Loan-to-Value (LTV) measures the percentage of the property's value that is financed through a mortgage, while Combined Loan-to-Value (CLTV) includes all loans secured by the property, such as a first mortgage plus any secondary loans or lines of credit. Lenders use LTV to assess risk for a single loan, whereas CLTV provides a comprehensive view of total debt against the home's value, influencing approval decisions and interest rates. Understanding the difference between LTV and CLTV helps borrowers evaluate their equity position and potential financing options more accurately.

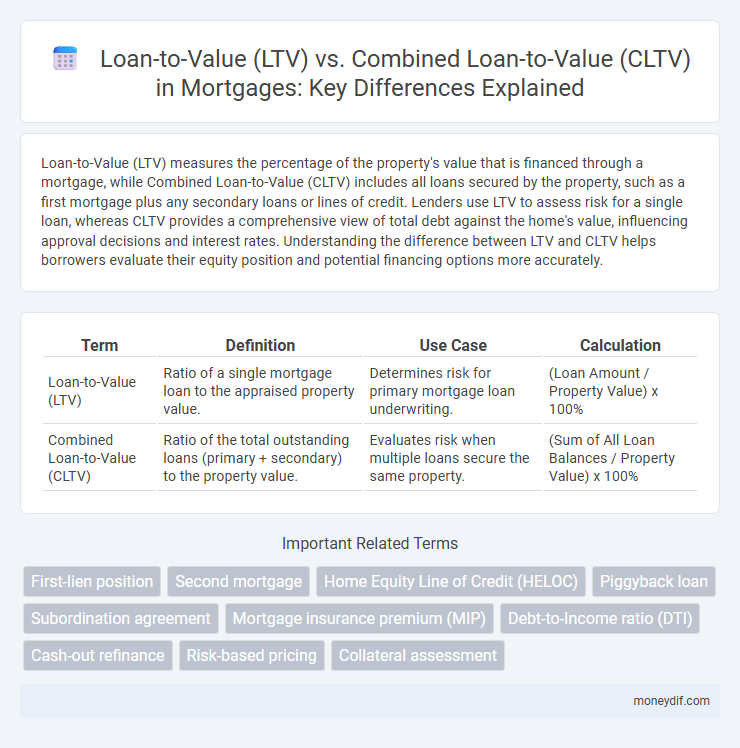

Table of Comparison

| Term | Definition | Use Case | Calculation |

|---|---|---|---|

| Loan-to-Value (LTV) | Ratio of a single mortgage loan to the appraised property value. | Determines risk for primary mortgage loan underwriting. | (Loan Amount / Property Value) x 100% |

| Combined Loan-to-Value (CLTV) | Ratio of the total outstanding loans (primary + secondary) to the property value. | Evaluates risk when multiple loans secure the same property. | (Sum of All Loan Balances / Property Value) x 100% |

Understanding Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio measures the loan amount against the appraised value of the property, determining the risk level for lenders and influencing interest rates and loan approval chances. A lower LTV ratio typically indicates less risk and can lead to better mortgage terms, while a higher LTV may require mortgage insurance. Understanding LTV is crucial for borrowers to gauge their borrowing capacity and financial commitment when purchasing or refinancing a home.

What is Combined Loan-to-Value (CLTV) Ratio?

The Combined Loan-to-Value (CLTV) ratio measures the total amount of all loans secured by a property compared to its appraised value, including both the primary mortgage and any secondary loans or lines of credit. Lenders use the CLTV to assess overall risk when multiple liens exist on a property, influencing borrowing limits and interest rates. A lower CLTV indicates less financial risk, potentially qualifying borrowers for better mortgage terms and refinancing options.

Key Differences Between LTV and CLTV

Loan-to-Value (LTV) measures the ratio of a single loan amount to the appraised property value, while Combined Loan-to-Value (CLTV) accounts for all outstanding loans secured by the property relative to its value. LTV is typically used to assess risk for a primary mortgage, whereas CLTV provides a more comprehensive risk evaluation by including second mortgages or home equity lines of credit (HELOCs). Lenders use LTV to determine eligibility and interest rates, while CLTV influences approval limits and overall borrowing capacity.

Importance of LTV in Mortgage Approval

Loan-to-Value (LTV) ratio is a critical metric in mortgage approval, measuring the loan amount relative to the property's appraised value, typically expressed as a percentage. A lower LTV indicates less risk for lenders, often leading to better interest rates and higher chances of loan approval. Unlike Combined Loan-to-Value (CLTV), which includes all outstanding loans on the property, LTV focuses solely on the primary mortgage, making it essential in assessing initial borrowing risk.

How CLTV Impacts Second Mortgages and Home Equity Lines

Combined Loan-to-Value (CLTV) ratio measures the total outstanding loan amounts, including primary mortgages and second mortgages or home equity lines of credit, against the property's appraised value, providing a more comprehensive risk assessment than Loan-to-Value (LTV) alone. Higher CLTV ratios can limit the availability or increase the cost of second mortgages and home equity lines due to increased lender risk, affecting borrower access to additional financing. Understanding CLTV helps homeowners and lenders evaluate the total leverage on a property, influencing loan approval terms and interest rates for secondary borrowing options.

Calculating LTV and CLTV: Step-by-Step Guide

Calculating Loan-to-Value (LTV) begins by dividing the primary mortgage amount by the appraised property value, then multiplying by 100 to express it as a percentage. To determine Combined Loan-to-Value (CLTV), sum all loan balances secured by the property, including second mortgages or home equity lines of credit, then divide that total by the appraised property value and multiply by 100. This step-by-step approach provides clear insight into borrowing limits and risk assessment for lenders and borrowers.

LTV vs CLTV: Which Matters More to Lenders?

