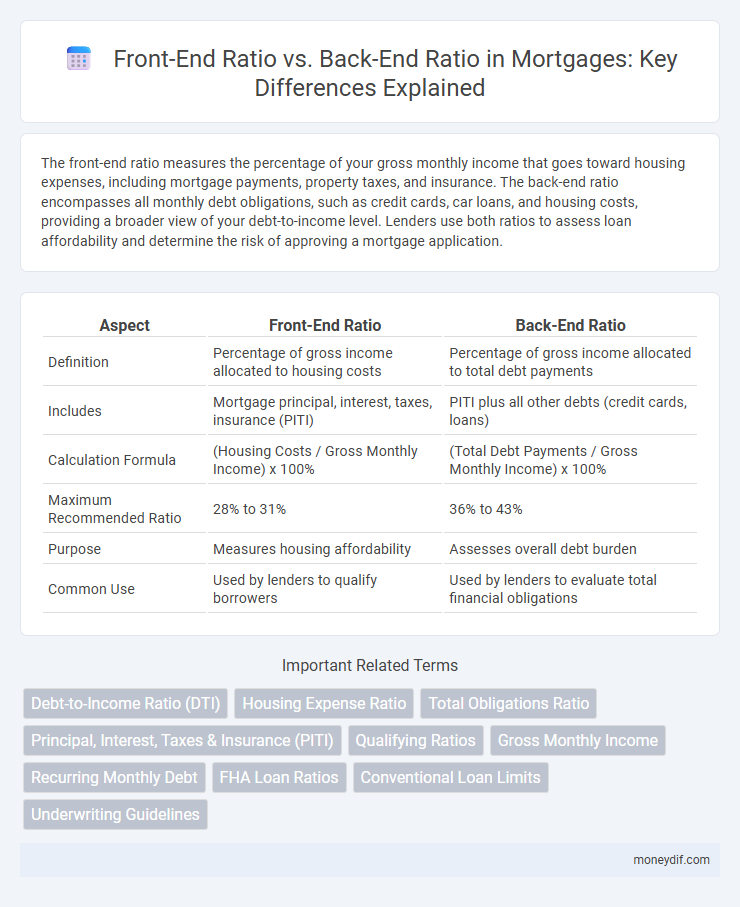

The front-end ratio measures the percentage of your gross monthly income that goes toward housing expenses, including mortgage payments, property taxes, and insurance. The back-end ratio encompasses all monthly debt obligations, such as credit cards, car loans, and housing costs, providing a broader view of your debt-to-income level. Lenders use both ratios to assess loan affordability and determine the risk of approving a mortgage application.

Table of Comparison

| Aspect | Front-End Ratio | Back-End Ratio |

|---|---|---|

| Definition | Percentage of gross income allocated to housing costs | Percentage of gross income allocated to total debt payments |

| Includes | Mortgage principal, interest, taxes, insurance (PITI) | PITI plus all other debts (credit cards, loans) |

| Calculation Formula | (Housing Costs / Gross Monthly Income) x 100% | (Total Debt Payments / Gross Monthly Income) x 100% |

| Maximum Recommended Ratio | 28% to 31% | 36% to 43% |

| Purpose | Measures housing affordability | Assesses overall debt burden |

| Common Use | Used by lenders to qualify borrowers | Used by lenders to evaluate total financial obligations |

Understanding Front-End and Back-End Ratios

Front-end ratio measures the percentage of a borrower's gross monthly income allocated to housing expenses, including mortgage payments, property taxes, and insurance. Back-end ratio evaluates the total monthly debt obligations, such as housing costs, credit card payments, car loans, and student loans, as a percentage of gross income. Lenders use these ratios to assess mortgage affordability and overall borrower risk, typically preferring a front-end ratio below 28% and a back-end ratio below 36%.

Why Mortgage Lenders Use Debt Ratios

Mortgage lenders use front-end and back-end debt ratios to assess a borrower's ability to repay a loan by comparing monthly housing expenses and total monthly debt obligations to gross income. The front-end ratio focuses on housing costs such as principal, interest, taxes, and insurance, while the back-end ratio includes all recurring debts like credit cards, car loans, and student loans. These ratios help lenders evaluate financial stability, reduce default risk, and determine appropriate loan amounts tailored to the borrower's income and debt levels.

