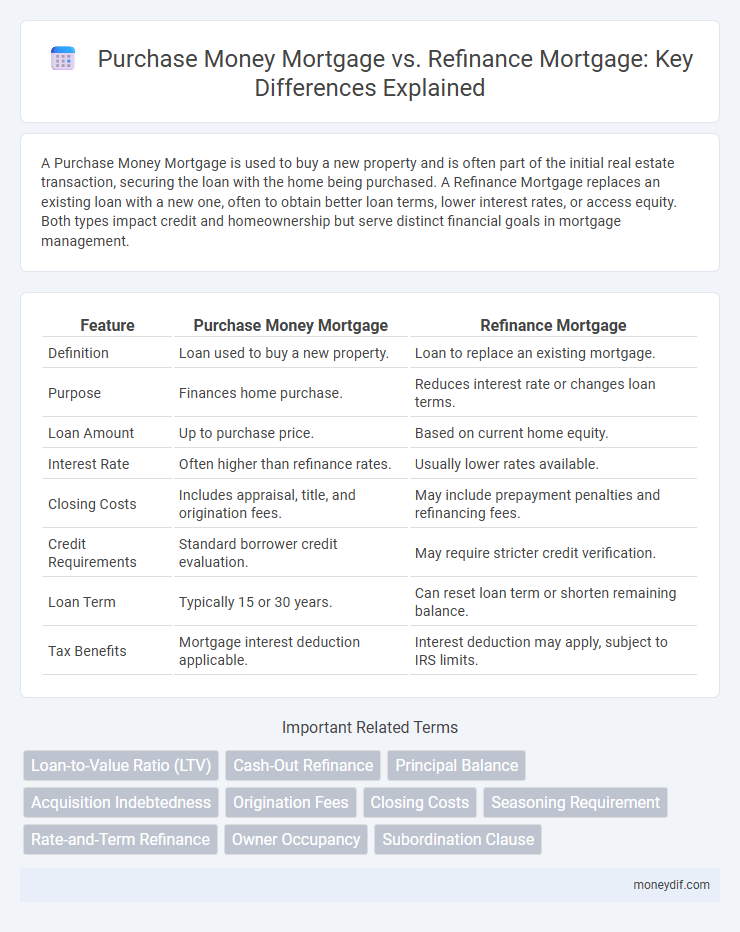

A Purchase Money Mortgage is used to buy a new property and is often part of the initial real estate transaction, securing the loan with the home being purchased. A Refinance Mortgage replaces an existing loan with a new one, often to obtain better loan terms, lower interest rates, or access equity. Both types impact credit and homeownership but serve distinct financial goals in mortgage management.

Table of Comparison

| Feature | Purchase Money Mortgage | Refinance Mortgage |

|---|---|---|

| Definition | Loan used to buy a new property. | Loan to replace an existing mortgage. |

| Purpose | Finances home purchase. | Reduces interest rate or changes loan terms. |

| Loan Amount | Up to purchase price. | Based on current home equity. |

| Interest Rate | Often higher than refinance rates. | Usually lower rates available. |

| Closing Costs | Includes appraisal, title, and origination fees. | May include prepayment penalties and refinancing fees. |

| Credit Requirements | Standard borrower credit evaluation. | May require stricter credit verification. |

| Loan Term | Typically 15 or 30 years. | Can reset loan term or shorten remaining balance. |

| Tax Benefits | Mortgage interest deduction applicable. | Interest deduction may apply, subject to IRS limits. |

Introduction to Purchase Money Mortgage and Refinance Mortgage

A Purchase Money Mortgage is a loan used by buyers to finance the acquisition of a property, typically arranged at the time of purchase and secured by the real estate itself. In contrast, a Refinance Mortgage involves replacing an existing mortgage with a new loan, often to obtain better terms, lower interest rates, or access home equity. Understanding the distinctions between these mortgage types is essential for optimizing financing strategies and managing homeownership costs effectively.

Key Differences Between Purchase and Refinance Mortgages

Purchase money mortgages secure financing for buying a new property, typically involving a down payment and underwriting based on the property's value and buyer's credit profile. Refinance mortgages replace an existing loan on a property, often to obtain better interest rates, adjust loan terms, or tap into home equity through cash-out refinancing. Key differences include the loan purpose, eligibility criteria, costs involved, and impact on credit scores, with purchase mortgages focusing on acquisition and refinance mortgages centered on financial optimization of existing homes.

How Purchase Money Mortgages Work

Purchase Money Mortgages are loans taken out specifically to buy real estate, where the borrower uses the mortgage to finance the purchase price directly. The lender holds a lien on the property until the loan is fully repaid, securing the transaction and enabling the borrower to acquire the home without paying the full amount upfront. These mortgages typically involve fixed or adjustable interest rates and require a down payment, making them distinct from refinance mortgages, which replace or modify existing loan terms.

How Refinance Mortgages Work

Refinance mortgages replace an existing loan with a new mortgage, often to secure lower interest rates or adjust loan terms. Homeowners apply for refinancing through lenders, who assess creditworthiness, property value, and outstanding loan balance before approval. This process can reduce monthly payments, shorten the loan term, or convert equity into cash through a cash-out refinance.

