Refinancing a mortgage involves replacing your current loan with a new one to secure a lower interest rate or change loan terms, often requiring a full credit check and closing costs. Recasting adjusts your existing loan by applying a lump sum payment to reduce the principal balance, lowering monthly payments without changing the interest rate or loan term and with minimal fees. Choosing between refinancing and recasting depends on your financial goals, credit status, and how long you plan to stay in the home.

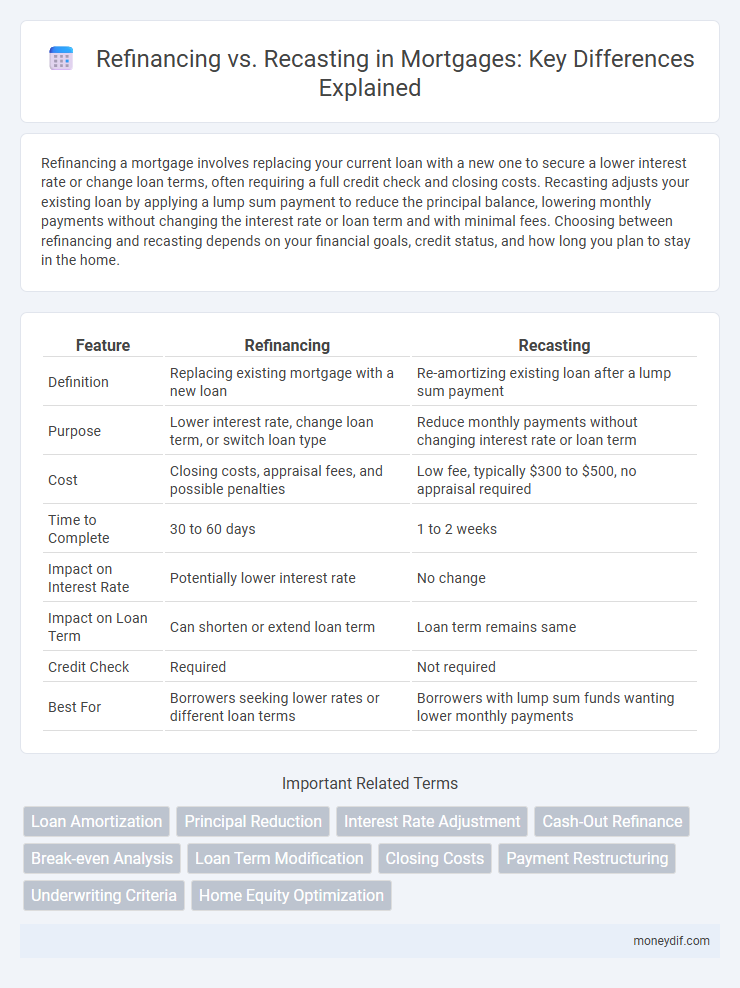

Table of Comparison

| Feature | Refinancing | Recasting |

|---|---|---|

| Definition | Replacing existing mortgage with a new loan | Re-amortizing existing loan after a lump sum payment |

| Purpose | Lower interest rate, change loan term, or switch loan type | Reduce monthly payments without changing interest rate or loan term |

| Cost | Closing costs, appraisal fees, and possible penalties | Low fee, typically $300 to $500, no appraisal required |

| Time to Complete | 30 to 60 days | 1 to 2 weeks |

| Impact on Interest Rate | Potentially lower interest rate | No change |

| Impact on Loan Term | Can shorten or extend loan term | Loan term remains same |

| Credit Check | Required | Not required |

| Best For | Borrowers seeking lower rates or different loan terms | Borrowers with lump sum funds wanting lower monthly payments |

Refinancing vs Recasting: Key Differences

Refinancing replaces an existing mortgage with a new loan, often to secure a lower interest rate or change loan terms, while recasting involves paying a lump sum toward the principal to reduce monthly payments without altering the loan's interest rate or term. Refinancing typically requires a new credit check, appraisal, and closing costs, whereas recasting generally has minimal fees and no credit evaluation. Homeowners choose refinancing for long-term savings and flexibility, while recasting is ideal for reducing payments quickly with minimal paperwork.

