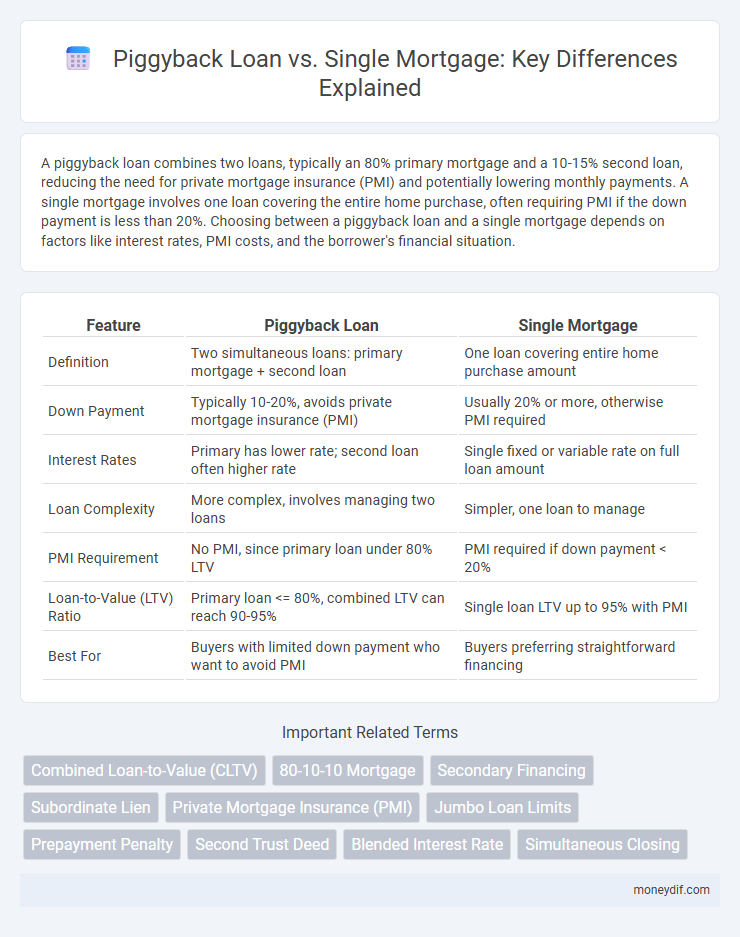

A piggyback loan combines two loans, typically an 80% primary mortgage and a 10-15% second loan, reducing the need for private mortgage insurance (PMI) and potentially lowering monthly payments. A single mortgage involves one loan covering the entire home purchase, often requiring PMI if the down payment is less than 20%. Choosing between a piggyback loan and a single mortgage depends on factors like interest rates, PMI costs, and the borrower's financial situation.

Table of Comparison

| Feature | Piggyback Loan | Single Mortgage |

|---|---|---|

| Definition | Two simultaneous loans: primary mortgage + second loan | One loan covering entire home purchase amount |

| Down Payment | Typically 10-20%, avoids private mortgage insurance (PMI) | Usually 20% or more, otherwise PMI required |

| Interest Rates | Primary has lower rate; second loan often higher rate | Single fixed or variable rate on full loan amount |

| Loan Complexity | More complex, involves managing two loans | Simpler, one loan to manage |

| PMI Requirement | No PMI, since primary loan under 80% LTV | PMI required if down payment < 20% |

| Loan-to-Value (LTV) Ratio | Primary loan <= 80%, combined LTV can reach 90-95% | Single loan LTV up to 95% with PMI |

| Best For | Buyers with limited down payment who want to avoid PMI | Buyers preferring straightforward financing |

Introduction to Piggyback Loans and Single Mortgages

Piggyback loans involve two simultaneous loans to cover home purchase costs, commonly structured as an 80-10-10 split, reducing the need for private mortgage insurance (PMI). Single mortgages are standalone loans covering the entire home purchase, often requiring PMI if the down payment is less than 20%. Choosing between piggyback loans and single mortgages depends on factors such as credit score, loan-to-value ratio, and interest rates.