Lenders prioritize Combined Loan-to-Value (CLTV) over Loan-to-Value (LTV) because CLTV represents the total outstanding loans secured by the property, including secondary mortgages and home equity lines of credit. A lower CLTV indicates less risk for lenders by demonstrating a smaller overall debt burden relative to the property's value. While LTV focuses on the primary mortgage, CLTV provides a comprehensive view of the borrower's total leverage, influencing loan approval and terms more significantly.

Impact of LTV and CLTV on Interest Rates and Terms

Loan-to-Value (LTV) and Combined Loan-to-Value (CLTV) ratios critically influence mortgage interest rates and loan terms, as higher ratios represent increased lending risk. Lenders often charge elevated interest rates and impose stricter terms when LTV or CLTV exceeds standard thresholds, typically 80%, to mitigate default risk. Lower LTV and CLTV ratios generally qualify borrowers for more favorable rates, reduced mortgage insurance premiums, and flexible loan conditions.

Strategies to Improve Your LTV and CLTV Ratios

Improving your Loan-to-Value (LTV) and Combined Loan-to-Value (CLTV) ratios can enhance mortgage approval odds and secure better interest rates. Strategies include increasing your down payment to reduce the loan amount, paying down existing debts to lower total loan balances, and seeking property appraisals that reflect higher home values. Maintaining a strong credit score and consolidating secondary loans into the primary mortgage can also optimize both LTV and CLTV ratios for more favorable lending terms.

LTV and CLTV: Frequently Asked Questions for Homebuyers

Loan-to-Value (LTV) measures the ratio of the primary mortgage loan amount to the appraised value or purchase price of the home, helping lenders assess risk and determine loan eligibility. Combined Loan-to-Value (CLTV) includes all loans secured by the property, such as second mortgages or home equity lines of credit, compared against the home's value to provide a comprehensive risk overview. Homebuyers often inquire how LTV and CLTV affect interest rates, down payment requirements, and loan approval chances in mortgage applications.

Important Terms

First-lien position

First-lien position indicates the primary claim on a property in case of default, typically associated with the Loan-to-Value (LTV) ratio, which measures the mortgage amount against the property's appraised value. Combined Loan-to-Value (CLTV) includes all secured loans on the property, providing a broader risk assessment by accounting for additional liens beyond the first mortgage.

Second mortgage

Second mortgage approval depends heavily on the Loan-to-Value (LTV) ratio, which measures the primary loan balance against the property's current value. Lenders also evaluate the Combined Loan-to-Value (CLTV) ratio, accounting for the total balance of both first and second mortgages relative to property value, ensuring the combined debt does not exceed acceptable risk thresholds.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is often approved based on the Loan-to-Value (LTV) ratio, which measures the amount of the HELOC compared to the home's appraised value, typically requiring an LTV below 80%. Combined Loan-to-Value (CLTV) considers all outstanding loans secured by the property, including the primary mortgage and the HELOC, with lenders usually capping CLTV at 85% to manage risk and ensure borrower equity.

Piggyback loan

A piggyback loan involves taking out a second mortgage to cover part of the down payment, reducing the Loan-to-Value (LTV) ratio on the primary mortgage and potentially avoiding private mortgage insurance (PMI). Combined Loan-to-Value (CLTV) reflects the total indebtedness by combining both loan amounts divided by the home's appraised value, providing a comprehensive risk assessment for lenders.

Subordination agreement

A subordination agreement prioritizes primary liens over secondary liens, directly affecting the Loan-to-Value (LTV) ratio by ensuring the first lender's claim takes precedence in property foreclosure. This agreement also influences the Combined Loan-to-Value (CLTV) ratio by coordinating multiple loan balances against the property's appraised value, impacting the overall borrowing capacity and risk assessment for lenders.

Mortgage insurance premium (MIP)

Mortgage insurance premium (MIP) rates vary based on Loan-to-Value (LTV) ratios, with higher LTVs typically requiring higher MIP, while Combined Loan-to-Value (CLTV) considers all liens on the property, affecting the total insurance cost and eligibility. LTV focuses on the primary loan amount relative to property value, whereas CLTV includes secondary financing, impacting overall mortgage insurance calculations and borrower risk assessment.

Debt-to-Income ratio (DTI)

The Debt-to-Income ratio (DTI) measures a borrower's monthly debt payments relative to their gross income, directly impacting loan approval by assessing repayment capacity. Loan-to-Value (LTV) compares the loan amount to the property value, while Combined Loan-to-Value (CLTV) includes all loans secured by the property, with lower DTI facilitating better approval odds even when LTV or CLTV ratios are high.

Cash-out refinance

Cash-out refinance evaluates Loan-to-Value (LTV) by comparing the new loan amount to the home's appraised value, while Combined Loan-to-Value (CLTV) includes all loans secured by the property, offering a more comprehensive risk assessment. Lenders often use CLTV limits to determine eligibility and maximum cash-out amounts, as it accounts for both the primary mortgage and any secondary liens.

Risk-based pricing

Risk-based pricing adjusts interest rates based on the Loan-to-Value (LTV) ratio, which measures the loan amount against the appraised property value, reflecting individual borrower risk. Combined Loan-to-Value (CLTV) incorporates all secured loans on the property, offering a comprehensive risk assessment that influences lending terms and pricing more accurately than LTV alone.

Collateral assessment

Collateral assessment evaluates the value of assets securing a loan to determine lending risk, primarily using Loan-to-Value (LTV) ratios that compare the individual loan amount to the property value. Combined Loan-to-Value (CLTV) extends this by aggregating all outstanding loans on the property, providing a comprehensive risk profile for lenders assessing total borrower leverage.

Loan-to-Value (LTV) vs Combined Loan-to-Value (CLTV) Infographic

moneydif.com

moneydif.com