Calculating the Front-End Ratio

The Front-End Ratio, also known as the housing ratio, calculates the percentage of a borrower's gross monthly income that goes toward housing expenses, including principal, interest, taxes, and insurance (PITI). Lenders typically prefer a front-end ratio of 28% or less to ensure manageable housing costs. Accurate calculation of this ratio is critical for mortgage approval and determines the maximum affordable monthly housing payment.

Breaking Down the Back-End Ratio

The back-end ratio measures total monthly debt payments, including mortgage, credit cards, student loans, and other obligations, against gross monthly income, providing a comprehensive view of financial liabilities. Lenders use this ratio to evaluate a borrower's ability to manage existing debts alongside the proposed mortgage payment, typically preferring a back-end ratio below 43%. Understanding the back-end ratio helps borrowers assess overall debt burden and improve financial readiness for mortgage approval.

Front-End vs. Back-End Ratio: Key Differences

Front-End Ratio measures the percentage of gross monthly income allocated to housing expenses, primarily mortgage payments, property taxes, and insurance. Back-End Ratio includes all monthly debt obligations such as housing costs, credit card payments, car loans, and other debts, reflecting overall debt load. Lenders use Front-End Ratio to assess housing affordability and Back-End Ratio to evaluate total financial risk when approving a mortgage.

Ideal Ratio Benchmarks for Mortgage Approval

Ideal mortgage approval benchmarks typically set the front-end ratio at 28%, representing the portion of gross monthly income allocated to housing expenses, including mortgage payments, property taxes, and insurance. The back-end ratio, encompassing all monthly debt obligations such as credit cards, car loans, and student loans, is generally recommended to stay below 36% to 43%, depending on lender flexibility. Maintaining these ratios within the ideal range significantly enhances the likelihood of mortgage approval and favorable loan terms.

How Debt-to-Income Ratios Impact Loan Eligibility

Front-end ratio measures the percentage of gross monthly income spent on housing costs, typically including mortgage payments, property taxes, and insurance, while the back-end ratio accounts for all monthly debt obligations such as credit cards, car loans, and student loans in addition to housing costs. Lenders evaluate these debt-to-income (DTI) ratios to assess a borrower's ability to manage monthly payments and determine loan eligibility. A lower front-end ratio, usually below 28%, and a back-end ratio under 36% improve the chances of mortgage approval and favorable interest rates.

Improving Your Ratios for a Better Mortgage Rate

Improving your front-end and back-end ratios enhances your mortgage approval chances and secures lower interest rates. The front-end ratio measures housing costs against gross income, while the back-end ratio accounts for all monthly debts relative to income. Reducing debt, increasing income, and minimizing housing expenses can optimize these ratios, leading to more favorable mortgage terms and greater financial stability.

Common Mistakes in Debt Ratio Calculations

Common mistakes in debt ratio calculations often involve misinterpreting the front-end ratio, which measures housing expenses alone, while neglecting the back-end ratio that includes all monthly debts such as credit cards, car loans, and student loans. Borrowers frequently underestimate their total debt load by focusing solely on the front-end ratio, leading to inaccurate assessments of loan eligibility. Proper calculation requires detailed accounting of all recurring debts to avoid loan rejections and ensure accurate mortgage qualification.

FAQs on Mortgage Front-End and Back-End Ratios

Mortgage front-end ratio measures the percentage of a borrower's gross monthly income allocated to housing expenses, including principal, interest, taxes, and insurance, typically recommended to stay below 28%. Back-end ratio includes all monthly debt obligations such as credit cards, car loans, and student loans, along with housing costs, ideally not exceeding 36-43% depending on the lender. Understanding these ratios helps borrowers determine affordability and qualify for mortgages with favorable terms.

