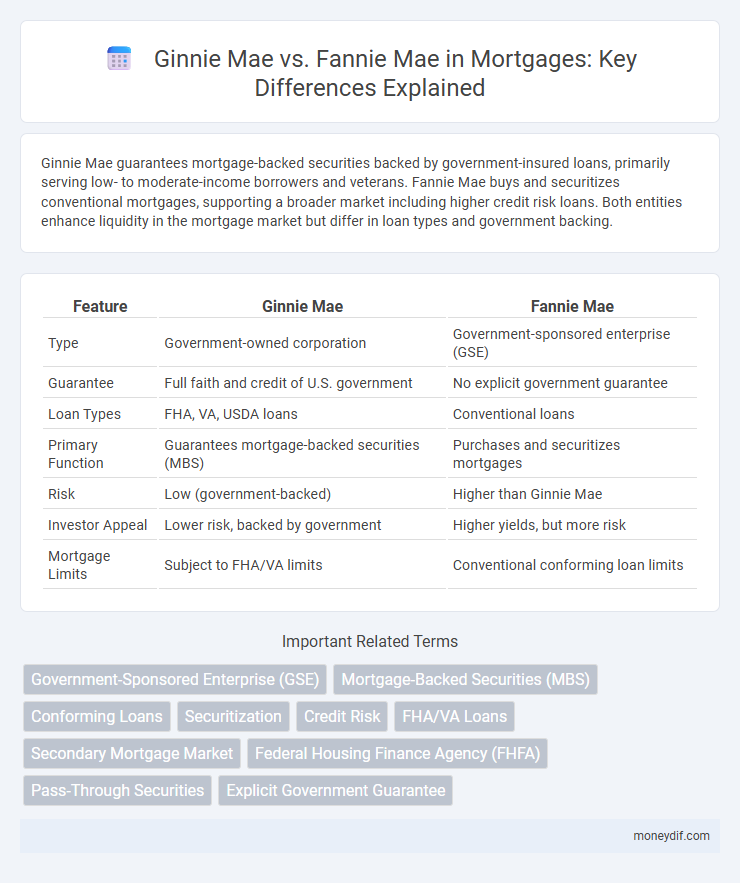

Ginnie Mae guarantees mortgage-backed securities backed by government-insured loans, primarily serving low- to moderate-income borrowers and veterans. Fannie Mae buys and securitizes conventional mortgages, supporting a broader market including higher credit risk loans. Both entities enhance liquidity in the mortgage market but differ in loan types and government backing.

Table of Comparison

| Feature | Ginnie Mae | Fannie Mae |

|---|---|---|

| Type | Government-owned corporation | Government-sponsored enterprise (GSE) |

| Guarantee | Full faith and credit of U.S. government | No explicit government guarantee |

| Loan Types | FHA, VA, USDA loans | Conventional loans |

| Primary Function | Guarantees mortgage-backed securities (MBS) | Purchases and securitizes mortgages |

| Risk | Low (government-backed) | Higher than Ginnie Mae |

| Investor Appeal | Lower risk, backed by government | Higher yields, but more risk |

| Mortgage Limits | Subject to FHA/VA limits | Conventional conforming loan limits |

Overview of Ginnie Mae and Fannie Mae

Ginnie Mae, officially known as the Government National Mortgage Association, guarantees mortgage-backed securities (MBS) backed by federally insured or guaranteed loans, primarily targeting government-insured mortgages such as FHA and VA loans. Fannie Mae, the Federal National Mortgage Association, operates as a government-sponsored enterprise (GSE) that buys mortgages from lenders, pools them, and issues MBS primarily composed of conventional, conforming loans. Both entities support liquidity in the mortgage market but differ in their mission focus, with Ginnie Mae emphasizing government-insured loans while Fannie Mae focuses on conventional loans and affordable housing goals.

Historical Background and Founding

Ginnie Mae, established in 1968 under the Department of Housing and Urban Development (HUD), was created to guarantee government-backed mortgage securities to support affordable housing for low- to moderate-income borrowers. Fannie Mae, founded earlier in 1938 during the New Deal as part of the National Housing Act, aimed to expand the secondary mortgage market by purchasing and securitizing loans from federally insured banks. Both entities have played pivotal roles in stabilizing and expanding the U.S. housing finance system, with Ginnie Mae focusing on government-insured loans and Fannie Mae on conventional loans.

