Conventional mortgages typically have lower loan amounts and adhere to conforming loan limits set by government-sponsored entities, offering competitive interest rates and more flexible qualification standards. Jumbo mortgages exceed these loan limits, requiring higher credit scores, larger down payments, and often come with higher interest rates due to the increased risk for lenders. Borrowers should carefully assess their financial situation and loan requirements to determine which mortgage type aligns best with their homebuying goals.

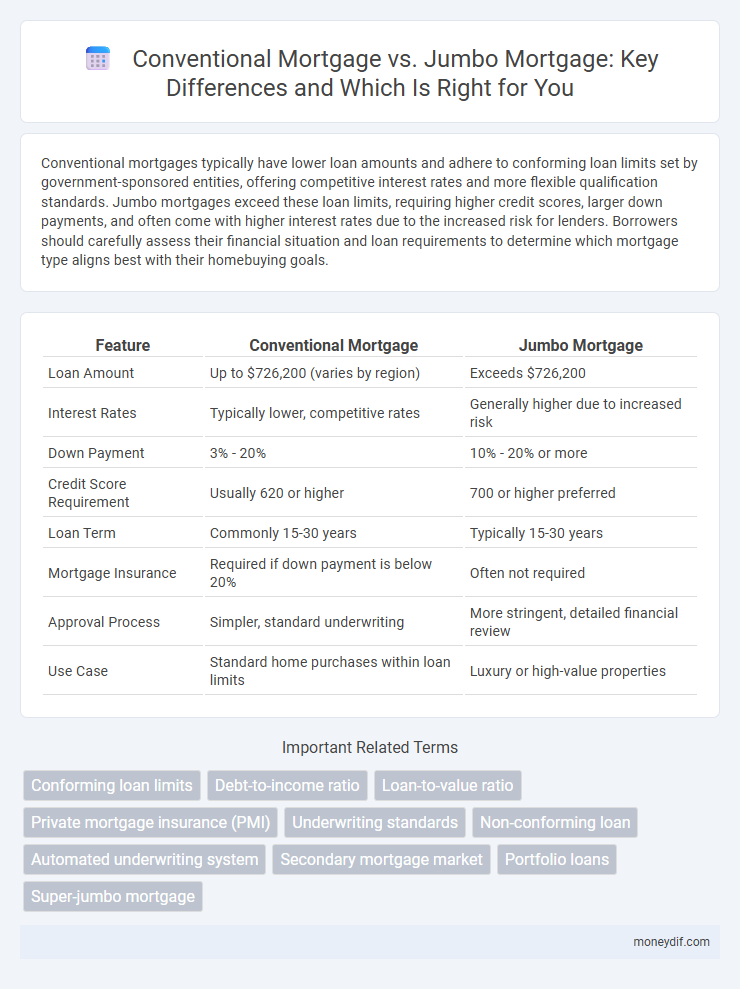

Table of Comparison

| Feature | Conventional Mortgage | Jumbo Mortgage |

|---|---|---|

| Loan Amount | Up to $726,200 (varies by region) | Exceeds $726,200 |

| Interest Rates | Typically lower, competitive rates | Generally higher due to increased risk |

| Down Payment | 3% - 20% | 10% - 20% or more |

| Credit Score Requirement | Usually 620 or higher | 700 or higher preferred |

| Loan Term | Commonly 15-30 years | Typically 15-30 years |

| Mortgage Insurance | Required if down payment is below 20% | Often not required |

| Approval Process | Simpler, standard underwriting | More stringent, detailed financial review |

| Use Case | Standard home purchases within loan limits | Luxury or high-value properties |

Understanding Conventional Mortgages

Conventional mortgages are home loans that conform to the underwriting guidelines set by Fannie Mae and Freddie Mac, making them ideal for borrowers with strong credit and a stable income. These loans typically require a minimum down payment of 3% to 20% and have limits on how much you can borrow, usually up to $726,200 in most areas for 2024. Understanding conventional mortgages helps borrowers access competitive interest rates and flexible terms while avoiding the higher costs associated with jumbo mortgages that exceed conforming loan limits.

What Defines a Jumbo Mortgage?

