Portfolio loans are held by the original lender, allowing for more flexible underwriting criteria and personalized terms compared to secondary market loans, which are sold to investors like Fannie Mae or Freddie Mac and must meet standardized guidelines. Portfolio loans often benefit borrowers with unique financial situations or unconventional income sources, while secondary market loans typically offer lower interest rates due to their standardized risk profiles. Choosing between these loan types depends on the borrower's credit profile, loan amount, and need for customized loan features versus competitive pricing.

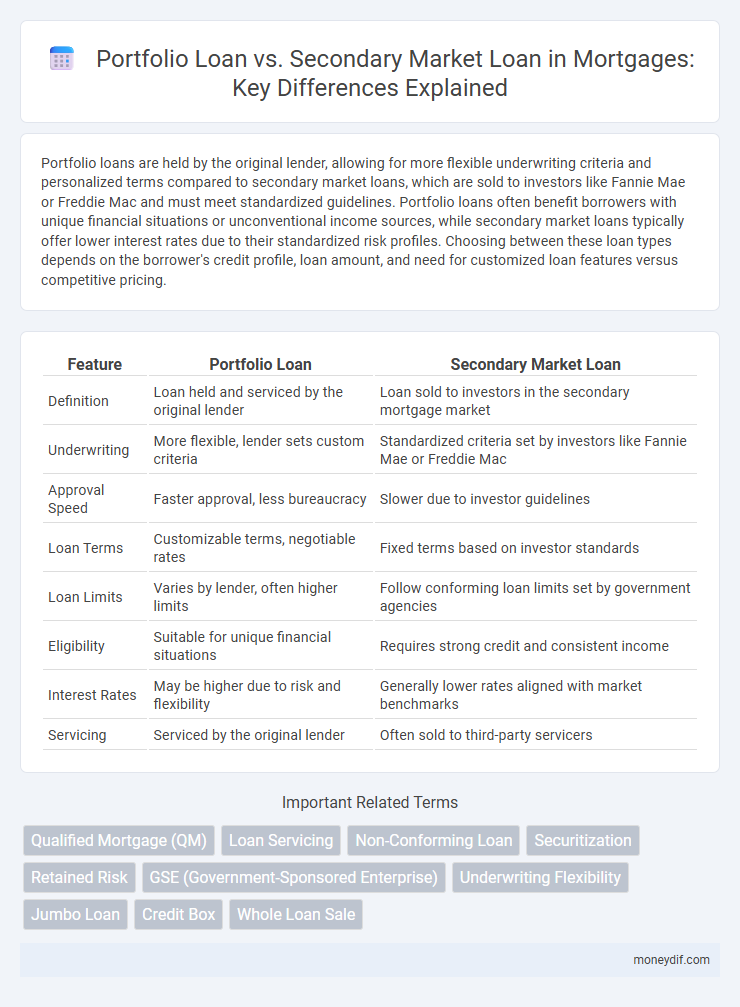

Table of Comparison

| Feature | Portfolio Loan | Secondary Market Loan |

|---|---|---|

| Definition | Loan held and serviced by the original lender | Loan sold to investors in the secondary mortgage market |

| Underwriting | More flexible, lender sets custom criteria | Standardized criteria set by investors like Fannie Mae or Freddie Mac |

| Approval Speed | Faster approval, less bureaucracy | Slower due to investor guidelines |

| Loan Terms | Customizable terms, negotiable rates | Fixed terms based on investor standards |

| Loan Limits | Varies by lender, often higher limits | Follow conforming loan limits set by government agencies |

| Eligibility | Suitable for unique financial situations | Requires strong credit and consistent income |

| Interest Rates | May be higher due to risk and flexibility | Generally lower rates aligned with market benchmarks |

| Servicing | Serviced by the original lender | Often sold to third-party servicers |

Understanding Portfolio Loans and Secondary Market Loans

Portfolio loans are mortgages retained and serviced by the original lender, allowing flexible underwriting standards tailored to unique borrower profiles. Secondary market loans conform to specific guidelines set by entities like Fannie Mae or Freddie Mac, enabling lenders to sell these loans on the secondary market for liquidity. Understanding the distinctions between portfolio and secondary market loans helps borrowers and lenders optimize loan terms, risk management, and market accessibility.

