Qualified Mortgages (QM) meet strict lending standards set by regulators, including limits on debt-to-income ratios and prohibitions on risky features, ensuring borrowers have the ability to repay. Non-Qualified Mortgages (Non-QM) do not conform to these criteria and often cater to borrowers with unique financial situations, such as self-employed individuals or those with irregular income. Lenders offering Non-QM loans typically charge higher interest rates to offset increased risk associated with these less-regulated loan products.

Table of Comparison

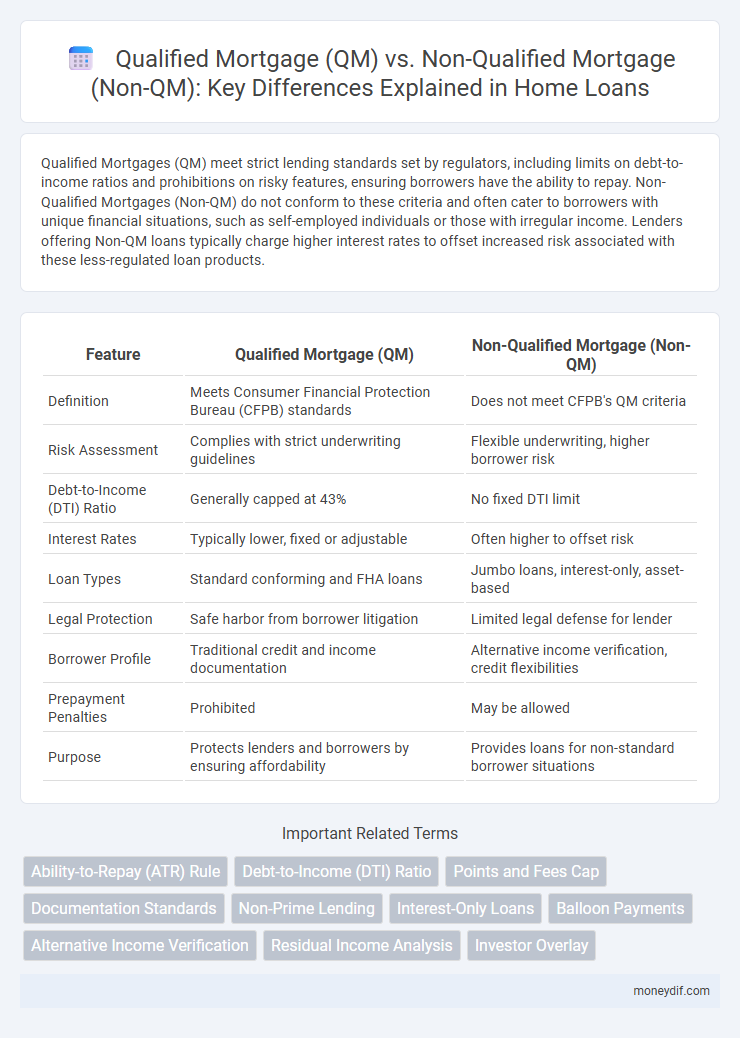

| Feature | Qualified Mortgage (QM) | Non-Qualified Mortgage (Non-QM) |

|---|---|---|

| Definition | Meets Consumer Financial Protection Bureau (CFPB) standards | Does not meet CFPB's QM criteria |

| Risk Assessment | Complies with strict underwriting guidelines | Flexible underwriting, higher borrower risk |

| Debt-to-Income (DTI) Ratio | Generally capped at 43% | No fixed DTI limit |

| Interest Rates | Typically lower, fixed or adjustable | Often higher to offset risk |

| Loan Types | Standard conforming and FHA loans | Jumbo loans, interest-only, asset-based |

| Legal Protection | Safe harbor from borrower litigation | Limited legal defense for lender |

| Borrower Profile | Traditional credit and income documentation | Alternative income verification, credit flexibilities |

| Prepayment Penalties | Prohibited | May be allowed |

| Purpose | Protects lenders and borrowers by ensuring affordability | Provides loans for non-standard borrower situations |

Understanding Qualified Mortgages (QM): Key Features

Qualified Mortgages (QM) are home loans that meet specific regulatory standards designed to reduce borrower risk and ensure affordability, including limits on debt-to-income ratios, documentation requirements, and restrictions on risky loan features like negative amortization. Lenders benefit from QM status because these loans offer legal protections against borrower claims for repayment ability, increasing their attractiveness in the mortgage market. Key features of QMs include predictable payment structures, verified income and assets, and compliance with the Ability-to-Repay rule established by the Consumer Financial Protection Bureau (CFPB).

What Defines a Non-Qualified Mortgage (Non-QM)?