How Piggyback Loans Work

Piggyback loans involve taking out two simultaneous mortgages to avoid private mortgage insurance (PMI) and reduce the down payment, typically structured as an 80/10/10 split: 80% first mortgage, 10% second mortgage, and 10% down payment. The second loan, often a home equity loan or line of credit, covers part of the down payment, allowing borrowers to finance more of the home's purchase price without exceeding the conventional 80% loan-to-value (LTV) threshold. This strategy can help improve cash flow but may involve higher interest rates on the second mortgage compared to a single, larger loan.

Understanding Single Mortgage Options

Single mortgage options offer borrowers a straightforward financing solution by consolidating their home loan into one primary mortgage with a single interest rate and repayment schedule. This method simplifies monthly payments and often results in more competitive interest rates compared to piggyback loans, where two separate loans are involved. Understanding single mortgage products, such as fixed-rate and adjustable-rate mortgages, helps homebuyers make informed decisions based on affordability, loan term, and market conditions.

Qualification Requirements for Both Loan Types

Piggyback loans typically require a strong credit score, low debt-to-income ratio, and significant equity in the home to qualify, as lenders assess the risk of splitting the mortgage into two loans. Single mortgages generally have more straightforward qualification criteria, often necessitating a higher credit score and stable income but do not demand additional collateral or multiple approvals. Understanding these requirements helps borrowers determine eligibility and optimize their mortgage strategy for better approval odds and potentially lower interest rates.

Down Payment Implications

A piggyback loan allows homebuyers to avoid private mortgage insurance (PMI) by splitting the mortgage into two loans, typically an 80/10/10 structure where 10% is a second loan and 10% is the down payment. This approach reduces the upfront down payment compared to a single mortgage that often requires at least 20% down to avoid PMI charges. Choosing between piggyback loans and single mortgages depends on the borrower's financial situation, credit score, and willingness to pay PMI as part of the overall cost.

Interest Rates Comparison

Piggyback loans typically offer higher interest rates compared to single mortgages due to increased lender risk and loan complexity. Single mortgages often provide lower interest rates, benefiting from streamlined underwriting and reduced administrative costs. Borrowers must weigh potential savings from avoiding private mortgage insurance against the costlier rates of piggyback loans when deciding between these financing options.

Closing Costs and Fees

Piggyback loans often involve higher closing costs and multiple sets of fees since they require processing two separate loans, whereas a single mortgage consolidates these expenses into one. Borrowers should expect additional appraisal, underwriting, and title fees with piggyback loans, increasing overall upfront costs. Evaluating lender fees and comparing total closing costs is crucial to determine which option offers better financial advantages.

Pros and Cons of Piggyback Loans

Piggyback loans allow borrowers to avoid private mortgage insurance (PMI) by splitting the home purchase into two loans, often with a lower down payment requirement compared to a single mortgage. Pros include reduced PMI costs and increased purchasing power, while cons involve potentially higher interest rates on the second loan and increased complexity in loan management. Borrowers should evaluate credit scores, interest rates, and loan terms carefully to determine if the piggyback strategy outweighs the simplicity and potentially lower overall cost of a single, conventional mortgage.

Pros and Cons of Single Mortgages

Single mortgages offer the advantage of simpler application processes and typically lower interest rates compared to piggyback loans, making them a cost-effective option for borrowers with adequate down payments. However, single mortgages require higher upfront capital, as they usually demand a minimum 20% down payment to avoid private mortgage insurance (PMI), which can increase monthly expenses. Borrowers with limited cash reserves may find piggyback loans beneficial for avoiding PMI, but single mortgages provide clearer long-term repayment structures and streamlined financial management.

Which Loan Type is Right for You?

Choosing between a piggyback loan and a single mortgage depends on your down payment size, credit score, and overall financial goals. Piggyback loans allow buyers to avoid private mortgage insurance (PMI) by combining a first mortgage with a second loan, often requiring at least 10% down, while single mortgages typically demand 20% down to skip PMI. Evaluating interest rates, monthly payments, and long-term costs will help determine which loan structure best fits your home financing needs.

