Interest-only mortgages require borrowers to pay only the interest on the loan for a set period, resulting in lower initial monthly payments but no reduction in the principal balance. Principal-and-interest mortgages involve payments that cover both the interest and a portion of the loan principal, gradually reducing the debt over time. Choosing between these options depends on financial goals, cash flow needs, and long-term affordability.

Table of Comparison

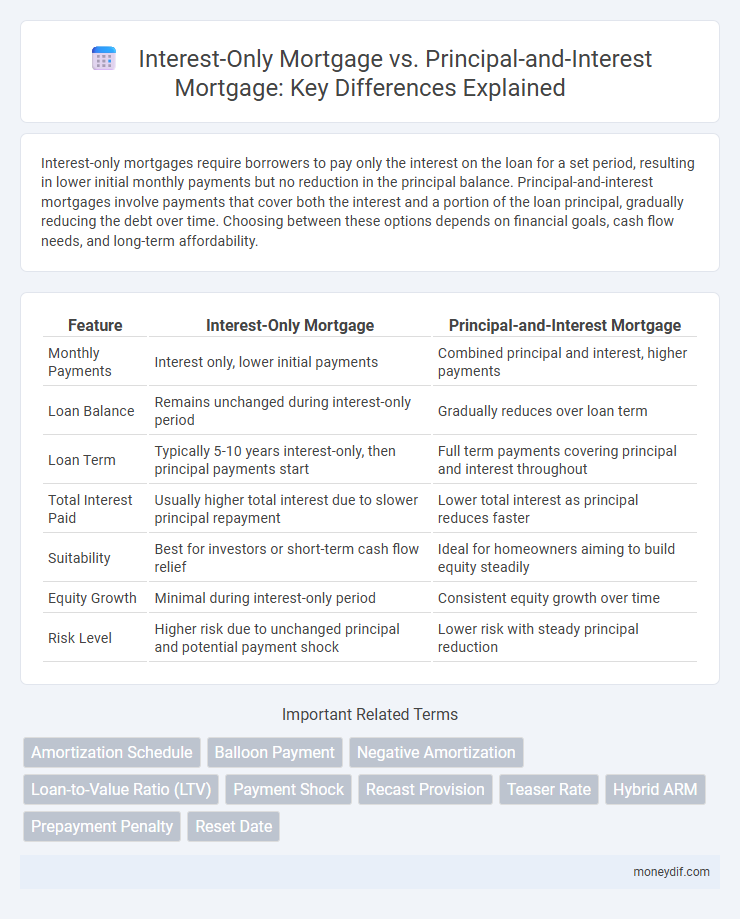

| Feature | Interest-Only Mortgage | Principal-and-Interest Mortgage |

|---|---|---|

| Monthly Payments | Interest only, lower initial payments | Combined principal and interest, higher payments |

| Loan Balance | Remains unchanged during interest-only period | Gradually reduces over loan term |

| Loan Term | Typically 5-10 years interest-only, then principal payments start | Full term payments covering principal and interest throughout |

| Total Interest Paid | Usually higher total interest due to slower principal repayment | Lower total interest as principal reduces faster |

| Suitability | Best for investors or short-term cash flow relief | Ideal for homeowners aiming to build equity steadily |

| Equity Growth | Minimal during interest-only period | Consistent equity growth over time |

| Risk Level | Higher risk due to unchanged principal and potential payment shock | Lower risk with steady principal reduction |

Overview of Interest-Only vs Principal-and-Interest Mortgages

Interest-only mortgages require borrowers to pay only the interest for a set period, resulting in lower monthly payments but no reduction in the principal balance during that time. Principal-and-interest mortgages involve monthly payments that cover both the loan's principal and accrued interest, gradually reducing the loan balance and building equity. Choosing between these mortgage types impacts long-term financial planning, loan amortization, and total interest paid over the life of the loan.

How Interest-Only Mortgages Work

Interest-only mortgages require borrowers to pay only the interest portion of the loan for a fixed period, typically 5 to 10 years, without reducing the principal balance. During this interest-only period, monthly payments are lower compared to principal-and-interest mortgages, which cover both interest and principal repayment from the start. After the interest-only term ends, borrowers must either begin paying principal and interest or refinance, potentially resulting in higher monthly payments.

How Principal-and-Interest Mortgages Work

Principal-and-interest mortgages require regular payments that cover both the loan principal and the accrued interest, steadily reducing the outstanding balance over time. Each payment decreases the loan amount, which lowers future interest charges and builds home equity progressively. This structure ensures full repayment of the mortgage by the end of the loan term, providing financial predictability and potential cost savings compared to interest-only options.

Key Differences Between Interest-Only and Principal-and-Interest Loans

Interest-only mortgages require borrowers to pay only the interest for a set period, resulting in lower initial monthly payments but no reduction in principal balance. Principal-and-interest loans involve monthly payments that cover both interest and principal, gradually reducing the loan balance over time. The key difference lies in payment structure: interest-only loans maintain a constant principal, while principal-and-interest loans build equity through consistent principal repayment.

