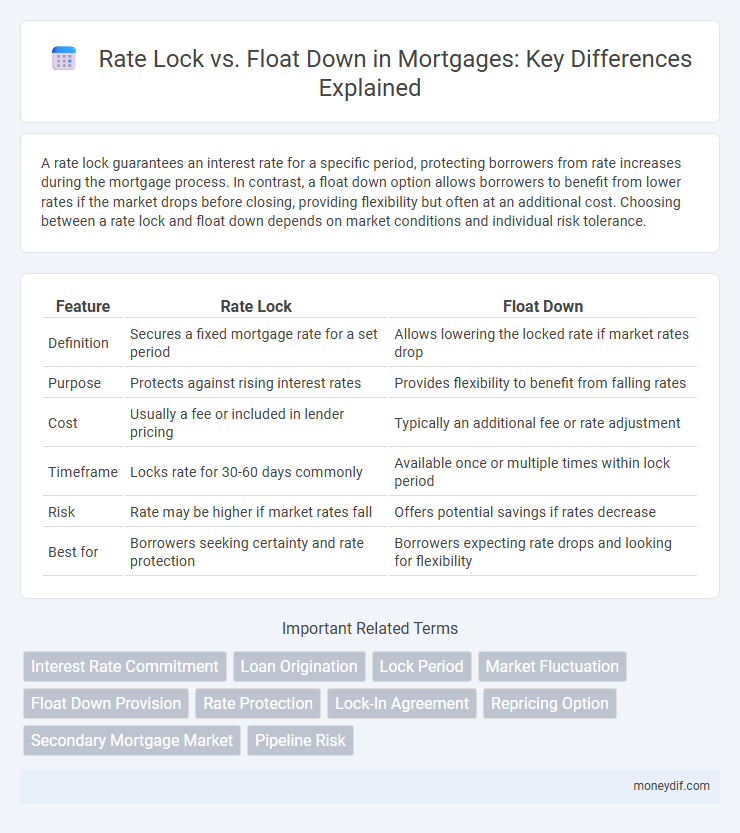

A rate lock guarantees an interest rate for a specific period, protecting borrowers from rate increases during the mortgage process. In contrast, a float down option allows borrowers to benefit from lower rates if the market drops before closing, providing flexibility but often at an additional cost. Choosing between a rate lock and float down depends on market conditions and individual risk tolerance.

Table of Comparison

| Feature | Rate Lock | Float Down |

|---|---|---|

| Definition | Secures a fixed mortgage rate for a set period | Allows lowering the locked rate if market rates drop |

| Purpose | Protects against rising interest rates | Provides flexibility to benefit from falling rates |

| Cost | Usually a fee or included in lender pricing | Typically an additional fee or rate adjustment |

| Timeframe | Locks rate for 30-60 days commonly | Available once or multiple times within lock period |

| Risk | Rate may be higher if market rates fall | Offers potential savings if rates decrease |

| Best for | Borrowers seeking certainty and rate protection | Borrowers expecting rate drops and looking for flexibility |

Understanding Mortgage Rate Locks

Mortgage rate locks secure an interest rate for a set period, protecting borrowers from market fluctuations during loan processing. Float down options allow borrowers to benefit from lower rates if market prices drop before closing. Understanding the terms and costs of rate locks versus float downs is crucial for optimizing mortgage affordability and minimizing financial risk.

What Is a Float Down Option?

A float down option in mortgage lending allows borrowers to secure a low interest rate with a rate lock while retaining the ability to adjust to a lower rate if market rates decline before closing. This feature provides financial flexibility by protecting borrowers from rising rates yet offering potential savings if rates fall within a specified timeframe. Float down options typically require an additional fee and specific terms outlined in the loan agreement.

Key Differences: Rate Lock vs Float Down

Rate lock secures a fixed interest rate at loan application to protect borrowers from rising rates, while float down offers flexibility to adjust the rate downward if market rates decrease before closing. Rate lock provides certainty and budget predictability, whereas float down usually involves fees and conditions limiting when and how often the rate can be lowered. Borrowers should assess market volatility, loan timelines, and cost implications when choosing between rate lock and float down options.

Pros and Cons of Locking Your Rate

Locking your mortgage rate guarantees a fixed interest rate, protecting you from market fluctuations and ensuring predictable monthly payments, but it may result in missing out on potential rate drops if the market improves. While rate locks eliminate uncertainty and help with budgeting, they often come with fees and expiration dates, requiring timely loan closure. Floating down options offer flexibility to reduce rates if they fall, but such options may involve additional costs and are not always permitted by lenders.

