A deed of trust involves three parties: the borrower, the lender, and a neutral trustee who holds the property title until the loan is paid off, providing a faster foreclosure process compared to a mortgage deed. A mortgage deed is a two-party agreement between the borrower and lender, where the lender holds a lien on the property until the loan is fully repaid. Understanding the differences between these instruments is crucial for borrowers navigating state-specific regulations and foreclosure procedures.

Table of Comparison

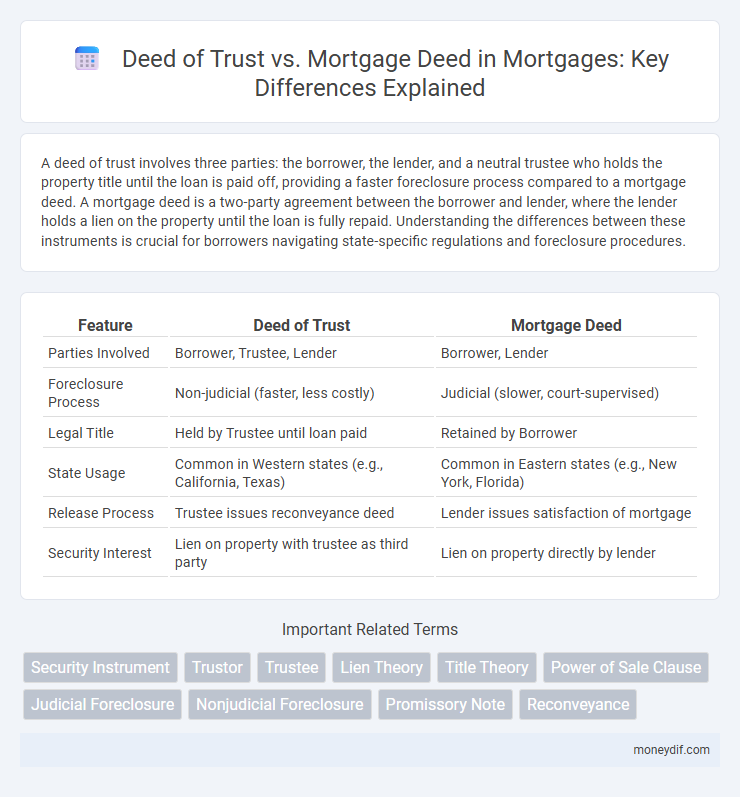

| Feature | Deed of Trust | Mortgage Deed |

|---|---|---|

| Parties Involved | Borrower, Trustee, Lender | Borrower, Lender |

| Foreclosure Process | Non-judicial (faster, less costly) | Judicial (slower, court-supervised) |

| Legal Title | Held by Trustee until loan paid | Retained by Borrower |

| State Usage | Common in Western states (e.g., California, Texas) | Common in Eastern states (e.g., New York, Florida) |

| Release Process | Trustee issues reconveyance deed | Lender issues satisfaction of mortgage |

| Security Interest | Lien on property with trustee as third party | Lien on property directly by lender |

Understanding the Basics: Deed of Trust vs Mortgage Deed

A deed of trust involves a three-party agreement between the borrower, lender, and a neutral trustee who holds the property title until the loan is paid off, while a mortgage deed is a two-party agreement directly between the borrower and lender. In a deed of trust, the trustee can expedite foreclosure without court intervention, resulting in a faster process compared to the judicial foreclosure required in a mortgage deed. Both documents secure the lender's interest in the property, but the choice between them depends on state laws and the preferred foreclosure method.

Key Legal Differences Between Deed of Trust and Mortgage Deed

A deed of trust involves three parties: the borrower, lender, and a neutral trustee who holds the title until the loan is repaid, enabling non-judicial foreclosure, which streamlines property seizure if default occurs. In contrast, a mortgage deed typically involves two parties--the borrower and the lender--and requires judicial foreclosure, a court-supervised process that is often lengthier and more costly. The key legal difference lies in the foreclosure method and title transfer mechanics, with deeds of trust offering more efficient loan recovery due to the trustee's authority.