Eligibility Criteria for Each Mortgage Type

Purchase money mortgages require borrowers to qualify based on the property's purchase price, typically necessitating a down payment of 3% to 20%, a minimum credit score around 620, and sufficient income to cover monthly payments. Refinance mortgages evaluate eligibility by assessing current equity in the property, often requiring a loan-to-value (LTV) ratio below 80%, stable credit history, and proof of consistent income to ensure repayment capacity. Both mortgage types demand verification of employment, creditworthiness, and debt-to-income (DTI) ratios, but refinance loans may have stricter scrutiny on existing debt obligations and property appraisal results.

Pros and Cons of Purchase Money Mortgages

Purchase money mortgages enable homebuyers to finance property acquisition directly through the seller or lender, often requiring lower upfront costs and facilitating quicker transactions. However, these mortgages may come with higher interest rates and stricter qualification criteria compared to refinance mortgages, potentially increasing overall borrowing costs. Buyers should weigh the ease of obtaining a purchase money mortgage against possible limitations on loan terms and flexibility.

Pros and Cons of Refinance Mortgages

Refinance mortgages offer the advantage of potentially lowering interest rates, reducing monthly payments, and consolidating debt, which can improve cash flow and financial stability. However, refinancing often involves closing costs, potential extension of loan terms, and the risk of higher overall interest paid if the loan period is extended. Borrowers should weigh these factors carefully to ensure refinancing aligns with their long-term financial goals.

Costs and Fees: Purchase vs Refinance Mortgages

Purchase money mortgages typically involve higher upfront costs such as loan origination fees, appraisal fees, and closing costs associated with acquiring a new property. Refinance mortgages often incur lower fees, primarily related to loan processing and appraisal, but may include prepayment penalties and mortgage insurance adjustments depending on the existing loan terms. Comparing cost structures, purchase mortgages demand more substantial initial outlays, while refinance mortgages focus on optimizing interest rates and monthly payments with potentially reduced closing expenses.

When to Choose Purchase Money Mortgage or Refinance Mortgage

Choose a Purchase Money Mortgage when buying a new property, as it directly finances the purchase, often with competitive interest rates and down payment options. Opt for a Refinance Mortgage to replace an existing loan, typically to secure a lower interest rate, reduce monthly payments, or access home equity for cash out. Evaluate current interest rates, loan terms, and financial goals to determine whether a purchase or refinancing mortgage better suits your situation.

Frequently Asked Questions About Mortgage Types

Purchase money mortgages finance the acquisition of a new property, typically involving a down payment and lender approval based on creditworthiness and income verification. Refinance mortgages replace an existing loan to obtain improved interest rates, reduced monthly payments, or access to home equity for cash-out purposes. Common questions focus on eligibility requirements, differences in closing costs, and the impact on credit scores between purchase money and refinance mortgages.

Important Terms

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) measures the loan amount against the property's appraised value, typically lower for Purchase Money Mortgages due to down payments, while Refinance Mortgages often have higher LTVs since they're based on current home equity. A Purchase Money Mortgage usually has an LTV around 80%, whereas Refinance Mortgages can exceed 80%, reflecting different risk profiles for lenders.

Cash-Out Refinance

Cash-Out Refinance allows homeowners to replace their existing mortgage with a new loan exceeding the current balance, converting home equity into cash, contrasting with a Purchase Money Mortgage which is used solely for acquiring property. Unlike Purchase Money Mortgages that fund home purchases, Cash-Out Refinance restructures debt to access funds for expenses like home improvements, consolidations, or investments.

Principal Balance

The principal balance in a purchase money mortgage typically represents the original loan amount used to buy a property, whereas in a refinance mortgage, it reflects the remaining debt after replacing or modifying an existing loan.

Acquisition Indebtedness

Acquisition indebtedness refers to the loan amount incurred to buy, build, or substantially improve a qualified residence, distinguishing purchase money mortgages used for original property acquisition from refinance mortgages primarily used to replace existing debt.

Origination Fees

Origination fees for purchase money mortgages typically range from 0.5% to 1.5% of the loan amount, reflecting the costs associated with initiating a new loan for home purchase, while refinance mortgage origination fees may vary similarly but can sometimes be lower depending on lender policies and borrower creditworthiness. These fees cover underwriting, processing, and other administrative tasks essential in both types of loans but can impact overall closing costs differently based on loan type and terms.

Closing Costs

Closing costs for purchase money mortgages typically range from 2% to 5% of the loan amount, whereas refinance mortgage closing costs usually average between 2% and 6%, influenced by factors such as loan size, lender fees, and property location.

Seasoning Requirement

Seasoning requirements typically mandate a waiting period between the closing of a purchase money mortgage and eligibility for refinancing, ensuring sufficient equity buildup and loan seasoning before refinancing options become available.

Rate-and-Term Refinance

Rate-and-term refinance adjusts the interest rate or loan term on an existing mortgage, unlike a purchase money mortgage which funds a home purchase, with refinance mortgages replacing the original loan typically to secure better terms or access equity.

Owner Occupancy

Owner occupancy significantly impacts the terms and qualification criteria for Purchase Money Mortgages compared to Refinance Mortgages, with lenders often requiring proof of primary residence for purchase loans to ensure favorable interest rates and down payment options. Refinance Mortgages typically offer less stringent owner occupancy requirements, focusing more on creditworthiness and loan-to-value ratios rather than initial occupancy intent, affecting loan structure and borrower eligibility.

Subordination Clause

A subordination clause in a purchase money mortgage ensures the mortgage lender's priority position, whereas in a refinance mortgage, it allows the new loan to take precedence over the original purchase money mortgage.

Purchase Money Mortgage vs Refinance Mortgage Infographic

moneydif.com

moneydif.com