The due-on-sale clause allows lenders to demand full repayment of a mortgage when the property is sold or transferred, preventing the new owner from assuming the existing loan. The acceleration clause permits the lender to require immediate payment of the entire loan balance if the borrower defaults or breaches specific terms. Understanding these clauses is crucial for homeowners to avoid unexpected financial obligations and maintain control over their mortgage terms.

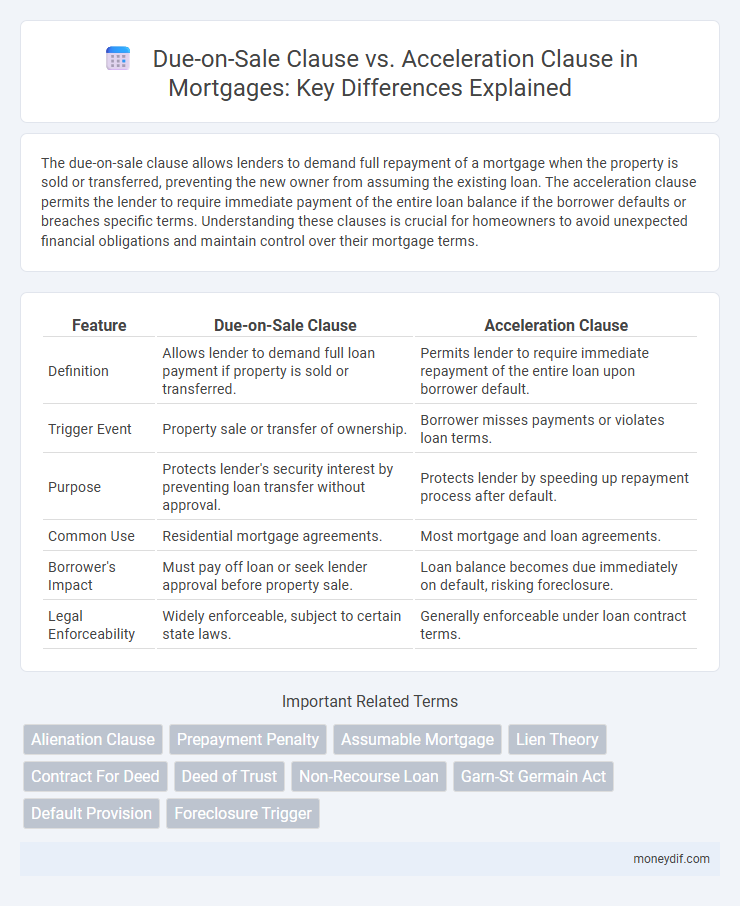

Table of Comparison

| Feature | Due-on-Sale Clause | Acceleration Clause |

|---|---|---|

| Definition | Allows lender to demand full loan payment if property is sold or transferred. | Permits lender to require immediate repayment of the entire loan upon borrower default. |

| Trigger Event | Property sale or transfer of ownership. | Borrower misses payments or violates loan terms. |

| Purpose | Protects lender's security interest by preventing loan transfer without approval. | Protects lender by speeding up repayment process after default. |

| Common Use | Residential mortgage agreements. | Most mortgage and loan agreements. |

| Borrower's Impact | Must pay off loan or seek lender approval before property sale. | Loan balance becomes due immediately on default, risking foreclosure. |

| Legal Enforceability | Widely enforceable, subject to certain state laws. | Generally enforceable under loan contract terms. |

Understanding the Due-on-Sale Clause

The Due-on-Sale Clause allows lenders to demand full loan repayment if the property is sold or transferred without their consent, protecting them from unwanted assumption by a new borrower. This clause ensures that mortgage terms remain intact and prevents unauthorized loan assumptions, maintaining the lender's control over loan conditions. Understanding this clause is critical for homeowners intending to sell or transfer property with an existing mortgage to avoid triggering immediate repayment obligations.

What Is an Acceleration Clause?

An acceleration clause in a mortgage contract allows the lender to demand full repayment of the outstanding loan balance if the borrower defaults or violates specific terms. This clause triggers the immediate due date of the entire debt, rather than continuing with scheduled payments. Unlike the due-on-sale clause, which activates upon property transfer, the acceleration clause enforces payment acceleration primarily due to borrower default.

Key Differences: Due-on-Sale vs Acceleration Clause

The Due-on-Sale Clause requires the borrower to repay the full mortgage balance upon transferring ownership, preventing assumption by a new buyer without lender approval. The Acceleration Clause allows the lender to demand immediate repayment of the entire loan balance if the borrower defaults on payments or violates loan terms. While both protect lenders, the Due-on-Sale Clause triggers upon property sale, whereas the Acceleration Clause activates primarily due to borrower default.

Legal Implications of Each Clause

The Due-on-Sale Clause legally requires full repayment of the mortgage when the property is sold or transferred, preventing unauthorized assumption of the loan and protecting the lender's financial interests. The Acceleration Clause empowers the lender to demand immediate repayment of the entire loan balance upon borrower default, serving as a critical enforcement tool to mitigate risk. Both clauses carry significant legal implications by defining lender rights in foreclosure processes and impacting borrower obligations under the mortgage contract.