Important Terms

Debt-to-Income Ratio (DTI)

The Debt-to-Income Ratio (DTI) measures a borrower's monthly debt payments relative to their gross monthly income, with the Front-End Ratio focusing specifically on housing costs such as mortgage, taxes, and insurance, while the Back-End Ratio includes all monthly debt obligations like credit cards, car loans, and student loans. Lenders use both ratios to assess a borrower's ability to manage monthly payments and determine loan eligibility, typically preferring a Front-End Ratio below 28% and a Back-End Ratio below 36%.

Housing Expense Ratio

Housing Expense Ratio, commonly known as the Front-End Ratio, measures the percentage of a borrower's gross income allocated to housing costs, including mortgage payments, property taxes, and insurance. The Back-End Ratio expands this calculation by encompassing all monthly debt obligations, such as credit card payments, car loans, and student loans, providing a comprehensive view of a borrower's total debt load relative to income.

Total Obligations Ratio

The Total Obligations Ratio (TOR) measures the percentage of a borrower's gross income used for all monthly debt payments, encompassing both the Front-End Ratio, which focuses solely on housing costs, and the Back-End Ratio, which includes all debt obligations such as credit cards and loans. Lenders use TOR to assess overall financial stability, ensuring that combined housing and other debt payments do not exceed a safe threshold, typically around 36% to 43% of gross income.

Principal, Interest, Taxes & Insurance (PITI)

PITI, encompassing Principal, Interest, Taxes, and Insurance, plays a crucial role in calculating both the Front-End Ratio and Back-End Ratio, which lenders use to assess mortgage affordability. The Front-End Ratio measures housing costs relative to gross monthly income, while the Back-End Ratio includes total debt obligations, incorporating PITI and other debts, to evaluate overall financial stability.

Qualifying Ratios

Qualifying ratios, specifically the Front-End and Back-End Ratios, assess a borrower's ability to manage monthly housing expenses and overall debt obligations; the Front-End Ratio calculates housing costs such as mortgage, taxes, and insurance as a percentage of gross income, typically capped around 28-31%. The Back-End Ratio includes all monthly debt payments including housing expenses, credit cards, and loans, with a usual threshold near 36-43%, providing lenders a comprehensive view of the borrower's total debt burden for mortgage qualification.

Gross Monthly Income

Gross Monthly Income serves as the foundational figure for calculating Front-End and Back-End Ratios, which lenders use to evaluate a borrower's ability to manage monthly housing costs and overall debt, respectively. The Front-End Ratio typically limits housing expenses to 28-31% of gross income, while the Back-End Ratio encompasses all debt payments and commonly caps at 36-43%, ensuring balanced financial obligations.

Recurring Monthly Debt

Recurring monthly debt significantly impacts both the front-end and back-end ratios, critical metrics in mortgage lending used to evaluate a borrower's ability to manage monthly housing costs and overall debt load. The front-end ratio considers housing expenses relative to gross income, while the back-end ratio encompasses all recurring monthly debts, providing a comprehensive view of financial obligations.

FHA Loan Ratios

FHA loan ratios require a front-end ratio typically not exceeding 31%, representing the portion of gross monthly income allocated to housing costs such as mortgage payments, property taxes, and insurance. The back-end ratio, often capped at 43%, includes all monthly debt obligations like credit cards, car loans, and student loans, ensuring the borrower's total debt load remains manageable for FHA loan approval.

Conventional Loan Limits

Conventional loan limits influence the front-end ratio, which typically should not exceed 28% of gross monthly income, ensuring borrowers can manage mortgage payments comfortably. The back-end ratio, encompassing all monthly debt obligations, generally caps at 36% to assess overall debt load and loan eligibility under conventional lending standards.

Underwriting Guidelines

Underwriting guidelines prioritize a front-end ratio of typically 28% to ensure borrowers can manage primary housing expenses, while the back-end ratio, often capped around 36-43%, assesses total debt obligations including credit cards and loans to determine overall financial stability. Lenders use these ratios to balance risk and approve loans by evaluating a borrower's gross monthly income against housing costs and debt payments.

Front-End Ratio vs Back-End Ratio Infographic

moneydif.com

moneydif.com