Pros and Cons of Interest-Only Mortgages

Interest-only mortgages offer lower initial monthly payments since borrowers pay only interest for a set period, providing short-term cash flow flexibility but not reducing the loan principal. This type of mortgage can be beneficial for investors seeking to maximize cash flow or individuals expecting increased income before principal repayment begins. However, the main drawbacks include no equity buildup during the interest-only term and potentially higher payments later, increasing the risk of payment shock and negative amortization if the principal is not adequately managed.

Pros and Cons of Principal-and-Interest Mortgages

Principal-and-interest mortgages provide consistent monthly payments that gradually reduce the loan balance, building home equity over time. Borrowers benefit from the financial discipline of paying down both principal and interest, which can lead to full ownership by the end of the loan term. However, monthly payments tend to be higher compared to interest-only options, requiring a stronger short-term budget commitment.

Financial Impact: Monthly Repayments Comparison

Interest-only mortgages require borrowers to pay only the interest accrued each month, resulting in lower monthly repayments compared to principal-and-interest mortgages where payments cover both interest and the loan principal. Over the loan term, principal-and-interest repayments lead to building equity by reducing the loan balance, while interest-only payments do not decrease the principal, potentially increasing overall interest costs. Borrowers choosing interest-only options may face higher future financial burdens when principal repayments begin, impacting long-term financial planning and affordability.

Long-Term Costs and Risks of Each Mortgage Type

Interest-only mortgages often result in higher long-term costs due to unpaid principal accumulating over time, leading to larger repayments when the interest-only period ends. Principal-and-interest mortgages reduce the principal gradually, lowering overall interest paid and building equity, which mitigates financial risk. Borrowers with interest-only loans face increased risk of negative equity and payment shock, while principal-and-interest loans provide financial stability through consistent amortization.

Who Should Consider Interest-Only vs Principal-and-Interest Loans

Interest-only mortgages suit borrowers with irregular income, such as investors or professionals expecting higher future earnings, allowing lower initial payments focused on interest. Principal-and-interest loans benefit those seeking steady equity growth and predictable repayments, ideal for first-time homebuyers or risk-averse individuals. Homeowners prioritizing long-term financial stability often opt for principal-and-interest options, while investors valuing cash flow flexibility lean toward interest-only plans.

Making the Right Mortgage Choice for Your Financial Goals

Choosing between an interest-only mortgage and a principal-and-interest mortgage depends on your financial goals and cash flow situation. Interest-only mortgages offer lower initial payments, ideal for investors seeking short-term cash flow relief or those expecting increased income later. Principal-and-interest mortgages build home equity faster and provide long-term financial stability, making them suitable for homeowners prioritizing wealth accumulation and loan repayment.

Important Terms

Amortization Schedule

An amortization schedule for an interest-only mortgage shows payments covering only interest until principal repayment begins, whereas a principal-and-interest mortgage schedule gradually reduces the loan balance by combining both principal and interest payments from the start.

Balloon Payment

A balloon payment in an interest-only mortgage occurs when the initial loan term ends without principal reduction, requiring a large lump sum payment, unlike in principal-and-interest mortgages where regular payments gradually reduce both interest and principal.

Negative Amortization

Negative amortization occurs in interest-only mortgages when unpaid interest is added to the loan balance, unlike principal-and-interest mortgages where monthly payments reduce both principal and interest, preventing loan balance growth.

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) significantly impacts interest rates and approval chances, with interest-only mortgages typically allowing higher LTVs compared to principal-and-interest mortgages due to differing risk profiles.

Payment Shock

Payment shock occurs when transitioning from an interest-only mortgage to a principal-and-interest mortgage, causing a significant increase in monthly payments as borrowers start repaying both principal and interest.

Recast Provision

A recast provision allows borrowers with principal-and-interest mortgages to reduce monthly payments by recalculating amortization after a large payment, which is generally unavailable for interest-only mortgages.

Teaser Rate

Teaser rates on interest-only mortgages offer temporarily low monthly payments by charging interest only for an initial period, often attracting borrowers seeking lower short-term costs. Principal-and-interest mortgages require consistent payments covering both principal and interest from the start, leading to higher initial payments but greater loan amortization and long-term equity growth.

Hybrid ARM

Hybrid ARM loans combine fixed-rate periods with adjustable rates, offering lower initial payments compared to Principal-and-Interest mortgages but differ from Interest-Only mortgages by requiring principal repayment after the fixed phase ends.

Prepayment Penalty

Prepayment penalties are more common in interest-only mortgages than principal-and-interest mortgages, as lenders seek to recover expected interest income lost when borrowers repay principal early.

Reset Date

The reset date in an Interest-Only Mortgage marks when borrowers must begin repaying the principal, contrasting with Principal-and-Interest Mortgages where regular payments include both interest and principal from the start. This reset can significantly impact monthly repayment amounts and overall loan duration.

Interest-Only Mortgage vs Principal-and-Interest Mortgage Infographic

moneydif.com

moneydif.com