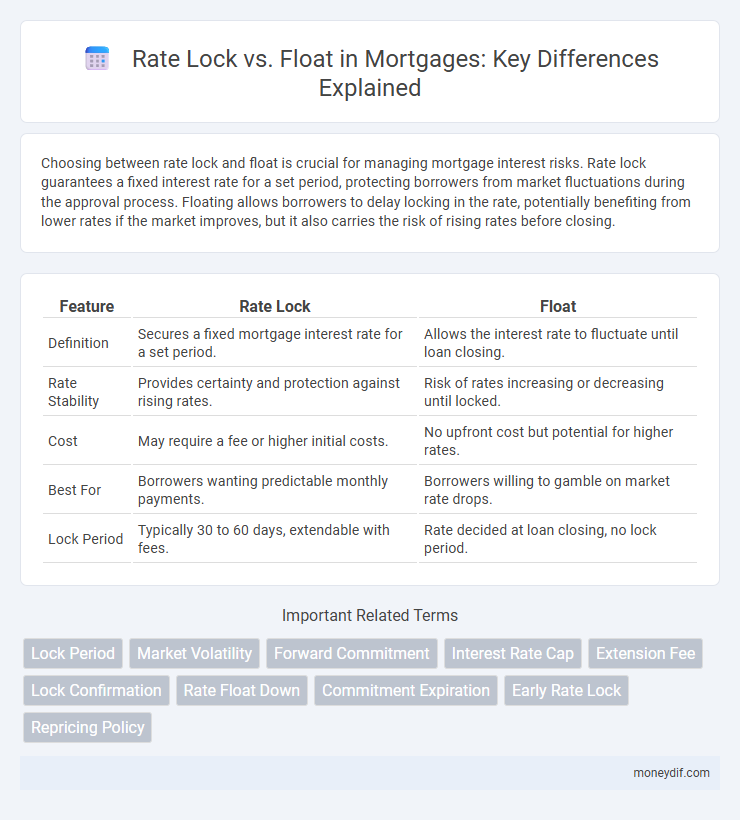

Choosing between rate lock and float is crucial for managing mortgage interest risks. Rate lock guarantees a fixed interest rate for a set period, protecting borrowers from market fluctuations during the approval process. Floating allows borrowers to delay locking in the rate, potentially benefiting from lower rates if the market improves, but it also carries the risk of rising rates before closing.

Table of Comparison

| Feature | Rate Lock | Float |

|---|---|---|

| Definition | Secures a fixed mortgage interest rate for a set period. | Allows the interest rate to fluctuate until loan closing. |

| Rate Stability | Provides certainty and protection against rising rates. | Risk of rates increasing or decreasing until locked. |

| Cost | May require a fee or higher initial costs. | No upfront cost but potential for higher rates. |

| Best For | Borrowers wanting predictable monthly payments. | Borrowers willing to gamble on market rate drops. |

| Lock Period | Typically 30 to 60 days, extendable with fees. | Rate decided at loan closing, no lock period. |

Understanding Rate Locks: What They Mean

Rate locks in mortgage agreements guarantee a borrower's interest rate for a set period, protecting against market fluctuations. Choosing to lock avoids the risk of rising rates during the lock window, typically 30 to 60 days, while floating leaves the rate subject to market changes until closing. Understanding the trade-offs between locking and floating ensures borrowers make informed decisions based on their risk tolerance and market outlook.

The Basics of Mortgage Rate Floating

Mortgage rate floating allows borrowers to keep their loan interest rate variable until they decide to lock it, providing flexibility to benefit from potential market rate drops. This option involves risk, as rates may rise before locking, increasing borrowing costs, but it can be advantageous for those expecting favorable shifts. Understanding rate float enables smarter timing decisions in securing mortgage terms aligned with market movements.

Rate Lock: How It Works and When to Use It

Rate lock secures a specific mortgage interest rate for a set period, typically 30 to 60 days, protecting borrowers from market fluctuations during the loan approval process. Borrowers use a rate lock when they anticipate rising interest rates or want certainty in their monthly payments, especially in volatile markets. It is crucial to time the rate lock with the loan application to avoid fees and ensure the locked rate applies through closing.

Pros and Cons of Locking Your Mortgage Rate

Locking your mortgage rate guarantees a fixed interest rate for a set period, providing protection against rising rates and ensuring predictable monthly payments. However, rate locks often come with fees and may expire before closing, potentially causing stress if market rates drop and you miss out on lower costs. Floating your rate offers flexibility to benefit from rate decreases but introduces uncertainty and financial risk if rates increase before locking in.

Floating Your Rate: Benefits and Risks

Floating your mortgage rate offers the advantage of potentially securing a lower interest rate if market conditions improve before closing, saving thousands over the loan term. However, this strategy carries the risk of rates rising, which could increase your monthly payments and overall loan cost. Carefully monitoring economic indicators like Federal Reserve announcements and bond market trends helps borrowers make informed decisions about when to lock in their rate.

