctuate after a fixed period, which may result in varying payments and financial uncertainty. Choosing between the two depends on your risk tolerance, financial goals, and expected duration of homeownership.

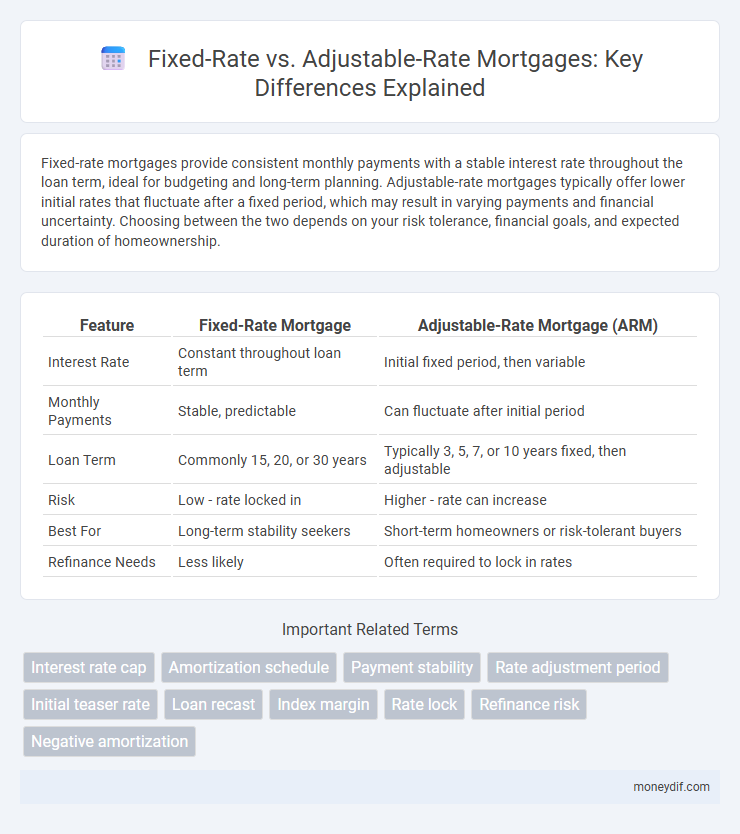

Table of Comparison

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Constant throughout loan term | Initial fixed period, then variable |

| Monthly Payments | Stable, predictable | Can fluctuate after initial period |

| Loan Term | Commonly 15, 20, or 30 years | Typically 3, 5, 7, or 10 years fixed, then adjustable |

| Risk | Low - rate locked in | Higher - rate can increase |

| Best For | Long-term stability seekers | Short-term homeowners or risk-tolerant buyers |

| Refinance Needs | Less likely | Often required to lock in rates |

Understanding Fixed-Rate Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payments throughout the loan term, providing financial stability and predictability for borrowers. These loans typically have terms of 15, 20, or 30 years, making it easier to budget for long-term homeownership expenses. Fixed-rate mortgages are ideal for buyers seeking to avoid interest rate fluctuations and secure a stable payment schedule.

What is an Adjustable-Rate Mortgage?

An Adjustable-Rate Mortgage (ARM) features an interest rate that fluctuates periodically based on a specific financial index, resulting in variable monthly payments. Initial rates are typically lower than fixed-rate mortgages, providing short-term affordability but carrying the risk of increased payments when rates adjust. ARMs often include caps limiting rate increases, offering some protection against steep payment hikes over the loan term.

Key Differences: Fixed-Rate vs Adjustable-Rate

Fixed-rate mortgages maintain a consistent interest rate and monthly payment throughout the loan term, providing predictable budgeting and protection from market fluctuations. Adjustable-rate mortgages (ARMs) offer lower initial rates that adjust periodically based on index rates, potentially lowering initial costs but introducing payment uncertainty over time. Borrowers seeking long-term stability often prefer fixed-rate loans, while those anticipating short-term ownership or fluctuating income might benefit from ARMs' flexibility.

Pros and Cons of Fixed-Rate Mortgages

Fixed-rate mortgages provide borrowers with predictable monthly payments and protection against interest rate fluctuations, making budgeting easier and offering long-term financial stability. The main drawback lies in typically higher initial interest rates compared to adjustable-rate mortgages, potentially resulting in higher overall costs if interest rates drop. These loans are ideal for homeowners planning to stay in their property for an extended period, benefiting from consistent payments despite market changes.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, which can result in significant savings during the early years of the mortgage. However, the main disadvantage of ARMs is the potential for increasing interest rates over time, leading to higher monthly payments and payment uncertainty. Borrowers with plans to sell or refinance within a few years may benefit from ARMs, while those seeking long-term stability often prefer fixed-rate mortgages.

How Interest Rates Affect Your Mortgage Choice

Fixed-rate mortgages provide stability with consistent monthly payments by locking in an interest rate for the loan term, ideal when rates are low or expected to rise. Adjustable-rate mortgages (ARMs) offer lower initial rates that adjust periodically based on market indexes, potentially reducing early payments but introducing future rate uncertainty. Borrowers should evaluate current interest rate trends, economic forecasts, and their financial risk tolerance to select a mortgage type that balances payment predictability with potential savings.

