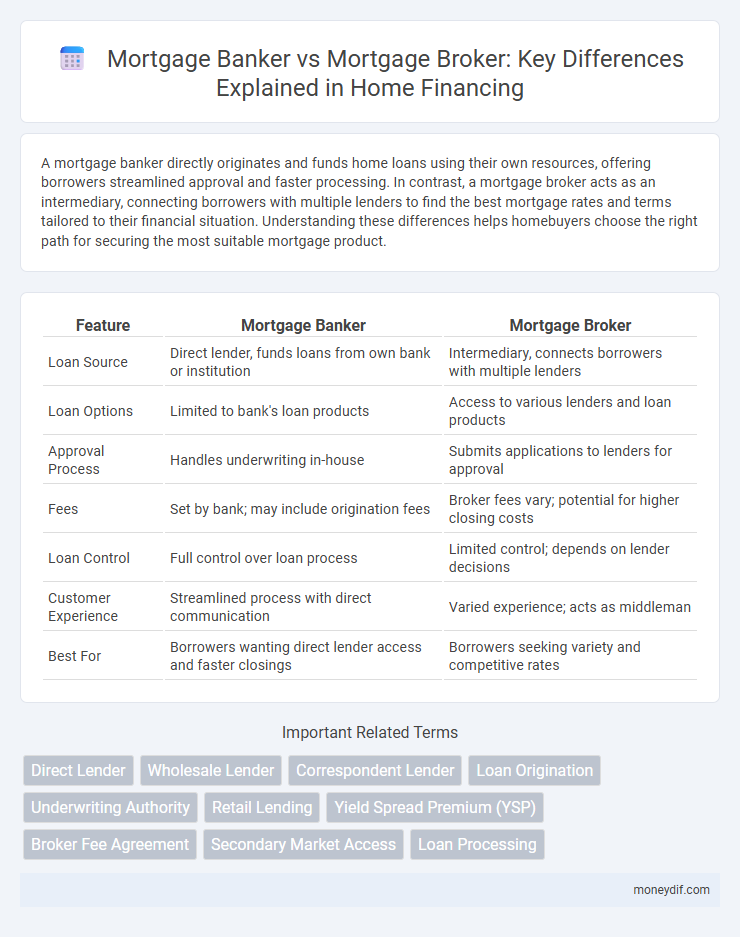

A mortgage banker directly originates and funds home loans using their own resources, offering borrowers streamlined approval and faster processing. In contrast, a mortgage broker acts as an intermediary, connecting borrowers with multiple lenders to find the best mortgage rates and terms tailored to their financial situation. Understanding these differences helps homebuyers choose the right path for securing the most suitable mortgage product.

Table of Comparison

| Feature | Mortgage Banker | Mortgage Broker |

|---|---|---|

| Loan Source | Direct lender, funds loans from own bank or institution | Intermediary, connects borrowers with multiple lenders |

| Loan Options | Limited to bank's loan products | Access to various lenders and loan products |

| Approval Process | Handles underwriting in-house | Submits applications to lenders for approval |

| Fees | Set by bank; may include origination fees | Broker fees vary; potential for higher closing costs |

| Loan Control | Full control over loan process | Limited control; depends on lender decisions |

| Customer Experience | Streamlined process with direct communication | Varied experience; acts as middleman |

| Best For | Borrowers wanting direct lender access and faster closings | Borrowers seeking variety and competitive rates |

Understanding Mortgage Bankers and Mortgage Brokers

Mortgage bankers are financial institutions or individuals that directly fund and service mortgage loans, managing the entire loan process from application to closing. Mortgage brokers act as intermediaries who connect borrowers with multiple lenders, offering a wider range of loan products but do not fund the loans themselves. Understanding the distinct roles, responsibilities, and services of mortgage bankers versus mortgage brokers is crucial for borrowers seeking tailored financing solutions.

Key Roles of a Mortgage Banker

A mortgage banker originates, underwrites, funds, and services loans using its own capital, offering borrowers a streamlined lending process with direct control over loan approval and funding timelines. Unlike mortgage brokers who act as intermediaries between borrowers and multiple lenders, mortgage bankers maintain a portfolio of loans and often retain servicing rights, enhancing control over the loan lifecycle. This key role allows mortgage bankers to provide consistent customer service and potentially lower rates due to reduced reliance on third-party lenders.

What Does a Mortgage Broker Do?

A mortgage broker acts as an intermediary between borrowers and multiple lenders, helping clients find the best mortgage rates and terms tailored to their financial situation. They gather necessary financial documents, submit loan applications, and negotiate terms on behalf of the borrower, streamlining the mortgage approval process. Unlike mortgage bankers who lend directly, brokers provide access to a broader range of loan products from various lenders.

Differences in Loan Approval Processes

Mortgage bankers underwrite and approve loans using their own funds and internal guidelines, providing faster loan approval but limited loan product options. Mortgage brokers act as intermediaries who gather loan applications and submit them to multiple lenders, increasing the variety of loan products but potentially extending the approval timeline. The control over loan approval processes distinguishes mortgage bankers' direct authority from mortgage brokers' role as loan facilitators.

Access to Loan Products: Banker vs Broker

Mortgage bankers have direct access to loan products they underwrite and fund themselves, offering borrowers streamlined application and approval processes. Mortgage brokers connect borrowers with multiple lenders, providing a broader range of loan options but relying on third-party funding and underwriting. This difference affects loan product availability, rates, and terms, impacting borrower choice and flexibility.

