Subprime loans target borrowers with poor credit histories, often featuring higher interest rates and increased risk of default. Alt-A loans cater to borrowers with better credit but less documentation or higher debt-to-income ratios, offering moderate risk between prime and subprime categories. Understanding the differences helps lenders assess risk and borrowers find suitable mortgage options.

Table of Comparison

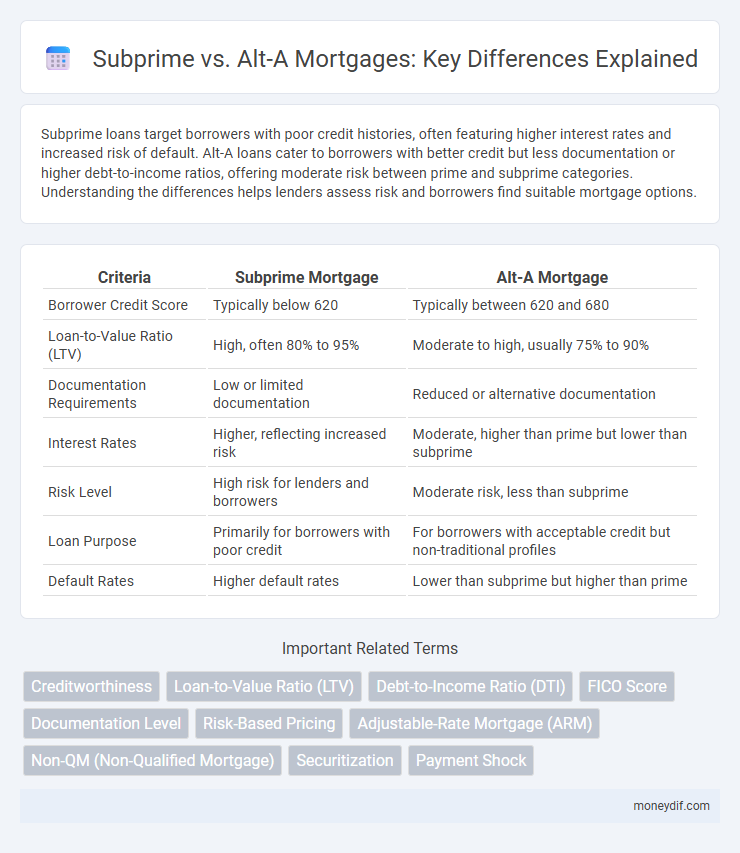

| Criteria | Subprime Mortgage | Alt-A Mortgage |

|---|---|---|

| Borrower Credit Score | Typically below 620 | Typically between 620 and 680 |

| Loan-to-Value Ratio (LTV) | High, often 80% to 95% | Moderate to high, usually 75% to 90% |

| Documentation Requirements | Low or limited documentation | Reduced or alternative documentation |

| Interest Rates | Higher, reflecting increased risk | Moderate, higher than prime but lower than subprime |

| Risk Level | High risk for lenders and borrowers | Moderate risk, less than subprime |

| Loan Purpose | Primarily for borrowers with poor credit | For borrowers with acceptable credit but non-traditional profiles |

| Default Rates | Higher default rates | Lower than subprime but higher than prime |

Understanding Subprime and Alt-A Mortgages

Subprime mortgages target borrowers with credit scores typically below 620, presenting higher risk and resulting in elevated interest rates and fees. Alt-A mortgages cater to borrowers with better credit profiles but non-traditional documentation or higher loan-to-value ratios, striking a balance between prime and subprime loan criteria. Understanding the nuanced differences in borrower qualifications and risk factors between Subprime and Alt-A mortgages is essential for lenders and investors managing mortgage portfolios.