A Non-Qualified Mortgage (Non-QM) is defined by its failure to meet the Consumer Financial Protection Bureau's (CFPB) Qualified Mortgage (QM) criteria, often due to irregular income documentation, higher debt-to-income ratios, or unique loan features like interest-only payments. Non-QM loans cater to borrowers with non-traditional financial situations, self-employed individuals, or those with recent credit events such as bankruptcy or foreclosure. These loans typically carry higher interest rates to offset increased lender risk and less regulatory protection compared to QM loans.

QM vs Non-QM: Major Differences Explained

Qualified Mortgage (QM) loans adhere to strict regulatory standards, including limitations on debt-to-income ratios, loan features, and borrower ability to repay, providing lenders with legal protection from certain lawsuits. Non-Qualified Mortgage (Non-QM) loans do not meet these criteria and often serve borrowers with unique financial situations, such as self-employed individuals or those with irregular income, typically featuring higher interest rates and less standardized terms. The primary differences lie in risk tolerance, documentation requirements, and borrower eligibility, impacting loan approval processes and cost structures.

Credit Requirements for QM and Non-QM Loans

Qualified Mortgages (QM) require borrowers to meet strict credit score thresholds, typically a minimum FICO score of 620, ensuring lower risk profiles and compliance with the Ability-to-Repay rule. Non-Qualified Mortgages (Non-QM) offer more flexible credit criteria, accommodating borrowers with lower credit scores, recent credit events like bankruptcies, or non-traditional income documentation. Lenders assess debt-to-income ratio rigorously in QM loans, generally not exceeding 43%, whereas Non-QM loans may accept higher ratios or alternative credit evaluations to broaden access.

Documentation and Income Verification: QM vs Non-QM

Qualified Mortgages (QM) require stringent documentation and thorough income verification to ensure borrower ability to repay, typically involving verified pay stubs, tax returns, and credit reports. Non-Qualified Mortgages (Non-QM) offer more flexible income verification methods, accommodating self-employed borrowers or those with irregular income through alternative documentation like bank statements or asset depletion calculations. Lenders assess risk more rigorously in QM loans due to standardized guidelines, while Non-QM loans rely on customized underwriting criteria.

Interest Rates and Loan Terms: Comparing QM and Non-QM Mortgages

Qualified Mortgages (QM) typically offer lower interest rates due to their adherence to strict underwriting standards and regulatory protections, whereas Non-Qualified Mortgages (Non-QM) often carry higher rates reflecting increased risk and flexible criteria. Loan terms for QM loans usually include fixed or adjustable rates with standardized duration limits, commonly 15 to 30 years, while Non-QM loans may feature unconventional terms such as interest-only payments or extended amortization schedules. Borrowers seeking stable, predictable payments often prefer QM, whereas Non-QM suits those with unique financial situations needing customized loan structures.

Who Should Consider a Qualified Mortgage?

Borrowers with stable income and low debt-to-income ratios should consider a Qualified Mortgage (QM) for its standardized underwriting criteria and strong legal protections. QM loans are ideal for first-time homebuyers, self-employed individuals with consistent earnings, and those seeking predictable loan terms and lower risk of foreclosure. Mortgage lenders often prefer QM loans due to their clear compliance with the Ability-to-Repay rule, making them safer options for both borrowers and financial institutions.

When is a Non-Qualified Mortgage the Better Option?

Non-Qualified Mortgages (Non-QM) are often the better option for borrowers with unique financial situations such as self-employment income, inconsistent earnings, or high debt-to-income ratios that disqualify them from Qualified Mortgage (QM) standards. Non-QM loans provide flexibility in income verification and underwriting criteria, enabling approval when traditional QM guidelines are too restrictive. Lenders catering to Non-QM loans assess risk through alternative methods, which can be advantageous for borrowers needing customized loan structures or higher loan amounts beyond QM limits.

Risks and Protections: QM vs Non-QM Borrowers

Qualified Mortgages (QM) offer stronger borrower protections through standardized underwriting criteria and reduced risk of loan default, making lenders less vulnerable to litigation under the Ability-to-Repay rule. Non-Qualified Mortgages (Non-QM) carry higher risks due to less stringent documentation and credit requirements, increasing the likelihood of borrower default and potential financial loss for lenders. Borrowers with Non-QM loans face greater uncertainty and fewer regulatory safeguards, which can result in higher interest rates and limited refinancing options compared to QM borrowers.

The Future of QM and Non-QM Mortgages in the Housing Market

The future of Qualified Mortgage (QM) and Non-Qualified Mortgage (Non-QM) loans hinges on evolving regulatory frameworks and shifting borrower demographics, with QM preserving its reputation for safety and standardized underwriting criteria. Non-QM mortgages are gaining traction by addressing niche markets such as self-employed borrowers and those with non-traditional income, catering to the demand for broader credit access beyond conventional QM parameters. Technological advancements and data analytics will further drive innovation in loan underwriting, potentially narrowing the gap between QM reliability and Non-QM flexibility in the housing market.

