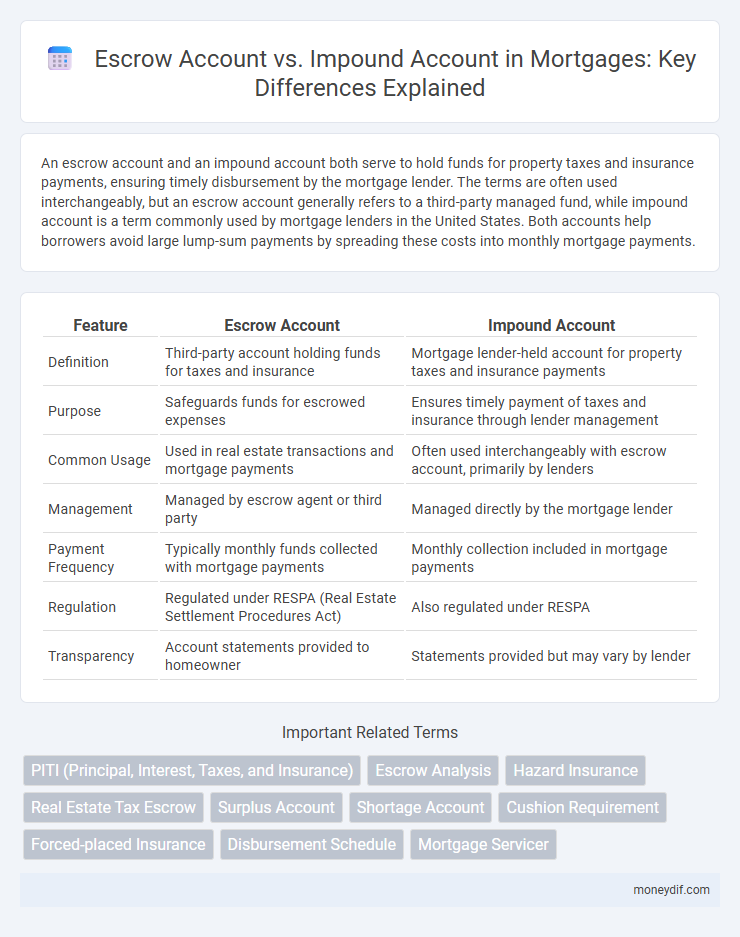

An escrow account and an impound account both serve to hold funds for property taxes and insurance payments, ensuring timely disbursement by the mortgage lender. The terms are often used interchangeably, but an escrow account generally refers to a third-party managed fund, while impound account is a term commonly used by mortgage lenders in the United States. Both accounts help borrowers avoid large lump-sum payments by spreading these costs into monthly mortgage payments.

Table of Comparison

| Feature | Escrow Account | Impound Account |

|---|---|---|

| Definition | Third-party account holding funds for taxes and insurance | Mortgage lender-held account for property taxes and insurance payments |

| Purpose | Safeguards funds for escrowed expenses | Ensures timely payment of taxes and insurance through lender management |

| Common Usage | Used in real estate transactions and mortgage payments | Often used interchangeably with escrow account, primarily by lenders |

| Management | Managed by escrow agent or third party | Managed directly by the mortgage lender |

| Payment Frequency | Typically monthly funds collected with mortgage payments | Monthly collection included in mortgage payments |

| Regulation | Regulated under RESPA (Real Estate Settlement Procedures Act) | Also regulated under RESPA |

| Transparency | Account statements provided to homeowner | Statements provided but may vary by lender |

Understanding Escrow and Impound Accounts

Escrow accounts and impound accounts both serve to hold funds for property taxes and insurance payments, ensuring homeowners stay current on these obligations. Escrow accounts act as neutral third-party accounts managed by the lender, collecting monthly deposits alongside mortgage payments, while impound accounts are often used interchangeably but can vary in terminology by region or lender preference. Understanding these accounts helps borrowers avoid tax liens and insurance lapses by streamlining the payment process through automatic escrow contributions.

Key Differences Between Escrow and Impound Accounts

Escrow accounts and impound accounts both hold funds for property taxes and insurance, but the key difference lies in terminology and regional usage; escrow accounts are commonly used nationwide, while impound accounts are a term favored by specific lenders or regions. Escrow accounts are managed by a neutral third party to ensure timely payment of taxes and insurance, providing transparency and legal protection, whereas impound accounts function similarly but may differ slightly in terms of fee structures or account management depending on the lender. Understanding these distinctions helps borrowers manage mortgage payments effectively and avoid penalties for missed tax or insurance payments.

How Escrow Accounts Work in Mortgages

Escrow accounts in mortgages function as secure holding accounts managed by lenders to collect and pay property taxes and homeowners insurance on behalf of borrowers, ensuring timely payments and preventing tax liens or insurance lapses. Each month, a portion of the borrower's mortgage payment is deposited into the escrow account, which accumulates funds until the bills are due. This system streamlines financial management by consolidating necessary expenses into one mortgage payment, promoting fiscal responsibility and avoiding large lump-sum payments.

The Role of Impound Accounts in Home Loans

Impound accounts, also known as escrow accounts, play a crucial role in home loans by ensuring timely payment of property taxes and homeowners insurance directly from the borrower's mortgage payments. These accounts protect both lenders and borrowers by preventing missed payments that could lead to tax liens or insurance lapses. Maintaining an impound account streamlines the financial management of a mortgage, reducing the risk of default and keeping the home loan in good standing.

