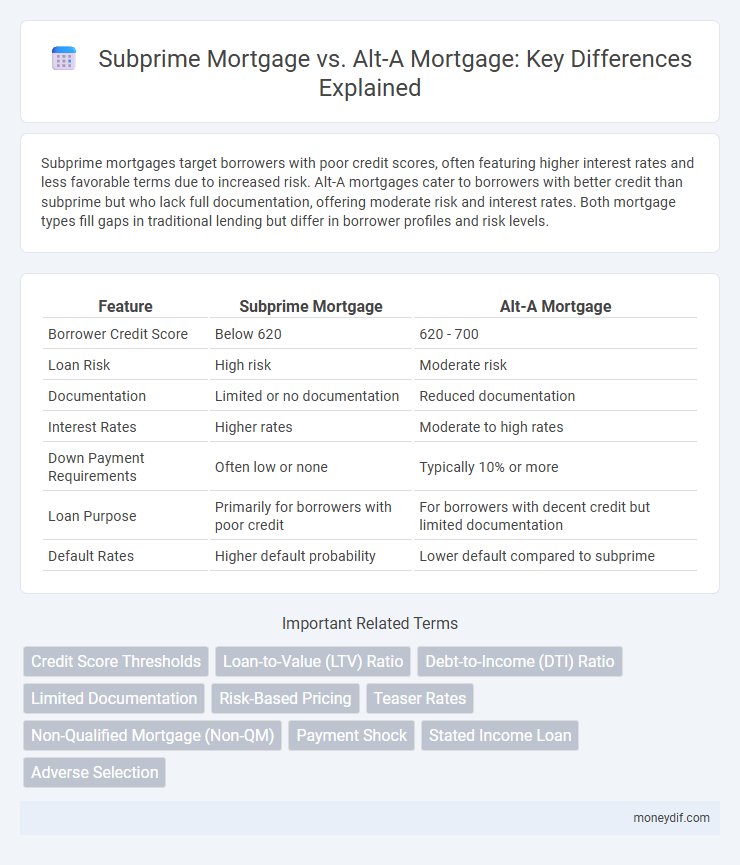

Subprime mortgages target borrowers with poor credit scores, often featuring higher interest rates and less favorable terms due to increased risk. Alt-A mortgages cater to borrowers with better credit than subprime but who lack full documentation, offering moderate risk and interest rates. Both mortgage types fill gaps in traditional lending but differ in borrower profiles and risk levels.

Table of Comparison

| Feature | Subprime Mortgage | Alt-A Mortgage |

|---|---|---|

| Borrower Credit Score | Below 620 | 620 - 700 |

| Loan Risk | High risk | Moderate risk |

| Documentation | Limited or no documentation | Reduced documentation |

| Interest Rates | Higher rates | Moderate to high rates |

| Down Payment Requirements | Often low or none | Typically 10% or more |

| Loan Purpose | Primarily for borrowers with poor credit | For borrowers with decent credit but limited documentation |

| Default Rates | Higher default probability | Lower default compared to subprime |

Introduction to Subprime and Alt-A Mortgages

Subprime mortgages cater to borrowers with poor credit scores, carrying higher interest rates due to increased default risks. Alt-A mortgages target borrowers who typically have good credit but lack complete documentation or present higher loan-to-value ratios. Both loan types sit between prime mortgages and high-risk loans, offering alternative financing options with varied underwriting standards.

Defining Subprime Mortgages

Subprime mortgages are home loans offered to borrowers with poor credit scores, typically below 620, who present a higher risk of default. These loans usually come with higher interest rates and less favorable terms compared to prime or Alt-A mortgages to compensate for the increased risk. Subprime borrowers often have limited credit history, recent delinquencies, or higher debt-to-income ratios, distinguishing these loans from the relatively safer Alt-A category.

Understanding Alt-A Mortgages

Alt-A mortgages occupy a risk category between prime and subprime loans, typically issued to borrowers with good credit but limited documentation or higher debt-to-income ratios. These loans often feature non-traditional documentation requirements, such as stated income or reduced verification, appealing to borrowers who do not meet conventional underwriting standards. Understanding Alt-A mortgages is crucial for assessing risk, as they carry moderate default probabilities compared to subprime loans but offer higher returns for lenders.

Key Differences Between Subprime and Alt-A Loans

Subprime mortgages target borrowers with low credit scores below 640, carrying higher interest rates and increased risk of default, while Alt-A loans serve borrowers with better credit but limited documentation, such as no income verification. Subprime loans typically have adjustable rates and higher fees compared to Alt-A loans, which often feature more flexible terms with moderate risk levels. Loan-to-value ratios in Alt-A loans tend to be more conservative, whereas subprime mortgages allow higher LTV ratios, amplifying potential financial exposure.

Borrower Qualifications and Credit Requirements

Subprime mortgages target borrowers with low credit scores typically below 620 and often feature higher interest rates due to increased risk. Alt-A mortgages serve borrowers with better credit profiles, usually above 620, but who lack full documentation or have higher debt-to-income ratios. Both loan types offer alternatives to prime mortgages but differ significantly in credit requirements and borrower qualifications.

