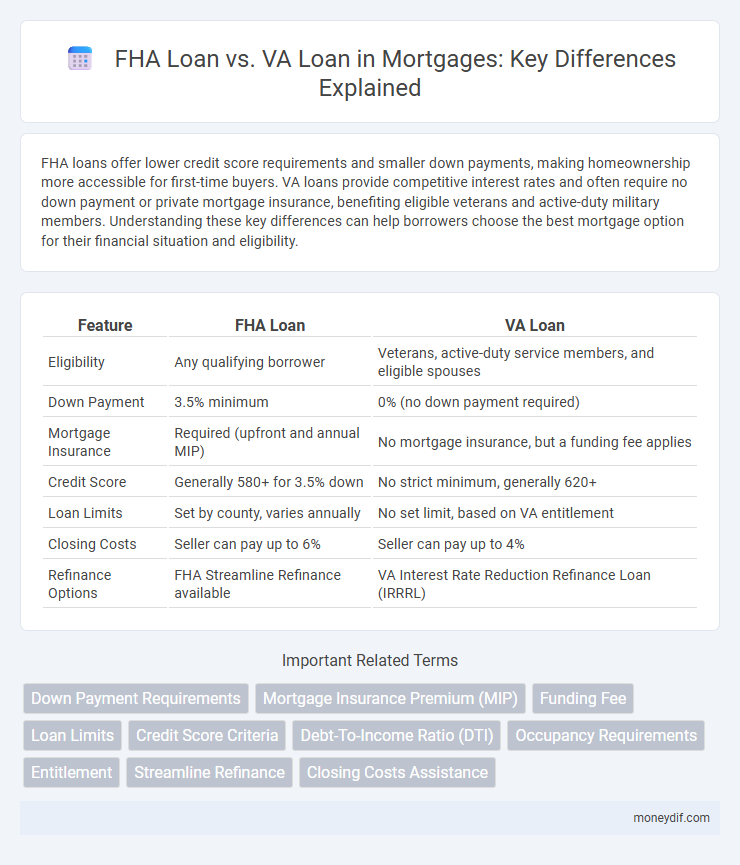

FHA loans offer lower credit score requirements and smaller down payments, making homeownership more accessible for first-time buyers. VA loans provide competitive interest rates and often require no down payment or private mortgage insurance, benefiting eligible veterans and active-duty military members. Understanding these key differences can help borrowers choose the best mortgage option for their financial situation and eligibility.

Table of Comparison

| Feature | FHA Loan | VA Loan |

|---|---|---|

| Eligibility | Any qualifying borrower | Veterans, active-duty service members, and eligible spouses |

| Down Payment | 3.5% minimum | 0% (no down payment required) |

| Mortgage Insurance | Required (upfront and annual MIP) | No mortgage insurance, but a funding fee applies |

| Credit Score | Generally 580+ for 3.5% down | No strict minimum, generally 620+ |

| Loan Limits | Set by county, varies annually | No set limit, based on VA entitlement |

| Closing Costs | Seller can pay up to 6% | Seller can pay up to 4% |

| Refinance Options | FHA Streamline Refinance available | VA Interest Rate Reduction Refinance Loan (IRRRL) |

FHA Loan vs VA Loan: Key Differences

FHA loans require a minimum credit score of 500 with a 10% down payment or 580 with 3.5% down, while VA loans offer 100% financing with no down payment requirement for eligible veterans and service members. FHA loans impose mortgage insurance premiums (MIP) throughout the loan term, whereas VA loans charge a one-time funding fee that can be financed into the loan and generally offer lower interest rates. FHA loans are available to all qualified buyers, while VA loans are exclusive to eligible veterans, active-duty military, and certain members of the National Guard and Reserves.

