Pre-approval involves a lender conducting a thorough review of your financial documents to offer a conditional commitment on a mortgage, whereas pre-qualification is a preliminary assessment based on self-reported information. Pre-approval strengthens your negotiating position by demonstrating serious intent and financial reliability to sellers. Pre-qualification serves as an initial estimate of borrowing capacity but lacks the credibility and detailed verification that pre-approval provides.

Table of Comparison

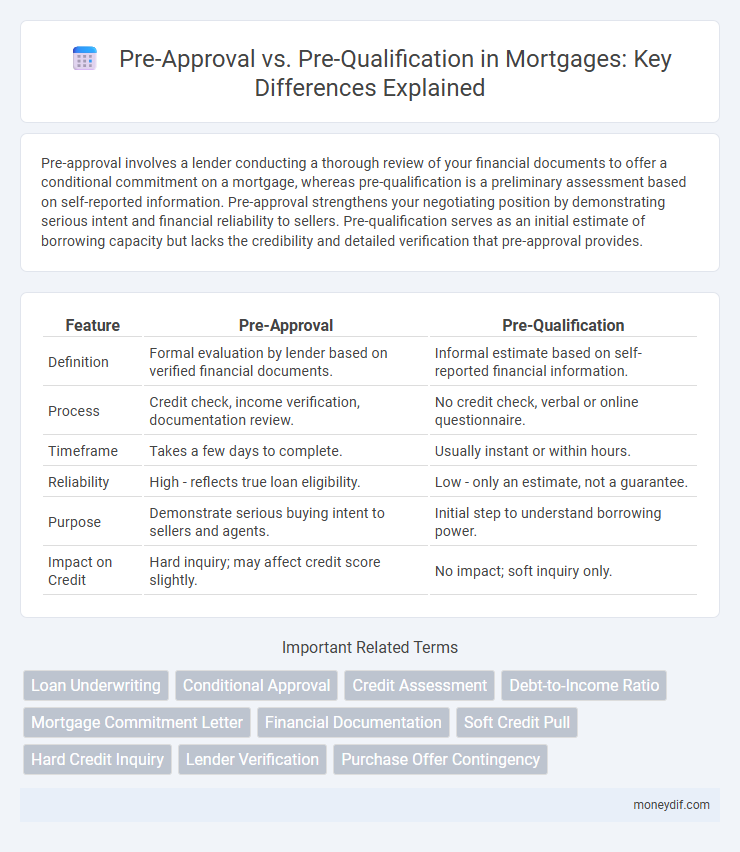

| Feature | Pre-Approval | Pre-Qualification |

|---|---|---|

| Definition | Formal evaluation by lender based on verified financial documents. | Informal estimate based on self-reported financial information. |

| Process | Credit check, income verification, documentation review. | No credit check, verbal or online questionnaire. |

| Timeframe | Takes a few days to complete. | Usually instant or within hours. |

| Reliability | High - reflects true loan eligibility. | Low - only an estimate, not a guarantee. |

| Purpose | Demonstrate serious buying intent to sellers and agents. | Initial step to understand borrowing power. |

| Impact on Credit | Hard inquiry; may affect credit score slightly. | No impact; soft inquiry only. |

Understanding Pre-Approval and Pre-Qualification

Pre-approval involves a thorough evaluation of a borrower's financial documents by a lender to determine the maximum loan amount they qualify for, providing a conditional commitment that strengthens offers on homes. Pre-qualification is a preliminary estimate based on self-reported financial information, offering a general idea of potential loan eligibility without detailed verification. Understanding the distinction helps buyers navigate the mortgage process more effectively, ensuring clearer expectations and stronger negotiating positions.

Key Differences Between Pre-Approval and Pre-Qualification

Pre-approval involves a thorough evaluation of your financial background, including credit checks and verification of income, assets, and debts, providing a conditional commitment for a mortgage loan. Pre-qualification is an informal estimate based on self-reported information without credit checks, offering a general idea of the loan amount you might qualify for. The key difference lies in the reliability and depth of assessment, with pre-approval carrying more weight in competitive homebuying scenarios.

Why Pre-Approval Holds More Weight

Pre-approval holds more weight than pre-qualification in the mortgage process because it involves a thorough evaluation of the borrower's financial background, including credit checks, income verification, and debt assessment. This detailed scrutiny provides lenders with a more accurate estimate of the loan amount the borrower qualifies for, making pre-approval a stronger indicator of buying power. Real estate agents and sellers prefer buyers with pre-approval letters as they demonstrate serious intent and financial readiness, enhancing negotiation leverage.

When to Seek Pre-Qualification

Seek pre-qualification early in the homebuying process to gain an initial understanding of your borrowing potential and budget. Pre-qualification provides a preliminary estimate based on self-reported financial information, allowing buyers to identify affordable price ranges before property hunting. This step can streamline savings goals and prepare buyers for more detailed pre-approval when ready to make an offer.