Factors Influencing Rate Changes During Mortgage Processing

Mortgage interest rates fluctuate based on market conditions, economic indicators, and lender policies, impacting whether borrowers should choose rate lock or float options. Volatility in Treasury yields, inflation rates, and Federal Reserve decisions can cause rate changes during mortgage processing periods. Borrowers risk higher costs if rates rise after floating, while locking secures a rate but may forfeit potential savings if rates fall.

Cost Implications: Lock Fees vs. Potential Savings

Rate lock fees offer upfront cost certainty by securing an interest rate for a specified period, preventing potential spikes during market volatility. Floating without a lock can lead to savings if rates decline but risks higher expenses if rates increase before closing. Borrowers must weigh the lock fee against the probability of rate movement to optimize mortgage cost efficiency.

Real-Life Scenarios: When to Lock or Float

Homebuyers facing fluctuating mortgage rates must decide between rate lock and floating options based on market trends and personal timelines. Locking a rate suits borrowers expecting rising interest rates or closing soon, providing cost certainty and budget stability. Floating benefits those who anticipate rate drops or have flexible closing dates, potentially securing lower payments but risking rate increases.

Tips for Deciding: Lock or Float Your Mortgage Rate

Evaluate current market trends and economic forecasts before deciding to lock or float your mortgage rate; locking secures your interest rate against potential rises, while floating may benefit from rate decreases. Consider your loan closing timeline and personal risk tolerance to balance the trade-offs between rate stability and potential savings. Consult with your mortgage advisor to analyze rate lock fees and expiration periods, ensuring an informed decision tailored to your financial goals.

Current Market Trends and Their Impact on Rate Decisions

Current market trends show fluctuating interest rates influenced by central bank policies and economic indicators, making the decision between rate lock and float crucial for borrowers. Locking a mortgage rate can protect against imminent rate hikes during volatile periods, while floating offers potential savings if rates decline. Understanding market forecasts and lender risk tolerance helps optimize timing for securing favorable mortgage rates.

Important Terms

Lock Period

The lock period in mortgage financing is the fixed duration during which a borrower secures an interest rate through a rate lock, preventing fluctuations despite market changes. In contrast, opting to float allows the rate to vary with the market until closing, potentially benefiting from rate decreases but risking increases before the lock period expires.

Market Volatility

Market volatility significantly impacts the decision between rate lock and float options in mortgage financing, as fluctuating interest rates can increase the risk of higher borrowing costs when choosing to float. Opting for a rate lock secures a fixed interest rate amidst unpredictability, providing financial stability during periods of economic uncertainty.

Forward Commitment

Forward commitment in real estate financing secures an interest rate ahead of loan closing, effectively locking the rate despite market fluctuations. Unlike a floating rate that varies with market conditions, rate lock provides certainty on borrowing costs, protecting borrowers from potential rate increases during the transaction period.

Interest Rate Cap

An interest rate cap limits the maximum interest rate on a variable-rate loan, providing protection against rising rates while allowing benefits if rates fall, unlike a rate lock which fixes the rate at a specific point regardless of market changes. Borrowers choosing between rate lock and float must assess market trends and risk tolerance, with rate locks securing rates upfront and floating rates offering potential savings if interest rates decline but risk increases if rates rise above the cap level.

Extension Fee

Extension fees apply when borrowers extend their rate lock period beyond the original expiration to maintain interest rate guarantees amid fluctuating market rates. Rate lock extensions prevent exposure to rising float rates but often incur additional costs based on the lender's policies and the duration of the extension.

Lock Confirmation

Lock Confirmation secures a mortgage interest rate at the time of application, protecting borrowers from market fluctuations during the loan process. Unlike floating rates that vary with market conditions, a rate lock guarantees the agreed-upon rate for a specified period, reducing financial uncertainty for homebuyers.

Rate Float Down

Rate Float Down allows borrowers to benefit from a lower interest rate if market rates decline after a rate lock is secured, offering flexibility compared to a strict Rate Lock that fixes the rate regardless of fluctuations. This feature is particularly valuable in volatile mortgage markets, enabling potential savings without the risk of rates increasing before closing.

Commitment Expiration

Commitment expiration defines the deadline by which a borrower must close their loan to retain the agreed-upon interest rate in a rate lock agreement, preventing exposure to market fluctuations. If the lock expires before closing, the borrower may be forced to accept current float rates, which can result in higher costs if interest rates have increased.

Early Rate Lock

Early Rate Lock secures an interest rate early in the mortgage process, protecting borrowers from market fluctuations and potential rate increases before loan closing. Unlike the Float option, which allows rates to move with the market in hopes of a lower rate, Early Rate Lock provides certainty and risk mitigation but may come at a slightly higher cost.

Repricing Policy

Repricing policy defines how mortgage rates are adjusted between the initial lock and closing, directly impacting borrower costs and lender risk. Rate lock secures a fixed interest rate for a set period, while float allows rates to fluctuate, providing potential savings or increased expenses depending on market movements.

Rate Lock vs Float Infographic

moneydif.com

moneydif.com