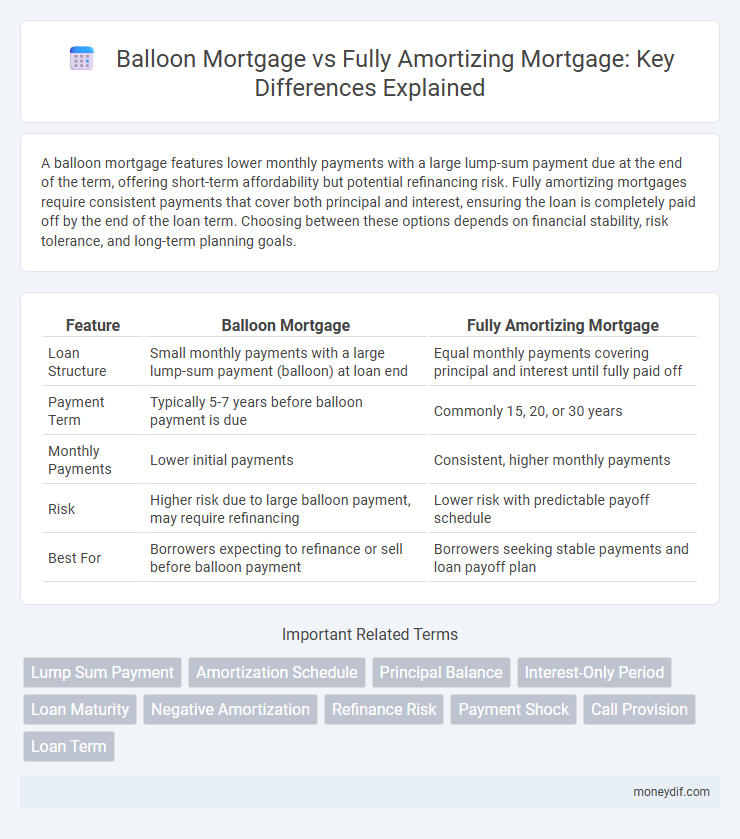

A balloon mortgage features lower monthly payments with a large lump-sum payment due at the end of the term, offering short-term affordability but potential refinancing risk. Fully amortizing mortgages require consistent payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the loan term. Choosing between these options depends on financial stability, risk tolerance, and long-term planning goals.

Table of Comparison

| Feature | Balloon Mortgage | Fully Amortizing Mortgage |

|---|---|---|

| Loan Structure | Small monthly payments with a large lump-sum payment (balloon) at loan end | Equal monthly payments covering principal and interest until fully paid off |

| Payment Term | Typically 5-7 years before balloon payment is due | Commonly 15, 20, or 30 years |

| Monthly Payments | Lower initial payments | Consistent, higher monthly payments |

| Risk | Higher risk due to large balloon payment, may require refinancing | Lower risk with predictable payoff schedule |

| Best For | Borrowers expecting to refinance or sell before balloon payment | Borrowers seeking stable payments and loan payoff plan |

Introduction to Balloon and Fully Amortizing Mortgages

Balloon mortgages feature low initial payments with a large lump-sum due at the end of the term, typically around 5 to 7 years, appealing to borrowers expecting increased income or refinancing options. Fully amortizing mortgages spread equal payments over the loan term, usually 15 to 30 years, covering both principal and interest, leading to complete loan payoff by maturity. Choosing between these mortgage types depends on financial stability, risk tolerance, and long-term housing plans.

Key Features of Balloon Mortgages

Balloon mortgages feature lower initial monthly payments due to interest-only or smaller principal payments, with a large lump sum payment, or "balloon," due at the end of the loan term, typically 5 to 7 years. These loans often have shorter terms compared to fully amortizing mortgages and may require refinancing or a full payoff at maturity, posing potential refinancing risk. Balloon mortgages appeal to borrowers expecting increased future income, sale of property, or refinancing options before the balloon payment is due.

Key Features of Fully Amortizing Mortgages

Fully amortizing mortgages feature fixed monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the loan term. These mortgages provide predictable budgeting without large lump-sum payments at maturity. Common terms range from 15 to 30 years, offering stability and gradual equity buildup for homeowners.

Pros and Cons of Balloon Mortgages

Balloon mortgages offer lower initial monthly payments and shorter loan terms, making them attractive for borrowers expecting increased income or planning to refinance before the balloon payment is due. However, they pose significant risks due to the large lump-sum payment required at the end of the term, potentially leading to financial strain or the need for refinancing under unfavorable conditions. Borrowers must carefully assess their future financial stability and the housing market before choosing balloon loans over fully amortizing mortgages, which provide predictable payments and full loan payoff over the loan term.

Pros and Cons of Fully Amortizing Mortgages

Fully amortizing mortgages provide predictable monthly payments that cover both principal and interest, ensuring the loan is entirely paid off by the end of the term, which reduces financial uncertainty. They prevent the risk of large, lump-sum payments typical of balloon mortgages, making budgeting easier for homeowners. However, fully amortizing loans often come with higher initial monthly payments compared to balloon mortgages, which may limit affordability for some borrowers.

Payment Structure Comparison

Balloon mortgages require smaller monthly payments with a large lump sum due at the end of the term, creating potential payment shocks for borrowers. Fully amortizing mortgages have consistent monthly payments that cover both principal and interest, ensuring the loan is paid off completely by maturity. The predictable payment structure of fully amortizing loans offers greater financial stability compared to the variable demands of balloon mortgages.

