Amortization involves gradually paying off a mortgage loan through regular principal and interest payments, reducing the loan balance over time. Negative amortization occurs when monthly payments are insufficient to cover interest, causing the unpaid interest to be added to the loan principal, increasing the total debt. Understanding these differences helps borrowers manage loan repayment strategies and avoid unexpectedly higher mortgage balances.

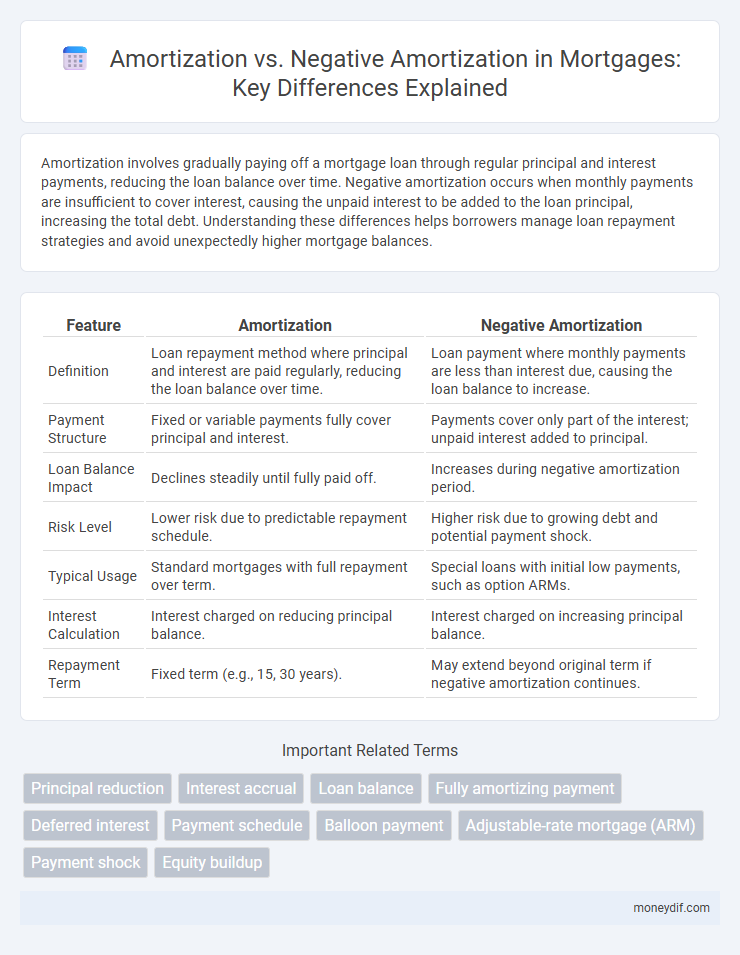

Table of Comparison

| Feature | Amortization | Negative Amortization |

|---|---|---|

| Definition | Loan repayment method where principal and interest are paid regularly, reducing the loan balance over time. | Loan payment where monthly payments are less than interest due, causing the loan balance to increase. |

| Payment Structure | Fixed or variable payments fully cover principal and interest. | Payments cover only part of the interest; unpaid interest added to principal. |

| Loan Balance Impact | Declines steadily until fully paid off. | Increases during negative amortization period. |

| Risk Level | Lower risk due to predictable repayment schedule. | Higher risk due to growing debt and potential payment shock. |

| Typical Usage | Standard mortgages with full repayment over term. | Special loans with initial low payments, such as option ARMs. |

| Interest Calculation | Interest charged on reducing principal balance. | Interest charged on increasing principal balance. |

| Repayment Term | Fixed term (e.g., 15, 30 years). | May extend beyond original term if negative amortization continues. |

Understanding Amortization in Mortgages

Amortization in mortgages refers to the gradual reduction of the loan balance through scheduled, consistent payments of principal and interest over the loan term, ensuring full repayment by maturity. Negative amortization occurs when monthly payments are insufficient to cover the interest, causing the unpaid interest to be added to the principal balance, which increases the loan amount owed. Understanding the difference is crucial for borrowers to manage payment expectations and avoid growing debt.

What Is Negative Amortization?

Negative amortization occurs when mortgage payments are insufficient to cover the interest accrued, causing the unpaid interest to be added to the loan principal balance. This results in the loan balance increasing over time instead of decreasing, which can lead to higher debt and potential financial strain for borrowers. Negative amortization typically happens with certain adjustable-rate or option ARM loans, where minimum payments are deliberately set below the interest amount.

Key Differences: Amortization vs Negative Amortization

Amortization involves paying both principal and interest gradually over the loan term, reducing the loan balance consistently until fully paid off. Negative amortization occurs when monthly payments are insufficient to cover the interest, causing the unpaid interest to be added to the loan principal and increasing the total debt. The key difference lies in loan balance movement: amortization decreases debt, while negative amortization increases it, often leading to higher future payments.

How Amortization Affects Your Mortgage Balance

Amortization steadily reduces your mortgage balance through consistent monthly payments that cover both principal and interest, ensuring the loan is paid off by the end of the term. Negative amortization occurs when payments are insufficient to cover interest, causing the loan balance to increase instead of decrease. Understanding amortization schedules helps borrowers predict their payoff timeline and manage their mortgage costs effectively.

Risks Associated with Negative Amortization Loans

Negative amortization loans pose significant risks, including increasing loan balances as unpaid interest is added to the principal, potentially leading to higher monthly payments and longer repayment periods. Borrowers may face payment shock when the loan recasts, causing financial strain and increased default risk. Unlike standard amortization schedules, negative amortization can result in negative equity if property values decline.

