Alt-A loans typically target borrowers with good credit but limited documentation, offering interest rates between prime and subprime loans. Subprime loans serve borrowers with poor credit scores, generally carrying higher interest rates to offset increased lending risk. Choosing between Alt-A and subprime loans depends on the borrower's credit profile and ability to provide documentation.

Table of Comparison

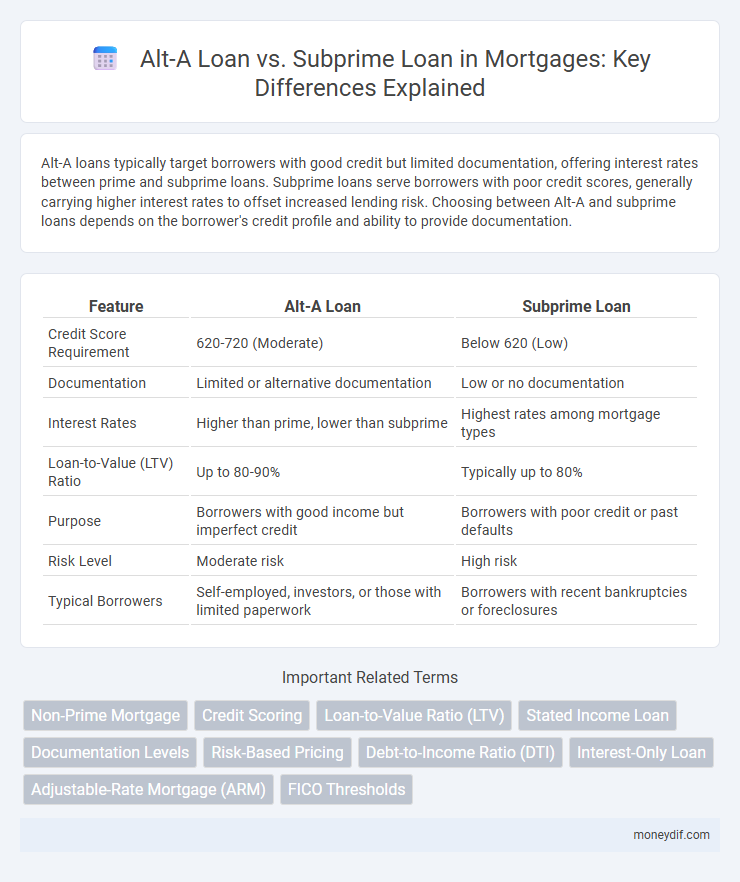

| Feature | Alt-A Loan | Subprime Loan |

|---|---|---|

| Credit Score Requirement | 620-720 (Moderate) | Below 620 (Low) |

| Documentation | Limited or alternative documentation | Low or no documentation |

| Interest Rates | Higher than prime, lower than subprime | Highest rates among mortgage types |

| Loan-to-Value (LTV) Ratio | Up to 80-90% | Typically up to 80% |

| Purpose | Borrowers with good income but imperfect credit | Borrowers with poor credit or past defaults |

| Risk Level | Moderate risk | High risk |

| Typical Borrowers | Self-employed, investors, or those with limited paperwork | Borrowers with recent bankruptcies or foreclosures |

Understanding Alt-A and Subprime Loans

Alt-A loans target borrowers with strong credit but limited documentation, offering flexible underwriting standards that balance risk and accessibility. Subprime loans cater to borrowers with poor credit scores, higher default risk, and often carry higher interest rates to compensate lenders. Understanding the distinct borrower profiles and risk levels helps in choosing between Alt-A and subprime loan options for mortgage financing.

Key Differences Between Alt-A and Subprime Mortgages

Alt-A loans typically require better credit scores than subprime loans but have higher risk factors than prime loans, making them a middle-tier option for borrowers. Subprime mortgages target borrowers with poor credit scores, often resulting in higher interest rates and increased default risk due to less favorable loan terms. Key differences include loan-to-value ratios, documentation standards, and borrower credit profiles, with Alt-A loans often requiring some documentation and better credit standing compared to the loosely documented, high-risk subprime loans.

Borrower Profiles: Alt-A vs Subprime

Alt-A loans target borrowers with moderate credit scores and stable income but lack full documentation, appealing to those who fall between prime and subprime categories. Subprime loans cater to borrowers with poor credit histories, higher debt-to-income ratios, and increased risk of default. Lenders price Alt-A loans lower than subprime due to relatively stronger borrower profiles and reduced default risk.

Credit Score Requirements for Alt-A and Subprime Loans

Alt-A loans typically require credit scores ranging from 620 to 700, targeting borrowers with moderate credit risk who may lack full documentation. Subprime loans accept lower credit scores, often below 620, catering to high-risk borrowers with significant credit challenges. The credit score threshold significantly impacts interest rates and loan approval chances for both Alt-A and subprime mortgage products.

Interest Rates: Alt-A vs Subprime Mortgages

Alt-A mortgages generally offer lower interest rates compared to subprime loans due to better borrower credit profiles and reduced risk of default. Subprime loans carry higher interest rates reflecting the increased likelihood of borrower delinquency and poorer credit histories. Lenders price Alt-A loans more competitively, balancing moderate risk with stricter underwriting criteria, whereas subprime mortgages compensate for significant risk through elevated rates.

Documentation Standards: Alt-A Loan Compared to Subprime

Alt-A loans require moderate documentation standards, often involving reduced income verification or asset documentation compared to traditional mortgages, but still maintain a degree of borrower qualification. Subprime loans typically demand minimal documentation, targeting borrowers with poor credit scores or financial instability, resulting in higher risk profiles. The documentation level in Alt-A loans serves as a middle ground, balancing lender risk and borrower accessibility.