Key Differences Between Portfolio and Secondary Market Loans

Portfolio loans are held and serviced by the original lender, allowing for more flexible underwriting criteria and customized terms. Secondary market loans are originated by lenders but sold to entities like Fannie Mae or Freddie Mac, which adhere to strict guidelines and standardize loan terms. Portfolio loans often benefit borrowers with unique financial situations, while secondary market loans typically offer lower interest rates due to greater liquidity and investor demand.

How Portfolio Loans Work in Mortgage Lending

Portfolio loans are mortgage loans that lenders keep in their own investment portfolios instead of selling them to secondary markets like Fannie Mae or Freddie Mac. These loans offer flexible underwriting standards, allowing borrowers with unique financial situations or less-than-perfect credit to qualify. By retaining the loan, lenders can customize terms and maintain direct control over servicing, interest rates, and repayment structures.

How Secondary Market Loans Operate

Secondary market loans operate by originating mortgages that lenders subsequently package and sell as mortgage-backed securities to investors, providing liquidity and risk distribution. These loans adhere to standardized underwriting criteria set by agencies like Fannie Mae and Freddie Mac, facilitating efficient trading and valuation. This process enables lenders to replenish capital quickly, supporting sustained mortgage lending activity.

Qualification Criteria: Portfolio vs Secondary Market Loans

Portfolio loans prioritize flexible qualification criteria, often allowing borrowers with unique income sources, lower credit scores, or higher debt-to-income ratios to qualify, as these loans are retained and serviced by the original lender. Secondary market loans follow stringent guidelines set by entities like Fannie Mae and Freddie Mac, requiring standard credit scores, verified stable income, and conforming debt-to-income ratios to ensure eligibility. The qualification difference stems from portfolio loans' lender-specific underwriting policies versus secondary market loans' adherence to federally established standards.

Pros and Cons of Portfolio Loans

Portfolio loans offer lenders flexibility by keeping mortgages on their own balance sheets, allowing approval for borrowers with unique financial situations or non-traditional credit profiles. They often feature customizable terms and less stringent qualification requirements but may have higher interest rates and less liquidity compared to secondary market loans. Borrowers benefit from personalized service and potential approval when conventional loans are unavailable, although limited resale options can impact loan accessibility and pricing.

Pros and Cons of Secondary Market Loans

Secondary market loans offer competitive interest rates due to investor demand, providing borrowers with lower monthly payments and better refinancing options. However, these loans involve strict underwriting guidelines and require adherence to standardized terms, which can limit flexibility for unique financial situations. The secondary market's liquidity enables lenders to offer more loans, but it also introduces the risk of changing market conditions affecting loan availability and pricing.

Which Loan Type Offers More Flexibility?

Portfolio loans provide greater flexibility by allowing lenders to set customized terms based on borrower profiles, as these loans are retained on the lender's balance sheet rather than sold. Secondary market loans must conform to stringent guidelines set by entities like Fannie Mae and Freddie Mac, limiting options for loan amounts, credit scores, and documentation. Borrowers seeking tailored solutions for unique financial situations often find portfolio loans to be the more adaptable choice.

Impact on Interest Rates: Portfolio vs Secondary Market

Portfolio loans typically carry higher interest rates because lenders retain the loan on their books, assuming increased risk and offering more flexible terms. Secondary market loans often feature lower interest rates due to standardized underwriting guidelines and the ability to sell the loan to investors, reducing lender risk. The impact on interest rates is significant as portfolio loans cater to non-conforming borrowers, while secondary market loans benefit from broader investor demand and market competition.

Choosing the Right Mortgage: Portfolio or Secondary Market?