Understanding Mortgage Recasting

Mortgage recasting involves making a large lump-sum payment toward the principal balance, which recalculates monthly payments based on the reduced balance while keeping the original loan terms intact. This process can lower monthly mortgage payments without the fees and credit checks required in refinancing. Understanding mortgage recasting is essential for homeowners seeking to reduce their monthly financial obligations efficiently without altering interest rates or loan duration.

How Mortgage Refinancing Works

Mortgage refinancing involves replacing an existing loan with a new one, typically to secure a lower interest rate, reduce monthly payments, or change the loan term. Borrowers apply for a new loan, which pays off the original mortgage, and then begin making payments under the new loan's terms. Refinancing can lead to significant savings over the life of the loan, especially when interest rates drop or credit scores improve.

Pros and Cons of Recasting Your Mortgage

Recasting a mortgage involves making a large lump-sum payment toward the principal, which reduces monthly payments without changing the interest rate or loan term. Pros include lower monthly payments and minimal closing costs compared to refinancing, while cons consist of limited availability from lenders and no option to change loan terms or access cash out. Homeowners with stable interest rates and no need to alter loan duration often benefit most from mortgage recasting.

Advantages and Disadvantages of Refinancing

Refinancing a mortgage allows homeowners to secure a lower interest rate or adjust the loan term, potentially reducing monthly payments and overall interest costs. However, refinancing involves closing costs, application fees, and possible prepayment penalties, which may outweigh short-term savings. The process also resets the loan term, potentially extending debt duration despite monthly payment reductions.

Costs Associated with Refinancing and Recasting

Refinancing a mortgage often involves substantial costs, including application fees, appraisal fees, and closing costs that typically range from 2% to 6% of the loan amount. In contrast, recasting fees are generally minimal, usually around $300 to $500, making it a more cost-effective option for borrowers looking to lower monthly payments without incurring high upfront expenses. Understanding the cost difference is crucial for homeowners deciding between refinancing to obtain a new loan or recasting to adjust an existing loan balance.

Eligibility Criteria for Recasting vs Refinancing

Eligibility for mortgage recasting typically requires a minimum principal payment, often starting at $5,000 or more, and the loan must be in good standing without recent late payments. Refinancing eligibility involves income verification, credit score requirements usually above 620, and sufficient home equity, often at least 20%. Recasting benefits borrowers who want to lower monthly payments without altering the loan terms, while refinancing suits those seeking better interest rates or different loan structures.

Impact on Monthly Payments: Recasting vs Refinancing

Recasting a mortgage lowers monthly payments by applying a lump sum toward the principal, recalculating payments based on the remaining balance and loan term without changing the interest rate. Refinancing replaces the existing loan with a new mortgage, often at a different interest rate and term, which can significantly reduce monthly payments but may involve closing costs and a credit check. While recasting offers a quick reduction in payments with minimal fees, refinancing provides more flexibility to adjust loan terms and potentially achieve greater long-term savings.

Tax Implications: What Homeowners Should Know

Refinancing a mortgage may offer tax benefits such as the ability to deduct mortgage interest on the new loan, but it often resets the loan term and can include closing costs that impact overall savings. Recasting a mortgage typically involves a lump-sum payment toward the principal, lowering monthly payments without changing the interest rate or loan term, and does not create new tax deductions. Homeowners must evaluate these tax implications with a tax advisor to ensure their decision aligns with financial goals and current IRS regulations.

Choosing the Right Option: When to Recast or Refinance

Recasting a mortgage is ideal for borrowers with a lump sum ready to reduce monthly payments without changing interest rates or loan terms, offering lower costs and minimal paperwork. Refinancing suits those seeking better interest rates, different loan terms, or cash-out options despite higher fees and longer processing times. Assessing current interest rates, remaining loan balance, and financial goals helps determine whether recasting or refinancing maximizes savings and aligns with long-term plans.

