An amortization schedule breaks down each mortgage payment into principal and interest components over the loan term, providing a clear timeline for debt repayment. The loan term defines the length of time you have to repay the mortgage, directly impacting monthly payment amounts and total interest paid. Understanding both helps borrowers plan their finances by balancing payment affordability with long-term cost efficiency.

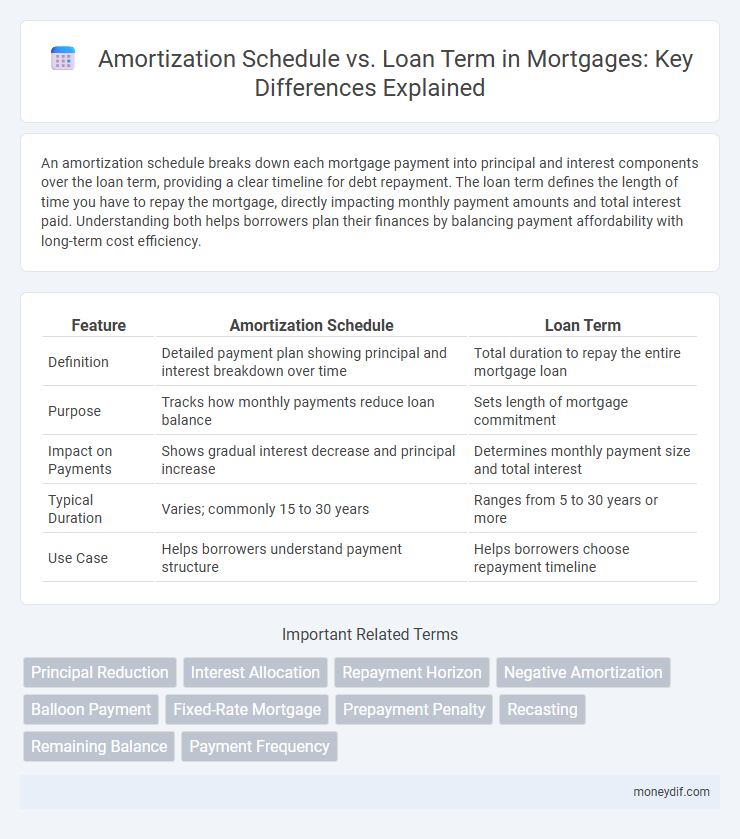

Table of Comparison

| Feature | Amortization Schedule | Loan Term |

|---|---|---|

| Definition | Detailed payment plan showing principal and interest breakdown over time | Total duration to repay the entire mortgage loan |

| Purpose | Tracks how monthly payments reduce loan balance | Sets length of mortgage commitment |

| Impact on Payments | Shows gradual interest decrease and principal increase | Determines monthly payment size and total interest |

| Typical Duration | Varies; commonly 15 to 30 years | Ranges from 5 to 30 years or more |

| Use Case | Helps borrowers understand payment structure | Helps borrowers choose repayment timeline |

Understanding Amortization Schedules

An amortization schedule details each loan payment by breaking down principal and interest over the loan term, providing transparency in how the mortgage balance decreases over time. Understanding this schedule helps borrowers see how early payments mainly cover interest while later payments increasingly reduce principal, influencing total interest paid. Accurate knowledge of the amortization schedule supports strategic decisions such as refinancing or making extra payments to shorten the loan term and save on interest costs.

Defining Loan Terms in Mortgages

Loan terms in mortgages specify the length of time borrowers have to repay the full loan amount, commonly ranging from 15 to 30 years. The amortization schedule details each monthly payment breakdown, showing portions allocated to principal and interest over the loan term. Understanding the loan term is crucial because it directly influences monthly payment size, total interest paid, and the overall amortization timeline.

Key Differences: Amortization Schedule vs Loan Term

The amortization schedule details each monthly payment's allocation toward principal and interest over the loan's lifespan, illustrating how the loan balance decreases progressively. The loan term refers to the total length of time agreed upon to repay the mortgage, commonly ranging from 15 to 30 years, and directly impacts monthly payment amounts and interest paid over time. Understanding the distinction between the amortization schedule and loan term is crucial for borrowers optimizing repayment strategies and assessing long-term financial commitments.

How Amortization Impacts Total Interest Paid

An amortization schedule divides each mortgage payment into principal and interest, gradually increasing principal repayment over the loan term, which directly affects the total interest paid. A longer loan term results in smaller monthly payments but higher total interest due to extended interest accrual, whereas a shorter term accelerates principal reduction, minimizing interest costs. Understanding how amortization influences interest allocation enables borrowers to choose loan terms that optimize overall payment efficiency and interest savings.