Important Terms

Ability-to-Repay (ATR) Rule

The Ability-to-Repay (ATR) Rule requires lenders to verify a borrower's capacity to repay a loan by evaluating income, assets, employment status, credit history, and debt obligations. Qualified Mortgages (QM) comply with ATR standards and offer legal protections to lenders, while Non-Qualified Mortgages (Non-QM) do not meet these criteria, potentially resulting in higher risk and fewer consumer safeguards.

Debt-to-Income (DTI) Ratio

The Debt-to-Income (DTI) ratio is a critical metric used to determine borrower eligibility, with Qualified Mortgages (QM) typically requiring a DTI at or below 43%, ensuring the borrower's ability to repay. Non-Qualified Mortgages (Non-QM) allow for higher DTI ratios, offering flexibility for borrowers with unique financial situations but often come with higher interest rates and stricter underwriting standards.

Points and Fees Cap

The Points and Fees Cap for Qualified Mortgages (QM) is generally set at 3% of the loan amount, limiting borrower costs to ensure affordability and reduce default risk, while Non-Qualified Mortgages (Non-QM) often exceed this limit due to higher risk profiles and less stringent lending standards. QM loans must adhere to these caps to receive Safe Harbor protection under the Ability-to-Repay rule, whereas Non-QM loans may not qualify, potentially increasing lender liability and borrower costs.

Documentation Standards

Documentation standards for Qualified Mortgage (QM) loans emphasize verified income, assets, and debt-to-income ratios to ensure borrower ability to repay, aligning with Consumer Financial Protection Bureau (CFPB) guidelines. Non-Qualified Mortgage (Non-QM) loans allow more flexible documentation, often accepting alternative income verification methods, catering to self-employed individuals or borrowers with non-traditional financial profiles.

Non-Prime Lending

Non-Prime Lending often involves Non-Qualified Mortgages (Non-QM), which cater to borrowers with unique financial profiles that do not meet the strict criteria of Qualified Mortgages (QM). While QM loans provide standardized guidelines and protections under the Ability-to-Repay rule, Non-QM loans offer greater flexibility in underwriting, accommodating higher debt-to-income ratios, alternative income verification, and credit challenges.

Interest-Only Loans

Interest-only loans typically do not meet the stricter debt-to-income (DTI) ratio and repayment standards required by Qualified Mortgage (QM) rules, categorizing many as Non-Qualified Mortgages (Non-QM). Non-QM loans offer more flexible terms, including interest-only payment options, catering to borrowers with unique financial profiles that fall outside QM guidelines.

Balloon Payments

Balloon payments in Qualified Mortgages (QM) are generally restricted, ensuring borrowers avoid sudden repayment shocks, whereas Non-Qualified Mortgages (Non-QM) often permit balloon payments, catering to borrowers with unique financial situations or irregular income streams. Lenders offering Non-QM loans incorporate balloon payments to balance risk while providing flexible loan terms unavailable in strict QM guidelines.

Alternative Income Verification

Alternative income verification methods, such as bank statement analysis and profit-and-loss statements, are increasingly used in Non-Qualified Mortgage (Non-QM) loans to assess borrower capacity when traditional documentation is insufficient or unavailable. Qualified Mortgage (QM) loans generally require standard income verification like W-2s and tax returns, ensuring compliance with Consumer Financial Protection Bureau (CFPB) guidelines that limit risk for lenders and borrowers.

Residual Income Analysis

Residual Income Analysis assesses a borrower's capacity to cover living expenses after debt obligations, crucial for distinguishing Qualified Mortgage (QM) loans, which meet Consumer Financial Protection Bureau standards, from Non-Qualified Mortgage (Non-QM) loans that do not fully comply. QM loans typically require stricter residual income thresholds to ensure affordability and reduce default risk, whereas Non-QM loans allow more flexible residual income guidelines to accommodate borrowers with unique financial profiles.

Investor Overlay

Investor overlay policies impose stricter lending criteria on Qualified Mortgage (QM) loans compared to Non-Qualified Mortgage (Non-QM) loans, often requiring higher credit scores and lower debt-to-income ratios to mitigate risk. These overlays impact loan approval rates and investor risk profiles by adding layers beyond standard QM and Non-QM regulatory requirements, influencing liquidity and portfolio diversification.

Qualified Mortgage (QM) vs Non-Qualified Mortgage (Non-QM) Infographic

moneydif.com

moneydif.com