Parties Involved: Who’s Who in Deed of Trust and Mortgage Deed

A deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee) who holds the title until the loan is repaid. A mortgage deed typically has two parties: the borrower (mortgagor) and the lender (mortgagee), with the borrower retaining the title until default. Understanding these roles is crucial for grasping the differing foreclosure processes and legal protections each instrument provides.

Foreclosure Processes: Deed of Trust vs Mortgage Deed

Foreclosure processes under a deed of trust typically involve non-judicial foreclosure, allowing lenders to expedite property repossession without court intervention, significantly reducing time and legal costs. In contrast, mortgage deeds require judicial foreclosure, necessitating lender approval from the court, which can extend the timeline and increase expenses. The choice between these instruments impacts foreclosure efficiency, with deed of trust favoring faster recovery for lenders in default situations.

Geographic Preferences: Where Each Document Is Commonly Used

Deed of trust is predominantly used in states like California, Texas, and Virginia, where it involves a third-party trustee to hold the title until the loan is repaid. Mortgage deeds are more common in states such as New York, Florida, and Illinois, where the borrower retains title and the lender holds a lien on the property. Geographic preferences for these documents affect foreclosure processes and lender protections, reflecting regional legal frameworks.

Rights and Obligations: Borrower’s Perspective

A deed of trust involves three parties--the borrower, lender, and a neutral trustee--granting the trustee the right to sell the property if the borrower defaults, while a mortgage deed involves only two parties, borrower and lender, requiring judicial foreclosure to reclaim the property. From the borrower's perspective, a deed of trust may expedite foreclosure proceedings, reducing time and legal costs compared to a mortgage deed. Both agreements impose obligations to repay the loan, maintain the property, and comply with loan terms, but the method and timeline for lenders to enforce their rights differ significantly.

Lender Protections: Deed of Trust vs Mortgage Deed

A deed of trust offers stronger lender protections by involving a neutral third-party trustee who can quickly initiate a non-judicial foreclosure, minimizing the lender's risk and time to recover funds. In contrast, a mortgage deed requires judicial foreclosure, which is often slower and more costly, exposing lenders to greater financial risk. This legal distinction directly impacts the efficiency and security of the lender's ability to enforce the loan agreement.

Recording Process and Legal Implications

The recording process for a deed of trust involves filing the document with the county recorder's office, establishing a public record that secures the lender's interest, while a mortgage deed is similarly recorded to perfect the lien on the property. Legally, a deed of trust includes a third-party trustee who can initiate a non-judicial foreclosure, often resulting in a faster, less costly process compared to the judicial foreclosure required with a mortgage deed. Understanding these distinctions is crucial for borrowers and lenders as they impact foreclosure timelines, legal rights, and the protection of interests during property disputes.

Advantages and Disadvantages of Deed of Trust and Mortgage Deed

Deed of trust offers faster foreclosure processes and involves three parties: borrower, lender, and trustee, which can streamline property recovery but may limit borrower protections compared to mortgage deeds. Mortgage deeds provide stronger borrower rights through judicial foreclosure, requiring court intervention that can prolong resolution and increase costs for lenders. Evaluating these differences helps borrowers and lenders weigh speed and control against legal safeguards in real estate financing.

How to Choose: Deciding Between Deed of Trust and Mortgage Deed

Choosing between a deed of trust and a mortgage deed depends on state laws and foreclosure processes; states using deeds of trust often allow non-judicial foreclosure, making the process faster and less costly. Mortgage deeds typically require judicial foreclosure, which can extend the timeline and increase expenses but offer more borrower protections. Evaluate your state's foreclosure procedures, lender requirements, and your risk tolerance to determine the optimal security instrument for your real estate financing.