Key Differences Between Subprime and Alt-A Loans

Subprime loans target borrowers with low credit scores below 620 and often require higher interest rates due to increased default risks, while Alt-A loans serve applicants with better credit profiles but incomplete or unverifiable income documentation. Subprime mortgages typically involve greater loan-to-value ratios and less stringent underwriting standards compared to Alt-A loans, which feature moderate risk and often waive traditional documentation requirements. Lenders price subprime loans higher to offset default probability, whereas Alt-A loans balance risk and accessibility by catering to borrowers in transitional financial situations.

Credit Score Requirements: Subprime vs Alt-A

Subprime mortgages typically require credit scores below 620, reflecting higher risk borrowers with past credit issues or limited credit history. Alt-A loans target borrowers with credit scores ranging from 620 to 680, often characterized by acceptable credit but lacking full documentation. Understanding these credit score thresholds is essential for distinguishing qualification criteria and associated risk in mortgage lending.

Typical Borrower Profiles for Each Mortgage Type

Subprime borrowers typically have poor credit scores below 620, unstable income, and higher debt-to-income ratios, reflecting greater risk for lenders. Alt-A borrowers generally maintain credit scores between 620 and 680, possess moderate income stability, and may have alternative documentation or higher loan-to-value ratios. These distinct profiles influence loan terms, interest rates, and approval likelihood within mortgage underwriting criteria.

Loan Terms and Interest Rates Comparison

Subprime loans typically feature higher interest rates and less favorable loan terms due to the increased risk associated with borrowers who have lower credit scores or financial instability. Alt-A loans, positioned between prime and subprime, offer more flexible loan terms with moderate interest rates, targeting borrowers with better credit profiles but limited documentation or higher debt-to-income ratios. The difference in loan terms and interest rates reflects the varying risk assessments lenders apply to these mortgage categories.

Common Risks Associated with Subprime and Alt-A Mortgages

Subprime and Alt-A mortgages commonly carry higher default risks due to borrowers' weaker credit profiles and limited documentation requirements. These loan types often feature adjustable interest rates, increasing payment volatility and the likelihood of borrower delinquency. Lenders face elevated risk exposure from potential foreclosure losses, impacting overall mortgage portfolio stability.

Documentation and Qualification Standards

Subprime mortgages typically involve borrowers with lower credit scores and higher risk profiles, often requiring minimal or no documentation, which increases default risk. Alt-A loans feature moderate-risk borrowers with better credit than subprime but often allow reduced documentation, such as limited income verification or no asset proof. Both categories deviate from prime mortgage standards, with Alt-A loans balancing risk through better borrower qualifications despite looser documentation requirements.

Impact on Real Estate Market and Economy

Subprime and Alt-A mortgages influence the real estate market by increasing risk exposure; subprime loans target borrowers with poor credit, leading to higher default rates and market volatility, while Alt-A loans serve borrowers with better credit but limited documentation, causing hidden risks. The proliferation of these loans contributed to inflated housing prices and subsequent market corrections, which triggered widespread financial instability and economic downturns. Understanding the distinctions between subprime and Alt-A lending is crucial for assessing credit risk, regulatory policies, and long-term economic resilience.

Pros and Cons: Subprime vs Alt-A Mortgages

Subprime mortgages offer higher approval rates for borrowers with poor credit but come with significantly higher interest rates and increased risk of default. Alt-A mortgages cater to borrowers with better credit than subprime but who lack full documentation, often resulting in more flexible terms and moderate interest rates. The main advantage of Alt-A loans is lower risk compared to subprime, but they typically require larger down payments and have stricter underwriting criteria.

Choosing the Right Mortgage: Subprime or Alt-A?

Choosing the right mortgage involves understanding the key differences between subprime and Alt-A loans, where subprime targets borrowers with poor credit scores typically below 620, while Alt-A caters to those with better credit but limited documentation or higher debt-to-income ratios. Subprime mortgages usually carry higher interest rates and fees to offset the increased risk, whereas Alt-A loans may offer more flexible underwriting but still require careful income verification and asset disclosure. Evaluating your credit profile, financial stability, and long-term affordability helps determine whether the costlier subprime or moderately priced Alt-A mortgage aligns better with your home financing goals.