Risk Assessment: Balloon vs. Fully Amortizing Mortgages

Balloon mortgages pose a higher risk due to a large lump-sum payment at the end of the term, which can lead to refinancing challenges or default if the borrower lacks sufficient funds. Fully amortizing mortgages spread payments evenly over the loan term, reducing default risk by ensuring the loan is completely paid off by maturity. Assessing a borrower's financial stability and market conditions is crucial when choosing between these mortgage types for optimal risk management.

Ideal Borrower Profiles for Each Mortgage Type

Balloon mortgages suit borrowers with short-term housing needs or expecting significant income growth, as they offer lower initial payments followed by a lump sum due at term end. Fully amortizing mortgages benefit long-term homeowners seeking predictable monthly payments and full loan payoff by term completion, ideal for stable financial situations. Borrowers prioritizing cash flow flexibility and future refinancing options lean toward balloon loans, while those valuing steady budgeting and reduced refinancing risk prefer fully amortizing loans.

Long-Term Financial Implications

Balloon mortgages require a large lump-sum payment at the end of the term, potentially causing financial strain or refinancing challenges, whereas fully amortizing mortgages spread payments evenly over the loan's life, ensuring predictable budgeting and gradual equity build-up. Borrowers with balloon mortgages face higher risk of refinancing at unfavorable rates or possible default, impacting long-term financial stability compared to the consistent, declining principal balance of fully amortizing loans. Choosing a fully amortizing mortgage supports steady wealth accumulation and reduces exposure to interest rate volatility over the loan duration.

Choosing the Right Mortgage: Factors to Consider

Choosing the right mortgage depends on factors such as loan term, monthly payment affordability, and risk tolerance. Balloon mortgages feature lower initial payments with a lump-sum payment due at the end, suitable for borrowers expecting increased income or refinancing options. Fully amortizing mortgages offer stable monthly payments that fully repay the loan over time, ideal for long-term financial planning and minimizing payment shocks.

Important Terms

Lump Sum Payment

A lump sum payment on a balloon mortgage reduces the large principal due at the loan's maturity, which is typically a single large payment after a short-term period, unlike a fully amortizing mortgage that spreads principal and interest payments evenly over the loan term without requiring a significant final payment. Balloon mortgages tend to have lower initial monthly payments but higher risk due to the lump sum payment, while fully amortizing mortgages provide consistent monthly payments that fully pay off the loan balance by the end of the term.

Amortization Schedule

An amortization schedule for a balloon mortgage shows smaller periodic payments with a large lump-sum balloon payment due at the end of the term, whereas a fully amortizing mortgage's schedule includes consistent payments that fully repay both principal and interest by the final payment. Balloon mortgages typically have lower initial monthly payments but require refinancing or full repayment at maturity, contrasting with the predictable, gradually decreasing principal balance in fully amortizing loans.

Principal Balance

The principal balance of a balloon mortgage remains largely unchanged throughout the loan term, requiring a substantial lump-sum payment at maturity, whereas a fully amortizing mortgage systematically reduces the principal balance with each payment until it reaches zero by loan end. This difference impacts monthly payment amounts and refinancing or payoff strategies for borrowers.

Interest-Only Period

An interest-only period in a balloon mortgage allows borrowers to pay only the interest for a set time before a large lump-sum principal payment is due, contrasting with a fully amortizing mortgage where monthly payments cover both principal and interest, gradually reducing the loan balance. Balloon mortgages can offer lower initial payments but carry higher risk at maturity, while fully amortizing mortgages provide stable payments and full loan payoff over the loan term.

Loan Maturity

Loan maturity in balloon mortgages typically involves a shorter term with a large lump-sum payment due at the end, contrasting with fully amortizing mortgages that spread payments evenly over the loan term until full repayment. Balloon mortgages carry higher refinancing risk due to the final payment, while fully amortizing loans provide predictable cash flow and reduce default risk.

Negative Amortization

Negative amortization occurs when mortgage payments are insufficient to cover the interest, causing the loan balance to increase, commonly found in balloon mortgages where lower initial payments lead to a large lump sum due at maturity. In contrast, fully amortizing mortgages require fixed payments that cover both principal and interest, preventing loan balance growth and avoiding negative amortization.

Refinance Risk

Refinance risk is higher in balloon mortgages because borrowers face a large lump-sum payment at maturity, requiring refinancing under uncertain credit conditions, while fully amortizing mortgages spread payments evenly, reducing the likelihood of abrupt refinancing needs. Balloon mortgages expose borrowers to interest rate fluctuations and credit tightening at term end, increasing default probability compared to the steady amortization schedule in fully amortizing loans.

Payment Shock

Payment shock occurs when borrowers face a sudden and significant increase in monthly payments, commonly experienced with balloon mortgages as the large principal balance becomes due at maturity, unlike fully amortizing mortgages which spread payments evenly over the loan term. Balloon mortgages typically require refinancing or a lump-sum payment at the end, risking higher financial strain compared to the stable, predictable payments of a fully amortizing mortgage.

Call Provision

Call provision in a balloon mortgage allows the lender to demand full repayment before the maturity date, contrasting with fully amortizing mortgages where regular payments fully repay the loan over the term without such early repayment clauses. This feature influences borrower risk and loan pricing, as balloon mortgages carry higher refinancing or prepayment risk compared to fully amortizing loans.

Loan Term

Loan term impacts Balloon Mortgages by offering shorter periods, often 5 to 7 years, leading to a large final payment, while Fully Amortizing Mortgages typically have longer terms of 15 to 30 years, spreading payments evenly to fully repay the loan by maturity. Borrowers choosing Balloon Mortgages face refinancing risk at loan end, whereas Fully Amortizing Mortgages provide consistent principal reduction throughout the term, eliminating lump-sum payments.

Balloon Mortgage vs Fully Amortizing Mortgage Infographic

moneydif.com

moneydif.com