The loan origination fee is a one-time charge by the lender to process and underwrite a mortgage application, typically calculated as a percentage of the loan amount. Loan discount points are prepaid interest fees paid upfront to reduce the mortgage interest rate, lowering monthly payments over the loan term. Understanding the difference between origination fees and discount points helps borrowers make informed decisions on upfront costs versus long-term savings.

Table of Comparison

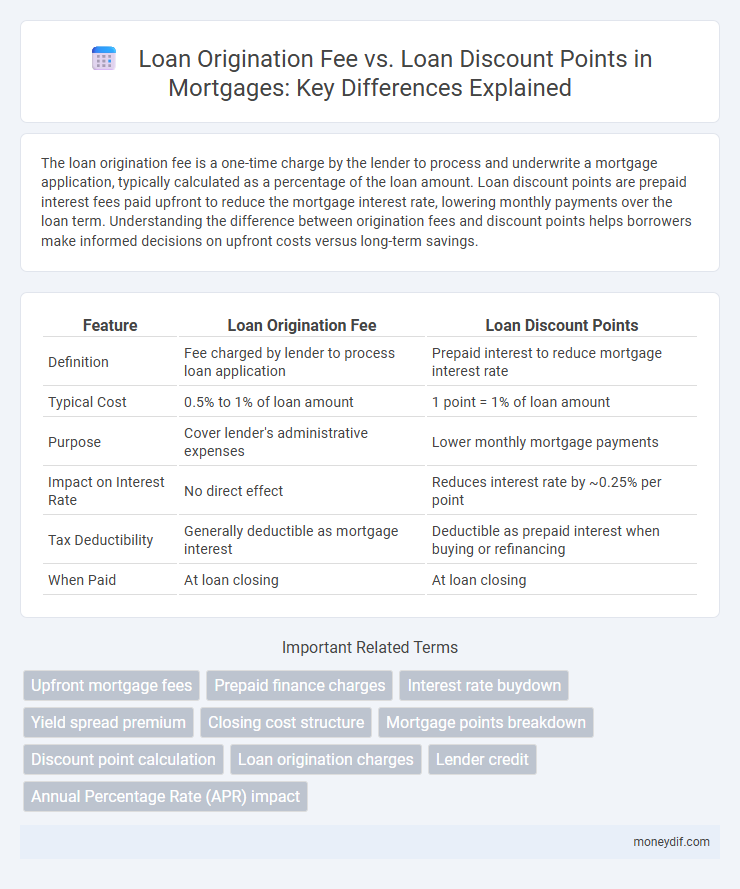

| Feature | Loan Origination Fee | Loan Discount Points |

|---|---|---|

| Definition | Fee charged by lender to process loan application | Prepaid interest to reduce mortgage interest rate |

| Typical Cost | 0.5% to 1% of loan amount | 1 point = 1% of loan amount |

| Purpose | Cover lender's administrative expenses | Lower monthly mortgage payments |

| Impact on Interest Rate | No direct effect | Reduces interest rate by ~0.25% per point |

| Tax Deductibility | Generally deductible as mortgage interest | Deductible as prepaid interest when buying or refinancing |

| When Paid | At loan closing | At loan closing |

Understanding Loan Origination Fees

Loan origination fees are upfront charges paid to lenders for processing and underwriting a mortgage, typically ranging from 0.5% to 1% of the loan amount. These fees differ from loan discount points, which are prepaid interest used to lower the mortgage interest rate over the loan term. Understanding loan origination fees helps borrowers evaluate the true cost of securing a mortgage and compare offers effectively.

What Are Loan Discount Points?

Loan discount points are upfront fees paid to a lender at closing to reduce the interest rate on a mortgage, effectively buying down the rate for long-term savings. Each point typically equals 1% of the loan amount and can lower the interest rate by about 0.25%, resulting in lower monthly payments. Borrowers use loan discount points to achieve more affordable financing over the life of the loan compared to the standard interest rate.

Key Differences Between Origination Fees and Discount Points

Loan origination fees are charges paid to lenders for processing a mortgage application, typically expressed as a percentage of the loan amount, while loan discount points are prepaid interest that borrowers buy to reduce their mortgage interest rate. Origination fees cover administrative costs and do not affect the loan's interest rate, whereas discount points directly lower the interest rate, resulting in long-term savings on monthly payments. Understanding these distinctions helps borrowers decide between upfront costs and potential interest rate reductions when securing a mortgage.

How Loan Origination Fees Affect Your Mortgage

Loan origination fees typically range from 0.5% to 1% of the loan amount and directly increase your upfront mortgage costs, affecting your total closing expenses. These fees compensate lenders for processing your application, underwriting, and funding the loan, which can make the mortgage more expensive initially compared to loan discount points that reduce your interest rate. Understanding how loan origination fees impact your mortgage helps you evaluate the trade-off between upfront costs and long-term savings on interest payments.

How Discount Points Can Lower Your Interest Rate

Discount points are upfront fees paid to reduce the mortgage interest rate, directly lowering monthly payments and overall loan cost. Each discount point typically costs 1% of the loan amount and can decrease the interest rate by about 0.25%, effectively saving borrowers thousands over the loan term. Unlike the loan origination fee, which covers the lender's administrative costs, discount points specifically act as prepaid interest to secure a better rate.