Choosing the right mortgage involves understanding the differences between portfolio loans and secondary market loans. Portfolio loans are held by lenders, offering flexible terms and accommodating unique financial situations, while secondary market loans are sold to investors, typically following standardized underwriting guidelines for lower interest rates. Evaluating your financial goals, credit profile, and loan purpose will help determine which mortgage type best fits your needs.

Important Terms

Qualified Mortgage (QM)

Qualified Mortgage (QM) standards establish specific criteria for loans to ensure borrower ability to repay, which often aligns with secondary market loans designed for resale to agencies like Fannie Mae or Freddie Mac. Portfolio loans, held by lenders in-house, may not always meet QM requirements but offer more flexible underwriting and terms outside of standardized secondary market parameters.

Loan Servicing

Portfolio loans are retained by the original lender, allowing customized servicing and flexible underwriting standards, while secondary market loans are sold to investors, requiring standardized servicing and strict compliance with market guidelines. Effective loan servicing ensures timely payments, accurate reporting, and risk management tailored to the loan type, impacting portfolio performance and investor returns.

Non-Conforming Loan

Non-conforming loans, often referred to as portfolio loans, are held by lenders instead of being sold on the secondary market, allowing for more flexible underwriting criteria and terms. Unlike conforming loans that meet Fannie Mae or Freddie Mac guidelines and are sold to investors, portfolio loans cater to borrowers with unique financial situations or higher risk profiles, offering customized solutions outside standard secondary market parameters.

Securitization

Securitization transforms a portfolio loan--comprising a pool of similar loans held by a lender--into tradable securities sold in the secondary market, enhancing liquidity and risk distribution. Unlike secondary market loans purchased individually, portfolio loans are originated and maintained by lenders until bundled for securitization, enabling investors to access diversified cash flows from the underlying assets.

Retained Risk

Retained risk in portfolio loans involves the lender maintaining the credit risk exposure on their balance sheet, allowing for greater control over loan servicing and credit decisions, which can lead to higher returns but increased capital requirements. In contrast, secondary market loans transfer credit risk from the original lender to investors, offering liquidity and risk diversification while potentially reducing the lender's direct influence over borrower relationships and loan performance.

GSE (Government-Sponsored Enterprise)

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac primarily purchase and securitize secondary market loans, which meet stringent underwriting guidelines, excluding most portfolio loans held by lenders for long-term investment. Portfolio loans, typically non-conforming and customized, remain on lenders' balance sheets and are less frequently securitized or sold through the secondary market facilitated by GSEs.

Underwriting Flexibility

Underwriting flexibility significantly differs between portfolio loans and secondary market loans, with portfolio loans allowing lenders to customize criteria such as credit score, debt-to-income ratio, and asset requirements based on borrower profiles. Secondary market loans adhere to strict guidelines set by entities like Fannie Mae and Freddie Mac, limiting underwriting adaptability but enabling easier loan sale and liquidity.

Jumbo Loan

Jumbo loans exceed conforming loan limits set by Fannie Mae and Freddie Mac, making them ineligible for purchase in the secondary market and often funded as portfolio loans held by lenders. Portfolio loans offer lenders flexibility with underwriting standards and terms, while secondary market loans follow strict guidelines to ensure resaleability to investors.

Credit Box

Credit Box defines the criteria and risk parameters for portfolio loans, which lenders hold in-house to manage risk directly, contrasting with secondary market loans sold to investors for liquidity. Portfolio loans offer flexible underwriting standards and customized terms, whereas secondary market loans adhere to standardized conforming guidelines to meet investor requirements.

Whole Loan Sale

Whole loan sales involve transferring entire mortgage loans from lenders to investors, facilitating liquidity and risk management. Compared to portfolio loans held on a lender's balance sheet, whole loans sold in the secondary market enable lenders to free capital for new originations and diversify risk exposure.

Portfolio Loan vs Secondary Market Loan Infographic

moneydif.com

moneydif.com