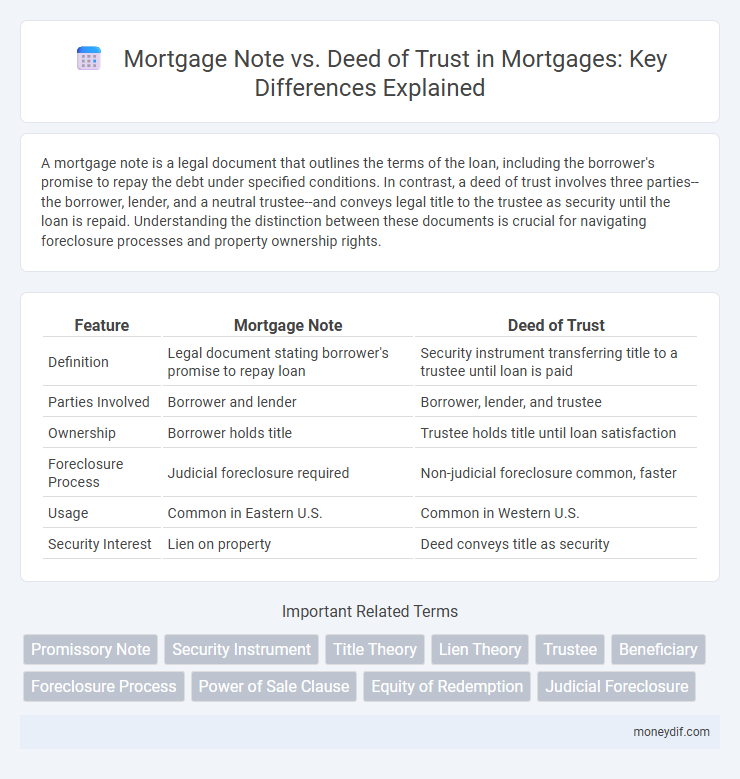

A mortgage note is a legal document that outlines the terms of the loan, including the borrower's promise to repay the debt under specified conditions. In contrast, a deed of trust involves three parties--the borrower, lender, and a neutral trustee--and conveys legal title to the trustee as security until the loan is repaid. Understanding the distinction between these documents is crucial for navigating foreclosure processes and property ownership rights.

Table of Comparison

| Feature | Mortgage Note | Deed of Trust |

|---|---|---|

| Definition | Legal document stating borrower's promise to repay loan | Security instrument transferring title to a trustee until loan is paid |

| Parties Involved | Borrower and lender | Borrower, lender, and trustee |

| Ownership | Borrower holds title | Trustee holds title until loan satisfaction |

| Foreclosure Process | Judicial foreclosure required | Non-judicial foreclosure common, faster |

| Usage | Common in Eastern U.S. | Common in Western U.S. |

| Security Interest | Lien on property | Deed conveys title as security |

Understanding Mortgage Notes

A Mortgage Note is a legally binding document that outlines the borrower's promise to repay the loan under specific terms, including interest rate, loan amount, and repayment schedule. This note serves as evidence of the debt and is critical for lenders to enforce loan repayment obligations. Unlike a Deed of Trust, which secures the loan by transferring property title to a third-party trustee, the Mortgage Note primarily details the financial agreement between borrower and lender.

What Is a Deed of Trust?

A Deed of Trust is a legal document used in real estate transactions to secure a loan on a property, involving three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee). It functions as a security instrument that transfers the legal title to the trustee, who holds it until the borrower repays the mortgage in full. Unlike a mortgage note, which outlines the loan terms and repayment schedule, the Deed of Trust specifically governs the conditions under which the property may be foreclosed if the borrower defaults.

Key Differences Between Mortgage Note and Deed of Trust

The Mortgage Note serves as the borrower's written promise to repay the loan, detailing the loan amount, interest rate, and payment schedule, while the Deed of Trust acts as the security instrument that transfers legal title of the property to a trustee until the loan is paid off. Unlike a Mortgage Note, which is primarily a contractual agreement, the Deed of Trust enables a non-judicial foreclosure process through the trustee if the borrower defaults. Key differences include the parties involved--Mortgage involves borrower and lender, whereas Deed of Trust includes borrower, lender, and trustee--and the foreclosure procedures governed by state laws.

Legal Implications of Mortgage Notes

A Mortgage Note is a legally binding contract outlining the loan terms and borrower's repayment obligations, serving as evidence of the debt. It directly affects the lender's ability to enforce payment and initiate foreclosure in case of default. Unlike a Deed of Trust, which involves a neutral trustee holding the property title until the loan is repaid, the Mortgage Note focuses solely on the financial agreement and borrower's legal responsibilities.

Role of Trustee in a Deed of Trust

The trustee in a deed of trust acts as a neutral third party holding the property title until the borrower fulfills the loan obligations. This role enables the trustee to initiate a non-judicial foreclosure if the borrower defaults, streamlining the foreclosure process compared to a mortgage note-based judicial foreclosure. The trustee's authority ensures lender protection while providing a clear mechanism for property transfer upon loan repayment or default.

Foreclosure Processes: Mortgage Note vs Deed of Trust

The foreclosure process differs significantly between a mortgage note and a deed of trust, where a mortgage note involves judicial foreclosure requiring court approval, leading to longer timelines and higher costs. In contrast, a deed of trust typically enables non-judicial foreclosure through a trustee's sale, which is faster and less expensive since it bypasses the court system. Understanding these differences is crucial for lenders and borrowers to navigate foreclosure procedures efficiently and anticipate associated legal implications.