Important Terms

Combined Loan-to-Value (CLTV)

Combined Loan-to-Value (CLTV) measures the total mortgage balance, including both the primary loan and a piggyback loan, against the property's appraised value, often used to avoid private mortgage insurance (PMI). A piggyback loan structure typically involves a first mortgage covering 80% of the home price and a second loan covering 10-15%, keeping the CLTV below 80%, while a single mortgage usually exceeds this threshold, triggering PMI.

80-10-10 Mortgage

An 80-10-10 mortgage combines a primary loan covering 80% of the home's purchase price, a piggyback loan for 10%, and a 10% down payment, minimizing private mortgage insurance (PMI) costs while leveraging two loans. This contrasts with a single mortgage that finances 100% or close to the purchase price, often requiring PMI if the down payment is under 20%, making the piggyback loan a strategic option to avoid PMI and reduce overall borrowing costs.

Secondary Financing

A Piggyback Loan combines a primary mortgage with a secondary loan, typically an 80/10/10 structure, to avoid private mortgage insurance (PMI) and reduce upfront costs, while a Single Mortgage consolidates the entire loan amount into one mortgage with PMI if down payment is less than 20%. Secondary financing through Piggyback Loans often offers better interest rates on the primary mortgage and can improve debt-to-income ratios compared to a Single Mortgage.

Subordinate Lien

A subordinate lien in a piggyback loan scenario represents a secondary mortgage that exists alongside a primary lien, often used to avoid private mortgage insurance (PMI) by splitting the loan into first and second mortgages totaling 80% combined loan-to-value (CLTV). In contrast, a single mortgage involves one primary lien covering the entire loan amount, making the subordinated position irrelevant but potentially increasing PMI costs or requiring higher down payments.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required for single mortgages when the down payment is less than 20%, protecting lenders from borrower default risk. Piggyback loans, such as the 80-10-10 structure, combine a primary mortgage with a second loan to avoid PMI by covering more than 20% of the home's value upfront.

Jumbo Loan Limits

Jumbo loan limits exceed conventional conforming loan caps set by entities like Fannie Mae and Freddie Mac, necessitating alternative financing strategies such as piggyback loans to avoid private mortgage insurance (PMI). Piggyback loans involve pairing a primary mortgage with a secondary loan, often an 80-10-10 structure, whereas a single jumbo mortgage consolidates borrowing into one high-value loan that surpasses standard conforming limits.

Prepayment Penalty

Prepayment penalties in piggyback loans often differ from single mortgages, as piggyback loans typically involve two separate loans that may each carry distinct prepayment terms and penalties. Borrowers should carefully compare the prepayment fees and conditions of both piggyback and single mortgage options to determine potential cost savings and flexibility in early loan payoff.

Second Trust Deed

A Second Trust Deed functions as a secondary lien on a property, often used in piggyback loan arrangements where the borrower takes out two simultaneous loans to avoid private mortgage insurance (PMI). In contrast, a single mortgage involves one primary loan securing the entire property, usually requiring PMI if the down payment is less than 20%.

Blended Interest Rate

Blended interest rate combines rates from both the first mortgage and piggyback loan, offering borrowers a potentially lower overall rate compared to a single mortgage with higher interest. Piggyback loans can reduce private mortgage insurance costs by splitting financing, but the effective blended rate depends on the relative amounts and rates of each loan component.

Simultaneous Closing

Simultaneous closing involves coordinating two separate loans--a piggyback loan and a single mortgage--to purchase a home while minimizing private mortgage insurance (PMI) costs. This method allows borrowers to secure financing through an 80-10-10 piggyback loan structure or close a primary loan alongside a secondary loan, reducing upfront expenses and improving cash flow management compared to a single mortgage.

Piggyback Loan vs Single Mortgage Infographic

moneydif.com

moneydif.com