Open-end mortgages allow borrowers to access additional funds up to a predetermined limit without refinancing, offering flexibility for future financial needs or home improvements. Closed-end mortgages provide a fixed loan amount with set terms and repayment schedules, ideal for borrowers seeking stable monthly payments and predictable loan duration. Choosing between these mortgage types depends on the borrower's financial goals and need for credit access after the initial loan disbursement.

Table of Comparison

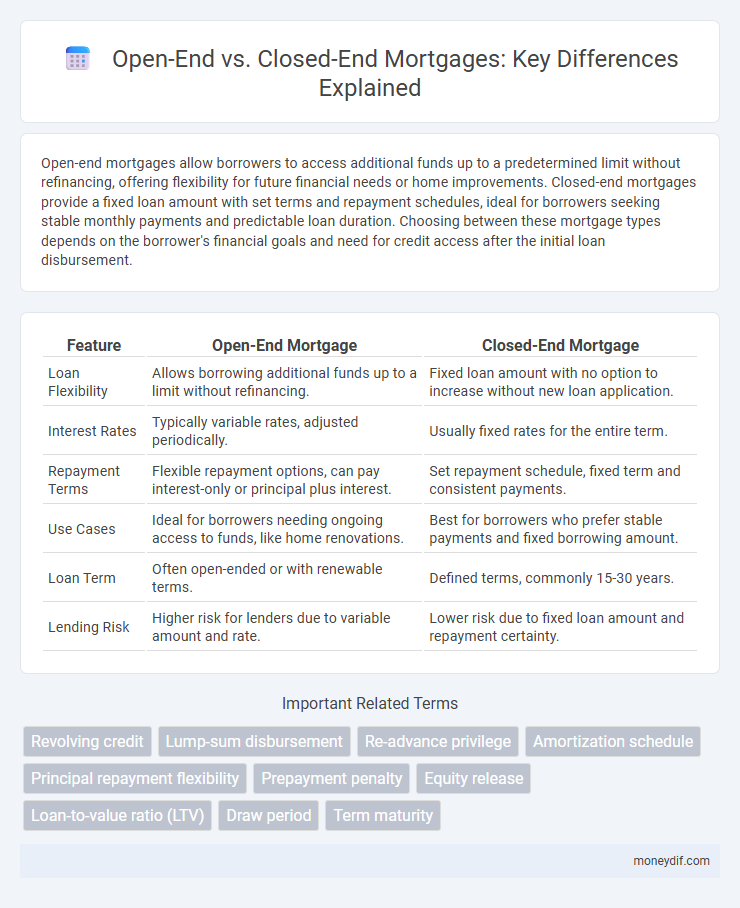

| Feature | Open-End Mortgage | Closed-End Mortgage |

|---|---|---|

| Loan Flexibility | Allows borrowing additional funds up to a limit without refinancing. | Fixed loan amount with no option to increase without new loan application. |

| Interest Rates | Typically variable rates, adjusted periodically. | Usually fixed rates for the entire term. |

| Repayment Terms | Flexible repayment options, can pay interest-only or principal plus interest. | Set repayment schedule, fixed term and consistent payments. |

| Use Cases | Ideal for borrowers needing ongoing access to funds, like home renovations. | Best for borrowers who prefer stable payments and fixed borrowing amount. |

| Loan Term | Often open-ended or with renewable terms. | Defined terms, commonly 15-30 years. |

| Lending Risk | Higher risk for lenders due to variable amount and rate. | Lower risk due to fixed loan amount and repayment certainty. |

Understanding Open-End Mortgages

Open-end mortgages allow borrowers to access additional funds up to a predetermined credit limit without needing to reapply, making them flexible for ongoing expenses like home improvements or debt consolidation. Unlike closed-end mortgages, which provide a lump sum with fixed repayment terms, open-end mortgages function similarly to a revolving credit line tied to the property's equity. Understanding the benefits of open-end mortgages helps homeowners manage cash flow efficiently while leveraging their home's value with adjustable borrowing capacity.

What Is a Closed-End Mortgage?

A closed-end mortgage is a loan with a fixed amount borrowed upfront and a specified repayment schedule over a set term, commonly used for home purchases. Unlike open-end mortgages, it does not allow additional borrowing beyond the original loan amount without refinancing. This type of mortgage offers predictability in monthly payments and interest rates, making it a popular choice for buyers seeking financial stability.

Key Differences Between Open-End and Closed-End Mortgages

Open-end mortgages allow borrowers to access additional funds up to a maximum limit without reapplying, providing flexibility for future borrowing needs, while closed-end mortgages loan a fixed amount with a predetermined repayment schedule and no opportunity for extra borrowing. Open-end loans often function like home equity lines of credit (HELOCs), enabling ongoing withdrawals and repayments, whereas closed-end loans are typically conventional mortgages with set terms. Interest rates on closed-end mortgages are usually fixed or adjustable for the entire loan term, contrasting with the variable rates commonly found on open-end mortgages.

Pros and Cons of Open-End Mortgages

Open-end mortgages offer flexibility by allowing borrowers to increase their loan balance without refinancing, making them ideal for ongoing expenses like home improvements. However, they typically come with higher interest rates and stricter credit requirements compared to closed-end mortgages. Borrowers must carefully manage the risk of fluctuating payments and potential over-borrowing inherent in open-end mortgage agreements.