States Using Mortgage Notes vs Deed of Trust

States like New York, Florida, and Illinois primarily use mortgage notes, where the borrower pledges the property as security and the lender holds the note as evidence of the loan. In contrast, states such as California, Texas, and Virginia commonly use deeds of trust, involving a third-party trustee who holds the title until the loan is paid off. The choice between mortgage notes and deeds of trust significantly affects the foreclosure process and legal remedies available to lenders in each state.

Borrower's Rights and Responsibilities

A Mortgage Note outlines the borrower's promise to repay the loan under specified terms, including interest rates and payment schedules, establishing legal obligations for timely payments. The Deed of Trust secures the loan by transferring legal title to a trustee, who holds it as security for the lender until repayment, impacting the borrower's rights regarding foreclosure processes. Borrowers have the right to receive notices about their loan status and foreclosure proceedings while bearing responsibilities to maintain the property and comply with loan covenants to avoid default.

Lender Protections: Mortgage Note vs Deed of Trust

The Mortgage Note outlines the borrower's promise to repay the loan, serving as the primary evidence of debt while providing the lender with the legal right to collect payments and enforce terms. The Deed of Trust involves a third-party trustee who holds the title until the loan is fully repaid, offering lenders a streamlined foreclosure process through non-judicial means, which can be faster and less costly than court proceedings. Both documents protect lenders, but the Deed of Trust generally enhances lender security by facilitating quicker collateral recovery in case of borrower default.

Choosing the Right Agreement for Your Home Loan

Choosing the right agreement for your home loan is crucial to protect your property rights and facilitate smooth foreclosure processes. A mortgage note outlines the borrower's promise to repay the loan with specified terms, while a deed of trust involves a third-party trustee holding the property title until the loan is fully paid. Understanding state laws and lender preferences helps determine whether a mortgage note or deed of trust best suits your financial and legal needs.

Important Terms

Promissory Note

A Promissory Note is a written promise to repay a specific loan amount under agreed terms, often used alongside a Mortgage Note that creates a lien on the property as security; in contrast, a Deed of Trust involves a third-party trustee holding the title until the loan is repaid, providing a different legal framework for securing real estate loans. Understanding the distinctions between these documents is critical in real estate transactions, as the Mortgage Note and Promissory Note focus on the borrower's repayment obligation, while the Deed of Trust governs property title and foreclosure processes.

Security Instrument

A Security Instrument, such as a Deed of Trust or a Mortgage Note, legally secures a loan by placing a lien on the property used as collateral. Unlike a Mortgage Note, which outlines the borrower's repayment terms, a Deed of Trust involves a third-party trustee who holds the title until the loan is fully repaid, facilitating a non-judicial foreclosure process in many states.

Title Theory

Title Theory treats the mortgage as a true transfer of title to the lender until the debt is fully paid, contrasting with the Deed of Trust where a neutral third party holds title as security. In jurisdictions following Title Theory, mortgage notes directly convey ownership rights to the lender, simplifying foreclosure processes compared to the non-judicial procedures involving deeds of trust.

Lien Theory

Lien Theory treats a mortgage as a lien on the property, allowing the borrower to retain both legal and equitable title, whereas a Deed of Trust involves a third-party trustee who holds legal title until the loan is paid. In states following Lien Theory, foreclosure proceeds through judicial processes due to the lender's lien status, contrasting with non-judicial foreclosure typical in Deed of Trust arrangements.

Trustee

A Trustee in a Deed of Trust holds legal title to the property until the mortgage debt is repaid, acting as a neutral third party to facilitate foreclosure if necessary. Unlike a Mortgage Note, which is the borrower's promise to repay the loan, the Deed of Trust involves three parties: borrower, lender, and trustee, creating a streamlined foreclosure process without court intervention.

Beneficiary

A beneficiary in a mortgage note represents the lender who holds the debt obligation, whereas in a deed of trust, the beneficiary is the party entitled to repayment secured by the property held in trust. The distinction affects enforcement rights, with beneficiaries in deeds of trust often able to initiate non-judicial foreclosure processes.

Foreclosure Process

The foreclosure process varies significantly between mortgage notes and deeds of trust, with mortgage notes typically requiring judicial foreclosure through a court, while deeds of trust often allow for non-judicial foreclosure using a power of sale clause. Understanding the specific legal framework and state laws governing each instrument is crucial for lenders and borrowers to navigate timelines, redemption rights, and sale procedures effectively.

Power of Sale Clause

The Power of Sale Clause grants the lender the authority to foreclose on a property without judicial intervention, commonly included in Deeds of Trust but not in Mortgage Notes, which typically require a court-supervised foreclosure process. This clause expedites the sale of the property upon default, providing a faster remedy compared to judicial foreclosure associated with Mortgage Notes.

Equity of Redemption

The equity of redemption represents the borrower's right to reclaim their property by paying off the full mortgage debt before foreclosure, applicable in mortgage notes where judicial foreclosure is common. In contrast, deeds of trust often limit or eliminate the equity of redemption due to non-judicial foreclosure processes, granting the trustee authority to sell the property without court involvement.

Judicial Foreclosure

Judicial foreclosure involves a court-supervised process to recover debt secured by real property when a borrower defaults, commonly used with mortgage notes, which create a lien on the property but require court approval for sale. In contrast, a deed of trust allows non-judicial foreclosure through a trustee's sale, bypassing court intervention, as it separates legal and equitable interests among borrower, lender, and trustee.

Mortgage Note vs Deed of Trust Infographic

moneydif.com

moneydif.com