Escrow impound accounts collect property taxes and insurance premiums as part of your monthly mortgage payment, ensuring timely payments without extra effort. Direct pay requires homeowners to manage and pay these expenses independently, providing greater control but increasing the risk of missed payments. Choosing between escrow impound and direct pay depends on your preference for convenience versus autonomy in managing homeownership costs.

Table of Comparison

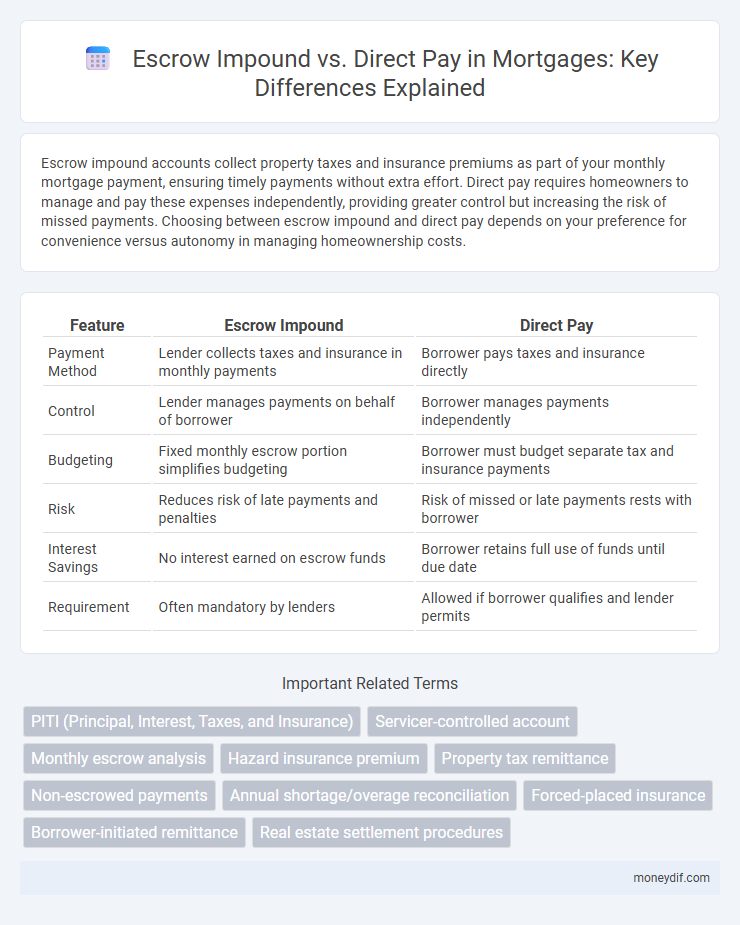

| Feature | Escrow Impound | Direct Pay |

|---|---|---|

| Payment Method | Lender collects taxes and insurance in monthly payments | Borrower pays taxes and insurance directly |

| Control | Lender manages payments on behalf of borrower | Borrower manages payments independently |

| Budgeting | Fixed monthly escrow portion simplifies budgeting | Borrower must budget separate tax and insurance payments |

| Risk | Reduces risk of late payments and penalties | Risk of missed or late payments rests with borrower |

| Interest Savings | No interest earned on escrow funds | Borrower retains full use of funds until due date |

| Requirement | Often mandatory by lenders | Allowed if borrower qualifies and lender permits |

Understanding Escrow Impound Accounts

Escrow impound accounts are used by lenders to collect and hold funds for property taxes and homeowners insurance, ensuring these expenses are paid on time and protecting the lender's interest. Unlike direct pay, where homeowners pay these bills independently, escrow accounts bundle these payments into the monthly mortgage payment, providing convenience and avoiding large lump-sum payments. Understanding escrow impound accounts helps borrowers manage their finances and maintain mortgage compliance.

What Is Direct Pay for Mortgages?

Direct pay for mortgages refers to a payment method where borrowers send their principal, interest, taxes, and insurance payments directly to their mortgage servicer without an escrow account. This option gives homeowners greater control over their property tax and insurance payments, allowing them to manage and pay these bills independently. By choosing direct pay, borrowers avoid the impound account fees and can potentially earn interest on funds held outside escrow.

Key Differences Between Escrow Impound and Direct Pay

Escrow impound involves the lender collecting property taxes and insurance premiums as part of the monthly mortgage payment, ensuring these expenses are paid on time from a dedicated account. Direct pay requires the borrower to manage and pay property taxes and insurance premiums independently, outside of the mortgage payment. The key difference lies in payment management and responsibility, with escrow providing convenience and protection for both lender and borrower, while direct pay offers more control but requires diligent financial planning.

Pros and Cons of Escrow Impound Accounts

Escrow impound accounts simplify mortgage payments by bundling property taxes and insurance into monthly installments, reducing the risk of large lump-sum expenses and ensuring timely payments to avoid penalties. However, they restrict cash flow flexibility since borrowers must maintain a reserve, often causing overpayment and low or no interest on the escrow balance. Escrow accounts provide financial discipline but may lead to higher monthly payments compared to direct pay options.

Benefits of Paying Taxes and Insurance Directly

Paying taxes and insurance directly outside of an escrow impound account ensures greater control over funds and provides transparency in managing property-related expenses. Borrowers avoid potential escrow shortages and benefit from possibly earning interest on their money until payments are due. This direct payment method can enhance cash flow flexibility, allowing homeowners to budget more efficiently for tax deadlines and insurance renewals.

