Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including loan limits, credit score requirements, and debt-to-income ratios, making them easier to qualify for with competitive interest rates. Non-conforming loans fall outside these standards, often due to higher loan amounts or unique borrower circumstances, typically resulting in stricter qualification criteria and higher interest rates. Understanding the distinctions between conforming and non-conforming loans helps borrowers choose the best mortgage option based on their financial profile and loan needs.

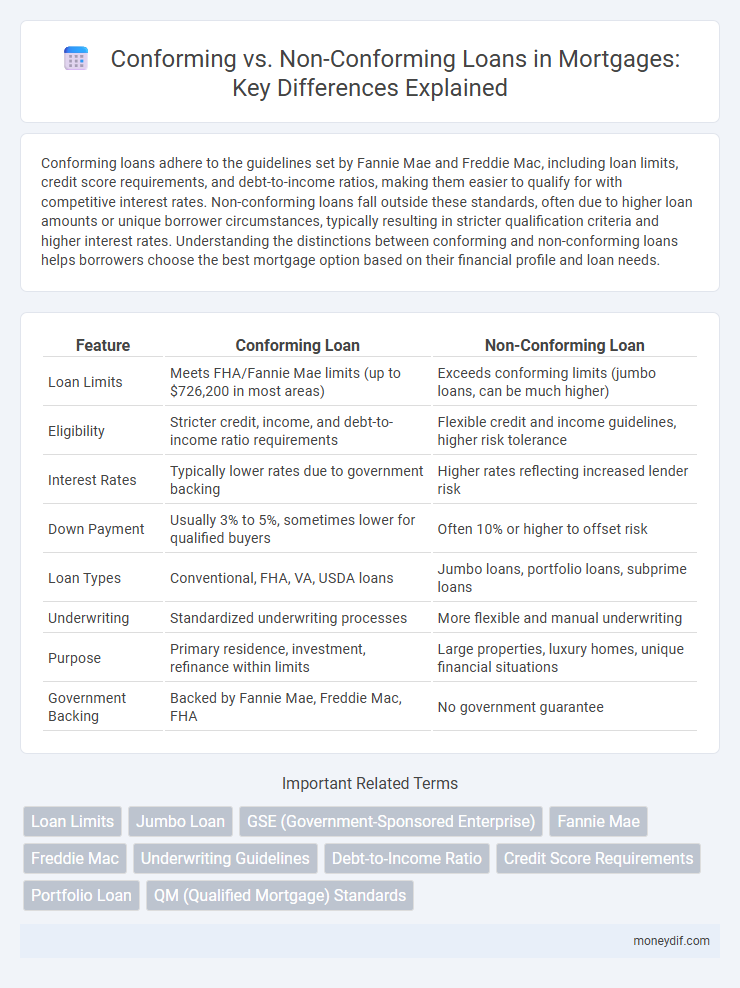

Table of Comparison

| Feature | Conforming Loan | Non-Conforming Loan |

|---|---|---|

| Loan Limits | Meets FHA/Fannie Mae limits (up to $726,200 in most areas) | Exceeds conforming limits (jumbo loans, can be much higher) |

| Eligibility | Stricter credit, income, and debt-to-income ratio requirements | Flexible credit and income guidelines, higher risk tolerance |

| Interest Rates | Typically lower rates due to government backing | Higher rates reflecting increased lender risk |

| Down Payment | Usually 3% to 5%, sometimes lower for qualified buyers | Often 10% or higher to offset risk |

| Loan Types | Conventional, FHA, VA, USDA loans | Jumbo loans, portfolio loans, subprime loans |

| Underwriting | Standardized underwriting processes | More flexible and manual underwriting |

| Purpose | Primary residence, investment, refinance within limits | Large properties, luxury homes, unique financial situations |

| Government Backing | Backed by Fannie Mae, Freddie Mac, FHA | No government guarantee |

Understanding Conforming and Non-Conforming Loans

Conforming loans adhere to guidelines set by Fannie Mae and Freddie Mac, including limits on loan size, borrower credit score, and debt-to-income ratios, ensuring easier approval and competitive interest rates. Non-conforming loans, also known as jumbo loans, exceed these thresholds or deviate from standard criteria, often carrying higher interest rates and requiring stricter qualification standards. Understanding the differences helps borrowers select the right mortgage product based on their financial profile and loan amount needs.

Key Differences Between Conforming and Non-Conforming Loans

Conforming loans adhere to the maximum loan limits and underwriting guidelines set by Fannie Mae and Freddie Mac, ensuring lower interest rates and easier approval for borrowers. Non-conforming loans, including jumbo loans, exceed these limits or have unique criteria, leading to higher interest rates and stricter qualification requirements. Understanding these distinctions is crucial for choosing the right mortgage product based on credit score, loan amount, and financial goals.

Loan Limits: Conforming vs. Non-Conforming

Conforming loans adhere to the maximum loan limits set by the Federal Housing Finance Agency (FHFA), which for 2024 typically is $726,200 in most areas, ensuring they qualify for purchase by Fannie Mae or Freddie Mac. Non-conforming loans exceed these limits, often referred to as jumbo loans, and do not meet underwriting guidelines established by these agencies. Loan limits directly impact interest rates and eligibility, with non-conforming loans generally requiring stricter credit qualifications and higher rates due to increased lender risk.