The Effect of Loan Term Length on Monthly Payments

Loan term length directly impacts monthly mortgage payments, with shorter terms resulting in higher monthly payments but significantly lower total interest paid over the life of the loan. An amortization schedule breaks down each payment into principal and interest components, illustrating how longer loan terms extend repayment periods and increase total interest costs. Choosing a loan term balances affordability and long-term cost efficiency based on individual financial goals.

Advantages of a Shorter Loan Term

A shorter loan term typically results in higher monthly payments but significantly reduces the total interest paid over the life of the mortgage, enhancing long-term savings. The amortization schedule for shorter terms shows faster principal reduction, building equity more quickly and increasing financial security. Borrowers with shorter loan terms also benefit from improved credit profiles due to quicker debt repayment and lower overall interest costs.

Benefits of a Longer Amortization Schedule

A longer amortization schedule lowers monthly mortgage payments by spreading the principal repayment over an extended period, improving cash flow for borrowers. It reduces financial strain, making homeownership more affordable and allowing greater budget flexibility for other expenses or investments. Although total interest paid increases, the manageable monthly amounts support long-term financial planning and stability.

Choosing the Right Loan Term for Your Financial Goals

Selecting the ideal loan term significantly impacts your mortgage's amortization schedule, influencing monthly payments and total interest paid over time. A shorter loan term accelerates principal reduction, lowering overall interest but increasing monthly obligations, while a longer term offers affordability with higher interest costs. Aligning your loan term with your financial goals optimizes cash flow management and long-term wealth accumulation.

Common Mistakes When Comparing Amortization and Loan Terms

Confusing amortization schedule length with the loan term often leads to underestimating total interest payments on mortgages. Borrowers frequently mistake a shorter loan term for a shorter amortization period, overlooking how a longer amortization increases overall interest despite lower monthly payments. Failure to distinguish these terms can result in selecting mortgage options that do not align with financial goals or affordability.

Frequently Asked Questions: Amortization Schedule vs Loan Term

An amortization schedule breaks down each mortgage payment into principal and interest components over the loan term, helping borrowers understand how their debt decreases over time. The loan term is the total length of time agreed upon to repay the mortgage, typically ranging from 15 to 30 years. Frequently asked questions often address how the amortization schedule affects monthly payments, total interest paid, and the implications of choosing different loan terms on overall financial planning.

Important Terms

Principal Reduction

Principal reduction accelerates loan payoff by increasing payments according to the amortization schedule, significantly shortening the overall loan term.

Interest Allocation

Interest allocation in an amortization schedule decreases over the loan term as principal payments increase, resulting in lower interest costs and faster equity buildup.

Repayment Horizon

The repayment horizon defines the total duration over which loan principal and interest are distributed in an amortization schedule, directly impacting the loan term and monthly payment amounts.

Negative Amortization

Negative amortization occurs when loan payments are insufficient to cover interest, causing the amortization schedule to extend beyond the original loan term and increase the overall loan balance.

Balloon Payment

A balloon payment is a large, lump-sum payment due at the end of a loan term that occurs when the amortization schedule extends beyond the loan term, resulting in smaller periodic payments followed by a significant final balance. This structure affects cash flow management by reducing monthly payments initially but requires careful planning to cover the substantial balloon payment once the loan matures.

Fixed-Rate Mortgage

A fixed-rate mortgage features consistent monthly payments calculated through an amortization schedule that evenly distributes principal and interest over the entire loan term.

Prepayment Penalty

Prepayment penalties are fees charged when a borrower pays off a loan before the end of its amortization schedule, which may differ from the loan term length. These penalties protect lenders by compensating for lost interest income, especially when the loan term is shorter than the amortization period, resulting in higher interest exposure if paid off early.

Recasting

Recasting a loan reduces monthly payments by recalculating the amortization schedule without extending the original loan term, enhancing affordability while maintaining the repayment timeline.

Remaining Balance

The remaining balance in an amortization schedule decreases with each payment as principal is repaid, directly impacting the loan term by determining the duration needed to fully settle the loan. An accurate amortization schedule provides a clear breakdown of principal versus interest payments over time, allowing borrowers to understand how early or extra payments can shorten the loan term and reduce total interest costs.

Payment Frequency

Payment frequency directly impacts the amortization schedule by determining the number of payments within the loan term, affecting total interest paid and loan payoff timing.

Amortization Schedule vs Loan Term Infographic

moneydif.com

moneydif.com