Eligibility Requirements for FHA and VA Loans

FHA loans require borrowers to have a minimum credit score of 580 for maximum financing, steady employment history, and a debt-to-income ratio below 43%, with no military service requirement. VA loans mandate that applicants be eligible veterans, active-duty service members, or certain members of the National Guard and Reserves, with no minimum credit score set by the VA but often requiring a stable income and satisfactory debt levels. Both loan types require property to meet specific standards, but VA loans offer more flexible eligibility focused on military affiliation, while FHA loans emphasize borrower credit and income criteria.

Down Payment Comparison: FHA vs VA

FHA loans typically require a minimum down payment of 3.5% of the home's purchase price, making them accessible to borrowers with lower credit scores. VA loans, available to eligible veterans and active-duty service members, often require no down payment at all, which can significantly reduce upfront costs. The down payment advantage of VA loans often results in lower initial expenses compared to FHA loans.

Credit Score Guidelines for FHA and VA Loans

FHA loans generally require a minimum credit score of 580 to qualify for the low 3.5% down payment, though borrowers with scores between 500 and 579 may still qualify but must put down at least 10%. VA loans do not have a strict minimum credit score set by the Department of Veterans Affairs; however, most lenders prefer a credit score of 620 or higher to approve the loan. Both FHA and VA loans offer more lenient credit score guidelines compared to conventional loans, making them accessible options for borrowers with less-than-perfect credit.

Mortgage Insurance: FHA vs VA Loans

FHA loans require upfront and annual mortgage insurance premiums (MIP) regardless of the down payment amount, impacting overall loan costs. VA loans do not require mortgage insurance but charge a one-time funding fee, which varies based on service type and down payment size. This difference often makes VA loans more cost-effective for eligible veterans by eliminating ongoing insurance premiums.

Interest Rates: FHA Loan vs VA Loan

FHA loans typically have interest rates ranging from 3% to 6%, influenced by borrower credit scores and down payment amounts. VA loans often offer lower interest rates, averaging between 2.5% and 5%, due to the government guarantee and no private mortgage insurance requirements. Lower VA loan interest rates can result in significant long-term savings compared to FHA loan rates.

Fees and Closing Costs: FHA vs VA

FHA loans typically require upfront mortgage insurance premiums (MIP) and monthly insurance payments, increasing overall closing costs, whereas VA loans often offer no upfront funding fee for eligible veterans and have no private mortgage insurance (PMI) requirements. Closing costs for FHA loans can include lender fees, appraisal fees, and escrow fees that may be higher due to FHA-specific requirements, while VA loans limit closing costs by capping fees charged to borrowers and allowing sellers to pay certain closing costs. Veterans benefit from VA loan fee waivers and lower insurance-related expenses, making VA loans generally more cost-effective in terms of fees and closing costs compared to FHA loans.

Property Requirements: FHA Loan vs VA Loan

FHA loans require properties to meet minimum safety, security, and soundness standards, including proper heating, roofing, and electrical systems, as outlined by HUD's appraisal guidelines. VA loans mandate that homes meet the VA Minimum Property Requirements (MPRs), ensuring the property is safe, structurally sound, and sanitary, with particular attention to essential utilities and pest infestation. Both loans enforce strict property standards but VA loans focus heavily on habitability and marketability to protect veterans' investments.

Pros and Cons of FHA and VA Loans

FHA loans offer lower credit score requirements and smaller down payments, making them accessible for first-time buyers but require mortgage insurance premiums that increase overall costs. VA loans provide 100% financing with no private mortgage insurance and competitive interest rates, but they are limited to eligible veterans and service members, potentially restricting borrower options. Evaluating the borrower's military status, credit profile, and available down payment is crucial when choosing between FHA and VA loan programs.

Which Loan Is Right for You: FHA or VA?

Choosing between an FHA loan and a VA loan depends on your eligibility and financial situation; FHA loans are ideal for buyers with lower credit scores and smaller down payments, requiring as little as 3.5% down. VA loans, available to eligible veterans and active-duty service members, offer competitive interest rates with no down payment and no private mortgage insurance (PMI) requirement. Evaluating credit profile, military service status, and upfront costs helps determine whether FHA or VA loans best fit your home financing needs.