Pros and Cons of Paying Origination Fees

Paying loan origination fees allows borrowers to cover the lender's administrative costs, often resulting in faster loan processing but increasing upfront expenses. These fees typically range from 0.5% to 1% of the loan amount, which can lead to higher initial out-of-pocket costs compared to paying discount points. While origination fees do not reduce the interest rate like discount points, they offer a clear, transparent cost structure without impacting long-term monthly mortgage payments.

When Should You Buy Discount Points?

Buying loan discount points is beneficial when you plan to stay in your home long enough to recoup the upfront cost through monthly interest savings, typically recommended if you hold the mortgage for more than 5-7 years. Discount points reduce your mortgage interest rate by a fixed percentage, lowering monthly payments and total interest over the loan term. Evaluating your break-even period and long-term financial goals helps determine if purchasing discount points maximizes mortgage savings compared to paying a standard loan origination fee.

Impact of Fees and Points on Closing Costs

Loan origination fees, typically ranging from 0.5% to 1% of the loan amount, directly increase closing costs by covering lender processing expenses, while loan discount points--each point equaling 1% of the loan--are prepaid interest used to lower the mortgage interest rate. Higher loan origination fees inflate upfront costs without affecting monthly payments, whereas purchasing discount points reduces long-term interest expenses but raises initial closing costs. Understanding the balance between these fees and points is crucial for borrowers aiming to minimize total loan costs over time.

Choosing Between Origination Fees and Discount Points

When choosing between loan origination fees and loan discount points, borrowers should evaluate the impact on upfront costs versus long-term interest savings. Loan origination fees are one-time charges for processing the mortgage, typically expressed as a percentage of the loan amount, while discount points are prepaid interest that reduce the mortgage interest rate over the life of the loan. Understanding the break-even point and how long you plan to stay in the home helps determine whether paying discount points or origination fees offers greater financial benefit.

Tips to Minimize Mortgage Fees and Points

Negotiating loan origination fees and carefully evaluating loan discount points can significantly reduce overall mortgage costs. Comparing lender offers and requesting fee waivers or reductions helps minimize upfront expenses. Opting for fewer discount points lowers initial payments but may increase long-term interest, so balance immediate savings with future affordability.

Important Terms

Upfront mortgage fees

Upfront mortgage fees typically include the loan origination fee, a percentage of the loan amount charged by the lender for processing the application, and loan discount points, which are prepaid interest fees that borrowers can pay to reduce their mortgage interest rate. While the origination fee covers administrative costs, discount points provide potential long-term savings by lowering monthly payments and overall interest over the life of the loan.

Prepaid finance charges

Prepaid finance charges include both loan origination fees and loan discount points, which are upfront costs paid to secure a mortgage loan. Loan origination fees cover the lender's administrative expenses, typically around 1% of the loan amount, while loan discount points are prepaid interest costs used to lower the mortgage interest rate, where one point equals 1% of the loan principal.

Interest rate buydown

Interest rate buydown reduces the effective loan interest rate by paying upfront fees, often achieved through loan discount points, which directly lower the rate in exchange for a percentage of the loan amount paid at closing. Loan origination fees differ as they cover the lender's processing costs and do not directly affect the interest rate, while discount points specifically reduce the long-term interest expense by prepaying interest.

Yield spread premium

Yield spread premium (YSP) represents the difference between the interest rate a borrower qualifies for and the rate offered by the lender, often used to offset loan origination fees or purchase loan discount points. Loan origination fees are direct charges by the lender for processing the loan, while discount points are prepaid interest that lower the loan's interest rate, both impacting the overall loan cost and the calculation of YSP.

Closing cost structure

Loan origination fees typically range from 0.5% to 1% of the loan amount and cover the lender's administrative costs in processing the mortgage application. Loan discount points, often priced at 1% of the loan amount per point, are prepaid interest that borrowers can purchase to lower their loan's interest rate and reduce monthly mortgage payments.

Mortgage points breakdown

Mortgage points include loan origination fees, which are charges by lenders for processing a loan application, and loan discount points, fees paid upfront to reduce the interest rate on a mortgage. Loan origination fees typically range from 0.5% to 1% of the loan amount, while each loan discount point usually costs 1% of the loan balance and can lower the interest rate by about 0.25%.

Discount point calculation

Discount point calculation involves multiplying the loan amount by the cost percentage of each point, where one discount point equals 1% of the loan principal to reduce the interest rate. Loan origination fees differ as they cover administrative costs charged by lenders, typically a fixed percentage of the loan amount, and are not applied toward interest rate reduction like discount points.

Loan origination charges

Loan origination charges encompass fees paid to lenders for processing a loan, primarily including the loan origination fee calculated as a percentage of the loan amount to cover administrative costs. Loan discount points differ by serving as prepaid interest bought upfront to lower the mortgage interest rate, directly affecting the loan's long-term cost rather than lender fees.

Lender credit

Lender credit reduces closing costs by offering a credit in exchange for a higher interest rate, effectively offsetting the loan origination fee or loan discount points paid upfront. Loan origination fees are charged by lenders to process the loan, while loan discount points are prepaid interest used to lower the interest rate, and lender credits balance these costs by adjusting interest terms to benefit borrower cash flow.

Annual Percentage Rate (APR) impact

Loan origination fees directly increase the upfront cost of a loan, thereby raising the Annual Percentage Rate (APR) by spreading these fees over the loan term; in contrast, loan discount points lower the interest rate, which can reduce the APR by decreasing the total interest paid over time. Understanding the balance between loan origination fees and discount points is crucial for accurately calculating APR and assessing the true cost of borrowing.

Loan origination fee vs Loan discount points Infographic

moneydif.com

moneydif.com