Key Differences in Ownership and Structure

Ginnie Mae is a government-owned corporation within the U.S. Department of Housing and Urban Development (HUD), primarily guaranteeing mortgage-backed securities (MBS) backed by government-insured loans such as FHA and VA loans. Fannie Mae operates as a publicly traded government-sponsored enterprise (GSE), purchasing and securitizing conventional mortgages from lenders to provide liquidity in the secondary mortgage market. The ownership and structural distinction affects risk exposure, with Ginnie Mae having full government backing, whereas Fannie Mae has implicit government support but functions as a shareholder-owned entity.

Mission and Primary Functions

Ginnie Mae primarily guarantees government-insured mortgage-backed securities to support affordable housing for low- and moderate-income borrowers, ensuring liquidity in the housing market. Fannie Mae focuses on purchasing and guaranteeing conventional home loans, promoting stability and affordability in the secondary mortgage market by providing a reliable source of capital. Both entities play crucial roles in expanding access to mortgage credit while targeting distinct borrower segments and loan types.

Role in the U.S. Mortgage Market

Ginnie Mae guarantees government-insured mortgage-backed securities, primarily supporting FHA, VA, and USDA loans to promote affordable housing for low-to-moderate income borrowers. Fannie Mae buys and securitizes conventional mortgages, providing liquidity to the secondary mortgage market and enabling lenders to offer more loans. Both entities play critical roles in stabilizing the U.S. housing finance system but target different segments of the mortgage market.

Types of Loans Supported

Ginnie Mae primarily supports government-insured loans such as FHA, VA, and USDA loans, which are designed to help low-to-moderate-income borrowers. Fannie Mae focuses on conventional loans, including conforming loans that meet specific size and underwriting standards set by the Federal Housing Finance Agency. Both agencies play crucial roles in expanding access to mortgage credit, but they differ fundamentally in the types of loan products they guarantee or purchase.

Securitization Process Explained

Ginnie Mae guarantees mortgage-backed securities (MBS) composed primarily of government-insured or guaranteed loans, such as FHA and VA loans, facilitating access to affordable housing financing through direct government backing. Fannie Mae securitizes conventional mortgage loans that meet specific underwriting standards, pooling these loans into MBS sold to investors to provide liquidity to the housing market. The securitization process for Ginnie Mae involves issuing MBS backed by FHA, VA, and USDA loans with full government guarantee, while Fannie Mae's process entails purchasing conforming loans from lenders, pooling them, and issuing MBS supported by its credit risk management but without direct government guarantee.

Impact on Homebuyers and Lenders

Ginnie Mae guarantees mortgage-backed securities backed by government-insured loans, providing lower risk and more stable funding for lenders, which can lead to more accessible loan options for first-time and low-income homebuyers. Fannie Mae buys conforming loans from lenders, increasing liquidity in the mortgage market and enabling competitive interest rates for borrowers with strong credit profiles. The differing structures of Ginnie Mae and Fannie Mae influence the availability and cost of home financing, shaping lender risk tolerance and homebuyer eligibility criteria.

Risks and Benefits Associated

Ginnie Mae guarantees mortgage-backed securities (MBS) backed by government-insured loans, reducing default risk but limiting investment to government-backed borrowers. Fannie Mae buys and securitizes conventional loans, offering broader market access and potentially higher yields but exposing investors to greater credit risk. Both entities provide liquidity and stability to the mortgage market, with differences in risk profiles tied to their underlying loan portfolios.

Choosing Between Ginnie Mae and Fannie Mae

Choosing between Ginnie Mae and Fannie Mae depends on the loan type and investor priorities; Ginnie Mae guarantees government-insured loans such as FHA and VA, offering lower risk and backing by the full faith and credit of the U.S. government. Fannie Mae primarily deals with conventional loans and provides more flexible underwriting standards, making it suitable for borrowers with higher credit scores and stable income. Investors seeking guaranteed payment streams favor Ginnie Mae's mortgage-backed securities, while those preferring broader loan eligibility may opt for Fannie Mae's offerings.

Important Terms

Government-Sponsored Enterprise (GSE)

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Ginnie Mae play crucial roles in the U.S. housing finance system, with Fannie Mae operating as a publicly traded entity that guarantees mortgage-backed securities (MBS) primarily backed by conventional loans, while Ginnie Mae, a government agency, guarantees MBS backed by federally insured or guaranteed loans such as FHA, VA, and USDA loans. Ginnie Mae's explicit government guarantee reduces investor risk and supports affordable housing programs, whereas Fannie Mae's implied guarantee fosters liquidity in the secondary mortgage market for conforming loans.