Important Terms

Loan Amortization

Loan amortization schedules can be significantly impacted by refinancing or recasting, where refinancing replaces the original loan with a new one, often at a lower interest rate or different term, altering monthly payments and total interest paid. Recasting, on the other hand, recalculates the existing loan balance after a lump-sum payment, typically reducing monthly payments without changing the interest rate or loan term, preserving the original amortization structure but lowering payment amounts.

Principal Reduction

Principal reduction lowers the loan balance directly, providing immediate equity improvement and potentially reduced monthly payments, unlike refinancing which replaces the loan with new terms, often requiring new credit approval and closing costs. Recasting adjusts the loan amortization based on a lump sum payment without changing the interest rate or loan terms, offering reduced payments but no principal forgiveness.

Interest Rate Adjustment

Interest rate adjustment in refinancing involves securing a new loan with a different rate, potentially lowering monthly payments and total interest costs by replacing the original loan. In contrast, recasting adjusts the existing loan's principal balance through a lump-sum payment, retaining the original interest rate while recalculating monthly payments based on the reduced balance.

Cash-Out Refinance

Cash-out refinance allows homeowners to convert home equity into cash by replacing their existing mortgage with a larger loan, differing from recasting which modifies the existing loan by making a lump-sum payment to reduce the principal and monthly payments without changing the loan terms. Refinancing involves obtaining a new mortgage with new terms and potentially a different interest rate, while recasting retains the original loan terms but lowers payments through principal reduction.

Break-even Analysis

Break-even analysis in the context of refinancing versus recasting helps determine the point at which the cost savings from lower interest rates or adjusted loan terms offset the refinancing fees compared to the minimal fees and payment adjustments of recasting. Evaluating monthly payment reductions, total interest savings, and upfront costs allows homeowners to identify the most financially beneficial strategy for reducing mortgage expenses.

Loan Term Modification

Loan term modification adjusts the duration of a mortgage to better fit the borrower's financial situation, often reducing monthly payments without changing the principal balance. Refinancing replaces the existing loan with a new one at different terms and interest rates, while recasting re-amortizes the original mortgage after a lump-sum payment, lowering monthly installments without altering the loan's interest rate or term.

Closing Costs

Closing costs for refinancing typically range from 2% to 5% of the loan amount, encompassing fees such as appraisal, title insurance, and lender charges, whereas recasting usually incurs minimal fees, often under $500, since it only involves modifying the existing loan terms without a new appraisal or underwriting. Refinancing may offer lower interest rates or different loan terms but demands higher upfront costs, while recasting reduces monthly payments by adjusting the principal balance and requires less financial outlay.

Payment Restructuring

Payment restructuring involves modifying loan terms to improve cash flow, commonly through refinancing or recasting. Refinancing replaces an existing loan with a new one, often with different interest rates or terms, while recasting adjusts the existing loan's amortization schedule after a lump-sum payment, lowering monthly payments without changing the interest rate.

Underwriting Criteria

Underwriting criteria for refinancing typically involve a comprehensive credit evaluation, debt-to-income ratio analysis, and property appraisal to reassess loan risk, whereas recasting primarily requires verification of the borrower's payment history and current equity without a full credit reassessment. Refinancing often incurs higher closing costs and stricter qualification standards compared to recasting, which allows borrowers to reduce monthly payments by adjusting the loan principal without triggering extensive underwriting.

Home Equity Optimization

Home equity optimization involves strategically managing your home's value by choosing between refinancing and recasting to lower monthly mortgage payments or reduce loan terms. Refinancing replaces the existing loan with new terms, often lowering interest rates, while recasting adjusts the current mortgage balance after a lump-sum payment, reducing monthly payments without changing the interest rate or loan duration.

Refinancing vs Recasting Infographic

moneydif.com

moneydif.com