Fixed-rate mortgage vs adjustable-rate mortgage: fixed-rate mortgages maintain a constant interest rate and monthly payment over the loan term, providing stability and predictability, while adjustable-rate mortgages feature interest rates that fluctuate based on market conditions, potentially lowering initial payments but increasing future uncertainty. Principal vs interest: principal refers to the original loan amount borrowed, whereas interest is the cost of borrowing that principal, calculated as a percentage of the outstanding balance. Loan-to-value ratio (LTV) vs debt-to-income ratio (DTI): LTV measures the loan amount against the appraised property value, indicating risk tolerance, while DTI compares monthly debt payments to gross income, guiding lenders in assessing borrower repayment capacity.

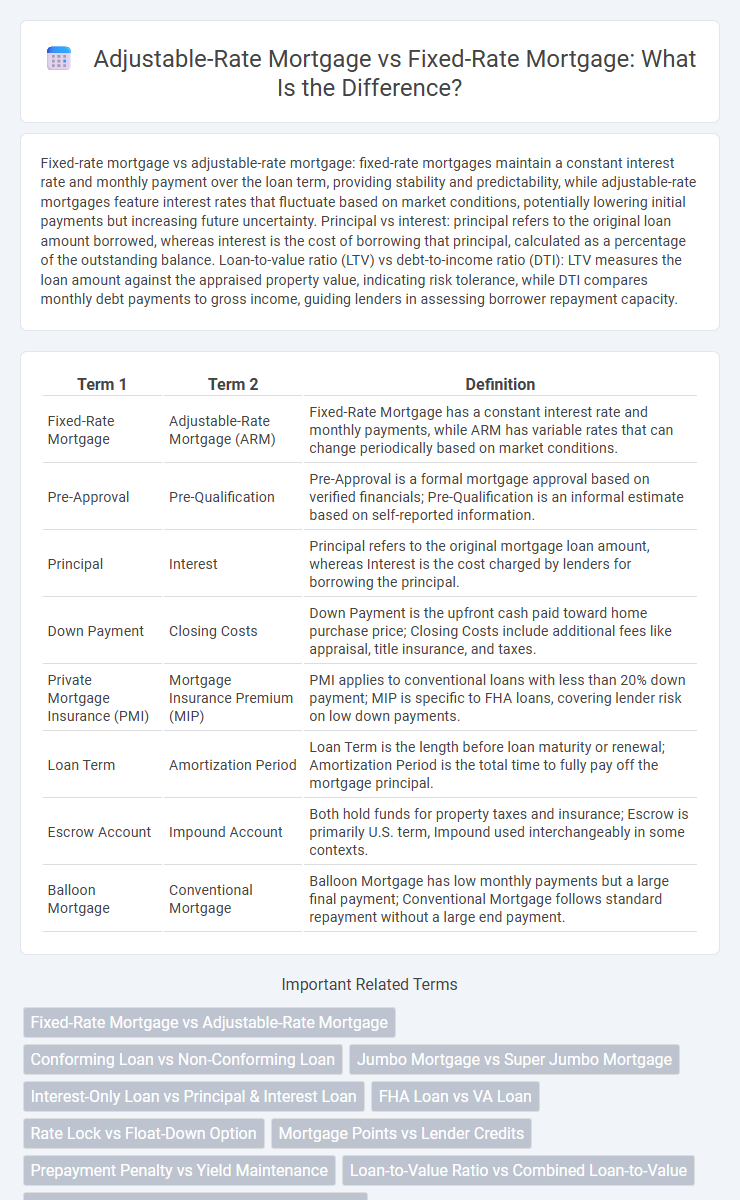

Table of Comparison

| Term 1 | Term 2 | Definition |

|---|---|---|

| Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) | Fixed-Rate Mortgage has a constant interest rate and monthly payments, while ARM has variable rates that can change periodically based on market conditions. |

| Pre-Approval | Pre-Qualification | Pre-Approval is a formal mortgage approval based on verified financials; Pre-Qualification is an informal estimate based on self-reported information. |

| Principal | Interest | Principal refers to the original mortgage loan amount, whereas Interest is the cost charged by lenders for borrowing the principal. |

| Down Payment | Closing Costs | Down Payment is the upfront cash paid toward home purchase price; Closing Costs include additional fees like appraisal, title insurance, and taxes. |

| Private Mortgage Insurance (PMI) | Mortgage Insurance Premium (MIP) | PMI applies to conventional loans with less than 20% down payment; MIP is specific to FHA loans, covering lender risk on low down payments. |

| Loan Term | Amortization Period | Loan Term is the length before loan maturity or renewal; Amortization Period is the total time to fully pay off the mortgage principal. |

| Escrow Account | Impound Account | Both hold funds for property taxes and insurance; Escrow is primarily U.S. term, Impound used interchangeably in some contexts. |

| Balloon Mortgage | Conventional Mortgage | Balloon Mortgage has low monthly payments but a large final payment; Conventional Mortgage follows standard repayment without a large end payment. |

