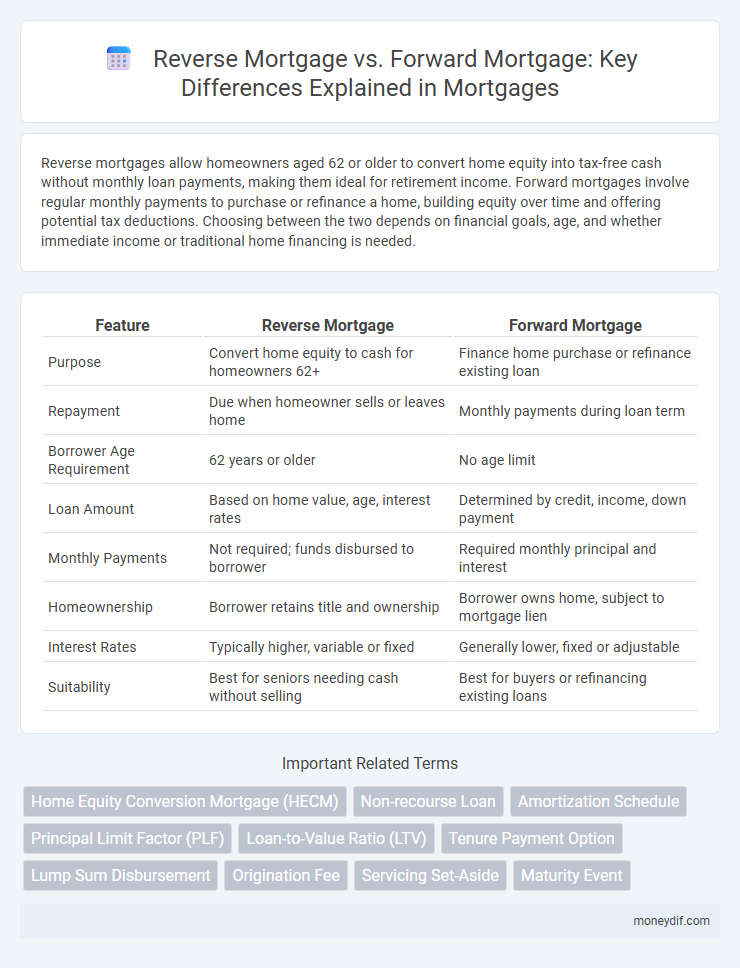

Reverse mortgages allow homeowners aged 62 or older to convert home equity into tax-free cash without monthly loan payments, making them ideal for retirement income. Forward mortgages involve regular monthly payments to purchase or refinance a home, building equity over time and offering potential tax deductions. Choosing between the two depends on financial goals, age, and whether immediate income or traditional home financing is needed.

Table of Comparison

| Feature | Reverse Mortgage | Forward Mortgage |

|---|---|---|

| Purpose | Convert home equity to cash for homeowners 62+ | Finance home purchase or refinance existing loan |

| Repayment | Due when homeowner sells or leaves home | Monthly payments during loan term |

| Borrower Age Requirement | 62 years or older | No age limit |

| Loan Amount | Based on home value, age, interest rates | Determined by credit, income, down payment |

| Monthly Payments | Not required; funds disbursed to borrower | Required monthly principal and interest |

| Homeownership | Borrower retains title and ownership | Borrower owns home, subject to mortgage lien |

| Interest Rates | Typically higher, variable or fixed | Generally lower, fixed or adjustable |

| Suitability | Best for seniors needing cash without selling | Best for buyers or refinancing existing loans |

Introduction to Reverse and Forward Mortgages

Reverse mortgages allow homeowners aged 62 and older to convert home equity into tax-free income without monthly loan payments, preserving ownership while receiving funds. Forward mortgages are traditional home loans where borrowers make monthly payments to build equity over time, commonly used for purchasing or refinancing a home. Understanding the key differences helps seniors decide between accessing home equity now versus financing a home purchase or reinvestment.

Key Differences Between Reverse and Forward Mortgages

Reverse mortgages allow homeowners aged 62 or older to convert home equity into loan proceeds without monthly payments, whereas forward mortgages require monthly payments and are commonly used for purchasing or refinancing. In a reverse mortgage, the loan balance increases over time and is typically repaid when the borrower sells the house or passes away, while forward mortgages accumulate equity as the loan is paid down. Eligibility criteria, repayment terms, and impact on inheritance diverge significantly between reverse and forward mortgage products.

How Reverse Mortgages Work

Reverse mortgages allow homeowners aged 62 or older to convert home equity into tax-free cash without selling their home or making monthly loan payments. Instead of monthly payments, the loan balance increases over time and is repaid when the homeowner sells the property, moves out permanently, or passes away. This financial product is ideal for seniors seeking supplemental retirement income while retaining home ownership.

How Forward Mortgages Work

Forward mortgages require borrowers to make monthly payments over a fixed term to gradually repay the loan, which is used to purchase or refinance a home. The loan balance decreases with each payment until fully paid off or the property is sold. Interest accrues based on the principal owed, and borrowers build home equity as the mortgage is repaid.