Important Terms

Down Payment Requirements

FHA loans typically require a minimum down payment of 3.5% of the purchase price, while VA loans often require no down payment for eligible veterans and active-duty service members, offering a significant upfront cost advantage. FHA loans also require mortgage insurance premiums, whereas VA loans include a one-time funding fee that can be financed or waived for disabled veterans.

Mortgage Insurance Premium (MIP)

Mortgage Insurance Premium (MIP) on FHA loans requires both an upfront fee of 1.75% of the loan amount and monthly payments that vary based on loan term and down payment, while VA loans do not require MIP but charge a one-time VA funding fee, which varies by service category and down payment amount. Compared to FHA loans, VA loans are generally more cost-effective due to the absence of ongoing mortgage insurance premiums, significantly lowering overall loan expenses.

Funding Fee

The FHA loan requires a funding fee, known as the mortgage insurance premium (MIP), which typically ranges from 1.75% upfront plus annual premiums, while VA loans charge a funding fee starting between 1.4% to 3.6% of the loan amount depending on service type and down payment, but do not require monthly mortgage insurance. The VA funding fee can be waived for veterans with service-connected disabilities, making VA loans generally more cost-effective for eligible borrowers compared to FHA loans.

Loan Limits

FHA loan limits vary by county and are generally lower than VA loan limits, which often have no maximum cap for eligible veterans using entitlement unless purchasing a property exceeding conforming loan limits. VA loans require no down payment and have flexible credit requirements, while FHA loans have lower credit score thresholds but require mortgage insurance premiums regardless of down payment size.

Credit Score Criteria

FHA loans typically require a minimum credit score of 580 for maximum financing, while VA loans do not have a strict minimum credit score but generally favor scores above 620 for approval. Lenders consider credit history, debt-to-income ratio, and payment history as crucial criteria in both FHA and VA loan underwriting processes.

Debt-To-Income Ratio (DTI)

The Debt-To-Income Ratio (DTI) for FHA loans typically allows up to 43%, though some lenders may permit higher ratios with compensating factors, while VA loans generally require a DTI below 41% but offer more flexibility through residual income calculations that can override strict DTI limits. FHA loans often have more lenient credit requirements but higher mortgage insurance premiums, whereas VA loans provide competitive interest rates and no mortgage insurance, making DTI a key consideration in loan qualification.

Occupancy Requirements

FHA loans allow occupancy requirements where the borrower must live in the property as their primary residence within 60 days of closing and maintain it for at least one year, ensuring eligibility for federal insurance. VA loans also require the property to be the borrower's primary residence shortly after closing, with occupancy inspections occasionally conducted to verify use, but offer more flexibility for certain exceptions like deployment or extended absences.

Entitlement

FHA loans provide entitlement based on borrowers' eligibility and previous usage, allowing for streamlined access to mortgage insurance benefits, while VA loans offer a specific VA loan entitlement that can be restored after payoff or foreclosure, ensuring veterans and active-duty service members access to favorable loan terms without private mortgage insurance. Understanding the differences in entitlement amounts and restoration rules is crucial for maximizing borrowing power with FHA versus VA loan programs.

Streamline Refinance

Streamline Refinance for FHA loans offers reduced documentation requirements and no appraisal, making it easier for eligible borrowers to lower their interest rates quickly. VA Streamline Refinance, also known as Interest Rate Reduction Refinance Loan (IRRRL), provides veterans with a simplified refinancing process featuring minimal underwriting and no out-of-pocket closing costs.

Closing Costs Assistance

Closing costs assistance for FHA loans often includes seller concessions up to 6% of the purchase price, which can help reduce out-of-pocket expenses, whereas VA loans limit seller contributions to 4% but allow the VA funding fee to be rolled into the loan. Both FHA and VA loans offer options to finance closing costs, yet VA loans generally require no down payment and provide more lenient guidelines on who can pay these fees, enhancing affordability for veterans and active-duty service members.

FHA Loan vs VA Loan Infographic

moneydif.com

moneydif.com