Which Mortgage is Better for First-Time Buyers?

Fixed-rate mortgages offer first-time buyers predictable monthly payments and long-term stability, making budgeting easier during the initial homeownership phase. Adjustable-rate mortgages may start with lower interest rates, providing initial affordability but posing potential payment increases that can strain inexperienced homeowners. Evaluating personal financial stability and future plans helps first-time buyers decide which mortgage aligns best with their risk tolerance and budget flexibility.

Long-Term Costs: Fixed-Rate vs Adjustable-Rate

Fixed-rate mortgages offer predictable long-term costs with consistent monthly payments and stable interest rates over the loan term, making them ideal for budgeting. Adjustable-rate mortgages (ARMs) typically start with lower initial rates but can increase over time, potentially raising monthly payments and total interest paid. Homebuyers should analyze interest rate trends, loan duration, and financial stability to determine which mortgage type minimizes long-term expenses.

When to Choose an Adjustable-Rate Mortgage

Choose an adjustable-rate mortgage (ARM) when planning to sell or refinance before the initial fixed-rate period ends, as ARMs often start with lower interest rates, reducing initial monthly payments. Borrowers expecting rising income or short-term residency benefit from ARMs by leveraging lower rates without long-term commitment. Understanding index rates and caps is crucial to manage potential rate increases over time.

Fixed-Rate vs Adjustable-Rate: Making the Right Decision

Choosing between fixed-rate and adjustable-rate mortgages depends on financial stability and market conditions. Fixed-rate loans provide predictable monthly payments and protection against interest rate fluctuations, ideal for long-term planning. Adjustable-rate mortgages may offer lower initial rates but carry the risk of increased payments as interest rates adjust periodically.

Important Terms

Interest rate cap

Interest rate caps limit the maximum interest charged on adjustable-rate mortgages (ARMs), providing borrowers protection against sudden rate hikes unlike fixed-rate mortgages which maintain a constant interest rate throughout the loan term. This cap enhances the appeal of ARMs by reducing financial risk while allowing potential savings when market rates are low.

Amortization schedule

An amortization schedule for fixed-rate mortgages provides consistent, predictable monthly payments where principal and interest are clearly outlined over the loan term. In contrast, adjustable-rate mortgage amortization schedules fluctuate with interest rate changes, affecting payment amounts and the distribution between principal and interest throughout the repayment period.

Payment stability

Fixed-rate mortgages provide payment stability by locking in a consistent interest rate and monthly payment throughout the loan term, protecting borrowers from market fluctuations. Adjustable-rate mortgages offer lower initial payments that can increase or decrease over time, introducing variability and potential unpredictability in monthly costs.

Rate adjustment period

Fixed-rate mortgages maintain a constant interest rate and monthly payment throughout the loan term, providing predictable budgeting for borrowers. Adjustable-rate mortgages feature a rate adjustment period, typically every 1, 3, 5, or 7 years, during which the interest rate can change based on market indices, affecting monthly payment amounts.

Initial teaser rate

Initial teaser rate refers to a temporarily low interest rate offered at the start of an adjustable-rate mortgage (ARM), which contrasts with the steady interest applied throughout the life of a fixed-rate mortgage. Borrowers benefit from lower initial payments with ARMs but face potential payment increases when the teaser period ends, unlike fixed-rate loans that provide consistent monthly payments.

Loan recast

Loan recasts adjust the monthly payments on fixed-rate loans, maintaining interest rates while reducing payment amounts through principal prepayment. Adjustable-rate loans rarely offer recasts because payment changes depend on fluctuating interest rates, making recasting less effective for these variable terms.

Index margin

Index margin represents the fixed percentage added to the benchmark index rate to establish the interest rate in adjustable-rate mortgages (ARMs). Fixed-rate mortgages maintain a consistent interest rate, while ARMs fluctuate based on the sum of the index rate plus the margin, impacting monthly payments.

Rate lock

Rate lock guarantees a fixed interest rate on a mortgage for a specified period, protecting borrowers from rate fluctuations typically associated with adjustable-rate mortgages (ARMs). Fixed-rate loans maintain constant payments throughout the loan term, while ARMs may start with lower initial rates but adjust periodically based on market indexes, increasing uncertainty without a rate lock.

Refinance risk

Refinance risk arises when homeowners with fixed-rate mortgages face higher interest rates upon refinancing, increasing monthly payments, while borrowers with adjustable-rate mortgages encounter variability in interest costs due to rate adjustments. Fixed-rate loans provide payment stability but can limit refinancing opportunities if market rates rise, whereas adjustable-rate mortgages expose borrowers to interest rate fluctuations that may impact financial planning.

Negative amortization

Negative amortization occurs when loan payments are insufficient to cover the interest, causing the unpaid interest to be added to the principal balance; this phenomenon is more common in adjustable-rate mortgages (ARMs) due to fluctuating interest rates, unlike fixed-rate mortgages where stable payments typically prevent negative amortization. Understanding the impact of interest rate changes on loan balance growth is critical when comparing fixed-rate versus adjustable-rate loan options for long-term financial planning.

Fixed-rate vs Adjustable-rate Infographic

moneydif.com

moneydif.com