Lender credits reduce your closing costs by allowing the lender to cover a portion of fees in exchange for a slightly higher interest rate, while seller concessions involve the seller agreeing to pay part of the buyer's closing costs to make the offer more attractive. Understanding the difference between lender credits and seller concessions helps buyers maximize financial benefits when negotiating mortgage terms and purchase agreements. Both strategies impact the overall transaction cost but affect loan terms and negotiations differently.

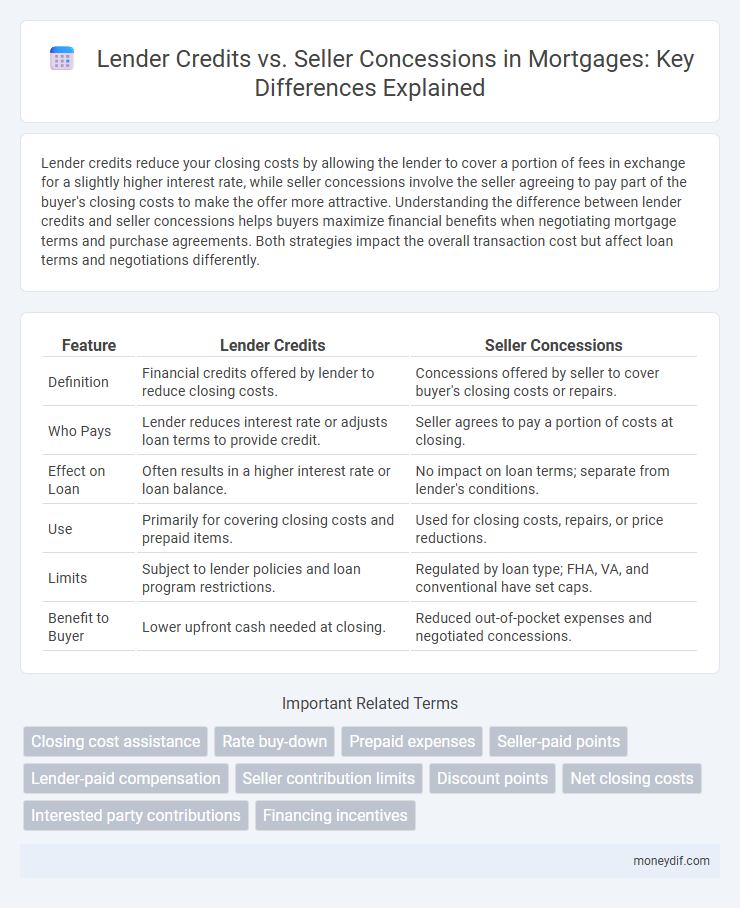

Table of Comparison

| Feature | Lender Credits | Seller Concessions |

|---|---|---|

| Definition | Financial credits offered by lender to reduce closing costs. | Concessions offered by seller to cover buyer's closing costs or repairs. |

| Who Pays | Lender reduces interest rate or adjusts loan terms to provide credit. | Seller agrees to pay a portion of costs at closing. |

| Effect on Loan | Often results in a higher interest rate or loan balance. | No impact on loan terms; separate from lender's conditions. |

| Use | Primarily for covering closing costs and prepaid items. | Used for closing costs, repairs, or price reductions. |

| Limits | Subject to lender policies and loan program restrictions. | Regulated by loan type; FHA, VA, and conventional have set caps. |

| Benefit to Buyer | Lower upfront cash needed at closing. | Reduced out-of-pocket expenses and negotiated concessions. |

Understanding Lender Credits and Seller Concessions

Lender credits are funds provided by the mortgage lender to cover closing costs in exchange for a slightly higher interest rate, effectively reducing upfront expenses for the borrower. Seller concessions, on the other hand, involve the seller agreeing to pay a portion of the buyer's closing costs or offer financial incentives to facilitate the home sale. Both lender credits and seller concessions can significantly impact the total out-of-pocket expenses during the home buying process, making it important to understand their terms and effects on loan costs and affordability.