Fixed-Rate Mortgage vs Adjustable-Rate Mortgage

Fixed-rate mortgages offer borrowers a consistent interest rate and stable monthly payments throughout the loan term, making budgeting predictable and reducing financial uncertainty. Adjustable-rate mortgages (ARMs) start with lower initial rates that can fluctuate periodically based on market indexes, potentially lowering initial costs but increasing long-term risk. Choosing between fixed-rate and adjustable-rate mortgages depends on factors like market conditions, loan duration, and borrower risk tolerance.

Conforming Loan vs Non-Conforming Loan

Conforming loans adhere to the maximum loan limits set by Fannie Mae and Freddie Mac, ensuring eligibility for government-backed purchase and lower interest rates. Non-conforming loans, also called jumbo loans, exceed these limits and often require higher credit scores, larger down payments, and come with higher interest rates due to increased risk. Understanding the distinction between conforming and non-conforming loans is crucial for borrowers aiming to optimize financing options and secure favorable mortgage terms.

FHA Loan vs Conventional Loan

FHA loans require lower credit scores and down payments, making them ideal for first-time homebuyers or those with limited savings, while conventional loans typically demand higher creditworthiness and larger down payments but offer more flexibility and potentially better rates. FHA loans are backed by the Federal Housing Administration, providing lenders with insurance against default, whereas conventional loans are not government-insured and rely on borrower qualification alone. Mortgage insurance premiums (MIP) apply to FHA loans regardless of down payment size, in contrast to private mortgage insurance (PMI) for conventional loans, which can be canceled once sufficient equity is reached.

Interest-Only Mortgage vs Amortizing Mortgage

Interest-only mortgages require borrowers to pay only the interest for a set period, resulting in lower initial monthly payments but no equity buildup during that time. Amortizing mortgages combine principal and interest payments, gradually reducing the loan balance and building equity with each payment over the loan term. Choosing between interest-only and amortizing mortgages impacts monthly cash flow, long-term financial stability, and total interest paid.

Jumbo Loan vs Super Jumbo Loan

Jumbo loans refer to mortgage loans that exceed conforming loan limits set by Fannie Mae and Freddie Mac, typically ranging from $647,200 to around $1 million, depending on the location. Super jumbo loans exceed the jumbo loan thresholds, often starting at $1.5 million and going significantly higher, catering to high-net-worth borrowers seeking luxury properties. Interest rates on super jumbo loans are usually higher due to increased lender risk, and they often require more stringent credit qualifications and larger down payments.

Pre-Approval vs Pre-Qualification

Pre-Approval involves a thorough evaluation of a borrower's financial documents by a lender, providing a conditional commitment for a mortgage amount, whereas Pre-Qualification is an informal assessment based on self-reported financial information to estimate borrowing capacity. Lenders use Pre-Approval to verify credit scores, income, assets, and debts, offering a stronger indication of loan eligibility compared to the preliminary Pre-Qualification process. Homebuyers often rely on Pre-Approval for competitive advantages in real estate transactions since it signals serious purchasing intent to sellers.

Private Mortgage Insurance (PMI) vs Mortgage Insurance Premium (MIP)

Private Mortgage Insurance (PMI) protects conventional loans by insuring lenders against borrower default when down payments are below 20%. Mortgage Insurance Premium (MIP) applies exclusively to FHA loans, requiring both upfront and monthly payments regardless of down payment size. PMI can be canceled once the loan-to-value ratio reaches 78%, while MIP often remains for the life of the loan unless refinanced.

Balloon Mortgage vs Fully Amortizing Loan

A balloon mortgage features low initial payments with a large lump sum due at the end of the loan term, typically five to seven years, contrasting with a fully amortizing loan that spreads payments evenly over the entire term, usually 15 to 30 years. Balloon mortgages carry higher refinancing risk due to the large final payment, while fully amortizing loans provide predictable monthly payments and eventual full repayment without a remaining balance. Borrowers seeking short-term financing or lower initial payments often favor balloon mortgages, whereas those aiming for long-term stability prefer fully amortizing loans.