When to Choose a Float Down Option

The float down option is ideal when mortgage rates are currently high but market forecasts predict a decline before closing, allowing borrowers to benefit from lower rates without committing immediately. This strategy suits buyers with flexible timelines who want protection against rate drops while avoiding the risk of locking in an unfavorable rate. Choosing float down can balance cost savings with risk management, especially in volatile interest rate environments.

Impact of Market Volatility on Your Choice

Rate lock provides borrowers with a fixed interest rate, protecting them from rising rates during market volatility, but may result in missed opportunities if rates drop. Float down options offer flexibility to secure a lower rate if market rates decline before closing, though they often come with additional fees or restrictions. Understanding current market trends and volatility helps borrowers weigh the cost-benefit of locking in a rate versus maintaining the potential to float down.

How Rate Lock Periods Work

Rate lock periods secure an interest rate for a specific timeframe, typically ranging from 15 to 60 days, protecting borrowers from market fluctuations during the mortgage approval process. These periods begin once the lender and borrower agree on the rate, ensuring the rate remains constant until closing, even if rates rise. If the lock expires before closing, the borrower may need to accept the current market rate or negotiate an extension, often incurring additional fees.

Costs Associated with Float Down Features

Float down features in mortgage loans allow borrowers to take advantage of lower interest rates after initially locking in a rate, but they often come with additional costs such as upfront fees or higher interest rates to compensate lenders for the risk. These costs vary by lender but typically include a float down fee ranging from 0.25% to 0.50% of the loan amount or a higher initial locked rate to offset potential savings. Understanding the precise cost structure is essential for borrowers to evaluate whether the potential benefit of a lower rate outweighs the expenses associated with the float down option.

Expert Tips for Timing Your Decision

Experts recommend locking your mortgage rate when market volatility is high to secure a favorable interest rate, especially if rates are trending upward. Floating down is advantageous if you anticipate rates dropping before closing, allowing you to benefit from lower costs without committing early. Monitoring economic indicators like Federal Reserve announcements and inflation trends helps optimize timing for locking or floating down rates.

Rate Lock and Float Down: FAQs for Homebuyers

Rate lock guarantees a specific mortgage interest rate for a set period, protecting homebuyers from rate increases during the loan process. Float down options allow borrowers to secure a rate initially and reduce it if market rates drop before closing, offering flexibility and potential savings. Understanding these features helps homebuyers make informed decisions and manage interest rate risks effectively.

Important Terms

Interest Rate Commitment

Interest Rate Commitment ensures a fixed mortgage rate by locking it in, while Rate Lock offers a freeze with the option to float down if market rates improve before closing.

Loan Origination

Rate lock in loan origination secures an interest rate for a specified period, while float down allows borrowers to benefit from lower rates if market rates decrease before closing.

Lock Period

Lock Period defines the timeframe during which a mortgage interest rate is guaranteed, protecting borrowers from market fluctuations. Rate Lock secures a fixed interest rate for this period, while Float Down options allow borrowers to benefit from lower rates if market rates decrease before closing.

Market Fluctuation

Market fluctuation impacts the advantage of rate locks and float-down options by determining whether borrowers benefit from fixed interest rates during volatility or can capitalize on lower rates if prices drop before closing.

Float Down Provision

A Float Down Provision allows borrowers to benefit from lower interest rates after a Rate Lock by adjusting their locked rate downward if market rates decline before loan closing.

Rate Protection

Rate protection options in mortgage lending include Rate Lock, which secures an interest rate for a set period, and Float Down, allowing borrowers to take advantage of lower rates if market rates drop before closing. Rate Lock provides certainty against rising rates, while Float Down offers flexibility, balancing risk and potential savings during the loan approval process.

Lock-In Agreement

A lock-in agreement secures a fixed mortgage rate, preventing increases during the rate lock period, while a float down option allows borrowers to take advantage of lower rates if market rates drop before closing.

Repricing Option

Repricing options in mortgage loans allow borrowers to adjust their interest rates by either locking a fixed rate or opting for a float-down feature to benefit from lower market rates before closing.

Secondary Mortgage Market

The Secondary Mortgage Market influences lender offerings by balancing rate lock agreements that secure borrower rates against float down options allowing rate adjustments before closing.

Pipeline Risk

Pipeline risk in mortgage lending arises when borrowers lock rates but market interest rates decline, prompting the need to evaluate the benefits of a float down option to secure lower rates before closing.

Rate Lock vs Float Down Infographic

moneydif.com

moneydif.com