Key Differences Between Lender Credits and Seller Concessions

Lender credits reduce the borrower's closing costs by having the lender absorb certain fees in exchange for a slightly higher interest rate, effectively lowering upfront expenses. Seller concessions involve the seller agreeing to pay a portion of the buyer's closing costs, often negotiated during the home purchase process, which can impact the sale price or terms. The key difference lies in the source of funds: lender credits come from the lender through interest rate adjustments, while seller concessions are negotiated between buyer and seller, affecting the transaction's financial dynamics.

How Lender Credits Work in Mortgage Transactions

Lender credits in mortgage transactions reduce the borrower's closing costs by allowing the lender to cover part of these fees in exchange for a higher interest rate on the loan. This trade-off means borrowers pay less upfront but incur slightly increased monthly mortgage payments over the life of the loan. Understanding the impact of lender credits on the overall cost of home financing helps borrowers make informed decisions based on their financial goals.

The Role of Seller Concessions in Home Financing

Seller concessions reduce the buyer's closing costs by having the seller cover a portion of these expenses, effectively lowering the upfront cash needed to finalize the home purchase. These concessions can include fees such as loan origination, appraisal, title insurance, and prepaid items, helping buyers with limited liquidity. By contrast, lender credits lower closing costs by increasing the loan's interest rate, but seller concessions directly decrease out-of-pocket expenses without impacting monthly mortgage payments.

Pros and Cons of Lender Credits for Homebuyers

Lender credits reduce upfront closing costs by offering buyers a credit in exchange for a slightly higher interest rate, making home purchases more affordable initially. However, higher interest rates can increase total loan costs over time, which may result in paying more throughout the life of the mortgage. Buyers should weigh immediate savings against long-term financial impact when considering lender credits.

Advantages and Disadvantages of Seller Concessions

Seller concessions offer the advantage of reducing the buyer's out-of-pocket expenses by covering closing costs, which can make purchasing a home more affordable initially. However, these concessions may result in a higher home sale price, potentially impacting the appraisal value and limiting negotiation flexibility. Buyers should consider that excessive seller concessions might also affect loan approval, as lenders often impose limits on the allowable concessions based on loan type and underwriting guidelines.

Impact on Closing Costs: Lender Credits vs Seller Concessions

Lender credits reduce closing costs by allowing borrowers to receive funds from the lender, offsetting fees in exchange for a slightly higher interest rate, effectively lowering upfront expenses but increasing long-term loan costs. Seller concessions directly decrease the buyer's out-of-pocket costs by having the seller pay a portion of the closing expenses, which does not impact the loan's interest rate or monthly payments. Understanding the difference between lender credits and seller concessions helps buyers optimize their cash flow by balancing immediate savings with total loan cost implications.

How to Negotiate Lender Credits with Mortgage Lenders

Negotiating lender credits with mortgage lenders involves understanding their impact on closing costs and interest rates, as these credits reduce upfront expenses but may increase long-term loan costs. Borrowers should request a Loan Estimate early to compare lender credit offers, leverage multiple quotes to negotiate better terms, and ask lenders to clarify how credits affect the APR and monthly payments. Successful negotiation requires balancing immediate financial relief against future interest obligations, ensuring lender credits align with overall loan affordability and homebuying goals.

Leveraging Seller Concessions to Lower Out-of-Pocket Expenses

Leveraging seller concessions can significantly reduce out-of-pocket expenses for homebuyers by allowing sellers to cover closing costs, easing immediate financial burdens. Unlike lender credits, which reduce upfront fees by offering a slightly higher interest rate, seller concessions come directly from the sale proceeds, providing a more flexible approach to managing cash flow. This strategy helps buyers maximize liquidity while facilitating smoother transactions in competitive real estate markets.

Which Option is Better: Lender Credits or Seller Concessions?