A jumbo mortgage is defined by its loan amount exceeding the conforming loan limits set by the Federal Housing Finance Agency (FHFA), typically over $726,200 in most U.S. regions for 2024. Unlike conventional mortgages, which adhere to these limits and qualifying criteria established by Fannie Mae and Freddie Mac, jumbo loans require more stringent credit qualifications and often have higher interest rates due to increased lender risk. Borrowers seeking jumbo mortgages usually need higher income, larger down payments, and stronger credit profiles to secure approval.

Key Differences Between Conventional and Jumbo Mortgages

Conventional mortgages typically conform to loan limits set by the Federal Housing Finance Agency (FHFA), generally maxing out at $726,200 in most U.S. counties for 2024, whereas jumbo mortgages exceed these limits and are designed for high-value properties. Conventional loans often feature lower interest rates and more competitive terms due to their eligibility for purchase by Fannie Mae and Freddie Mac, while jumbo loans carry higher rates and stricter underwriting requirements due to increased risk. Borrowers with jumbo mortgages usually need higher credit scores, larger down payments--often 20% or more--and more extensive documentation compared to conventional loan applicants.

Loan Limits: Conventional vs Jumbo

Conventional mortgages adhere to conforming loan limits set by the Federal Housing Finance Agency, typically capping at $726,200 for most U.S. counties in 2023, ensuring eligibility for Fannie Mae and Freddie Mac backing. Jumbo mortgages exceed these conforming loan limits, usually required for high-value properties and often come with stricter credit requirements, higher interest rates, and larger down payments. Borrowers seeking loans above the conventional limit must consider jumbo loans, which are not eligible for government-sponsored enterprise guarantees.

Credit Score Requirements: Which is Stricter?

Conventional mortgages generally require a minimum credit score of 620, while jumbo mortgages often demand higher scores, frequently above 700, due to their larger loan amounts and increased risk for lenders. Lenders impose stricter credit score requirements on jumbo loans to mitigate the risk associated with exceeding conforming loan limits set by entities like Fannie Mae and Freddie Mac. Borrowers seeking jumbo mortgages must demonstrate stronger creditworthiness to qualify for favorable interest rates and loan terms.

Down Payment Expectations for Each Loan Type

Conventional mortgages typically require a down payment ranging from 3% to 20% of the home's purchase price, with higher credit scores often qualifying for lower down payments. Jumbo mortgages, which exceed conforming loan limits set by the Federal Housing Finance Agency, usually demand larger down payments, commonly starting at 10% to 20% or more due to the increased risk. Borrowers opting for jumbo loans should prepare for stricter underwriting standards and potentially higher cash reserves alongside these elevated down payment requirements.

Interest Rates: Conventional vs Jumbo Mortgages

Conventional mortgages typically offer lower interest rates compared to jumbo mortgages due to their smaller loan amounts and conforming loan limits set by Fannie Mae and Freddie Mac. Jumbo mortgages, exceeding conforming loan limits, carry higher risk for lenders, resulting in higher interest rates and stricter qualification criteria. Borrowers with jumbo loans often face increased costs over the loan term due to these elevated interest rates.

Documentation and Approval Process

Conventional mortgage approvals typically require standard documentation such as proof of income, credit reports, and employment verification, with streamlined underwriting processes aligned with government-sponsored enterprise guidelines. Jumbo mortgages demand more extensive documentation, including higher income verification, larger asset reserves, and enhanced credit analysis due to loan amounts exceeding conforming limits. The approval process for jumbo loans is generally lengthier and more stringent, reflecting increased lender risk and stricter regulatory scrutiny.

Pros and Cons of Conventional Mortgages

Conventional mortgages offer competitive interest rates and flexible terms, making them ideal for borrowers with strong credit and moderate loan amounts typically under $647,200. However, they require private mortgage insurance (PMI) if the down payment is less than 20%, increasing overall costs. They are easier to qualify for compared to jumbo mortgages but have stricter debt-to-income ratio requirements.

Pros and Cons of Jumbo Mortgages

Jumbo mortgages allow borrowers to finance higher loan amounts above conforming limits, offering access to luxury properties and competitive rates compared to non-conforming loans. However, they require stricter credit qualifications, larger down payments typically above 20%, and often involve higher interest rates and increased closing costs, impacting affordability. Despite these challenges, jumbo loans provide flexibility for high-value purchases and potential tax deductions on mortgage interest.

