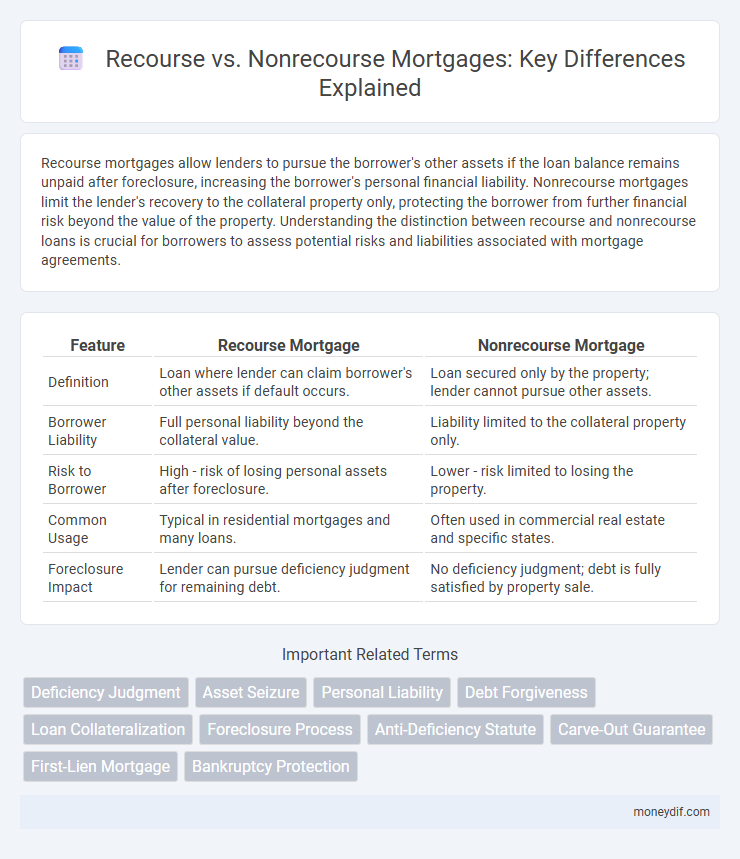

Recourse mortgages allow lenders to pursue the borrower's other assets if the loan balance remains unpaid after foreclosure, increasing the borrower's personal financial liability. Nonrecourse mortgages limit the lender's recovery to the collateral property only, protecting the borrower from further financial risk beyond the value of the property. Understanding the distinction between recourse and nonrecourse loans is crucial for borrowers to assess potential risks and liabilities associated with mortgage agreements.

Table of Comparison

| Feature | Recourse Mortgage | Nonrecourse Mortgage |

|---|---|---|

| Definition | Loan where lender can claim borrower's other assets if default occurs. | Loan secured only by the property; lender cannot pursue other assets. |

| Borrower Liability | Full personal liability beyond the collateral value. | Liability limited to the collateral property only. |

| Risk to Borrower | High - risk of losing personal assets after foreclosure. | Lower - risk limited to losing the property. |

| Common Usage | Typical in residential mortgages and many loans. | Often used in commercial real estate and specific states. |

| Foreclosure Impact | Lender can pursue deficiency judgment for remaining debt. | No deficiency judgment; debt is fully satisfied by property sale. |

Understanding Recourse and Nonrecourse Mortgages

Recourse mortgages allow lenders to pursue the borrower's other assets if the loan balance remains after foreclosure, ensuring full debt recovery. Nonrecourse mortgages limit the lender's claim to only the property collateral, protecting the borrower's personal assets from deficiency judgments. Understanding the distinctions between recourse and nonrecourse loans is critical for evaluating legal and financial risks associated with mortgage agreements.

Key Differences Between Recourse and Nonrecourse Loans

Recourse loans allow lenders to pursue the borrower's other assets beyond the collateral if the loan defaults, providing stronger lender protection. Nonrecourse loans limit the lender's recovery strictly to the collateral, typically the mortgaged property, meaning the borrower's other assets are shielded from claims. Understanding these distinctions is crucial for borrowers evaluating liability risk and for lenders assessing loan security in mortgage agreements.

How Recourse Loans Affect Borrowers

Recourse loans allow lenders to pursue borrowers' personal assets beyond the collateral if the mortgage defaults, increasing financial risk for borrowers. This extended liability often results in higher interest rates and stricter lending criteria to mitigate lender risk. Borrowers must carefully assess their ability to meet repayment obligations, as failure can lead to significant personal asset loss.

Nonrecourse Mortgages: Benefits and Drawbacks

Nonrecourse mortgages limit borrower liability to the property itself, protecting personal assets if foreclosure occurs. These loans often have higher interest rates and stricter qualification criteria due to increased lender risk. The main benefit is financial protection for borrowers, while the drawback includes potentially higher costs and limited loan availability.

Legal Implications of Recourse vs Nonrecourse Lending

Recourse lending legally allows lenders to pursue a borrower's personal assets beyond the collateral if loan default occurs, often resulting in a deficiency judgment. Nonrecourse loans limit lender recovery strictly to the collateral, protecting borrower's other assets from legal claims. This distinction significantly affects borrower risk exposure and lender's rights in foreclosure and deficiency proceedings.

Which States Offer Nonrecourse Mortgages?

Nonrecourse mortgages are primarily offered in states like California, Arizona, and Texas, where borrower liability is limited to the collateral property. These states protect homeowners by preventing lenders from pursuing personal assets beyond the foreclosure property. Understanding state-specific mortgage laws is crucial for borrowers seeking nonrecourse financing options.