How Lenders Handle Escrow Impound Accounts

Lenders manage escrow impound accounts by collecting monthly payments from borrowers to cover property taxes, homeowners insurance, and other related expenses, ensuring timely disbursement of these bills on behalf of the borrower. This method reduces the risk of tax liens or insurance lapses, providing financial security for both the lender and borrower. In contrast, direct pay requires borrowers to handle these payments independently, increasing the administrative burden and potential for missed deadlines.

Cost Implications: Escrow Impound vs Direct Pay

Escrow impound accounts bundle property taxes and insurance premiums into monthly mortgage payments, offering convenience but often resulting in higher overall costs due to escrow fees and potential overestimations. Direct pay requires borrowers to manage tax and insurance payments independently, which can reduce lender fees and interest accruals but demands disciplined budgeting and timely remittances. Choosing between escrow impound and direct pay directly affects cash flow management and can influence the total cost of homeownership over the loan term.

Impact on Homeowner Cash Flow

Escrow impound accounts require homeowners to include property taxes and insurance payments in their monthly mortgage installments, creating stable but higher monthly expenses and reducing immediate cash flow flexibility. Direct pay allows homeowners to manage tax and insurance payments independently, potentially increasing monthly disposable income but requiring disciplined budgeting to avoid missed payments. Choosing escrow impound often provides predictable cash flow management, while direct pay can enhance short-term liquidity but introduces payment risk.

Choosing the Best Option for Your Mortgage

Choosing between escrow impound and direct pay for your mortgage depends on your financial discipline and preference for managing payments. Escrow impound options bundle your property taxes and insurance premiums into monthly mortgage payments, offering convenience and predictable budgeting. Direct pay requires homeowners to handle tax and insurance payments independently, which can provide flexibility but demands careful financial planning to avoid missed payments or penalties.

Frequently Asked Questions About Escrow and Direct Pay

Escrow impound accounts collect property taxes and homeowners insurance payments alongside the mortgage payment, ensuring timely disbursement and protecting lenders from payment defaults. Direct pay requires homeowners to pay these expenses independently, offering more control but demanding strict budgeting discipline. Common questions address how escrow balances are managed, potential shortages, and the benefits or risks of each payment method.

Important Terms

PITI (Principal, Interest, Taxes, and Insurance)

PITI represents the total monthly mortgage payment including Principal, Interest, Taxes, and Insurance, where escrow impound accounts consolidate property taxes and insurance into the lender-held escrow for automatic payments, enhancing budget predictability. Direct pay requires homeowners to manage and remit property taxes and insurance premiums independently, often necessitating disciplined financial planning to avoid penalties or lapses in coverage.

Servicer-controlled account

A servicer-controlled account in mortgage loans manages funds collected from borrowers for property taxes and insurance, ensuring timely payments through escrow impound accounts, which protect both lender and borrower from missed obligations. In contrast, direct pay requires borrowers to handle these payments independently, increasing the risk of payment delays and potential lapses in coverage.

Monthly escrow analysis

Monthly escrow analysis ensures accurate calculation of escrow impound accounts by assessing property taxes and insurance payments, preventing shortages or surpluses. In contrast, direct pay borrowers manage these expenses independently without monthly escrow adjustments, affecting cash flow and payment schedules.

Hazard insurance premium

Hazard insurance premiums can be paid through escrow impound accounts, where lenders collect monthly installments as part of the mortgage payment to ensure timely coverage, or via direct pay by the homeowner, who is responsible for making premium payments independently. Escrow impound accounts provide automatic payment convenience and reduce the risk of missed deadlines, while direct pay offers greater control but requires diligent tracking of insurance due dates.

Property tax remittance

Property tax remittance involves either escrow impound accounts or direct pay methods, where escrow accounts accumulate monthly tax payments held by the lender to ensure timely tax remittance, while direct pay requires homeowners to submit tax payments independently. Escrow impound minimizes risk of tax delinquencies and potential penalties, whereas direct pay offers more control but demands vigilant payment management to avoid late fees or tax liens.

Non-escrowed payments

Non-escrowed payments, also known as direct pay, require borrowers to handle property taxes and insurance premiums independently, unlike escrow impound accounts where the lender collects and manages these funds monthly. This approach can provide greater cash flow flexibility but increases the risk of missed payments and financial exposure to penalties or lapses in coverage.

Annual shortage/overage reconciliation

Annual shortage/overage reconciliation compares the escrow impound account balance with actual expenses to ensure sufficient funds for property taxes and insurance, preventing payment defaults. In direct pay arrangements, homeowners are responsible for reconciling discrepancies independently, which requires disciplined budgeting to avoid shortfalls or overpayments.

Forced-placed insurance

Forced-placed insurance often arises when escrow impound accounts fail to maintain sufficient funds for homeowners insurance, prompting lenders to secure coverage themselves, typically at higher costs. Direct pay allows homeowners to manage insurance payments independently, reducing lender intervention and the risk of forced-placed policies.

Borrower-initiated remittance

Borrower-initiated remittance in escrow impound accounts involves the lender collecting and managing funds for property taxes and insurance, ensuring timely payments, while direct pay requires the borrower to remit payments independently, increasing control but adding the risk of missed deadlines. Escrow impound offers convenience and protection against default, whereas direct pay demands borrower diligence and financial discipline.

Real estate settlement procedures

Real estate settlement procedures involve transferring property ownership through escrow accounts that securely hold funds until closing, where escrow impound accounts collect monthly payments for taxes and insurance, ensuring timely disbursement. In contrast, direct pay requires borrowers to manage and pay these expenses independently, offering greater control but requiring discipline to avoid late payments or penalties.

Escrow impound vs Direct pay Infographic

moneydif.com

moneydif.com