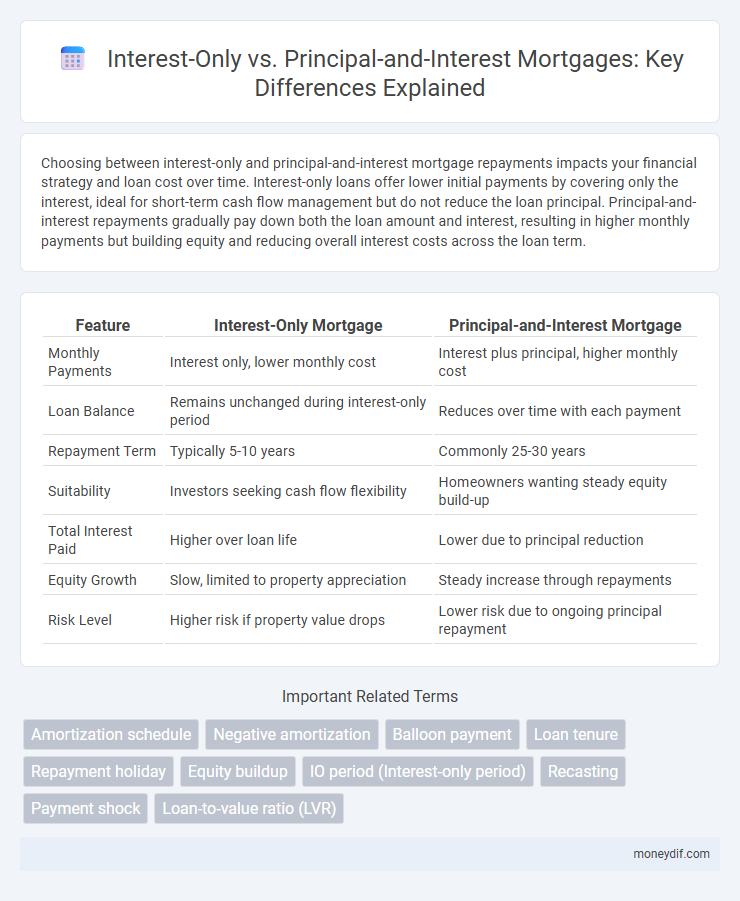

Choosing between interest-only and principal-and-interest mortgage repayments impacts your financial strategy and loan cost over time. Interest-only loans offer lower initial payments by covering only the interest, ideal for short-term cash flow management but do not reduce the loan principal. Principal-and-interest repayments gradually pay down both the loan amount and interest, resulting in higher monthly payments but building equity and reducing overall interest costs across the loan term.

Table of Comparison

| Feature | Interest-Only Mortgage | Principal-and-Interest Mortgage |

|---|---|---|

| Monthly Payments | Interest only, lower monthly cost | Interest plus principal, higher monthly cost |

| Loan Balance | Remains unchanged during interest-only period | Reduces over time with each payment |

| Repayment Term | Typically 5-10 years | Commonly 25-30 years |

| Suitability | Investors seeking cash flow flexibility | Homeowners wanting steady equity build-up |

| Total Interest Paid | Higher over loan life | Lower due to principal reduction |

| Equity Growth | Slow, limited to property appreciation | Steady increase through repayments |

| Risk Level | Higher risk if property value drops | Lower risk due to ongoing principal repayment |

Understanding Interest-Only Mortgages

Interest-only mortgages require borrowers to pay only the interest for a set period, typically 5 to 10 years, resulting in lower monthly payments but no reduction in the loan principal during this time. Principal-and-interest loans involve monthly payments that cover both interest and principal, gradually reducing the outstanding balance and building home equity. Understanding the differences helps borrowers choose between short-term affordability with interest-only loans and long-term financial stability with principal-and-interest repayments.

What Are Principal-and-Interest Mortgages?

Principal-and-interest mortgages require borrowers to make monthly payments covering both the loan principal and accumulated interest, gradually reducing the loan balance over time. These mortgages provide a clear path to full loan repayment by the end of the term, typically 15 to 30 years, offering predictable monthly expenses and building home equity. This structure contrasts with interest-only loans, where payments cover interest only, and the principal remains unchanged during the initial period.

Key Differences Between Interest-Only and Principal-and-Interest Loans

Interest-only loans require borrowers to pay only the interest for a set period, resulting in lower initial repayments but no reduction in the loan principal. Principal-and-interest loans involve higher repayments that cover both interest and principal, gradually reducing the loan balance over time. Key differences include repayment amounts, loan term impact, and overall interest cost, with principal-and-interest loans typically leading to full loan repayment by the end of the term.

Pros and Cons of Interest-Only Home Loans

Interest-only home loans offer lower initial monthly payments by requiring borrowers to pay only the interest for a set period, improving short-term cash flow flexibility. However, the principal remains unchanged during this time, potentially leading to higher overall interest costs and slower equity buildup compared to principal-and-interest loans. Borrowers with interest-only loans face the risk of payment shock once the principal repayments commence, making it essential to plan for increased future obligations.

Advantages of Principal-and-Interest Repayments

Principal-and-interest repayments build home equity faster by reducing the loan balance with each payment, offering long-term financial security. These repayments provide predictable budgeting through fixed amounts, protecting borrowers from interest rate fluctuations. Lenders often prefer this structure, potentially resulting in better loan terms and easier refinancing options.

Who Should Consider an Interest-Only Mortgage?