Pros and Cons of Standard Amortization

Standard amortization provides borrowers with a predictable repayment schedule, reducing principal and interest over the loan term and ultimately leading to full loan payoff. This approach offers financial clarity and gradual equity build-up, which helps in long-term budgeting and credit improvement. However, fixed payments may limit flexibility during financial hardship and potentially result in higher initial monthly costs compared to interest-only options.

Impact of Negative Amortization on Home Equity

Negative amortization occurs when monthly mortgage payments are insufficient to cover the interest, causing the unpaid interest to be added to the loan principal and increasing the overall debt. This process reduces home equity growth because the loan balance increases while property value remains unchanged or grows slower. As a result, homeowners may face challenges refinancing or selling their property due to decreased equity and higher outstanding loan amounts.

Common Mortgage Types: Amortizing vs Non-Amortizing

Amortizing mortgages require regular payments that cover both principal and interest, gradually reducing the loan balance until full repayment by the end of the term, making them the most common type for homebuyers. Negative amortization occurs in non-amortizing loans where monthly payments are insufficient to cover interest, causing the unpaid interest to be added to the loan principal, increasing the total debt over time. Common non-amortizing mortgage types, such as option ARMs or certain interest-only loans, carry higher risk due to potential payment shock when principal repayment begins.

Choosing the Right Mortgage for Your Financial Situation

Amortization involves making regular mortgage payments that cover both principal and interest, gradually reducing the loan balance over time, while negative amortization occurs when payments are insufficient to cover interest, causing the loan balance to increase. Choosing the right mortgage requires assessing your cash flow stability and future income prospects to avoid the risks of negative amortization, such as escalating debt and higher final payments. Careful analysis of loan terms, payment structures, and long-term financial goals ensures an optimal mortgage that aligns with your financial situation and risk tolerance.

Tips for Avoiding Negative Amortization Pitfalls

To avoid negative amortization pitfalls, borrowers should choose fixed-rate or fully amortizing adjustable-rate mortgages that ensure principal reduction with each payment. Regularly reviewing loan statements and understanding the loan's payment structure can prevent unexpected increases in loan balance. Opting for higher monthly payments than the minimum required helps maintain positive amortization, reducing total interest costs over the loan term.

Important Terms

Principal reduction

Principal reduction occurs when payments exceed the interest due, decreasing the loan balance through amortization, while negative amortization happens when payments are insufficient to cover interest, causing the principal to increase. Understanding these concepts is essential for managing loan repayment strategies effectively and avoiding long-term debt escalation.

Interest accrual

Interest accrual during amortization involves gradually reducing the loan principal through scheduled payments covering both interest and principal, ensuring the loan balance decreases over time. In contrast, negative amortization occurs when interest accrual exceeds the payment amount, causing the loan balance to increase as unpaid interest is added to the principal.

Loan balance

Loan balance decreases steadily with amortization as each payment covers both interest and principal, ensuring gradual debt reduction over time. Negative amortization occurs when payments are insufficient to cover interest, causing the loan balance to increase and leading to higher overall debt.

Fully amortizing payment

A fully amortizing payment ensures the loan balance is completely paid off by the end of the loan term through consistent principal and interest payments, contrasting with negative amortization where payments are insufficient, causing the loan balance to increase. Amortization schedules for fully amortizing loans provide predictable payoff timelines, while negative amortization loans result in growing debt despite regular payments.

Deferred interest

Deferred interest accrues when unpaid interest is added to the principal balance, leading to negative amortization where the loan balance increases instead of decreasing. In contrast, amortization involves scheduled payments that cover both principal and interest, gradually reducing the loan balance over time.

Payment schedule

A payment schedule under amortization consistently reduces the principal balance through fixed or variable payments covering both interest and principal, ensuring full loan repayment by the end of the term. In contrast, a negative amortization payment schedule results in payments that are insufficient to cover accrued interest, causing the loan balance to increase over time.

Balloon payment

A balloon payment is a large, lump-sum payment due at the end of a loan term, often resulting from partial amortization where regular payments do not fully repay the principal. Unlike negative amortization, where unpaid interest increases the loan balance, balloon payments require settling the remaining principal at maturity, highlighting the difference between full amortization and loan structures with deferred principal repayment.

Adjustable-rate mortgage (ARM)

Adjustable-rate mortgages (ARMs) feature interest rates that periodically adjust based on market indices, affecting the loan's amortization schedule where payments may initially cover both principal and interest, promoting loan balance reduction. In contrast, negative amortization occurs when ARM payments are insufficient to cover interest, causing the unpaid interest to be added to the principal balance, increasing the overall loan amount instead of decreasing it.

Payment shock

Payment shock occurs when borrowers face a sudden increase in mortgage payments, often due to transitioning from interest-only or negatively amortized loans to fully amortizing loans. Negative amortization increases loan principal as unpaid interest is added, leading to higher future payments, whereas traditional amortization gradually reduces principal balance generating consistent payment schedules.

Equity buildup

Equity buildup occurs through amortization when regular mortgage payments reduce the principal balance, increasing the homeowner's ownership stake. In contrast, negative amortization decreases equity as unpaid interest is added to the loan balance, causing the principal to grow despite payments.

Amortization vs Negative amortization Infographic

moneydif.com

moneydif.com