Lender credits reduce upfront closing costs by increasing the loan interest rate, benefiting buyers who prefer lower out-of-pocket expenses and plan to stay long-term. Seller concessions involve the seller paying certain closing costs, making it ideal for buyers seeking immediate financial relief without affecting loan terms. Choosing between lender credits and seller concessions depends on your financial situation, loan structure, and long-term homeownership plans.

Important Terms

Closing cost assistance

Closing cost assistance can significantly reduce out-of-pocket expenses by leveraging lender credits, which are financial incentives from lenders applied toward closing fees, and seller concessions, where the seller agrees to cover certain buyer costs within loan limits. Understanding the differences in how lender credits offset origination fees versus seller concessions being subject to percentage caps of the home price is essential for optimizing your home purchase financing strategy.

Rate buy-down

Rate buy-down lowers mortgage interest rates by using lender credits, which are funds provided by the lender to reduce upfront costs without increasing the loan balance, unlike seller concessions that come from the seller and are typically applied toward closing costs but do not directly reduce the interest rate. Understanding the distinction between lender credits and seller concessions is crucial for optimizing loan terms and minimizing out-of-pocket expenses during home purchase financing.

Prepaid expenses

Prepaid expenses related to lender credits typically cover upfront costs like loan origination fees or mortgage insurance and are applied to reduce the borrower's closing costs, while seller concessions often involve the seller agreeing to pay certain prepaid expenses such as property taxes or homeowners insurance on behalf of the buyer. Understanding the distinction helps optimize the allocation of prepaid expenses in real estate transactions, influencing net out-of-pocket costs and loan qualification criteria.

Seller-paid points

Seller-paid points reduce the buyer's loan balance by applying upfront fees directly to the mortgage, while lender credits offset closing costs by increasing the loan interest rate. Seller concessions refer to negotiated contributions from the seller toward the buyer's closing expenses, which can include paying points but are distinct from lender credits that come from the lender.

Lender-paid compensation

Lender-paid compensation involves the lender covering certain borrower costs through higher interest rates, which can offset closing expenses via lender credits, whereas seller concessions are negotiated reductions in costs or credits provided directly by the seller to the buyer. Lender credits typically reduce upfront fees tied to the loan, while seller concessions primarily address closing costs or repairs at sale, making the distinction crucial for determining the source and application of transaction credits.

Seller contribution limits

Seller contribution limits vary by loan type and impact lender credits and seller concessions, with conventional loans typically capping seller concessions at 3-9% depending on the borrower's down payment size. Lender credits are negotiated to offset closing costs and can reduce the buyer's cash required upfront, while seller concessions directly lower the buyer's expenses but must comply with FHA, VA, or USDA specific limits.

Discount points

Discount points are upfront fees paid to reduce a mortgage interest rate, enhancing long-term savings by lowering monthly payments. Lender credits offset closing costs by increasing the interest rate, while seller concessions involve the seller covering closing costs, directly affecting the borrower's cash needed at closing.

Net closing costs

Net closing costs represent the actual expenses paid by the buyer after accounting for lender credits, which reduce upfront fees through loan incentives, while seller concessions offset closing costs by the seller agreeing to pay part of the buyer's expenses. Comparing lender credits and seller concessions helps buyers optimize their net closing costs by balancing loan terms and negotiation strategies for a more affordable transaction.

Interested party contributions

Interested party contributions (IPCs) refer to funds provided by entities with a financial interest in the transaction, such as sellers, to help cover buyer closing costs. Lender credits reduce out-of-pocket expenses by offsetting fees with a higher interest rate, while seller concessions are negotiated amounts the seller agrees to pay on behalf of the buyer, both impacting the total loan-to-value ratio and closing cost structure.

Financing incentives

Lender credits reduce borrower closing costs by applying a higher interest rate, effectively lowering upfront expenses while increasing long-term payments. Seller concessions involve the seller covering part of the buyer's closing costs, beneficial in negotiations but typically capped by loan limits and regulations.

Lender credits vs Seller concessions Infographic

moneydif.com

moneydif.com