Important Terms

Conforming loan limits

Conforming loan limits are set by the Federal Housing Finance Agency (FHFA) and determine the maximum loan size eligible for purchase by Fannie Mae and Freddie Mac, typically $726,200 in most U.S. counties for 2024. Conventional mortgages adhere to these limits, offering competitive interest rates and lower down payments, while jumbo mortgages exceed conforming loan limits, often requiring higher credit scores, larger down payments, and higher interest rates due to increased lender risk.

Debt-to-income ratio

The debt-to-income ratio (DTI) is a crucial metric in assessing eligibility for conventional mortgages, typically requiring a DTI below 43%, whereas jumbo mortgages often allow for slightly higher ratios due to larger loan amounts and borrower qualifications. Lenders evaluating jumbo mortgage applications focus more on overall financial strength, credit score, and reserves, making DTI a flexible but still important indicator in loan approval.

Loan-to-value ratio

The loan-to-value (LTV) ratio typically maxes out at 80% for conventional mortgages, ensuring lower risk for lenders, while jumbo mortgages often require a lower LTV, sometimes around 70%, due to their larger loan amounts exceeding conforming loan limits. Conventional mortgage LTV ratios influence down payment requirements and private mortgage insurance (PMI) eligibility, whereas jumbo loans often demand higher down payments and stricter credit criteria to mitigate increased lender risk.

Private mortgage insurance (PMI)

Private mortgage insurance (PMI) is typically required for conventional mortgages when the down payment is less than 20%, protecting lenders against borrower default. Jumbo mortgages generally do not offer PMI due to their higher loan amounts and stricter qualification criteria, often necessitating larger down payments or alternative risk mitigation methods.

Underwriting standards

Underwriting standards for conventional mortgages typically require a debt-to-income ratio below 43%, a minimum credit score around 620, and loan amounts within conforming limits set by Fannie Mae and Freddie Mac, usually up to $726,200 in most areas. Jumbo mortgage underwriting involves stricter criteria, including a higher credit score often above 700, lower debt-to-income ratios, larger down payments--often 20% or more--and detailed income verification due to loan amounts exceeding conforming limits.

Non-conforming loan

Non-conforming loans fail to meet Fannie Mae or Freddie Mac guidelines, differentiating them from conventional mortgages that adhere to these standards; jumbo mortgages, often characterized by loan amounts exceeding conforming limits, are a primary type of non-conforming loan. These jumbo loans typically require higher credit scores, larger down payments, and carry higher interest rates due to increased risk and lack of government backing.

Automated underwriting system

Automated underwriting systems rapidly analyze credit scores, income, and loan-to-value ratios to determine eligibility for conventional mortgages, which typically fall under conforming loan limits set by Fannie Mae and Freddie Mac. For jumbo mortgages, which exceed conforming limits, these systems apply stricter criteria with enhanced risk assessment algorithms to accommodate higher loan amounts and borrower profiles.

Secondary mortgage market

The secondary mortgage market facilitates the buying and selling of mortgage loans, significantly impacting the liquidity and availability of both conventional mortgages, which conform to Fannie Mae and Freddie Mac loan limits, and jumbo mortgages, which exceed these conforming loan limits and typically carry higher interest rates due to increased risk. Investors in the secondary market evaluate credit quality, loan size, and borrower risk to price conventional versus jumbo mortgage-backed securities, influencing mortgage rates and underwriting standards.

Portfolio loans

Portfolio loans are private lender-held mortgages that do not conform to conventional or jumbo mortgage guidelines, offering flexible terms and underwriting criteria. Conventional mortgages adhere to Fannie Mae and Freddie Mac limits, while jumbo mortgages exceed these limits and often require stricter credit standards compared to portfolio loans.

Super-jumbo mortgage

Super-jumbo mortgages exceed standard jumbo loan limits, often surpassing $1 million, targeting high-value property purchases. Conventional mortgages follow conforming loan limits set by Fannie Mae and Freddie Mac, while jumbo mortgages exceed these limits but remain below the super-jumbo threshold, requiring stricter credit criteria and larger down payments.

Conventional mortgage vs Jumbo mortgage Infographic

moneydif.com

moneydif.com