Warehouse lending provides short-term financing to mortgage lenders, allowing them to fund loans before selling them to investors, while correspondent lending involves mortgage lenders originating and funding loans using their own capital before selling the closed loans to larger financial institutions. Warehouse lines enable lenders to rapidly close multiple loans without needing substantial upfront capital, whereas correspondent lending requires more capital but offers greater control over loan terms and customer relationships. Understanding the differences between these financing methods helps mortgage lenders optimize liquidity management and operational efficiency.

Table of Comparison

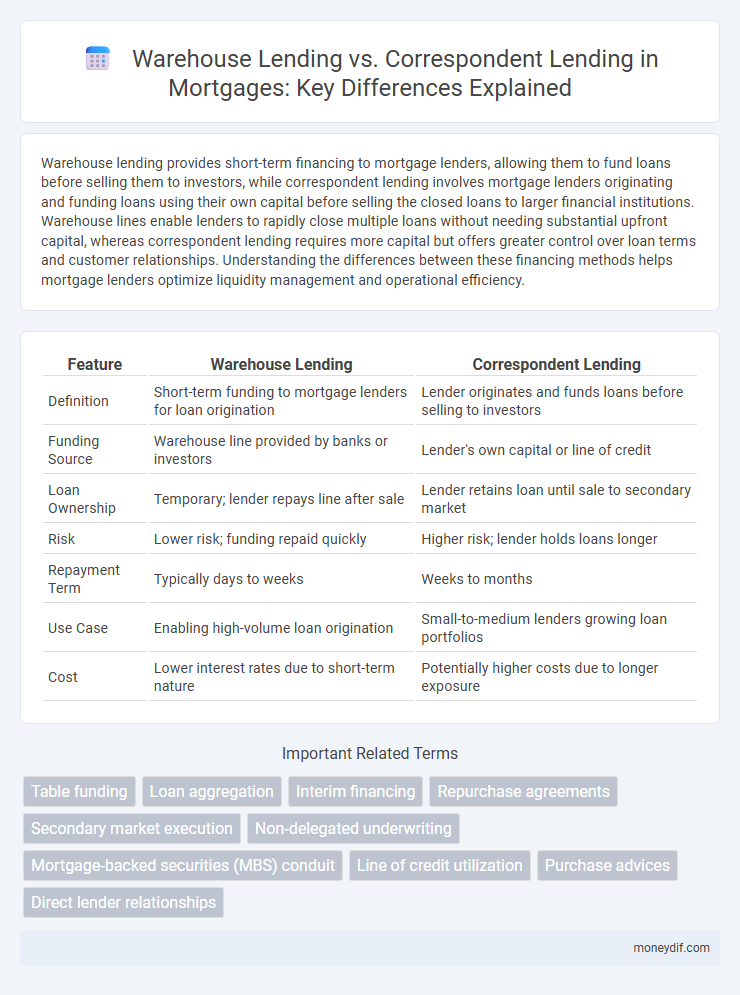

| Feature | Warehouse Lending | Correspondent Lending |

|---|---|---|

| Definition | Short-term funding to mortgage lenders for loan origination | Lender originates and funds loans before selling to investors |

| Funding Source | Warehouse line provided by banks or investors | Lender's own capital or line of credit |

| Loan Ownership | Temporary; lender repays line after sale | Lender retains loan until sale to secondary market |

| Risk | Lower risk; funding repaid quickly | Higher risk; lender holds loans longer |

| Repayment Term | Typically days to weeks | Weeks to months |

| Use Case | Enabling high-volume loan origination | Small-to-medium lenders growing loan portfolios |

| Cost | Lower interest rates due to short-term nature | Potentially higher costs due to longer exposure |

Understanding Warehouse Lending in Mortgages

Warehouse lending in mortgages involves short-term financing that allows mortgage lenders to fund loans while they are being processed before selling them to investors. This type of lending helps maintain liquidity, enabling lenders to originate more loans without using their own capital. Unlike correspondent lending, where lenders fund loans permanently and then sell them, warehouse lines are revolving credit facilities that facilitate continuous loan production.

What Is Correspondent Lending?

Correspondent lending involves mortgage lenders originating and funding loans using their own resources before selling them to larger investors or institutions. This model allows lenders to maintain direct control over the loan process and customer interaction while leveraging secondary market capital. Key benefits include faster loan processing times and increased flexibility in underwriting standards.

Key Differences: Warehouse Lending vs Correspondent Lending

Warehouse lending involves short-term funding that mortgage lenders use to finance loans until they are sold to investors, while correspondent lending entails mortgage companies originating and funding loans using their own capital before selling them. Warehouse lines provide liquidity for loan production but require ongoing loan sales to replenish funds, whereas correspondent lending allows for greater control over loan terms and underwriting standards. Key differences include the risk exposure, funding source, and operational flexibility inherent in each lending model.

Advantages of Warehouse Lending

Warehouse lending offers mortgage lenders increased liquidity by providing short-term funding to fund loans before selling them to investors, enabling faster loan processing and closing times. It reduces reliance on the lender's capital, allowing for higher loan volume and better cash flow management. This type of lending enhances operational efficiency and scale, facilitating competitive mortgage offerings in a fluctuating market.

Benefits of Correspondent Lending

Correspondent lending offers mortgage brokers access to a wider variety of loan products and faster funding times due to established relationships with multiple investors. This lending model allows for greater control over loan underwriting and processing, resulting in higher approval rates and customized loan solutions. Correspondent lending also enables lenders to retain servicing rights, creating ongoing revenue streams and stronger client relationships.