The Pre-Approval Process Explained

The pre-approval process involves a thorough evaluation of a borrower's financial status, including credit score, income verification, and debt-to-income ratio, conducted by a lender to determine the maximum mortgage amount they can offer. This process requires submitting detailed documentation such as pay stubs, tax returns, and bank statements, which allows lenders to provide a conditional commitment for financing. Pre-approval strengthens a buyer's position in the housing market by demonstrating serious intent and financial capability to sellers and real estate agents.

Benefits of Getting Pre-Qualified First

Getting pre-qualified for a mortgage offers a quick and straightforward assessment of your financial situation, helping you establish a realistic budget before house hunting. This initial step boosts your credibility with sellers by demonstrating your intent and financial capability, which can streamline the homebuying process. Pre-qualification also identifies potential credit or income issues early, allowing time to address them before applying for pre-approval.

Impact on Home Buying Negotiations

Pre-approval provides a verified loan amount based on credit checks and income verification, significantly strengthening your position in home buying negotiations by demonstrating serious buyer intent to sellers. Pre-qualification offers an initial estimate without in-depth verification, making it less influential during negotiations and reducing the buyer's credibility. Sellers and real estate agents typically prioritize buyers with pre-approval letters, as they indicate a higher likelihood of mortgage approval and a smoother transaction process.

Documentation Needed for Each Process

Pre-approval for a mortgage requires comprehensive documentation such as proof of income, tax returns, credit reports, employment verification, and bank statements to assess the borrower's creditworthiness accurately. Pre-qualification involves a less rigorous process, typically relying on self-reported financial information without official documentation, providing only an estimate of borrowing capacity. Lenders prioritize pre-approval documentation to offer conditional loan commitments, whereas pre-qualification serves as an initial financial snapshot with minimal paperwork.

Common Misconceptions About Pre-Approval vs Pre-Qualification

Many homebuyers confuse pre-approval and pre-qualification, but pre-approval involves a thorough review of financial documents and credit checks, making it a stronger commitment from lenders. Pre-qualification is an initial estimate based on self-reported information and does not guarantee loan approval. Understanding this distinction helps buyers better prepare for mortgage approval and strengthens their position in competitive housing markets.

Choosing the Right Option for Your Mortgage Journey

Pre-approval offers a conditional commitment from a lender based on verified financial information, providing stronger leverage when house hunting. Pre-qualification, while quicker and less detailed, gives an initial estimate of how much you might borrow but lacks the assurance lenders provide in pre-approval. Choosing pre-approval is ideal for serious buyers seeking clarity and competitive advantage, whereas pre-qualification suits those beginning their mortgage exploration.

Important Terms

Loan Underwriting

Loan underwriting rigorously assesses borrower creditworthiness, while pre-approval provides a conditional loan offer based on detailed financial verification, and pre-qualification offers an initial estimate without in-depth analysis.

Conditional Approval

Conditional approval requires verified financial documents and credit checks, offering more certainty than pre-qualification but less finality than full pre-approval in the mortgage process.

Credit Assessment

Credit assessment plays a crucial role in distinguishing pre-approval from pre-qualification, where pre-approval involves a thorough evaluation of credit history, income, and debt-to-income ratio to provide a conditional loan commitment. Pre-qualification is a preliminary estimate based on self-reported information without in-depth credit checks, offering buyers a general idea of potential borrowing capacity.

Debt-to-Income Ratio

Debt-to-Income Ratio plays a crucial role in mortgage pre-approval by providing lenders with a precise measure of a borrower's ability to repay, unlike pre-qualification which offers a preliminary estimate without in-depth financial verification.

Mortgage Commitment Letter

A Mortgage Commitment Letter is a formal document issued by a lender after thorough underwriting, confirming loan approval and specifying terms, whereas pre-approval offers a conditional promise based on verified financial information, and pre-qualification is an informal estimate based on self-reported data. Obtaining a commitment letter provides stronger assurance to sellers compared to pre-approval or pre-qualification, enhancing buyer credibility in competitive housing markets.

Financial Documentation

Pre-approval in financial documentation requires verified income, credit reports, and asset details, whereas pre-qualification relies on self-reported financial information without formal verification.

Soft Credit Pull

Soft credit pulls allow lenders to perform pre-approval and pre-qualification checks without impacting your credit score, using preliminary financial data to estimate creditworthiness.

Hard Credit Inquiry

A hard credit inquiry occurs when a lender reviews your credit report during the pre-approval process, potentially impacting your credit score, while pre-qualification typically involves a soft inquiry that does not affect your credit. Understanding the difference between pre-approval and pre-qualification helps borrowers gauge their likelihood of loan approval and manage credit report impacts effectively.

Lender Verification

Lender verification distinguishes pre-approval from pre-qualification by confirming income, credit, and assets during pre-approval to provide a more accurate loan estimate.

Purchase Offer Contingency

Purchase offer contingency often depends on buyer pre-approval, which provides stronger financial assurance than pre-qualification, thereby increasing offer credibility and contract security.

Pre-Approval vs Pre-Qualification Infographic

moneydif.com

moneydif.com