Credit Requirements for Each Loan Type

Conforming loans require borrowers to meet strict credit score criteria, typically a minimum credit score of 620, ensuring eligibility for standardized interest rates and terms set by Fannie Mae and Freddie Mac. Non-conforming loans, including jumbo loans, have more flexible credit requirements, accepting lower credit scores and higher debt-to-income ratios, but often come with higher interest rates due to increased lender risk. Borrowers with less-than-ideal credit profiles may opt for non-conforming loans despite potentially higher costs to secure financing.

Down Payment Differences

Conforming loans typically require a down payment of at least 3% to 5%, making them accessible for many homebuyers with moderate savings. Non-conforming loans, such as jumbo loans, often demand a higher down payment, usually ranging from 10% to 20%, due to increased lender risk. This significant difference in down payment requirements influences borrower eligibility and loan qualification criteria.

Interest Rates Comparison

Conforming loans typically offer lower interest rates compared to non-conforming loans due to their adherence to Fannie Mae and Freddie Mac guidelines, which reduces lender risk. Non-conforming loans, such as jumbo loans, carry higher interest rates reflecting increased borrower risk and less liquidity in the secondary market. Borrowers seeking better rates often qualify for conforming loans, while those with unique financial situations may accept higher rates on non-conforming loans.

Pros and Cons of Conforming Loans

Conforming loans offer lower interest rates and easier approval due to adherence to Fannie Mae and Freddie Mac guidelines, making them ideal for borrowers with good credit and stable income. However, their strict limits on loan size and borrower qualifications can exclude high-value properties and applicants with unique financial situations. Borrowers benefit from predictable payments and reduced risk but may find limited flexibility compared to non-conforming loan options.

Pros and Cons of Non-Conforming Loans

Non-conforming loans, including jumbo loans, offer higher borrowing limits and flexible underwriting standards, making them suitable for borrowers with unique financial situations or higher loan amounts. These loans often have higher interest rates and require larger down payments compared to conforming loans, increasing overall costs. Limited availability and less competitive terms can also pose challenges, requiring careful evaluation of the borrower's creditworthiness and financial goals.

Which Loan Type Is Right for You?

Choosing between a conforming loan and a non-conforming loan depends on your credit score, loan amount, and financial situation. Conforming loans follow Fannie Mae and Freddie Mac guidelines, offering lower interest rates and easier qualification for borrowers with strong credit and moderate loan amounts. Non-conforming loans, including jumbo loans, suit borrowers needing higher loan limits or with credit challenges but often come with higher interest rates and stricter qualification criteria.

Frequently Asked Questions About Conforming and Non-Conforming Loans

Conforming loans adhere to the maximum loan limits set by the Federal Housing Finance Agency (FHFA) and meet guidelines established by Fannie Mae and Freddie Mac, making them more accessible with lower interest rates. Non-conforming loans, including jumbo loans, exceed these limits or have unique borrower qualifications, often resulting in higher rates and stricter terms. Borrowers frequently ask about qualification criteria, interest rate differences, and whether down payment requirements vary between conforming and non-conforming loans.

Important Terms

Loan Limits

Conforming loans have a maximum loan limit set by the Federal Housing Finance Agency (FHFA), typically $726,200 in most areas for 2024, while non-conforming loans exceed these limits and include jumbo loans with higher amounts.

Jumbo Loan

A Jumbo Loan exceeds conforming loan limits set by the Federal Housing Finance Agency and typically requires stricter credit criteria compared to standard conforming loans.

GSE (Government-Sponsored Enterprise)

GSEs like Fannie Mae and Freddie Mac primarily purchase conforming loans that meet specific size and underwriting guidelines, whereas non-conforming loans fall outside these criteria and are typically not backed by GSEs.

Fannie Mae

Fannie Mae primarily purchases conforming loans that meet specific criteria, including loan size limits, borrower credit requirements, and documentation standards, ensuring liquidity in the housing market. Non-conforming loans, which exceed these limits or do not meet guidelines, are excluded from Fannie Mae's portfolio and often carry higher interest rates due to increased risk.

Freddie Mac

Freddie Mac primarily purchases and securitizes conforming loans that meet specific size, credit, and documentation standards set by the Federal Housing Finance Agency (FHFA). Non-conforming loans, which exceed these limits or have unique underwriting criteria, fall outside Freddie Mac's purchase guidelines and are typically serviced by private lenders or specialized investors.

Underwriting Guidelines

Underwriting guidelines for conforming loans adhere to Fannie Mae and Freddie Mac standards, including maximum loan amounts and credit requirements, while non-conforming loan guidelines allow for higher loan amounts and more flexible credit criteria.

Debt-to-Income Ratio

The Debt-to-Income Ratio for conforming loans typically must not exceed 43%, while non-conforming loans allow higher ratios depending on lender flexibility and borrower creditworthiness.

Credit Score Requirements

Conforming loans typically require a minimum credit score of 620, while non-conforming loans, including jumbo loans, often demand higher credit scores above 700 to qualify.

Portfolio Loan

Portfolio loans are privately held by lenders and offer flexibility beyond strict conforming loan limits, unlike non-conforming loans which exceed Fannie Mae or Freddie Mac guidelines and often include jumbo, subprime, or government-insured loans.

QM (Qualified Mortgage) Standards

Qualified Mortgage (QM) standards ensure borrower ability to repay by setting strict underwriting criteria for conforming loans, while non-conforming loans typically do not meet these criteria and often carry higher risk and interest rates.

Conforming Loan vs Non-Conforming Loan Infographic

moneydif.com

moneydif.com