Risks and Challenges in Warehouse Lending

Warehouse lending in mortgage finance presents significant risks including market volatility, borrower default, and liquidity challenges that can impact the lender's ability to release funds promptly. The short-term nature of warehouse lines requires stringent monitoring to mitigate exposure to interest rate fluctuations and changes in borrower creditworthiness. Unlike correspondent lending, warehouse lending demands robust risk management frameworks to address funding delays and regulatory compliance complexities.

Common Obstacles in Correspondent Lending

Correspondent lending often faces common obstacles such as stringent underwriting guidelines that can delay loan approvals and reduce flexibility compared to warehouse lending. Liquidity constraints and reliance on third-party investor approvals further complicate the process, increasing the risk of funding delays. These challenges can hinder efficient loan pipeline management and impact the overall profitability for mortgage lenders.

How Warehouse Lending Impacts Mortgage Originators

Warehouse lending provides mortgage originators with a short-term line of credit to fund multiple loans before selling them to investors, enhancing liquidity and operational capacity. This financing method allows originators to close loans quickly without waiting for full investor funding, improving turnaround times and competitiveness. Efficient warehouse lending reduces funding delays and supports higher loan volume, directly impacting an originator's ability to scale and maintain cash flow stability.

Choosing Between Warehouse and Correspondent Lending

Choosing between warehouse lending and correspondent lending depends on a lender's capital structure and funding strategy. Warehouse lending offers short-term financing by allowing lenders to fund multiple loans before selling them to investors, enhancing liquidity and operational flexibility. Correspondent lending involves purchasing completed loans from other lenders, enabling quicker inventory acquisition without the need for extensive funding lines.

Industry Trends: Warehouse vs Correspondent Lending

Warehouse lending continues to dominate mortgage financing by providing short-term capital to fund loans before they are sold on the secondary market, reflecting a preference for flexibility and scalable liquidity among lenders. Correspondent lending, though more reliant on originating and funding loans with own funds before selling, is seeing targeted growth in niche markets emphasizing rapid loan delivery and borrower customization. Current industry trends highlight a shift toward hybrid models combining warehouse and correspondent strategies to optimize capital efficiency and streamline loan fulfillment processes.

Important Terms

Table funding

Table funding enables warehouse lending by allowing lenders to fund loans off their balance sheet quickly, providing flexibility and liquidity. In contrast, correspondent lending involves a lender originating and closing loans before selling them to investors, often relying on table funding to transfer funds efficiently.

Loan aggregation

Loan aggregation platforms streamline the process of warehouse lending by consolidating multiple short-term loans used to finance mortgage originations before securitization or sale. Correspondent lending involves loan originators funding loans with their own capital and later selling the aggregated loans to investors or larger institutions, relying on warehouse lines to bridge funding gaps during this process.

Interim financing

Interim financing in warehouse lending provides short-term capital enabling mortgage lenders to fund loans before selling them in the secondary market, optimizing cash flow and reducing risk exposure. In contrast, correspondent lending relies on funding loans with the lender's own capital before delivering them to investors, requiring stronger balance sheet capacity and slower liquidity turnover.

Repurchase agreements

Repurchase agreements (repos) serve as short-term financing tools in warehouse lending, enabling lenders to provide liquidity by selling and agreeing to repurchase collateral, often mortgages, within a set timeframe. In correspondent lending, repos are less commonly used as funding primarily relies on overnight advances or secondary market sales, focusing on maintaining capital efficiency without relying on collateral repurchase contracts.

Secondary market execution

Secondary market execution in warehouse lending involves the rapid sale or securitization of originated loans to replenish funds for new loan originations, optimizing liquidity and minimizing interest rate risk. In correspondent lending, secondary market execution focuses on the delivery and sale of closed loans to investors, streamlining funding cycles and enabling lenders to expand origination capacity without retaining long-term loan portfolios.

Non-delegated underwriting

Non-delegated underwriting requires lenders to maintain full control over credit decisions, enhancing risk management in both Warehouse lending and Correspondent lending. In Warehouse lending, this approach mitigates exposure by ensuring strict borrower qualification, while in Correspondent lending, it ensures loan quality before sale to investors.

Mortgage-backed securities (MBS) conduit

Mortgage-backed securities (MBS) conduits facilitate liquidity by pooling mortgage loans funded through warehouse lending, where lenders use short-term credit lines to finance loan acquisition before securitization. Correspondent lending involves smaller lenders originating mortgages and selling them to larger institutions, which then aggregate these loans into MBS conduits for capital market distribution.

Line of credit utilization

Line of credit utilization in warehouse lending typically reflects short-term borrowing to fund mortgage originations, with lenders drawing down and paying off advances frequently, resulting in higher utilization rates. Correspondent lending often shows lower line of credit utilization as loans are purchased upfront with available funds rather than relying extensively on credit lines for interim financing.

Purchase advices

Warehouse lending offers short-term financing options for mortgage lenders to fund multiple loans simultaneously, enhancing liquidity and operational flexibility. Correspondent lending involves purchasing loans directly from smaller lenders, allowing investors to expand their loan portfolios while mitigating risk through immediate loan sale and servicing transfer.

Direct lender relationships

Direct lender relationships in warehouse lending involve financial institutions providing short-term funding lines to mortgage originators for loan inventory, enhancing liquidity and enabling faster loan closings. In correspondent lending, direct lender partnerships focus on bulk loan purchases where lenders immediately sell loans to investors, optimizing capital turnover and reducing long-term exposure.

Warehouse lending vs Correspondent lending Infographic

moneydif.com

moneydif.com