Risk Factors: Subprime vs Alt-A

Subprime mortgages present higher default risk due to borrowers' low credit scores and unstable income, often paired with higher interest rates and weaker loan terms. Alt-A mortgages, while generally involving borrowers with better credit than subprime, carry risk through limited documentation and higher loan-to-value ratios. Both loan types amplify risk factors compared to prime mortgages, impacting default rates and overall portfolio stability.

Interest Rates and Loan Terms Comparison

Subprime mortgages typically feature higher interest rates due to increased borrower risk, often exceeding those of Alt-A loans by 2-4 percentage points. Alt-A mortgages, positioned between prime and subprime, offer more favorable loan terms such as lower interest rates and better loan-to-value ratios, appealing to borrowers with moderate credit profiles. Loan terms for subprime mortgages generally include shorter durations and higher fees to mitigate lender risk, while Alt-A loans provide more flexible terms including longer amortization periods and lower upfront costs.

Impact on the Housing Market

Subprime mortgages, characterized by high-risk borrowers with low credit scores, significantly increased default rates during economic downturns, leading to widespread foreclosures and contributing to the 2008 housing market crash. Alt-A mortgages, with borrowers exhibiting moderate credit risks and limited documentation, fueled housing price inflation by expanding loan accessibility without full verification. The proliferation of both loan types intensified market volatility, undermining financial stability and triggering regulatory reforms in mortgage lending practices.

Pros and Cons of Subprime and Alt-A Mortgages

Subprime mortgages offer higher approval chances for borrowers with poor credit but come with significantly higher interest rates and increased risk of default. Alt-A mortgages cater to borrowers with better credit profiles than subprime but who do not meet conventional loan documentation standards, providing moderate rates but often requiring larger down payments. Both loan types fill gaps left by traditional mortgages but carry varying degrees of risk and cost based on credit quality and documentation.

Choosing the Right Mortgage Option

Subprime mortgages target borrowers with low credit scores, higher default risk, and often come with higher interest rates to compensate lenders. Alt-A mortgages cater to borrowers with better credit than subprime but who may lack full documentation or have other moderate risk factors, typically offering more competitive rates than subprime loans. When choosing the right mortgage option, evaluating credit profile, income documentation, and long-term financial goals is essential to balance affordability and risk exposure.

Important Terms

Credit Score Thresholds

Credit score thresholds typically range from below 620 for subprime mortgages to 620-680 for Alt-A mortgages, reflecting varying borrower risk levels and loan approval criteria.

Loan-to-Value (LTV) Ratio

Loan-to-Value (LTV) ratios for Subprime Mortgages typically exceed 80%, indicating higher risk due to lower borrower creditworthiness, whereas Alt-A Mortgages generally maintain LTV ratios between 70% and 80%, reflecting moderate risk with slightly better borrower profiles.

Debt-to-Income (DTI) Ratio

The Debt-to-Income (DTI) ratio plays a critical role in differentiating Subprime mortgages, which typically have higher DTI thresholds due to increased borrower risk, from Alt-A mortgages that often feature moderate DTI requirements reflecting better credit profiles but limited documentation.

Limited Documentation

Limited documentation loans in Alt-A mortgages offer more flexible income verification compared to stricter documentation requirements typical of subprime mortgages, impacting borrower eligibility and risk assessment.

Risk-Based Pricing

Risk-based pricing assigns higher interest rates to subprime mortgages due to greater default risk compared to Alt-A mortgages, which fall between prime and subprime in credit quality.

Teaser Rates

Teaser rates, commonly offered in subprime mortgages, attract borrowers with initially low monthly payments that later adjust to higher rates, increasing default risk among high credit-risk individuals. In contrast, Alt-A mortgages feature teaser rates tied to moderate credit profiles, often involving less documentation, balancing higher initial affordability with slightly improved risk compared to subprime loans.

Non-Qualified Mortgage (Non-QM)

Non-Qualified Mortgages (Non-QM) often target borrowers who do not meet the strict income verification or credit standards of prime loans, positioning them between higher-risk Subprime Mortgages, characterized by lower credit scores and higher default rates, and Alt-A Mortgages, which involve borrowers with better credit but less documentation or other nontraditional factors.

Payment Shock

Payment shock often occurs more frequently in Alt-A mortgage borrowers due to initial low "teaser" rates resetting to higher payments compared to the riskier but more stable payment structure of subprime mortgages.

Stated Income Loan

Stated Income Loans often serve as a bridge between Subprime Mortgages, which target high-risk borrowers with poor credit, and Alt-A Mortgages, which cater to borrowers with better credit but reduced documentation.

Adverse Selection

Adverse selection in mortgage markets occurs when lenders unknowingly issue higher-risk subprime loans to borrowers with poor credit while Alt-A mortgages target borrowers with moderate credit risk, resulting in asymmetric information and increased default probabilities.

Subprime Mortgage vs Alt-A Mortgage Infographic

moneydif.com

moneydif.com