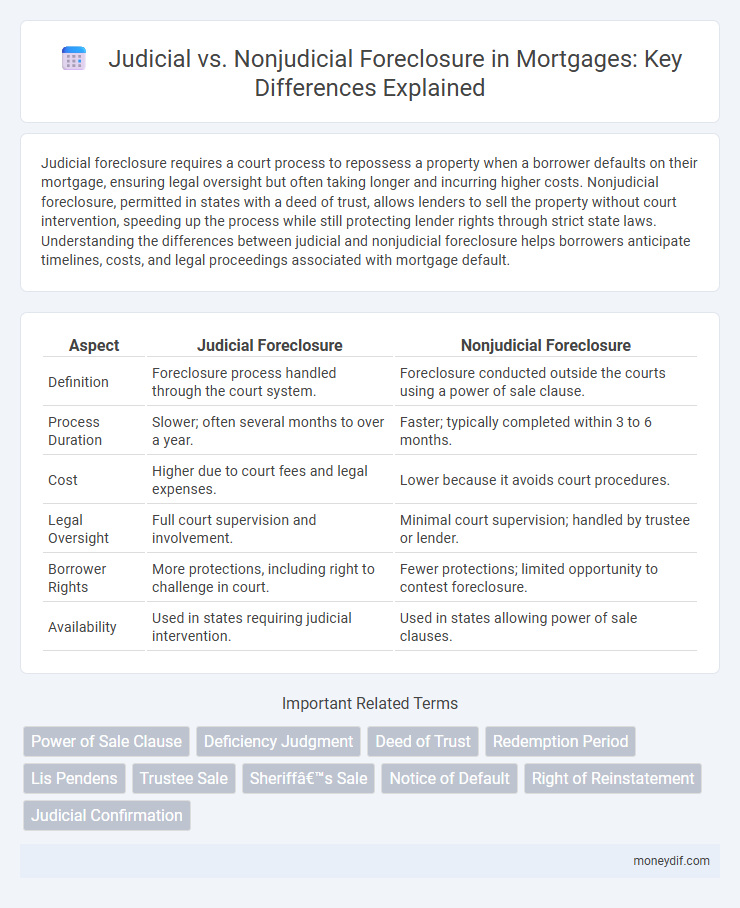

Judicial foreclosure requires a court process to repossess a property when a borrower defaults on their mortgage, ensuring legal oversight but often taking longer and incurring higher costs. Nonjudicial foreclosure, permitted in states with a deed of trust, allows lenders to sell the property without court intervention, speeding up the process while still protecting lender rights through strict state laws. Understanding the differences between judicial and nonjudicial foreclosure helps borrowers anticipate timelines, costs, and legal proceedings associated with mortgage default.

Table of Comparison

| Aspect | Judicial Foreclosure | Nonjudicial Foreclosure |

|---|---|---|

| Definition | Foreclosure process handled through the court system. | Foreclosure conducted outside the courts using a power of sale clause. |

| Process Duration | Slower; often several months to over a year. | Faster; typically completed within 3 to 6 months. |

| Cost | Higher due to court fees and legal expenses. | Lower because it avoids court procedures. |

| Legal Oversight | Full court supervision and involvement. | Minimal court supervision; handled by trustee or lender. |

| Borrower Rights | More protections, including right to challenge in court. | Fewer protections; limited opportunity to contest foreclosure. |

| Availability | Used in states requiring judicial intervention. | Used in states allowing power of sale clauses. |

Understanding Judicial Foreclosure

Judicial foreclosure involves a court-supervised process where the lender files a lawsuit to recover the mortgage debt, making it a more formal and often lengthier procedure compared to nonjudicial foreclosure. This method provides homeowners with legal protections, including the opportunity to contest the foreclosure in court and possibly negotiate repayment terms. Judicial foreclosure laws vary by state, impacting timelines, required notices, and the rights of both lenders and borrowers throughout the process.

What Is Nonjudicial Foreclosure?