Mortgage-Backed Securities (MBS)

Mortgage-Backed Securities (MBS) issued by Ginnie Mae carry the full faith and credit guarantee of the U.S. government, ensuring timely principal and interest payments, whereas Fannie Mae MBS are backed by the corporation's financial strength but lack a direct government guarantee. Ginnie Mae primarily securitizes loans insured or guaranteed by government agencies like FHA and VA, while Fannie Mae focuses on conventional conforming loans, influencing risk profiles and investor confidence.

Conforming Loans

Conforming loans adhere to Fannie Mae and Freddie Mac's established limits and underwriting guidelines, facilitating secondary market liquidity and lower interest rates; Ginnie Mae, however, guarantees mortgage-backed securities backed by government-insured loans like FHA and VA, impacting credit risk and loan eligibility differently. The primary distinction lies in Fannie Mae's focus on conventional loans while Ginnie Mae supports government-insured loans, influencing investor risk profiles and borrower qualification criteria.

Securitization

Securitization involving Ginnie Mae differs from Fannie Mae as Ginnie Mae guarantees mortgage-backed securities (MBS) backed by government-insured loans, primarily FHA and VA loans, while Fannie Mae deals with conventional, non-government-backed mortgages. This distinction impacts credit risk and investor appeal, with Ginnie Mae offering the explicit government guarantee that enhances investor confidence in government-backed MBS.

Credit Risk

Ginnie Mae guarantees mortgage-backed securities (MBS) backed by government-insured loans, resulting in lower credit risk due to full government backing, while Fannie Mae securitizes conventional loans, bearing higher credit risk as it operates with government sponsorship but without explicit guarantees. The credit risk exposure in Fannie Mae's MBS depends on borrower default and loan performance, whereas Ginnie Mae's guarantees eliminate default risk for investors, making Ginnie Mae securities more resilient during economic downturns.

FHA/VA Loans

FHA and VA loans are government-backed mortgage programs insured by the Federal Housing Administration and guaranteed by the Department of Veterans Affairs, respectively, and their securities are primarily issued through Ginnie Mae, ensuring government-backed guarantees. In contrast, Fannie Mae deals mostly with conventional loans and operates as a government-sponsored enterprise, purchasing mortgages from lenders to create mortgage-backed securities without the direct government guarantee present in Ginnie Mae-issued FHA/VA loan securities.

Secondary Mortgage Market

The Secondary Mortgage Market facilitates the buying and selling of mortgage-backed securities (MBS), with Ginnie Mae guaranteeing MBS backed by government-insured loans such as FHA and VA, ensuring lower credit risk, while Fannie Mae supports MBS composed mainly of conventional loans from private lenders. Ginnie Mae's explicit government guarantee contrasts with Fannie Mae's government-sponsored enterprise (GSE) status, affecting their risk profiles and investor appeal.

Federal Housing Finance Agency (FHFA)

The Federal Housing Finance Agency (FHFA) oversees Fannie Mae and Freddie Mac, regulating their role in providing liquidity to the mortgage market, while Ginnie Mae operates independently under the Department of Housing and Urban Development, guaranteeing mortgage-backed securities backed by government-insured loans. FHFA ensures the safety and soundness of Fannie Mae's mortgage activities, contrasting with Ginnie Mae's focus on supporting affordable housing through government-guaranteed securities.

Pass-Through Securities

Pass-through securities issued by Ginnie Mae are government-guaranteed mortgage-backed securities backed by federally insured loans, ensuring timely principal and interest payments, whereas Fannie Mae pass-through securities are agency-backed but lack explicit government guarantees, relying on the issuer's creditworthiness. Ginnie Mae primarily supports FHA and VA loans, while Fannie Mae focuses on conforming conventional loans, impacting investor risk profiles and market liquidity.

Explicit Government Guarantee

Explicit government guarantee refers to the direct backing by the U.S. government ensuring timely principal and interest payments on securities issued by agencies like Ginnie Mae, contrasting with Fannie Mae's implicit guarantee that relies on market perception without formal government commitment. Ginnie Mae securities carry full faith and credit of the U.S. government, enhancing their creditworthiness and stability during financial disruptions, whereas Fannie Mae's obligations are subject to potential government intervention but lack an explicit guarantee.

Ginnie Mae vs Fannie Mae Infographic

moneydif.com

moneydif.com