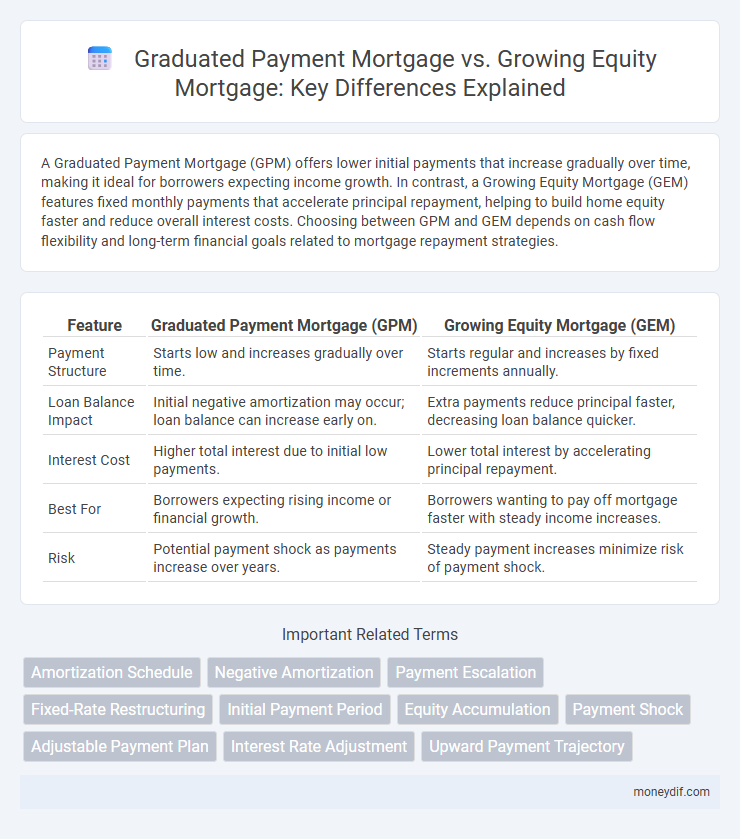

A Graduated Payment Mortgage (GPM) offers lower initial payments that increase gradually over time, making it ideal for borrowers expecting income growth. In contrast, a Growing Equity Mortgage (GEM) features fixed monthly payments that accelerate principal repayment, helping to build home equity faster and reduce overall interest costs. Choosing between GPM and GEM depends on cash flow flexibility and long-term financial goals related to mortgage repayment strategies.

Table of Comparison

| Feature | Graduated Payment Mortgage (GPM) | Growing Equity Mortgage (GEM) |

|---|---|---|

| Payment Structure | Starts low and increases gradually over time. | Starts regular and increases by fixed increments annually. |

| Loan Balance Impact | Initial negative amortization may occur; loan balance can increase early on. | Extra payments reduce principal faster, decreasing loan balance quicker. |

| Interest Cost | Higher total interest due to initial low payments. | Lower total interest by accelerating principal repayment. |

| Best For | Borrowers expecting rising income or financial growth. | Borrowers wanting to pay off mortgage faster with steady income increases. |

| Risk | Potential payment shock as payments increase over years. | Steady payment increases minimize risk of payment shock. |

Understanding Graduated Payment Mortgages

Graduated Payment Mortgages (GPMs) offer initially lower monthly payments that increase annually over a fixed period, making homeownership accessible to borrowers expecting future income growth. Unlike Growing Equity Mortgages, which accelerate principal repayment through fixed monthly payments that rise over time, GPMs start with smaller payments that gradually increase to cover both principal and interest. Understanding these structured payment schedules is crucial for borrowers to evaluate affordability and long-term financial impact effectively.

What Is a Growing Equity Mortgage?

A Growing Equity Mortgage (GEM) is a home loan with fixed interest rates and scheduled principal payments that increase annually, allowing borrowers to build home equity faster than traditional mortgages. Unlike Graduated Payment Mortgages, which start with low initial payments that increase to cover interest and principal over time, GEM payments grow specifically to reduce the loan principal more quickly. This accelerated equity growth helps homeowners pay off their mortgage sooner while potentially saving on interest costs over the life of the loan.