Pros and Cons of Working with a Mortgage Banker

Working with a mortgage banker offers streamlined loan processing and faster approval times due to direct lender access and in-house underwriting. However, mortgage bankers typically provide a limited range of loan products, which may restrict options compared to mortgage brokers who shop multiple lenders. Borrowers benefit from consistent communication and potentially lower fees but sacrifice some flexibility in loan terms and competitive rate comparison.

Advantages and Disadvantages of Using a Mortgage Broker

Mortgage brokers offer access to multiple lenders, increasing the chances of securing competitive interest rates and loan options tailored to individual financial situations. They simplify the loan application process by handling paperwork and negotiations, but their fees may add to overall costs and some brokers might prioritize higher commissions over borrower savings. Using a mortgage broker provides convenience and variety, yet borrowers should carefully evaluate broker credentials and loan terms to avoid potential conflicts of interest.

Costs and Fees: Comparing Mortgage Bankers and Brokers

Mortgage bankers typically charge fees directly related to loan origination, which may include application, underwriting, and processing fees, often resulting in higher upfront costs. Mortgage brokers generally earn a commission from lenders, which can lead to lower customer fees but potentially higher overall interest rates. Comparing costs requires evaluating both the transparent fees from bankers and the broker's indirect costs through interest rates to determine the most cost-effective option.

Which Option Is Better for Your Home Loan Needs?

Mortgage bankers directly underwrite and fund loans, providing faster processing and potentially lower fees, while mortgage brokers act as intermediaries connecting borrowers to multiple lenders for a wider range of loan options. Choosing the better option depends on your need for personalized service, loan variety, and competitive rates, with mortgage brokers offering more diversity but potentially higher costs. Understanding the loan terms, interest rates, and closing timelines from each can help you select the ideal path for your home financing goals.

How to Choose Between a Mortgage Banker and Mortgage Broker

Choosing between a mortgage banker and a mortgage broker depends on your preferences for loan options, as mortgage bankers work directly with specific lenders and offer faster processing, while mortgage brokers compare multiple lenders to find competitive rates. Evaluating factors such as interest rates, fees, loan terms, and personalized service is essential to determine which option aligns with your financial goals and timeline. Understanding the differences in application processes and lender relationships helps ensure you select the best mortgage professional for your unique home financing needs.

Important Terms

Direct Lender

Direct lenders, as mortgage bankers, fund loans with their own capital and hold the mortgage on their books, offering faster approval and streamlined communication. Mortgage brokers act as intermediaries, connecting borrowers to multiple lenders without using their own funds, which can provide more loan options but often involves longer processing times.

Wholesale Lender

Wholesale lenders provide mortgage products through mortgage brokers rather than directly to borrowers, offering competitive rates and a wider array of loan options. Mortgage bankers fund and service loans in-house, while mortgage brokers act as intermediaries sourcing loan products from multiple wholesale lenders to find the best fit for clients.

Correspondent Lender

A correspondent lender originates and funds mortgage loans using their own capital before selling them to larger investors, differing from mortgage brokers who act as intermediaries connecting borrowers with multiple lenders without funding the loan themselves. Unlike mortgage bankers who underwrite and service loans, correspondent lenders focus on loan origination and immediate funding but often do not retain servicing rights.

Loan Origination

Loan origination involves the process of applying for and obtaining a mortgage through either a mortgage banker or a mortgage broker, with mortgage bankers directly funding and servicing loans while mortgage brokers act as intermediaries connecting borrowers to multiple lenders. Key differences include mortgage bankers offering in-house loan products with faster processing times, whereas mortgage brokers provide a wider variety of loan options but typically require more steps and coordination.

Underwriting Authority

Mortgage bankers possess underwriting authority, allowing them to evaluate and approve loan applications internally, which expedites the mortgage approval process. In contrast, mortgage brokers act as intermediaries who submit loan applications to external lenders for underwriting, lacking direct authority to approve loans.

Retail Lending

Mortgage bankers originate and fund loans directly, controlling the underwriting process and servicing, while mortgage brokers act as intermediaries, connecting borrowers with multiple lenders to find competitive mortgage options. Retail lending through mortgage bankers often provides faster loan processing and greater pricing stability, whereas mortgage brokers offer broader access to diverse loan products and lender programs.

Yield Spread Premium (YSP)

Yield Spread Premium (YSP) represents the financial incentive paid by lenders to mortgage brokers for originating loans at higher interest rates, whereas mortgage bankers typically generate revenue through direct loan origination and servicing without relying on YSP. Mortgage brokers leverage YSP to enhance their earnings by negotiating interest rates above the lender's par rate, contrasting with mortgage bankers who fund and underwrite loans independently.

Broker Fee Agreement

A Broker Fee Agreement outlines the compensation structure between a mortgage broker and their client, distinct from the fee arrangements typically involved with mortgage bankers who often charge directly for loan services. Mortgage brokers act as intermediaries connecting borrowers with multiple lenders, whereas mortgage bankers fund loans through their own balance sheets, influencing the nature and disclosure of broker fees.

Secondary Market Access

Secondary market access allows mortgage bankers to sell loans directly to investors like Fannie Mae and Freddie Mac, providing faster funding and better pricing options. Mortgage brokers, however, connect borrowers with various lenders but do not hold loans, limiting their influence on secondary market transactions and loan terms.

Loan Processing

Mortgage bankers fund loans directly using their own capital, streamlining the loan processing timeline with in-house underwriting and approvals. Mortgage brokers act as intermediaries, connecting borrowers with multiple lenders to find competitive mortgage rates, but rely on third-party underwriting which can extend loan processing times.

Mortgage Banker vs Mortgage Broker Infographic

moneydif.com

moneydif.com