Eligibility Requirements for Each Mortgage Type

Reverse mortgages require homeowners to be at least 62 years old with significant equity in their primary residence, primarily designed for retirees seeking to convert home equity into loan proceeds without monthly payments. Forward mortgages, available to borrowers of any adult age, require income verification, creditworthiness, and a down payment based on loan type such as FHA, VA, or conventional loans. Eligibility criteria for forward mortgages emphasize steady income and debt-to-income ratio, while reverse mortgage eligibility centers on age, home equity, and residence type.

Pros and Cons: Reverse vs Forward Mortgages

Reverse mortgages allow homeowners aged 62 or older to convert home equity into tax-free funds without monthly payments, providing financial flexibility but reducing inheritance potential and incurring higher upfront fees. Forward mortgages offer fixed or adjustable rates with predictable monthly payments suited for long-term homeownership and building equity but require credit qualification and ongoing repayment obligations. Borrowers should weigh reverse mortgages' immediate cash flow benefits against forward mortgages' equity growth and repayment structure to choose the best fit for their financial goals.

Costs and Fees Comparison

Reverse mortgages typically have higher upfront costs, including origination fees, mortgage insurance premiums, and closing costs, which can reduce the borrower's home equity over time. Forward mortgages generally involve lower initial fees but require monthly principal and interest payments, potentially increasing total interest paid throughout the loan term. Comparing both, reverse mortgages may incur larger overall costs due to compound interest and fees rolled into the loan balance, while forward mortgages cost more through consistent monthly payments and varying interest rates.

Impact on Home Equity and Inheritance

A reverse mortgage allows homeowners aged 62 and older to convert home equity into tax-free cash without monthly payments, reducing the estate's value and potentially decreasing inheritance for heirs. A forward mortgage requires monthly payments, gradually building home equity and preserving or increasing inheritance value. Understanding these impacts helps homeowners balance financial needs with legacy goals.

Repayment Structures Explained

Reverse mortgage repayment is typically deferred until the borrower sells the home, moves out permanently, or passes away, allowing homeowners aged 62 or older to convert home equity into cash without monthly loan payments. Forward mortgages require regular monthly repayments of principal and interest over a fixed term, generally 15 to 30 years, making them suitable for borrowers planning long-term home ownership. The repayment structure of reverse mortgages offers flexibility and no immediate financial burden, contrasting with the consistent payment obligations inherent in forward mortgage agreements.

Choosing the Right Mortgage for Your Needs

Choosing the right mortgage depends on your financial goals and age; reverse mortgages are designed for homeowners aged 62 and older to convert home equity into cash without monthly payments, ideal for retirees needing supplemental income. Forward mortgages, including fixed-rate and adjustable-rate loans, require monthly payments and are suitable for buyers seeking to build equity over time or purchase a new home. Evaluating factors such as loan terms, repayment obligations, and eligibility criteria ensures alignment with your long-term financial strategy.

Important Terms

Home Equity Conversion Mortgage (HECM)

Home Equity Conversion Mortgage (HECM) is a federally insured reverse mortgage that allows homeowners aged 62 or older to convert home equity into loan proceeds without monthly payments, unlike forward mortgages which require regular repayments and credit qualifications.

Non-recourse Loan

A non-recourse loan in a reverse mortgage protects the borrower by limiting repayment to the home's value, unlike a forward mortgage where the borrower remains personally liable for the loan balance beyond the property's value.

Amortization Schedule

An amortization schedule for a reverse mortgage differs significantly from a forward mortgage by reflecting loan balance growth over time instead of systematic principal reduction through regular payments.

Principal Limit Factor (PLF)

Principal Limit Factor (PLF) determines the maximum loan amount eligible in a reverse mortgage based on borrower age and current interest rates, contrasting with forward mortgages where loan limits are set by creditworthiness and income verification.

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) for reverse mortgages typically ranges from 50% to 60% depending on the borrower's age and home value, whereas forward mortgages generally allow LTVs up to 80% or higher based on creditworthiness and down payment.

Tenure Payment Option

Tenure Payment Option in reverse mortgages guarantees fixed monthly payments for life, unlike forward mortgages which require regular loan repayments based on principal and interest.

Lump Sum Disbursement

Lump sum disbursement in reverse mortgages provides homeowners with immediate cash based on home equity without monthly repayments, unlike forward mortgages which require loan installments and accrue interest.

Origination Fee

Origination fees for reverse mortgages typically range from 0.5% to 2% of the loan amount and are often higher or more complex than the flat or percentage-based fees charged on forward mortgages due to differing risk assessments and loan structures.

Servicing Set-Aside

Servicing set-aside funds in reverse mortgages cover ongoing loan servicing costs, differing from forward mortgages where such costs are typically paid upfront or through monthly payments.

Maturity Event

A maturity event in reverse mortgages occurs when the borrower passes away, sells the home, or permanently moves out, triggering loan repayment typically from home sale proceeds, whereas forward mortgages mature at the end of the loan term or upon full repayment by the borrower. Reverse mortgages generally do not require monthly payments during the borrower's lifetime, contrasting with forward mortgages that involve regular monthly payments until maturity.

Reverse Mortgage vs Forward Mortgage Infographic

moneydif.com

moneydif.com