Key Differences Between GPM and GEM

Graduated Payment Mortgage (GPM) features initially low monthly payments that gradually increase over time, helping borrowers manage early affordability but resulting in slower equity buildup. Growing Equity Mortgage (GEM) involves increasing monthly payments that accelerate principal repayment, leading to faster equity accumulation and shorter loan terms. Key differences include the payment structure and impact on equity growth, with GPM easing initial payments while GEM focuses on rapid principal reduction.

How Monthly Payments Evolve Over Time

Graduated Payment Mortgages start with lower initial monthly payments that increase gradually over a set period, typically 5 to 10 years, allowing borrowers to manage early financial constraints. Growing Equity Mortgages feature steadily increasing monthly payments from the outset, accelerating principal repayment and building equity faster without a payment reset period. Both options adjust payment structures to accommodate financial growth, but Graduated Payments initially reduce payment burden while Growing Equity enhances equity accumulation efficiency.

Interest Rates: GPM vs GEM

Graduated Payment Mortgages (GPM) feature lower initial interest rates that gradually increase over time, allowing borrowers to make smaller payments early on, which then rise according to a predetermined schedule. Growing Equity Mortgages (GEM) maintain a fixed interest rate while increasing principal payments, accelerating equity buildup and reducing overall interest costs faster. The choice between GPM's escalating interest exposure and GEM's consistent rates with increasing equity depends on long-term affordability and financial goals.

Long-Term Financial Impact

Graduated Payment Mortgages (GPM) typically start with lower initial payments that increase gradually, potentially causing a higher long-term interest cost due to negative amortization in the early years. Growing Equity Mortgages (GEM) feature steadily increasing payments applied directly to principal reduction, resulting in faster equity accumulation and lower total interest paid over the loan term. Choosing between GPM and GEM significantly influences overall financial burden, with GEM often providing greater savings and quicker loan payoff, improving long-term financial stability.

Ideal Borrowers for GPM and GEM

Graduated Payment Mortgages (GPM) are ideal for borrowers expecting a steady increase in income over time, such as young professionals or those early in their careers, allowing smaller initial payments that gradually rise. Growing Equity Mortgages (GEM) suit borrowers focused on building home equity faster by increasing principal payments annually, beneficial for those with stable or increasing income aiming to pay off the loan sooner. Both GPM and GEM accommodate different financial growth trajectories, making them suitable for borrowers with specific income projections and repayment goals.

Pros and Cons of Graduated Payment Mortgages

Graduated Payment Mortgages (GPMs) offer lower initial payments that gradually increase over time, making them ideal for borrowers expecting rising incomes; however, the initial payments often do not cover full interest costs, causing negative amortization. This negative amortization can lead to higher overall loan balances initially, posing a financial risk if income growth does not materialize as expected. GPMs provide affordability upfront but carry potential payment shocks and increased total interest, contrasting with Growing Equity Mortgages that increase payments to reduce principal faster without negative amortization.

Advantages and Disadvantages of Growing Equity Mortgages

Growing Equity Mortgages (GEMs) offer the advantage of accelerated principal repayment through scheduled payment increases, reducing interest costs and shortening loan terms. This structure benefits borrowers anticipating rising incomes but carries the disadvantage of higher initial payments compared to Graduated Payment Mortgages, potentially limiting affordability for those with stagnant revenues. Unlike Graduated Payment Mortgages, GEMs avoid negative amortization, providing a more predictable equity build-up and financial stability over the loan period.

Choosing the Right Mortgage: GPM or GEM?

Graduated Payment Mortgages (GPM) offer lower initial payments that gradually increase, benefiting borrowers expecting rising income, while Growing Equity Mortgages (GEM) accelerate principal repayment through increasing payments. Choosing between GPM and GEM depends on financial stability and long-term goals; GPM suits those needing initial affordability, whereas GEM favors borrowers aiming to build equity faster and reduce interest costs. Evaluating income projections and equity growth priorities helps determine the optimal mortgage type for sustained financial planning.