Pros and Cons of Using Escrow Accounts

Escrow accounts provide a secure way for lenders to collect and manage property taxes and insurance premiums, ensuring timely payments while protecting borrowers from large lump-sum expenses. A key advantage is the convenience and budgeting ease, but drawbacks include limited borrower control over funds and potential inaccuracies in escrow calculations leading to unexpected shortages or surpluses. Some borrowers prefer impound accounts for increased transparency and flexibility, though these may require more diligent management to avoid missed payments.

Benefits and Drawbacks of Impound Accounts

Impound accounts, also known as escrow accounts, offer the benefit of consolidating property tax and insurance payments into monthly mortgage payments, reducing the risk of large lump-sum expenses. These accounts provide convenience and help borrowers avoid penalties by ensuring timely payments, though they can limit flexibility by requiring a consistent monthly escrow payment regardless of actual costs. Drawbacks include the potential for over-collection, where excess funds remain in the account, and sometimes increased upfront costs with initial escrow deposit requirements.

Which Account Is Right for Your Mortgage?

Choosing between an escrow account and an impound account depends on your mortgage lender's terminology and state regulations, as both serve the purpose of managing property taxes and insurance payments. An escrow account, commonly used in many states, holds funds collected with your mortgage payment to ensure timely tax and insurance bill settlements, reducing the risk of missed payments and penalties. Impound accounts function similarly but may be required or preferred by some lenders, so understanding your lender's requirements, monthly cash flow, and state mandates will help determine the best option for your mortgage management.

Managing Taxes and Insurance with Escrow vs Impound

An escrow account and an impound account both serve to manage property taxes and insurance payments by holding funds collected through monthly mortgage payments, ensuring bills are paid on time. While the terms are often used interchangeably, escrow accounts are more commonly referred to in federal lending, whereas impound accounts appear in state-specific mortgage practices. Both accounts protect lenders by preventing borrower defaults on taxes and insurance, promoting seamless financial management throughout the loan term.

Common Misconceptions About Escrow and Impound Accounts

Escrow accounts and impound accounts are often mistaken as entirely separate entities, yet both serve the same purpose of holding funds for property taxes and insurance payments. Many borrowers incorrectly assume these accounts are optional, while in reality, lenders frequently require them to manage risk effectively. Misunderstandings about how payments are collected and disbursed can lead to confusion, but both accounts function to protect both the borrower and lender by ensuring timely payment of key expenses.

Tips for Homebuyers: Choosing Between Escrow and Impound Accounts

Homebuyers should understand that escrow accounts and impound accounts both serve to manage property tax and insurance payments, but terminology varies by region and lender. Reviewing lender policies and comparing the fees, payment schedules, and flexibility of each account type can help in making an informed decision. Consulting with a mortgage advisor ensures the chosen account aligns with your financial goals and budgeting preferences.

Important Terms

PITI (Principal, Interest, Taxes, and Insurance)

PITI stands for Principal, Interest, Taxes, and Insurance, which are the four components of a monthly mortgage payment often managed through an escrow account, a financial arrangement where the lender holds funds to pay these expenses on behalf of the borrower. An impound account is a type of escrow account specifically used by mortgage lenders to collect and disburse property taxes and insurance premiums, ensuring timely payments and preventing borrower default.

Escrow Analysis

Escrow analysis compares the funding and disbursement processes of escrow accounts, which hold funds for taxes and insurance, versus impound accounts that specifically aggregate such payments to ensure timely property-related expenses.

Hazard Insurance

Hazard insurance payments held in an escrow account are managed by the lender to ensure timely coverage, while in an impound account, funds are collected and disbursed similarly but terminology varies by region.

Real Estate Tax Escrow

A real estate tax escrow is a specific type of escrow account designed to collect and hold property tax payments, while an impound account generally refers to a broader category that may also include homeowners insurance alongside property taxes.

Surplus Account

A Surplus Account in real estate escrow holds excess mortgage escrow funds collected beyond required property taxes and insurance, while an Impound Account specifically manages property tax and insurance payments, ensuring timely disbursement.

Shortage Account

A Shortage Account arises when funds in an Escrow Account, used for housing expenses, fall below required levels compared to an Impound Account, which systematically collects and disburses property tax and insurance payments.

Cushion Requirement

Cushion requirement in escrow accounts mandates maintaining an additional balance, typically one to two months' worth of property taxes and insurance premiums, whereas impound accounts may not always enforce this extra reserve.

Forced-placed Insurance

Forced-placed insurance is often charged through an escrow account, which collects funds from borrowers alongside property taxes and mortgage insurance, whereas an impound account specifically refers to the escrow account used to manage these recurring property-related payments.

Disbursement Schedule

A Disbursement Schedule for an Escrow Account outlines specific payments for taxes and insurance managed by a neutral third party, whereas an Impound Account's schedule is controlled directly by the lender to accumulate funds for these expenses.

Mortgage Servicer

Mortgage servicers manage escrow accounts to collect and hold funds for property taxes and insurance, ensuring timely payments on behalf of homeowners. An impound account is another term for an escrow account, both serving to protect lenders by securing essential costs within mortgage agreements.

Escrow Account vs Impound Account Infographic

moneydif.com

moneydif.com