How Mortgage Lenders Use Due-on-Sale Clauses

Mortgage lenders utilize due-on-sale clauses to protect their investment by requiring full loan repayment upon property transfer or sale, preventing unauthorized assumption of the mortgage by new owners. This clause strengthens lender control over loan terms and reduces risk associated with borrower creditworthiness changes. Unlike acceleration clauses that demand repayment upon default, due-on-sale clauses specifically address ownership changes, ensuring lenders can promptly adjust or call the loan.

Triggers for Acceleration Clauses in Mortgages

Acceleration clauses in mortgages are triggered primarily when a borrower defaults on loan payments, breaches specific terms like property transfer, or files for bankruptcy. These triggers enable lenders to demand the entire loan balance immediately, safeguarding their financial interest. Understanding these conditions is crucial for borrowers to avoid unexpected repayment demands.

Impact on Homeowners: Clause Comparison

The Due-on-Sale Clause allows lenders to demand full loan repayment if the property is sold or transferred, impacting homeowners by potentially forcing immediate refinancing or sale. In contrast, the Acceleration Clause enables lenders to require the outstanding mortgage balance to be paid in full upon default, significantly increasing financial pressure on homeowners facing missed payments. Both clauses protect lenders but differ in triggering events and consequences for homeowners managing property transfers or financial distress.

Due-on-Sale Clause and Property Transfers

The Due-on-Sale Clause in a mortgage contract allows the lender to demand full repayment of the loan if the property is sold or transferred without their consent, protecting the lender against unauthorized ownership changes. This clause is especially significant during property transfers, ensuring that new owners cannot assume the existing mortgage under its original terms unless approved by the lender. Compared to an Acceleration Clause, which triggers full repayment after borrower default, the Due-on-Sale Clause proactively enforces lending terms upon property transfer events.

Consequences of Clause Violation

Violation of the Due-on-Sale Clause typically triggers immediate loan repayment, forcing the borrower to pay the entire mortgage balance upon transferring property ownership without lender approval. Breaching the Acceleration Clause results in the lender demanding full loan repayment if the borrower defaults on payments or violates terms, accelerating the debt maturity. Both clause violations can lead to foreclosure, severely impacting the borrower's credit and financial stability.

Protecting Yourself: Navigating Mortgage Clauses

Understanding the due-on-sale clause is crucial as it allows lenders to demand full loan repayment if the property is sold or transferred, protecting their investment by preventing unauthorized assumption of the mortgage. The acceleration clause empowers lenders to call the entire loan balance due upon a default, enabling swift action to mitigate losses. Homeowners should carefully review these clauses to navigate mortgage agreements effectively and safeguard their financial interests.

Important Terms

Alienation Clause

The Alienation Clause restricts property transfer by triggering the Due-on-Sale Clause, which accelerates the mortgage payment through the Acceleration Clause upon unauthorized sale or transfer.

Prepayment Penalty

A prepayment penalty is a fee charged by lenders when a borrower pays off a loan early, designed to compensate for lost interest income. The due-on-sale clause triggers full loan repayment upon property transfer, whereas the acceleration clause demands immediate repayment if the borrower defaults, both potentially activating prepayment penalties.

Assumable Mortgage

An assumable mortgage allows a buyer to take over the seller's existing loan, bypassing the due-on-sale clause that typically triggers loan acceleration requiring full repayment upon property transfer.

Lien Theory

Lien theory states that a mortgage creates a lien on the property without transferring title, affecting the enforceability and invocation of due-on-sale clauses that require full loan payment upon transfer, while acceleration clauses allow lenders to demand the entire loan balance if terms are breached.

Contract For Deed

The Contract for Deed often conflicts with the Due-on-Sale Clause, which triggers full loan repayment upon property transfer, unlike the Acceleration Clause that demands immediate loan payoff only after borrower default.

Deed of Trust

A Deed of Trust often contains a due-on-sale clause, which requires full loan repayment if the property is sold or transferred, preventing unauthorized assumption of the mortgage. In contrast, an acceleration clause allows the lender to demand immediate repayment of the entire loan balance if the borrower defaults, enforcing quicker recovery of the debt.

Non-Recourse Loan

A non-recourse loan limits the lender's claim to the collateral without personal liability, making the due-on-sale clause enforceable to prevent property transfer without consent, while the acceleration clause enables immediate loan repayment upon default.

Garn-St Germain Act

The Garn-St Germain Depository Institutions Act of 1982 restricts enforcement of due-on-sale clauses by preventing lenders from accelerating a mortgage solely due to property transfers, thereby limiting acceleration clauses in specific transfer scenarios.

Default Provision

The default provision typically triggers the acceleration clause, allowing the lender to demand full loan repayment if the due-on-sale clause is violated by transferring property ownership without lender approval.

Foreclosure Trigger

A Foreclosure Trigger arises when a borrower violates the Due-on-Sale Clause, which requires full loan repayment if the property is sold or transferred without lender approval. The Acceleration Clause empowers the lender to demand immediate loan repayment upon breach, often preceding foreclosure proceedings.

Due-on-Sale Clause vs Acceleration Clause Infographic

moneydif.com

moneydif.com