Risk Factors Associated with Alt-A and Subprime Loans

Alt-A loans carry moderate risk due to reduced documentation and variable borrower credit profiles, increasing the likelihood of default compared to prime loans. Subprime loans present higher risk levels because they target borrowers with poor credit history, often featuring higher interest rates and less favorable terms to compensate for increased default probability. Both loan types contribute to elevated foreclosure rates, impacting lenders and overall mortgage market stability.

Impact on Homeownership: Alt-A vs Subprime Borrowers

Alt-A loans typically attract borrowers with moderate credit scores who have stable incomes but limited documentation, resulting in higher approval rates compared to subprime loans. Subprime loans target borrowers with poor credit histories and higher default risks, leading to increased foreclosure rates and financial instability. The impact on homeownership shows Alt-A borrowers often maintain more consistent repayments, while subprime borrowers face greater challenges in sustaining homeownership due to more frequent delinquencies.

Regulatory Oversight: Alt-A and Subprime Lending Practices

Alt-A loans typically face moderate regulatory oversight due to their borrowers' slightly better credit profiles compared to subprime loans, which are subject to stricter regulations because of higher default risks. Regulatory agencies enforce comprehensive guidelines on underwriting standards and disclosure requirements for subprime lending to protect consumers and reduce financial instability. Differences in regulatory scrutiny impact the availability, terms, and risk exposure associated with Alt-A versus subprime mortgage products.

Is an Alt-A or Subprime Loan Right for You?

Choosing between an Alt-A loan and a subprime loan depends on your credit profile and financial goals. Alt-A loans typically cater to borrowers with decent credit who may lack full documentation, offering more favorable interest rates than subprime loans, which target borrowers with poor credit histories. Evaluate your credit score, income stability, and loan terms carefully to determine which mortgage option aligns best with your ability to repay and long-term financial strategy.

Important Terms

Non-Prime Mortgage

Non-prime mortgages include Alt-A and subprime loans, where Alt-A loans feature moderate credit risks with limited documentation and better borrower profiles compared to subprime loans, which target high-risk borrowers with poor credit histories. Alt-A loans often have higher interest rates than prime loans but lower than subprime, reflecting risk levels and underwriting differences in loan terms and borrower qualifications.

Credit Scoring

Alt-A loans typically involve borrowers with better credit scores than subprime loans but less documentation than prime loans, positioning them between prime and subprime categories in credit scoring models. Subprime loans target borrowers with lower credit scores, often below 620, reflecting higher default risk and resulting in higher interest rates and stricter lending terms.

Loan-to-Value Ratio (LTV)

The Loan-to-Value Ratio (LTV) for Alt-A loans typically ranges from 80% to 90%, reflecting moderate risk due to better credit profiles compared to subprime loans, which often feature LTVs exceeding 90%, indicating higher risk with borrowers having poor credit histories. LTV directly impacts interest rates and loan approval chances, with Alt-A loans offering more favorable terms than subprime loans due to lower default probabilities.

Stated Income Loan

Stated Income Loans, commonly associated with Alt-A loans, allow borrowers to declare income without full documentation, positioning them between prime and subprime loans in credit risk. Unlike Subprime loans, which target borrowers with poor credit, Alt-A loans appeal to those with moderate credit but limited income verification, often resulting in higher interest rates than prime but lower than subprime loans.

Documentation Levels

Documentation levels for Alt-A loans typically fall between full documentation of prime loans and limited or no documentation of subprime loans, reflecting moderate borrower verification standards. Alt-A loans often require partial income verification, while subprime loans frequently involve minimal documentation, increasing risk due to less thorough assessment of borrower creditworthiness.

Risk-Based Pricing

Risk-based pricing differentiates Alt-A loans, which typically have moderate credit risk and require less documentation, from subprime loans that target borrowers with poor credit histories and higher default risk, leading to higher interest rates. Alt-A loans generally offer more favorable terms than subprime loans due to their lower delinquency rates and better credit profiles despite some loan documentation gaps.

Debt-to-Income Ratio (DTI)

Debt-to-Income Ratio (DTI) is a critical metric in evaluating borrower eligibility for Alt-A loans, which typically accept moderate DTI levels compared to the higher DTI thresholds seen in subprime loans that cater to riskier borrowers. Lenders use DTI ratios to gauge repayment capacity, with Alt-A loans often requiring DTIs below 45%, while subprime loans may approve borrowers with DTIs exceeding 50%, reflecting increased default risk.

Interest-Only Loan

Interest-only loans, often associated with Alt-A loans, allow borrowers to pay only the interest for a set period, reducing initial monthly payments but increasing risk if property values decline. Unlike subprime loans, which target borrowers with poor credit histories and higher default rates, Alt-A loans typically involve borrowers with better credit profiles but riskier documentation or loan features.

Adjustable-Rate Mortgage (ARM)

Adjustable-Rate Mortgages (ARMs) often intersect with Alt-A and Subprime loans, where Alt-A loans typically feature borrowers with better credit profiles but less documentation, while Subprime loans cater to higher-risk borrowers with lower credit scores. ARMs in Alt-A loans carry lower initial interest rates compared to Subprime ARMs but both face higher adjustment risks than prime loans, impacting affordability and default rates.

FICO Thresholds

FICO thresholds for Alt-A loans typically range from 620 to 679, reflecting moderate credit risk, while subprime loans usually have FICO scores below 620, indicating higher default probability. Lenders set these distinct FICO cutoffs to balance risk assessment and interest rate pricing between Alt-A borrowers, who have better credit profiles, and subprime borrowers, who present greater credit challenges.

Alt-A Loan vs Subprime Loan Infographic

moneydif.com

moneydif.com