Impact on Credit and Personal Assets

Recourse mortgages allow lenders to pursue borrowers' personal assets beyond the collateral if the loan defaults, directly impacting credit scores and financial stability. Nonrecourse mortgages limit the lender's claim to the property alone, protecting personal assets but potentially affecting credit if the foreclosure is reported. Understanding these distinctions helps borrowers manage risk and maintain long-term credit health.

Choosing Between Recourse and Nonrecourse Mortgages

Choosing between recourse and nonrecourse mortgages depends on the borrower's risk tolerance and financial situation. Recourse loans allow lenders to pursue the borrower's other assets if the collateral property value declines, increasing personal liability. Nonrecourse mortgages limit the lender's recovery to the collateral alone, reducing borrower risk but often featuring higher interest rates or stricter approval criteria.

Recourse vs Nonrecourse: Lender’s Perspective

From a lender's perspective, recourse loans provide stronger security by allowing full recovery through borrower's personal assets if the collateral property's value does not cover the outstanding mortgage balance. Nonrecourse loans limit the lender's recovery strictly to the collateral property, increasing credit risk but often attracting borrowers who prefer limited liability. This risk difference typically results in higher interest rates and stricter underwriting criteria for nonrecourse mortgages.

Frequently Asked Questions on Recourse and Nonrecourse Loans

Recourse loans allow lenders to pursue the borrower's other assets if the property collateral does not cover the outstanding debt, while nonrecourse loans limit the lender's recovery to the collateral itself. Borrowers often ask if recourse loans pose higher risks, which they do since personal assets are at stake, contrasted with nonrecourse loans that provide more protection by restricting lender claims to the property. Frequently asked questions include how each loan type affects credit risk, foreclosure processes, and borrower liability in case of default.

Important Terms

Deficiency Judgment

A deficiency judgment occurs when a lender seeks to recover the remaining loan balance after a nonrecourse or recourse foreclosure sale fails to cover the debt; in recourse loans, borrowers remain personally liable for the deficiency, while in nonrecourse loans, the lender's recovery is limited to the collateral, prohibiting deficiency judgments. Understanding the distinction between recourse and nonrecourse loans is crucial for assessing potential liabilities and foreclosure outcomes in real estate finance.

Asset Seizure

Asset seizure occurs when a lender enforces a security interest by taking possession of collateral used in a loan, common in recourse loans where the borrower is personally liable for any deficiency. Nonrecourse loans limit the lender's recovery to the collateral itself, making asset seizure the sole means of debt resolution without further claims against the borrower's other assets.

Personal Liability

Personal liability in recourse loans requires the borrower to repay the full debt, allowing lenders to pursue personal assets beyond the collateral if the loan defaults, whereas nonrecourse loans limit lender recovery strictly to the collateral without affecting the borrower's personal assets. Understanding the distinction is crucial for assessing financial risk exposure and potential personal asset forfeiture in loan agreements.

Debt Forgiveness

Debt forgiveness occurs when a lender agrees to release a borrower from the obligation to repay part or all of a loan, impacting the borrower's taxable income based on whether the debt is recourse or nonrecourse. In recourse debt forgiveness, the borrower remains personally liable, and forgiven amounts may be taxable income, whereas nonrecourse debt forgiveness involves relinquishing collateral only, typically resulting in different tax consequences and reduced borrower liability.

Loan Collateralization

Loan collateralization determines the security interest a lender holds in case of borrower default, impacting risk exposure and recovery options. In recourse loans, lenders can pursue the borrower's personal assets beyond the collateral, whereas nonrecourse loans limit recovery solely to the collateralized property.

Foreclosure Process

The foreclosure process varies significantly depending on whether a loan is recourse or nonrecourse; in a recourse loan, lenders can pursue the borrower's other assets beyond the collateral to recover the outstanding debt after foreclosure. Nonrecourse loans limit the lender's recovery to the collateral property only, preventing any deficiency judgment against the borrower after the foreclosure sale.

Anti-Deficiency Statute

The Anti-Deficiency Statute limits lenders' ability to pursue borrowers for any remaining balance after foreclosure in nonrecourse loans, ensuring liability is confined to the collateral property. In contrast, recourse loans allow lenders to seek a deficiency judgment against borrowers, holding them personally responsible beyond the collateral's value.

Carve-Out Guarantee

A Carve-Out Guarantee requires the borrower or a related party to repay specific debts if the primary loan becomes nonrecourse, thereby limiting lender risk in nonrecourse financing by preserving personal liability for defined carve-out events. This guarantee typically excludes full loan recourse, focusing liability on breaches such as fraud or environmental issues while maintaining the nonrecourse nature for other obligations.

First-Lien Mortgage

A first-lien mortgage provides the lender with priority claim over the property in case of default, often influencing whether a loan is recourse or nonrecourse. In recourse loans, borrowers remain personally liable beyond the collateral, while nonrecourse loans limit the lender's recovery strictly to the property securing the first-lien mortgage.

Bankruptcy Protection

Bankruptcy protection influences the distinction between recourse and nonrecourse debt by determining a lender's ability to pursue the borrower's other assets beyond the collateral in recourse loans, while nonrecourse loans limit the lender's claim strictly to the collateral, safeguarding the borrower from personal liability. Understanding these differences is crucial in bankruptcy cases to assess the risk exposure and potential recovery for lenders versus the financial relief and asset protection afforded to borrowers.

Recourse vs Nonrecourse Infographic

moneydif.com

moneydif.com