Borrowers with irregular income, such as self-employed individuals or investors, often consider interest-only mortgages to maximize cash flow during the initial loan term. Those planning to refinance or sell their property within the interest-only period also benefit from reduced early repayments. Interest-only loans suit buyers prioritizing short-term financial flexibility over gradual principal reduction.

Long-Term Costs of Interest-Only vs Principal-and-Interest

Interest-only mortgages typically have lower initial monthly payments but result in higher total interest paid over the loan term compared to principal-and-interest loans, which combine repayments to reduce both principal and interest simultaneously. By paying only interest, the loan balance does not decrease, leading to increased long-term costs and potentially larger financial burden upon loan maturity. Principal-and-interest loans amortize the debt, significantly lowering overall interest expenses and providing clearer equity build-up over time.

Effect on Home Equity: Interest-Only vs Principal-and-Interest

Interest-only mortgages delay building home equity since borrowers pay only interest, resulting in no reduction of the principal balance during the loan term. Principal-and-interest repayments contribute directly to home equity growth by steadily lowering the loan balance and increasing the homeowner's stake in the property. Over time, principal-and-interest loans typically lead to greater equity accumulation and financial stability compared to interest-only loans.

Impact on Borrower’s Financial Flexibility

Interest-only mortgage payments reduce initial monthly outgoings, enhancing the borrower's short-term financial flexibility and cash flow management. Principal-and-interest repayments, while higher initially, build equity over time and reduce overall interest paid, providing long-term financial stability and asset growth. Choosing between these options depends on the borrower's cash flow needs, investment goals, and risk tolerance.

Choosing the Right Mortgage Repayment Structure for You

Choosing the right mortgage repayment structure depends on your financial goals and cash flow needs. Interest-only loans offer lower initial payments, ideal for borrowers seeking short-term affordability or investment strategies, while principal-and-interest loans build equity faster by gradually reducing the loan balance. Carefully evaluating your income stability, long-term plans, and risk tolerance helps determine whether an interest-only or principal-and-interest mortgage aligns with your financial objectives.

Important Terms

Amortization schedule

An amortization schedule outlines the timeline of loan repayments, detailing each payment's allocation toward interest and principal balance reduction. Interest-only loans require payments covering solely interest for a set period, resulting in unchanged principal early on, while principal-and-interest loans combine both components, gradually decreasing the outstanding loan balance over time.

Negative amortization

Negative amortization occurs when loan payments are insufficient to cover the interest, causing the unpaid interest to be added to the principal balance, often seen in interest-only loans where borrowers pay only interest without reducing the principal. In contrast, principal-and-interest loans ensure consistent reduction of the loan balance, preventing negative amortization and promoting loan payoff over time.

Balloon payment

A balloon payment is a large lump sum due at the end of a loan term, commonly associated with interest-only loans where monthly payments cover just interest, leaving principal unpaid until maturity. In contrast, principal-and-interest loans amortize the loan, gradually reducing both principal and interest with each payment, avoiding a substantial balloon payment.

Loan tenure

Loan tenure significantly influences the total cost when choosing between interest-only and principal-and-interest repayments, with interest-only loans often having higher cumulative interest over time due to delayed principal reduction. Shorter tenures with principal-and-interest payments accelerate equity building and reduce overall interest expenses, optimizing long-term financial outcomes.

Repayment holiday

A repayment holiday allows borrowers to pause repayments temporarily, with interest-only loans accumulating interest during this period, while principal-and-interest loans defer both components, potentially extending the loan term or increasing future repayments. Understanding the impact on total interest paid and loan duration is crucial when choosing between interest-only and principal-and-interest options during a repayment holiday.

Equity buildup

Equity buildup accelerates faster with principal-and-interest loans because each payment reduces the loan balance, increasing homeownership stake, while interest-only loans delay equity growth since payments cover only interest without lowering principal. Investing in principal-and-interest mortgages enhances long-term net worth through consistent debt reduction and property value appreciation.

IO period (Interest-only period)

The IO period refers to the initial phase of a loan where only interest payments are required, resulting in lower monthly repayments compared to principal-and-interest loans that combine both principal and interest payments throughout the loan term. This structure benefits borrowers seeking short-term cash flow relief but may lead to higher total interest costs over time due to the outstanding principal remaining unchanged during the IO period.

Recasting

Recasting a mortgage reduces monthly payments by recalculating based on the remaining principal after a lump sum payment, benefiting both interest-only and principal-and-interest loans by lowering interest costs over time. Interest-only loans postpone principal repayment, so recasting primarily decreases future interest charges, whereas principal-and-interest loans see immediate reductions in both principal and interest portions of payments.

Payment shock

Payment shock occurs when borrowers switch from interest-only to principal-and-interest loans, causing monthly repayments to increase significantly. This shift often results in financial strain as payments move from covering only interest to including principal amortization, leading to higher cash outflows.

Loan-to-value ratio (LVR)

Loan-to-value ratio (LVR) significantly impacts the choice between interest-only and principal-and-interest loans, with higher LVRs often prompting lenders to impose stricter interest-only terms to mitigate risk; principal-and-interest repayments reduce the loan balance over time, lowering the effective LVR and improving equity. Borrowers with high LVRs typically face higher interest rates on interest-only loans compared to principal-and-interest loans due to increased lender risk.

Interest-only vs Principal-and-interest Infographic

moneydif.com

moneydif.com