Rate Lock vs Float-Down Option

Rate lock guarantees a fixed interest rate for a specified period, protecting borrowers from rate increases during the loan approval process. Float-down option allows borrowers to benefit from lower interest rates if market rates drop before closing, offering flexibility but typically comes with additional fees. Understanding these terms helps borrowers choose between rate stability and potential cost savings based on market conditions.

Principal vs Interest

Principal represents the original loan amount borrowed, excluding interest charges, while Interest is the cost paid to the lender for borrowing the principal. Monthly mortgage payments typically include both principal and interest portions, with the interest portion calculated based on the outstanding principal balance and the interest rate. Understanding the balance between principal reduction and interest costs is crucial for effective mortgage payoff strategies and long-term financial planning.

Important Terms

Fixed-Rate Mortgage vs Adjustable-Rate Mortgage

Fixed-rate mortgages offer borrowers stable monthly payments with interest rates locked for the loan's duration, providing predictability and protection against market fluctuations. Adjustable-rate mortgages feature interest rates that change periodically based on an index, potentially lowering initial payments but introducing uncertainty and risk of rate increases over time.

Conforming Loan vs Non-Conforming Loan

Conforming loans adhere to Fannie Mae and Freddie Mac guidelines, including loan limits, credit requirements, and documentation standards, ensuring lower interest rates and easier qualification. Non-conforming loans, such as jumbo loans or those for borrowers with poor credit, do not meet these standards and often come with higher interest rates and stricter underwriting criteria.

Jumbo Mortgage vs Super Jumbo Mortgage

Jumbo Mortgage vs Super Jumbo Mortgage: Jumbo mortgages exceed conforming loan limits, typically ranging from $647,200 to $1 million, while super jumbo mortgages surpass $1 million, often requiring stricter credit and income qualifications. Both loan types target high-value homebuyers but differ in loan size thresholds, interest rates, and underwriting criteria set by lenders.

Interest-Only Loan vs Principal & Interest Loan

Interest-only loans require payments solely on the loan principal's interest, reducing monthly outgo but not reducing the principal balance, while principal and interest loans involve repayments towards both the loan's principal and interest, gradually decreasing the outstanding loan amount. Borrowers opting for interest-only loans often anticipate increased cash flow short-term, whereas principal and interest loans build equity over time and typically result in higher monthly payments.

FHA Loan vs VA Loan

FHA Loan vs VA Loan: FHA loans require a minimum credit score of 580 and a 3.5% down payment, ideal for borrowers with lower credit or limited funds, while VA loans offer 0% down payment and no private mortgage insurance, exclusively for eligible veterans and active-duty service members. FHA loans are backed by the Federal Housing Administration, whereas VA loans are guaranteed by the Department of Veterans Affairs, providing different qualification criteria and benefits tailored to distinct borrower profiles.

Rate Lock vs Float-Down Option

Rate Lock secures a fixed interest rate for a mortgage loan during a specified period, protecting borrowers from rising rates, while the Float-Down Option allows borrowers to benefit from lower rates if market rates decrease before closing. Choosing between Rate Lock and Float-Down Option depends on market volatility and borrower risk tolerance for interest rate fluctuations.

Mortgage Points vs Lender Credits

Mortgage points reduce interest rates by prepaying interest upfront, lowering monthly payments over the loan term, whereas lender credits offer upfront cash from the lender in exchange for a higher interest rate, helping cover closing costs. Borrowers using lender credits can minimize initial out-of-pocket expenses, while those purchasing mortgage points save more money long-term through decreased interest costs.

Prepayment Penalty vs Yield Maintenance

Prepayment Penalty vs Yield Maintenance: prepayment penalties charge borrowers a fixed fee for early loan payoff, while yield maintenance compensates lenders for interest lost by requiring borrowers to pay the present value of remaining loan interest, often calculated using Treasury rates. Yield maintenance clauses are common in commercial real estate loans to protect lender returns, whereas prepayment penalties may vary in structure and are more prevalent in residential or smaller-scale loans.

Loan-to-Value Ratio vs Combined Loan-to-Value

Loan-to-Value Ratio (LTV) measures the loan amount against the appraised property value, influencing mortgage eligibility and interest rates. Combined Loan-to-Value (CLTV) accounts for all loans secured by the property, including second mortgages or home equity lines of credit, providing a comprehensive risk assessment for lenders.

Underwriting Approval vs Conditional Approval

Underwriting Approval confirms that all borrower qualifications and property specifics meet lender criteria, enabling loan processing to proceed toward closing. Conditional Approval indicates preliminary acceptance contingent upon the borrower satisfying specified conditions such as updated financial documents or property appraisals before final approval.

Sure! Here is a list of niche mortgage terms in a "term1 vs term2" format: Infographic

moneydif.com

moneydif.com