Important Terms

Amortization Schedule

An amortization schedule for a Graduated Payment Mortgage (GPM) shows initial lower payments increasing at a predetermined rate, resulting in negative amortization early on, while a Growing Equity Mortgage (GEM) features escalating payments that directly reduce principal faster without negative amortization. Comparing both, GPM schedules highlight payment growth with potential principal balance increases, whereas GEM schedules ensure accelerated equity gain through consistent principal prepayments reflected in shortened loan terms.

Negative Amortization

Negative amortization occurs in Graduated Payment Mortgages (GPM) when initial payments are insufficient to cover interest, causing the loan balance to increase, whereas Growing Equity Mortgages (GEM) avoid this by applying predetermined extra payments directly to principal, accelerating equity buildup. GPMs feature increasing payments that may start below interest costs, leading to deferred interest, while GEMs ensure gradual principal reduction without payment shortfalls, preventing negative amortization.

Payment Escalation

Payment escalation in Graduated Payment Mortgages (GPM) involves initially low payments that gradually increase over time to accommodate borrowers with increasing income, whereas Growing Equity Mortgages (GEM) feature fixed payments that accelerate principal repayment, building home equity faster. Both mortgage types offer structured payment increases, but GPM focuses on affordability early on, while GEM emphasizes equity growth through larger principal payments.

Fixed-Rate Restructuring

Fixed-Rate Restructuring in mortgage financing involves modifying a loan's interest rate or payment schedule while maintaining a stable fixed rate, often applied to Graduated Payment Mortgages (GPM) and Growing Equity Mortgages (GEM). Graduated Payment Mortgages start with lower initial payments that increase over time, whereas Growing Equity Mortgages feature escalating principal payments that accelerate equity buildup without changing the fixed interest rate during restructuring.

Initial Payment Period

The Initial Payment Period in Graduated Payment Mortgages features lower starting payments that gradually increase over time, easing borrowers into higher financial commitments. In contrast, Growing Equity Mortgages begin with fixed payments that accelerate, reducing the loan principal faster during the initial phase to build equity more rapidly.

Equity Accumulation

Equity accumulation in Graduated Payment Mortgages (GPM) is slower initially due to low starting payments that increase over time, while Growing Equity Mortgages (GEM) accelerate equity build-up by applying fixed payment increases directly toward principal reduction. GPM suits borrowers anticipating future income growth, whereas GEM offers faster principal repayment and equity growth from the start.

Payment Shock

Payment shock occurs when borrowers face a sudden increase in monthly payments, commonly seen in Graduated Payment Mortgages (GPM) where initial low payments gradually rise, potentially straining finances. In contrast, Growing Equity Mortgages (GEM) increase payments steadily with the goal of building home equity faster, minimizing the risk of payment shock by designing predictable payment growth schedules.

Adjustable Payment Plan

Adjustable Payment Plans allow borrowers to modify their payment amounts based on financial capacity, playing a key role in Graduated Payment Mortgages (GPM) where payments start low and increase gradually, and in Growing Equity Mortgages (GEM) where increased payments accelerate loan principal reduction. GPMs are designed to accommodate borrowers with initially lower income, while GEMs focus on building home equity faster through systematically rising payments.

Interest Rate Adjustment

Interest rate adjustments in Graduated Payment Mortgages (GPM) typically involve initially lower payments that increase over time, while Growing Equity Mortgages (GEM) maintain fixed interest rates with increasing principal payments that accelerate equity buildup. The GPM's structure can lead to higher interest costs due to negative amortization in early years, whereas GEM reduces total interest paid by allocating extra funds toward principal reduction throughout the loan term.

Upward Payment Trajectory

Upward Payment Trajectory in a Graduated Payment Mortgage (GPM) involves initial low payments that increase gradually over time to accommodate borrowers with limited initial income, whereas a Growing Equity Mortgage (GEM) features payments that start at a fixed level but increase based on a set schedule to accelerate principal repayment and build equity faster. Both structures aim to manage affordability early on while promoting equity growth, but GPM focuses on payment escalation aligned with expected income increases, unlike GEM's predetermined incremental principal contributions.

Graduated Payment Mortgage vs Growing Equity Mortgage Infographic

moneydif.com

moneydif.com