Advantages and Disadvantages of Closed-End Mortgages

Closed-end mortgages offer the advantage of predictable monthly payments and a fixed repayment schedule, making budgeting easier for borrowers. These loans typically have lower interest rates compared to open-end mortgages, providing cost savings over time. However, closed-end mortgages lack flexibility for additional borrowing, limiting access to extra funds without refinancing.

Common Use Cases for Open-End Mortgages

Open-end mortgages are commonly used for home equity lines of credit (HELOCs), allowing borrowers to access funds up to a credit limit and repay repeatedly without refinancing. They are ideal for ongoing expenses such as home renovations, education, or emergency funds due to their flexibility in borrowing and repayment. This contrasts with closed-end mortgages, which provide a fixed loan amount with a set repayment schedule primarily for purchasing or refinancing property.

When to Choose a Closed-End Mortgage

Choose a closed-end mortgage when you have a fixed borrowing need and prefer predictable monthly payments to manage your budget effectively. Closed-end mortgages are ideal for borrowers purchasing a home or refinancing with a set loan amount and repayment term. This option suits those seeking stability as repayment terms and interest rates remain constant throughout the loan duration.

Eligibility Requirements for Both Mortgage Types

Open-end mortgages typically require borrowers to have a strong credit score, steady income, and sufficient home equity to access future credit increases, making them suitable for those needing flexible borrowing options. Closed-end mortgages demand rigorous eligibility criteria, including consistent income verification, excellent credit history, and sufficient down payment, as the loan amount is fixed and fully disbursed at closing. Both mortgage types require thorough appraisal and debt-to-income ratio analysis to ensure borrowers' ability to repay.

Open-End vs Closed-End Mortgage: Which Is Right for You?

Open-End Mortgages offer flexible borrowing, allowing homeowners to access additional funds up to a predetermined limit without refinancing, ideal for those anticipating future expenses or renovations. Closed-End Mortgages provide a fixed loan amount with set terms and repayment schedules, offering predictability and potentially lower interest rates, suitable for buyers with one-time property purchases. Choosing between Open-End and Closed-End Mortgages depends on financial needs, future borrowing plans, and risk tolerance regarding interest rate fluctuations.

Frequently Asked Questions about Open-End and Closed-End Mortgages

Open-end mortgages allow borrowers to repeatedly borrow up to a maximum credit limit without refinancing, providing flexibility for future funding needs, while closed-end mortgages involve a fixed loan amount disbursed once with no additional borrowing. Frequently asked questions often cover differences in repayment terms, interest rates, and eligibility criteria between these two mortgage types. Borrowers typically inquire about how open-end mortgages adjust credit limits and how closed-end mortgages impact monthly payments and loan amortization schedules.

Important Terms

Revolving credit

Revolving credit allows borrowers to repeatedly draw, repay, and redraw funds up to a credit limit, while open-end mortgages provide similar flexible borrowing linked to home equity, unlike closed-end mortgages which involve a fixed loan amount with a set repayment schedule.

Lump-sum disbursement

Lump-sum disbursement in closed-end mortgages involves a fixed loan amount repaid over a set term, whereas open-end mortgages allow multiple lump-sum withdrawals up to a credit limit with flexible repayment options.

Re-advance privilege

Re-advance privilege allows borrowers with an Open-End Mortgage to access previously repaid principal without refinancing, enhancing financial flexibility. Closed-End Mortgages lack this feature, requiring full refinancing to borrow additional funds after the initial loan is paid down.

Amortization schedule

An amortization schedule for an open-end mortgage shows variable payments as borrowers can increase their loan balance, while a closed-end mortgage's fixed amortization schedule reflects consistent principal and interest payments over the loan term. Understanding these differences helps homeowners manage cash flow and long-term financial planning effectively.

Principal repayment flexibility

Open-end mortgages offer principal repayment flexibility by allowing borrowers to repay and re-borrow funds up to a credit limit, whereas closed-end mortgages require fixed principal payments without the option to re-borrow.

Prepayment penalty

Prepayment penalties are more commonly associated with closed-end mortgages, where borrowers face fees for paying off the loan early, whereas open-end mortgages typically allow flexible repayments without such penalties.

Equity release

Open-end mortgages allow borrowers to access additional funds up to a credit limit after the initial loan, making them ideal for flexible equity release, while closed-end mortgages provide a fixed loan amount disbursed once, requiring full repayment upon maturity.

Loan-to-value ratio (LTV)

The loan-to-value ratio (LTV) for open-end mortgages typically fluctuates as borrowers access additional funds against home equity, while closed-end mortgages maintain a fixed LTV based on the original loan amount.

Draw period

The draw period in an open-end mortgage allows borrowers to access additional funds up to a credit limit, unlike closed-end mortgages which provide a fixed loan amount with no option for future draws.

Term maturity

Term maturity in open-end mortgages allows flexible borrowing up to a credit limit without fixed repayment schedules, whereas closed-end mortgages have a fixed term maturity with set principal and interest payments.

Open-End Mortgage vs Closed-End Mortgage Infographic

moneydif.com

moneydif.com