Important Terms

Creditworthiness

Creditworthiness assessment in subprime lending focuses on borrowers with lower credit scores and higher risk of default, while Alt-A loans target borrowers with moderate credit profiles and incomplete documentation. Subprime loans typically carry higher interest rates due to increased default risk, whereas Alt-A loans balance risk with slightly better borrower profiles and conditions.

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) measures the loan amount relative to the appraised value of the property, crucial in assessing risk for mortgage categories such as Subprime and Alt-A loans. Subprime loans typically have higher LTV ratios, often exceeding 80%, reflecting greater risk due to borrower credit challenges, while Alt-A loans generally feature moderate LTVs, balancing risk between prime and subprime classifications.

Debt-to-Income Ratio (DTI)

Debt-to-Income Ratio (DTI) plays a critical role in differentiating Subprime and Alt-A mortgage loans, with Subprime borrowers typically exhibiting higher DTIs above 45%, indicating greater risk due to limited ability to manage monthly debt payments. Alt-A loans often feature DTIs ranging from 36% to 45%, reflecting moderate credit risk but lacking full documentation compared to prime loans.

FICO Score

FICO Score ranges typically classify Subprime borrowers with scores below 620, reflecting higher credit risk, while Alt-A borrowers often fall between 620 and 679, indicating moderate risk with some non-traditional documentation or higher loan-to-value ratios. Lenders use these distinctions to price mortgages, where Subprime loans carry higher interest rates and stricter terms compared to the relatively more favorable conditions available to Alt-A borrowers.

Documentation Level

Documentation level significantly distinguishes Subprime and Alt-A mortgages, with Subprime loans typically requiring minimal or no verification of income and assets, leading to higher default risk. Alt-A mortgages often feature reduced documentation but more rigorous verification than Subprime, balancing borrower accessibility with moderate underwriting standards.

Risk-Based Pricing

Risk-based pricing adjusts mortgage interest rates according to borrower credit risk, differentiating subprime loans with higher default risk from Alt-A loans that exhibit moderate credit risk but often lack full documentation. Subprime borrowers typically face significantly higher rates due to lower credit scores and greater likelihood of default, while Alt-A borrowers receive moderately elevated rates reflecting their intermediate risk profile and incomplete income verification.

Adjustable-Rate Mortgage (ARM)

Adjustable-Rate Mortgages (ARMs) often carry higher risk profiles, especially within Subprime and Alt-A loan categories, where borrowers typically have weaker credit or less documentation, resulting in elevated default rates. Subprime ARMs usually feature higher interest rate adjustments compared to Alt-A ARMs, reflecting the increased credit risk, which influences mortgage-backed securities and overall housing market volatility.

Non-QM (Non-Qualified Mortgage)

Non-QM loans, including Subprime and Alt-A categories, cater to borrowers who do not meet the strict criteria of Qualified Mortgages due to factors like reduced documentation or higher debt-to-income ratios. Subprime loans typically target borrowers with poor credit scores, while Alt-A loans serve those with moderate credit but unconventional income verification or property types, both reflecting varied risk profiles within the non-QM market.

Securitization

Securitization involving Subprime and Alt-A mortgage loans bundles high-risk loans into mortgage-backed securities, with Subprime loans characterized by lower credit scores and higher default rates compared to Alt-A loans, which typically have better credit profiles but less documentation. Investors in these securities face varied risk exposure depending on the loan tranche quality, influencing yield spreads and credit ratings in the structured finance market.

Payment Shock

Payment shock occurs when borrowers face a sudden increase in monthly mortgage payments due to rate resets or loan modifications, particularly common in subprime loans characterized by higher credit risk and lower documentation standards. Alt-A loans, while riskier than prime loans, generally exhibit less severe payment shock than subprime loans due to better borrower credit profiles and income verification.

Subprime vs Alt-A Infographic

moneydif.com

moneydif.com