Important Terms

Security Instrument

A Security Instrument, such as a Deed of Trust or Mortgage Deed, legally secures a loan by placing a lien on the property; a Deed of Trust involves three parties--borrower, lender, and trustee--allowing for non-judicial foreclosure, while a Mortgage Deed typically involves two parties--borrower and lender--with foreclosure proceeding through judicial courts. Understanding the distinct roles and foreclosure processes of these Security Instruments is essential for real estate financing and legal risk management.

Trustor

A Trustor in a Deed of Trust is the borrower who conveys legal title to a neutral third party, the Trustee, to hold as security for the loan, whereas in a Mortgage Deed, the borrower directly grants a lien to the lender without involving a trustee. The Deed of Trust facilitates a faster foreclosure process compared to the Mortgage Deed, which typically requires judicial foreclosure.

Trustee

A Trustee in a Deed of Trust holds legal title to the property on behalf of the lender until the borrower repays the loan, enabling faster foreclosure processes compared to a Mortgage Deed where the borrower retains title and the lender holds a lien. The Deed of Trust involves three parties--borrower, lender, and trustee--while a Mortgage Deed involves only two parties, borrower and lender, affecting the security interest enforcement differently across states.

Lien Theory

Lien Theory, predominant in states like California and New York, treats a mortgage deed as a lien on the property, allowing the borrower to retain legal title while the lender holds a security interest; conversely, a deed of trust involves a third-party trustee holding legal title until the loan is repaid, facilitating non-judicial foreclosure processes. This distinction impacts foreclosure timelines and borrower rights, with lien theory states generally requiring judicial foreclosure under a mortgage deed, whereas deed of trust structures allow faster foreclosure through trustee sales.

Title Theory

Title Theory holds that the lender retains legal title to the property until the debt is fully repaid, which is why deeds of trust involve a trustee holding title as security, whereas mortgage deeds transfer a lien while the borrower retains legal title. In jurisdictions adhering to Title Theory, deeds of trust allow for faster foreclosure processes compared to mortgage deeds based on Lien Theory, where the borrower holds both legal and equitable title.

Power of Sale Clause

A Power of Sale Clause permits the trustee in a Deed of Trust to initiate a non-judicial foreclosure sale without court involvement, while a Mortgage Deed typically requires judicial foreclosure to enforce lender rights upon borrower default. This clause accelerates property repossession in Deed of Trust agreements, offering lenders a faster remedy compared to the often lengthy judicial process tied to Mortgage Deeds.

Judicial Foreclosure

Judicial foreclosure requires a court process to enforce a mortgage deed, which creates a lien on the property as security for a loan, whereas a deed of trust typically allows for a non-judicial foreclosure through a trustee sale, bypassing the courts. Mortgage deeds involve borrower and lender agreements recorded with the county, while deeds of trust include a third-party trustee who holds title until the debt is repaid.

Nonjudicial Foreclosure

Nonjudicial foreclosure occurs when a deed of trust includes a power of sale clause allowing the trustee to sell the property without court intervention, contrasting with a mortgage deed which typically requires judicial foreclosure involving court proceedings. The deed of trust streamlines the foreclosure process, reducing time and legal expenses compared to the mortgage deed's more formal and lengthier judicial foreclosure process.

Promissory Note

A Promissory Note is a written promise to repay a loan, detailing the borrower's promise to pay a specific amount under agreed terms, while a Deed of Trust and a Mortgage Deed serve as security instruments that pledge real property to secure the loan. The Deed of Trust involves three parties--the borrower, lender, and trustee--and facilitates foreclosure through non-judicial processes, whereas a Mortgage Deed typically involves two parties and requires judicial foreclosure.

Reconveyance

Reconveyance is a legal process that occurs when a deed of trust is fully paid off, resulting in the trustee transferring the title back to the borrower, whereas mortgages typically require a separate satisfaction or release document to clear the lien. Unlike mortgages, which involve a direct lien between borrower and lender, deeds of trust include a third-party trustee who issues the reconveyance to confirm the borrower's ownership after loan payoff.

Deed of trust vs Mortgage deed Infographic

moneydif.com

moneydif.com