Nonjudicial foreclosure is a process used by lenders to repossess property without court intervention by enforcing a power of sale clause contained in the deed of trust or mortgage. This streamlined method typically results in faster foreclosure proceedings compared to judicial foreclosure, reducing legal costs and time. Nonjudicial foreclosure is commonly used in states like California, Texas, and Virginia, where state laws specifically authorize this procedure.

Key Differences Between Judicial and Nonjudicial Foreclosure

Judicial foreclosure requires a court process where the lender files a lawsuit to obtain a court order for property sale, making it typically more time-consuming and costly. Nonjudicial foreclosure bypasses the court system, relying on a power of sale clause in the mortgage or deed of trust, resulting in a faster and less expensive procedure. Key differences include the involvement of the judiciary, timelines, costs, and potential homeowner protections during the foreclosure process.

Legal Process of Judicial Foreclosure

The legal process of judicial foreclosure involves filing a lawsuit in court by the lender to obtain a court order to sell the property and recover the outstanding loan balance. This process requires a formal court procedure, including notifying the borrower, presenting evidence of default, and obtaining a judgment before the property can be auctioned. Judicial foreclosure offers the borrower an opportunity to respond in court, ensuring due process and often resulting in longer timelines compared to nonjudicial foreclosure.

Steps in Nonjudicial Foreclosure

Nonjudicial foreclosure involves a streamlined process where the lender enforces the deed of trust without court intervention, primarily used in states allowing power of sale clauses. The steps include issuing a notice of default to the borrower, providing a notice of sale publicized in local newspapers, and holding a foreclosure auction to sell the property to the highest bidder. This process typically concludes faster than judicial foreclosure, reducing costs and accelerating the lender's recovery of the loan balance.

Timeframe: Judicial vs Nonjudicial Foreclosure

Judicial foreclosure typically takes between 6 months to over a year due to court proceedings, while nonjudicial foreclosure can be completed in as little as 30 to 90 days, depending on state laws. The timeframe for judicial foreclosure varies by jurisdiction and court backlog, often extending the process significantly compared to nonjudicial foreclosure. Nonjudicial foreclosure follows a more streamlined path using a power of sale clause in the mortgage, resulting in faster resolution and property transfer.

Borrower Rights in Each Foreclosure Process

Judicial foreclosure requires lender to file a lawsuit and obtain court approval, providing borrowers the opportunity to present defenses and request reinstatement, thereby preserving borrower rights through judicial oversight. Nonjudicial foreclosure, governed by state statutes and typically faster, allows lenders to foreclose without court involvement, limiting borrower rights and reducing chances for legal defense or delay. Understanding state-specific laws is crucial for borrowers to protect their rights in either foreclosure process.

State Laws Governing Foreclosure Methods

State laws governing foreclosure methods distinctly categorize judicial foreclosure, which requires court approval and is mandated in states like Florida and New York, from nonjudicial foreclosure, allowed in states such as California and Texas where no court involvement is necessary. Judicial foreclosure processes often involve longer timelines and higher costs due to court oversight, while nonjudicial foreclosure relies on a trustee's sale following specific notice and procedural requirements set by statute. Understanding the state-specific statutes is essential for lenders and borrowers to navigate foreclosure effectively and ensure compliance with applicable legal frameworks.

Pros and Cons of Judicial Foreclosure

Judicial foreclosure involves court supervision, ensuring due process and providing an opportunity for the borrower to challenge the foreclosure, which can prevent wrongful loss of property. This process often takes longer and involves higher legal fees compared to nonjudicial foreclosure, increasing costs for lenders and extending the timeline. Judicial foreclosure creates a public record that may impact the borrower's credit but offers stronger legal protection and potential for negotiation during the proceedings.

Pros and Cons of Nonjudicial Foreclosure

Nonjudicial foreclosure offers a faster and less expensive process compared to judicial foreclosure, as it bypasses court involvement by relying on a power of sale clause in the mortgage. This method reduces the lender's costs and time to recover the property but may limit the borrower's opportunities to contest the foreclosure or negotiate alternatives in court. However, nonjudicial foreclosure risks potential legal challenges if procedures are not strictly followed, potentially exposing lenders to liability.

Important Terms

Power of Sale Clause

The Power of Sale Clause enables nonjudicial foreclosure by allowing a lender to sell the property without court involvement, expediting the foreclosure process. Judicial foreclosure requires court approval and is typically used when the Power of Sale Clause is absent or state law mandates court supervision.

Deficiency Judgment

Deficiency judgment refers to the lender's legal claim to recover the remaining loan balance if a foreclosure sale does not cover the entire mortgage debt, common in judicial foreclosure where court approval is required. In nonjudicial foreclosure, deficiency judgments are less frequently pursued due to streamlined processes and state-specific regulations limiting lender recourse after the sale.

Deed of Trust

A Deed of Trust involves a property transfer to a neutral trustee holding it as security for a loan, enabling nonjudicial foreclosure through the trustee's power of sale without court intervention, which contrasts with judicial foreclosure requiring a court process to obtain a sale order. Nonjudicial foreclosure is typically faster and less costly, while judicial foreclosure offers more borrower protections and may be necessary when issues of loan validity arise.

Redemption Period

The redemption period after a judicial foreclosure varies by jurisdiction but typically allows the borrower to reclaim the property by paying the debt within a statutory timeframe, whereas nonjudicial foreclosures generally do not offer a redemption period, leading to faster lender recovery of the property. Judicial foreclosures involve court supervision that can extend the redemption timeline, while nonjudicial foreclosures rely on a power of sale clause in the deed of trust, resulting in quicker resolution without court intervention.

Lis Pendens

Lis Pendens is a legal notice filed to indicate a pending lawsuit affecting title to real property, commonly associated with judicial foreclosure where the court process ensures formal notice to all parties. In contrast, nonjudicial foreclosure does not typically involve a Lis Pendens because it proceeds outside of court under the terms of a deed of trust or mortgage.

Trustee Sale

Trustee sale occurs in nonjudicial foreclosure where the trustee sells the property without court involvement, based on power of sale clauses in the deed of trust. Judicial foreclosure requires a court process to approve the sale, often resulting in longer timelines and higher legal costs compared to nonjudicial trustee sales.

Sheriff’s Sale

Sheriff's Sale is a public auction conducted by the county sheriff to sell foreclosed properties, typically following judicial foreclosure where court approval is required to proceed. In contrast, nonjudicial foreclosure bypasses the court system, allowing the lender to directly enforce the deed of trust or mortgage, but may also culminate in a sheriff's sale if specified by state law.

Notice of Default

Notice of Default initiates the foreclosure process by formally informing the borrower of their loan delinquency, which is mandatory in both judicial and nonjudicial foreclosure proceedings. Judicial foreclosure requires court approval and a public Notice of Default filing, whereas nonjudicial foreclosure follows a streamlined process governed by a deed of trust and state statutes, often avoiding court involvement.

Right of Reinstatement

The right of reinstatement allows a borrower to cure a default and avoid foreclosure by paying the overdue amount before the foreclosure sale, commonly applicable in judicial foreclosure processes where court supervision is involved. Nonjudicial foreclosure typically limits or eliminates the borrower's right of reinstatement, accelerating the foreclosure timeline through a trustee's sale without court intervention.

Judicial Confirmation

Judicial confirmation is a court-approved process that validates and finalizes the foreclosure sale, ensuring legal compliance primarily in judicial foreclosure cases, where the lender must file a lawsuit to repossess the property. Nonjudicial foreclosure bypasses court involvement, relying instead on a power of sale clause in the deed of trust, resulting in a faster but less court-supervised process that typically does not require judicial confirmation.

Judicial Foreclosure vs Nonjudicial Foreclosure Infographic

moneydif.com

moneydif.com